As per Intent Market Research, the Interventional Cardiology Devices Market was valued at USD 20.6 Billion in 2024-e and will surpass USD 31.5 Billion by 2030; growing at a CAGR of 7.3% during 2025 - 2030.

The Interventional Cardiology Devices Market focuses on minimally invasive tools and technologies designed for diagnosing and treating cardiovascular diseases, such as coronary artery disease and valvular heart disease. These devices are essential in modern medical care due to the rising prevalence of cardiovascular diseases globally, driven by aging populations, sedentary lifestyles, and increasing incidences of risk factors such as obesity, hypertension, and diabetes. The market is witnessing significant growth due to advancements in device technology, such as drug-eluting stents and bioresorbable scaffolds, which offer improved efficacy and safety for patients.

Key drivers for the market include the increasing adoption of minimally invasive procedures, which offer shorter recovery times and lower risk of complications compared to traditional surgeries, and the expanding healthcare infrastructure in developing regions. Technological innovations, such as hybrid materials for stents and advanced imaging-guided catheter systems, further propel the market. Additionally, the growing demand for interventional cardiology procedures is supported by favorable reimbursement policies and government initiatives aimed at reducing the burden of cardiovascular diseases.

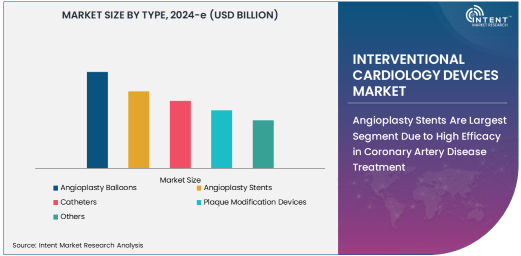

Angioplasty Stents Are Largest Segment Due to High Efficacy in Coronary Artery Disease Treatment

Angioplasty Stents represent the largest segment in the interventional cardiology devices market. These stents are widely used to treat coronary artery disease by keeping the arteries open after angioplasty procedures, ensuring proper blood flow. Drug-eluting stents (DES) dominate the subsegment due to their ability to reduce restenosis (re-narrowing of the artery) compared to bare-metal stents. Recent advancements, such as bioresorbable stents, are also gaining traction, offering a temporary scaffold that dissolves after the artery heals.

The high prevalence of coronary artery disease and the increasing preference for minimally invasive treatments contribute to the dominant position of stents in the market. Additionally, the integration of innovative materials and coatings in stent designs has improved their safety and long-term outcomes, further driving their adoption in interventional cardiology procedures.

Coronary Artery Disease Is Largest Application Segment Due to High Prevalence and Demand for Effective Treatments

Coronary Artery Disease (CAD) is the largest application segment in the interventional cardiology devices market. CAD is a leading cause of death worldwide, driven by factors such as unhealthy lifestyles, smoking, and the aging population. Interventional cardiology devices, including angioplasty stents and balloons, are critical in treating CAD by restoring blood flow to the heart and reducing the risk of heart attacks.

The increasing prevalence of CAD, combined with growing awareness about early diagnosis and treatment, drives the demand for interventional cardiology procedures. Moreover, advancements in device technology, such as the development of drug-coated balloons and next-generation stents, enhance the effectiveness of CAD treatments, further boosting this segment's growth.

Hospitals Are Largest End-Use Industry Due to High Volume of Interventional Cardiology Procedures

Hospitals are the largest end-use industry for interventional cardiology devices, as they serve as the primary setting for complex cardiac procedures, including angioplasty and stenting. Hospitals are equipped with advanced facilities and trained professionals required for performing interventional cardiology procedures, making them a preferred choice for patients.

The high patient inflow in hospitals, driven by the rising incidence of cardiovascular diseases and the availability of government-funded healthcare programs, supports their dominance in the market. Additionally, the integration of cutting-edge technologies, such as robotic-assisted interventions and advanced imaging systems, enhances procedural outcomes and drives the adoption of interventional cardiology devices in hospitals.

North America Is Largest Region Due to Advanced Healthcare Infrastructure and High Burden of Cardiovascular Diseases

North America holds the largest share of the interventional cardiology devices market, primarily due to its advanced healthcare infrastructure, high prevalence of cardiovascular diseases, and significant healthcare expenditure. The region benefits from a robust network of hospitals and cardiology centers that adopt state-of-the-art interventional cardiology technologies.

The United States, in particular, leads the region due to the presence of key market players, extensive R&D activities, and favorable reimbursement policies for interventional cardiology procedures. Additionally, the region's aging population and high prevalence of lifestyle-related risk factors, such as obesity and smoking, contribute to the growing demand for interventional cardiology devices.

Competitive Landscape and Leading Companies

The Interventional Cardiology Devices Market is highly competitive, with prominent companies focusing on innovations to improve device performance, safety, and patient outcomes. Key players in the market include Boston Scientific Corporation, Abbott Laboratories, Medtronic, Terumo Corporation, and B. Braun Melsungen AG. These companies lead the market with a diverse range of products, including drug-eluting stents, catheters, and advanced balloon angioplasty systems.

The competitive landscape is shaped by continuous advancements in device technologies, such as biodegradable stents and imaging-guided intervention tools. Companies are also focusing on strategic collaborations, acquisitions, and market expansions to strengthen their global presence. As cardiovascular diseases remain a significant global health challenge, leading companies are expected to maintain their dominance by developing innovative solutions that address the evolving needs of interventional cardiology.

Recent Developments:

- Abbott Laboratories launched a next-generation drug-eluting stent with enhanced deliverability.

- Boston Scientific Corporation announced FDA approval for its intravascular lithotripsy system.

- Medtronic unveiled a novel catheter for complex peripheral artery disease treatment.

- Terumo Corporation introduced a polymer-free coronary stent system in global markets.

- B. Braun Melsungen AG expanded its production capacity for vascular closure devices.

List of Leading Companies:

- Abbott Laboratories

- Boston Scientific Corporation

- Medtronic

- Terumo Corporation

- B. Braun Melsungen AG

- Cordis (A Cardinal Health Company)

- Biosensors International Group

- Biotronik SE & Co. KG

- Edwards Lifesciences Corporation

- MicroPort Scientific Corporation

- Meril Life Sciences

- AngioDynamics, Inc.

- Teleflex Incorporated

- Endologix LLC

- Koninklijke Philips N.V.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 20.6 Billion |

|

Forecasted Value (2030) |

USD 31.5 Billion |

|

CAGR (2025 – 2030) |

7.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Interventional Cardiology Devices Market by Type (Angioplasty Balloons, Angioplasty Stents, Catheters, Plaque Modification Devices), by Material (Metal, Polymer, Hybrid Materials), by Application (Coronary Artery Disease, Valvular Heart Disease), by End-Use Industry (Hospitals, Cardiology Centers, Ambulatory Surgery Centers), and by Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Abbott Laboratories, Boston Scientific Corporation, Medtronic, Terumo Corporation, B. Braun Melsungen AG, Cordis (A Cardinal Health Company), Biotronik SE & Co. KG, Edwards Lifesciences Corporation, MicroPort Scientific Corporation, Meril Life Sciences, AngioDynamics, Inc., Teleflex Incorporated, Koninklijke Philips N.V.

|

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Interventional Cardiology Devices Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Angioplasty Balloons |

|

4.2. Angioplasty Stents |

|

4.3. Catheters |

|

4.4. Plaque Modification Devices |

|

4.5. Others |

|

5. Interventional Cardiology Devices Market, by Material (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Metal |

|

5.2. Polymer |

|

5.3. Hybrid Materials |

|

6. Interventional Cardiology Devices Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Coronary Artery Disease |

|

6.2. Valvular Heart Disease |

|

6.3. Others |

|

7. Interventional Cardiology Devices Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Cardiology Centers |

|

7.3. Ambulatory Surgery Centers |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Interventional Cardiology Devices Market, by Type |

|

8.2.7. North America Interventional Cardiology Devices Market, by Material |

|

8.2.8. North America Interventional Cardiology Devices Market, by Application |

|

8.2.9. North America Interventional Cardiology Devices Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Interventional Cardiology Devices Market, by Type |

|

8.2.10.1.2. US Interventional Cardiology Devices Market, by Material |

|

8.2.10.1.3. US Interventional Cardiology Devices Market, by Application |

|

8.2.10.1.4. US Interventional Cardiology Devices Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Abbott Laboratories |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Boston Scientific Corporation |

|

10.3. Medtronic |

|

10.4. Terumo Corporation |

|

10.5. B. Braun Melsungen AG |

|

10.6. Cordis (A Cardinal Health Company) |

|

10.7. Biosensors International Group |

|

10.8. Biotronik SE & Co. KG |

|

10.9. Edwards Lifesciences Corporation |

|

10.10. MicroPort Scientific Corporation |

|

10.11. Meril Life Sciences |

|

10.12. AngioDynamics, Inc. |

|

10.13. Teleflex Incorporated |

|

10.14. Endologix LLC |

|

10.15. Koninklijke Philips N.V. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Interventional Cardiology Devices Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Interventional Cardiology Devices Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Interventional Cardiology Devices Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA