As per Intent Market Research, the Internet of Things (IoT) Market was valued at USD 63.7 Billion in 2024-e and will surpass USD 159.6 Billion by 2030; growing at a CAGR of 16.5% during 2025-2030.

The Internet of Things (IoT) market is experiencing rapid growth as more industries adopt connected devices to enhance automation, improve decision-making, and streamline operations. With a vast range of applications across various sectors, IoT is transforming how businesses and individuals interact with technology. The market is fueled by advances in hardware, software, and connectivity technologies, driving efficiency and data-driven insights. In this evolving landscape, each segment plays a crucial role, and understanding their dynamics is essential for evaluating the market's potential.

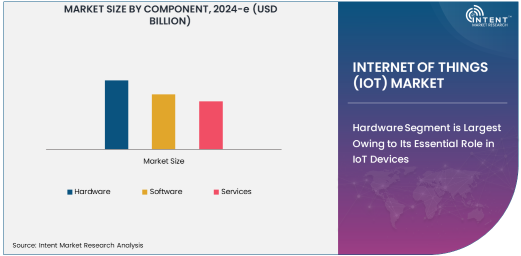

Hardware Segment is Largest Owing to Its Essential Role in IoT Devices

The hardware segment holds the largest share of the IoT market, primarily due to its foundational role in enabling the connectivity and functionality of IoT devices. This includes sensors, microcontrollers, processors, memory chips, and communication modules that facilitate data collection, transmission, and processing. As the number of connected devices continues to grow, the demand for advanced hardware solutions, such as sensors and edge devices, is expected to increase significantly. These components are vital to various industries, including automotive, healthcare, and manufacturing, driving the expansion of the hardware market.

The expansion of hardware in the IoT space is also driven by technological advancements. Companies are constantly innovating to provide smaller, more efficient, and power-conscious devices that can support a wide range of applications. Additionally, as IoT ecosystems become more complex, the need for customized and specialized hardware components continues to grow, making the hardware segment indispensable for the overall success of the IoT industry.

Smart Home Segment is Fastest Growing Owing to Increased Consumer Adoption

The smart home application segment is the fastest growing within the IoT market, driven by increasing consumer demand for connected devices that offer convenience, energy efficiency, and security. Smart home devices, such as thermostats, lighting systems, security cameras, and voice assistants, are rapidly becoming mainstream, thanks to improvements in user experience, affordability, and integration capabilities. As consumers continue to prioritize home automation for safety, energy savings, and enhanced lifestyles, smart homes are expected to remain at the forefront of IoT adoption.

The rise of smart homes is also linked to the growing penetration of 5G networks and enhanced connectivity options. With faster, more reliable internet connections, consumers are able to connect more devices seamlessly, thus propelling the growth of smart home applications. This trend is expected to continue as technologies evolve to support more sophisticated, AI-driven home automation systems.

Wi-Fi Connectivity is Largest Owing to Ubiquitous Use in IoT Devices

Wi-Fi is the largest connectivity type in the IoT market, providing widespread support for a broad range of IoT devices. Its high data transfer rates, cost-effectiveness, and the ability to support a large number of devices in a confined area make it ideal for various IoT applications, especially in smart homes and commercial environments. Wi-Fi’s ability to seamlessly connect multiple devices to the internet without requiring extensive infrastructure makes it a preferred option for consumers and businesses alike.

In addition to consumer-facing applications, Wi-Fi is widely used in industrial and healthcare IoT solutions, where stable and high-speed internet is crucial for real-time data transmission and remote monitoring. The continuous improvement in Wi-Fi technology, including the advent of Wi-Fi 6, has further cemented its dominance in the IoT connectivity space, enabling faster speeds, improved efficiency, and greater scalability.

Healthcare Segment is Largest End-User Industry Owing to Growing Demand for Remote Monitoring

The healthcare industry is the largest end-user industry in the IoT market, owing to the increasing demand for connected devices that enable remote patient monitoring, chronic disease management, and personalized healthcare solutions. IoT devices such as wearable health monitors, smart medical equipment, and connected drug delivery systems are revolutionizing patient care by providing real-time data that can enhance clinical decision-making and improve patient outcomes. The growing focus on patient-centric care and the need for more efficient healthcare systems are driving significant investments in healthcare IoT solutions.

The COVID-19 pandemic further accelerated the adoption of healthcare IoT, as the need for remote monitoring and telemedicine solutions became more apparent. As healthcare providers continue to seek innovative ways to enhance care delivery and reduce operational costs, IoT technologies are expected to remain a critical component in the transformation of healthcare systems globally.

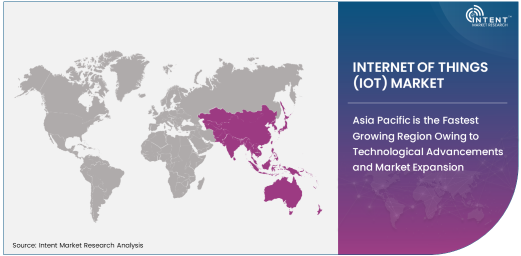

Asia Pacific is the Fastest Growing Region Owing to Technological Advancements and Market Expansion

Asia Pacific is the fastest growing region in the IoT market, driven by rapid technological advancements, increasing industrial automation, and strong government support for IoT adoption. Countries such as China, India, and Japan are at the forefront of IoT innovation, with smart city initiatives, industrial IoT applications, and a burgeoning consumer electronics market contributing to the region's growth. The region's large population and increasing smartphone penetration also contribute to the growing demand for connected devices and smart applications.

Furthermore, the proliferation of 5G networks and the expansion of IoT infrastructure in countries like China and South Korea are expected to create new opportunities for the IoT market. Asia Pacific’s manufacturing sector, which is increasingly adopting smart factories, is another key driver of the market, positioning the region as a hub for IoT development and deployment.

Leading Companies and Competitive Landscape

The IoT market is highly competitive, with major global players offering integrated solutions across hardware, software, and services. Companies like Cisco Systems, Intel Corporation, Qualcomm, Microsoft, and Amazon are at the forefront of IoT innovation, providing connectivity solutions, IoT platforms, and edge computing technologies. These companies leverage their technological expertise and established market presence to expand their IoT portfolios and form strategic partnerships.

The competitive landscape is also characterized by a mix of startups and tech giants focusing on specialized IoT applications, such as healthcare monitoring, smart home technologies, and industrial automation. As the market continues to evolve, companies are increasingly focusing on improving device interoperability, developing AI-driven IoT solutions, and expanding their product offerings to meet the growing demand for intelligent, connected ecosystems.

Recent Developments:

- Amazon Web Services recently expanded its IoT capabilities with the launch of AWS IoT Core for LoRaWAN, enabling low-power wide-area networks for connected devices in industries like agriculture, utilities, and logistics.

- Microsoft acquired a leading IoT cloud solutions provider to enhance its Azure IoT platform, strengthening its position in the industrial IoT space.

- Intel and Siemens have formed a strategic partnership to provide innovative IoT solutions in manufacturing, focusing on smart automation and industrial control systems.

- Google has launched a new suite of AI-powered IoT products under its Google Cloud platform, allowing organizations to leverage machine learning to optimize their connected devices and data analytics.

- Qualcomm unveiled its next-generation 5G IoT platform to enhance the connectivity and data transmission capabilities of IoT devices, positioning itself as a leader in IoT hardware and connectivity solutions.

List of Leading Companies:

- Cisco Systems Inc.

- Intel Corporation

- Qualcomm Technologies Inc.

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Amazon Web Services (AWS)

- PTC Inc.

- General Electric Company (GE)

- Samsung Electronics

- Siemens AG

- Bosch IoT

- Arm Holdings

- Schneider Electric

- Oracle Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 63.7 Billion |

|

Forecasted Value (2030) |

USD 159.6 Billion |

|

CAGR (2025 – 2030) |

16.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Internet of Things (IoT) Market By Product Type (Autonomous Mobile Robots, Delivery Drones, Autonomous Delivery Vehicles, Ground-based Delivery Robots, Indoor Delivery Robots), By Payload Capacity (Low Payload Capacity, Medium Payload Capacity, High Payload Capacity), By End-User Industry (Retail & E-commerce, Food Delivery, Healthcare & Pharmaceutical, Logistics & Warehouse Management, Industrial), By Mode of Operation (Fully Autonomous, Semi-autonomous, Manual), By Navigation Technology (GPS-based Navigation, Vision-based Navigation, LiDAR-based Navigation, Hybrid Navigation) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Cisco Systems Inc., Intel Corporation, Qualcomm Technologies Inc., IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services (AWS), PTC Inc., General Electric Company (GE), Samsung Electronics, Siemens AG, Bosch IoT, Arm Holdings, Schneider Electric, Oracle Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Internet of Things (IoT) Market, by Component (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Hardware |

|

4.2. Software |

|

4.3. Services |

|

5. Internet of Things (IoT) Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Smart Home |

|

5.2. Healthcare |

|

5.3. Industrial IoT (IIoT) |

|

5.4. Smart Cities |

|

5.5. Automotive |

|

5.6. Retail |

|

5.7. Agriculture |

|

5.8. Others |

|

6. Internet of Things (IoT) Market, by Connectivity (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Wi-Fi |

|

6.2. Bluetooth |

|

6.3. Zigbee |

|

6.4. LPWAN (Low Power Wide Area Network) |

|

6.5. Cellular |

|

6.6. Satellite |

|

6.7. Others |

|

7. Internet of Things (IoT) Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Consumer Electronics |

|

7.2. Automotive |

|

7.3. Healthcare |

|

7.4. Retail |

|

7.5. Industrial |

|

7.6. Agriculture |

|

7.7. Energy & Utilities |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Internet of Things (IoT) Market, by Component |

|

8.2.7. North America Internet of Things (IoT) Market, by Application |

|

8.2.8. North America Internet of Things (IoT) Market, by Connectivity |

|

8.2.9. North America Internet of Things (IoT) Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Internet of Things (IoT) Market, by Component |

|

8.2.10.1.2. US Internet of Things (IoT) Market, by Application |

|

8.2.10.1.3. US Internet of Things (IoT) Market, by Connectivity |

|

8.2.10.1.4. US Internet of Things (IoT) Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Cisco Systems Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Intel Corporation |

|

10.3. Qualcomm Technologies Inc. |

|

10.4. IBM Corporation |

|

10.5. Microsoft Corporation |

|

10.6. Google LLC |

|

10.7. Amazon Web Services (AWS) |

|

10.8. PTC Inc. |

|

10.9. General Electric Company (GE) |

|

10.10. Samsung Electronics |

|

10.11. Siemens AG |

|

10.12. Bosch IoT |

|

10.13. Arm Holdings |

|

10.14. Schneider Electric |

|

10.15. Oracle Corporation |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Internet of Things (IoT) Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Internet of Things (IoT) Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Internet of Things (IoT) Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA