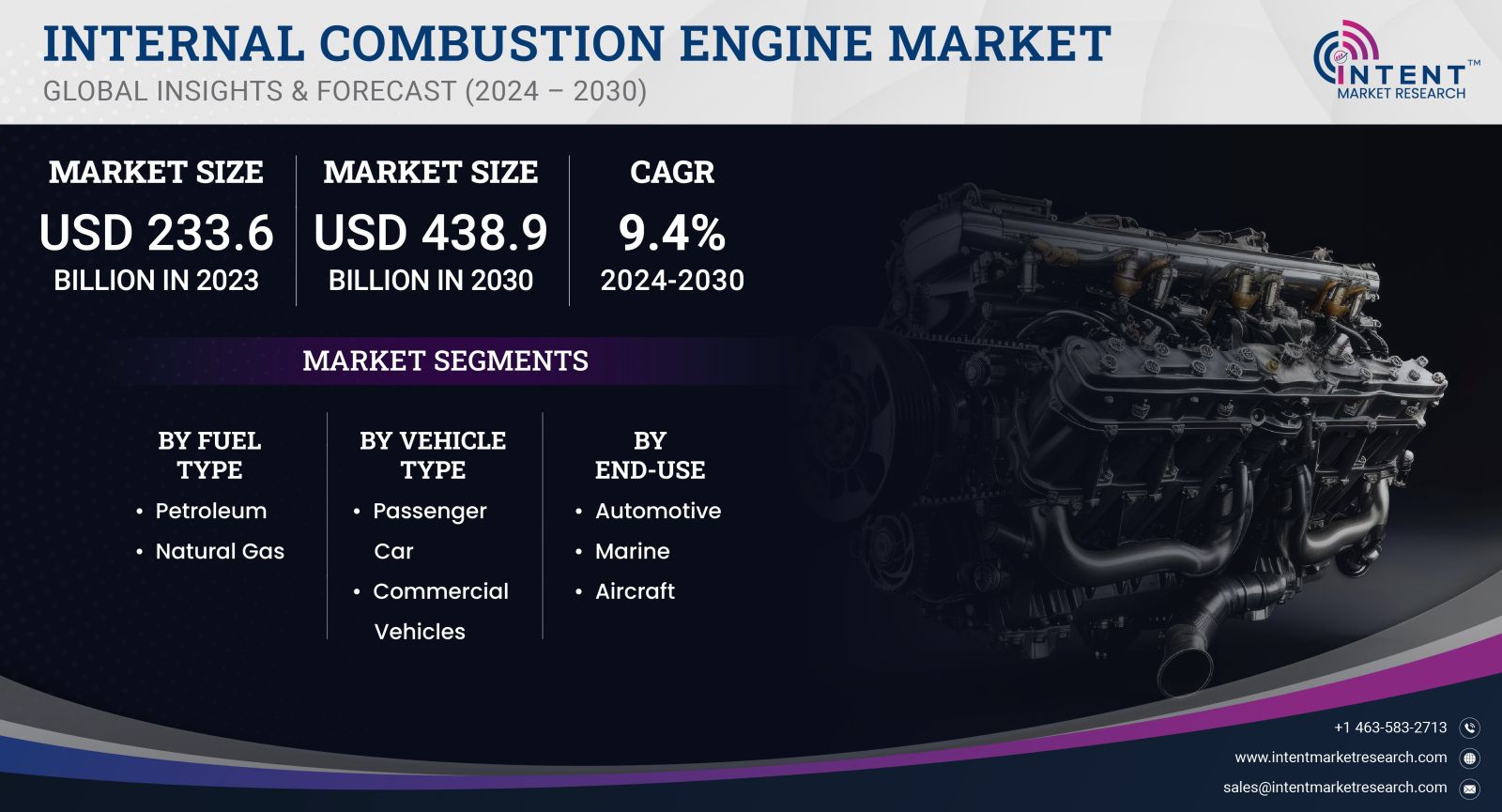

As per Intent Market Research, the Internal Combustion Engine Market was valued at USD 233.6 billion in 2023-e and will surpass USD 438.9 billion by 2030; growing at a CAGR of 9.4% during 2024 - 2030.

The Internal Combustion Engine (ICE) market has long been a cornerstone of the global automotive and machinery industries. As a driving force behind the transportation and power generation sectors, ICEs are known for their efficiency and performance. The market encompasses various types of engines, including gasoline, diesel, and natural gas engines, which cater to a wide array of applications such as passenger vehicles, commercial vehicles, and industrial equipment. Despite the growing trend towards electrification and alternative energy sources, the ICE market continues to thrive, driven by the demand for reliable power and the existing infrastructure supporting combustion engines.

The growth is fueled by emerging economies and ongoing advancements in engine technologies, ensuring that internal combustion engines remain competitive in a rapidly evolving landscape. As the industry adapts to regulatory pressures for lower emissions and improved fuel efficiency, significant investments in R&D and innovation are anticipated to bolster the market's sustainability and longevity.

Gasoline Segment is Largest Owing to Consumer Preference

The gasoline segment is recognized as the largest within the Internal Combustion Engine market, accounting for a substantial share due to its widespread consumer acceptance and versatility. Gasoline engines are prevalent in light-duty vehicles, which are the most commonly used mode of transportation globally. Their relatively lower cost, ease of operation, and availability of fuel infrastructure contribute significantly to their dominance. Moreover, advancements in gasoline engine technologies, such as turbocharging and direct fuel injection, enhance their performance and fuel efficiency, making them appealing to consumers.

Furthermore, the gasoline segment benefits from the increasing trend of hybridization, where gasoline engines are combined with electric powertrains to optimize fuel economy and reduce emissions. This trend not only reinforces the segment's prominence but also positions it favorably in a market that is gradually transitioning towards sustainable solutions. As manufacturers invest in cleaner technologies and comply with stringent emission regulations, gasoline engines will likely remain a vital component of the automotive landscape in the coming years.

Diesel Segment is Fastest Growing Owing to Commercial Applications

The diesel segment is the fastest-growing sub-segment within the Internal Combustion Engine market, primarily driven by its applications in commercial vehicles and heavy-duty machinery. Diesel engines are preferred for their superior torque, fuel efficiency, and longevity, making them ideal for transporting goods and powering industrial equipment. The demand for diesel-powered vehicles is particularly strong in logistics and construction sectors, where performance and durability are crucial.

Recent advancements in diesel technology, including turbocharging and improved fuel injection systems, have enhanced engine performance while simultaneously reducing emissions. As global trade continues to expand and the construction industry experiences growth, the diesel segment is projected to maintain a robust growth trajectory. Regulatory initiatives aimed at improving diesel fuel quality and engine efficiency will also support the segment's development, ensuring that diesel engines remain a key player in the market.

Natural Gas Segment is Emerging Fastest Owing to Environmental Concerns

The natural gas segment is emerging as one of the fastest-growing areas within the Internal Combustion Engine market, driven by increasing environmental concerns and the pursuit of cleaner fuel alternatives. Natural gas engines offer reduced emissions of pollutants and greenhouse gases compared to traditional gasoline and diesel engines, making them an attractive option for governments and organizations aiming to meet stringent environmental regulations.

Moreover, the growing investment in natural gas infrastructure, including refueling stations and pipelines, has facilitated the adoption of natural gas vehicles (NGVs). In commercial transportation, where lower fuel costs and compliance with emission regulations are paramount, natural gas engines are increasingly favored. As more industries recognize the long-term benefits of transitioning to cleaner fuels, the natural gas segment is poised for significant growth in the coming years, driven by a global shift towards sustainability.

Two-Stroke Segment is Fastest Growing Owing to Lightweight Applications

The two-stroke engine segment is recognized as the fastest-growing sub-segment within the Internal Combustion Engine market, primarily due to its lightweight design and simplicity in construction. Two-stroke engines are widely used in applications such as motorcycles, chainsaws, and other portable equipment where weight and size are critical factors. Their ability to deliver a high power-to-weight ratio makes them suitable for various recreational and utility purposes, further driving their demand.

Additionally, advancements in two-stroke engine technology, such as improved lubrication systems and fuel efficiency measures, are addressing historical concerns regarding emissions and fuel consumption. With growing interest in lightweight and efficient vehicles, the two-stroke segment is expected to expand rapidly, catering to niche markets and meeting the demands of consumers seeking power without the bulk.

Heavy-Duty Segment is Largest Owing to Industrial Requirements

The heavy-duty segment of the Internal Combustion Engine market is the largest due to its integral role in powering commercial and industrial vehicles. Heavy-duty engines are specifically designed to handle substantial loads and operate under challenging conditions, making them essential for sectors like logistics, construction, and agriculture. Their ability to deliver high torque and durability ensures that they meet the rigorous demands of heavy-duty applications.

Moreover, the increasing focus on efficiency and reduced emissions has prompted manufacturers to innovate within the heavy-duty segment, integrating advanced technologies that enhance performance while adhering to environmental regulations. The rise in e-commerce and demand for efficient logistics solutions are also propelling the growth of the heavy-duty engine segment, cementing its position as a leader in the Internal Combustion Engine market.

Leading Region is Asia-Pacific Owing to Economic Growth

The Asia-Pacific region is the leading market for Internal Combustion Engines, driven by rapid economic growth, urbanization, and increasing vehicle production. Countries such as China and India are experiencing significant growth in their automotive industries, fueled by rising disposable incomes and a growing middle class. This economic boom is resulting in heightened demand for personal and commercial vehicles, further enhancing the region's prominence in the ICE market.

Furthermore, government initiatives to improve transportation infrastructure and a focus on manufacturing are propelling the development of the Internal Combustion Engine sector in the Asia-Pacific. As the region continues to invest in technological advancements and innovation, the Asia-Pacific market is expected to sustain its leadership position through 2030, adapting to changing consumer preferences and environmental regulations.

Competitive Landscape of the Internal Combustion Engine Market

The competitive landscape of the Internal Combustion Engine market is characterized by a mix of established players and emerging companies striving to innovate and capture market share. The top ten companies in this space include:

- General Motors: Renowned for its advanced ICE technologies and diverse portfolio of vehicles.

- Ford Motor Company: A leader in gasoline and diesel engines with a focus on efficiency and performance.

- Toyota Motor Corporation: Known for its hybrid technology and commitment to sustainable engine solutions.

- Volkswagen AG: A major player in the ICE market, investing heavily in R&D for cleaner combustion engines.

- Honda Motor Co., Ltd.: Recognized for its efficient and high-performance gasoline engines.

- Cummins Inc.: A prominent name in diesel engines, particularly for commercial applications.

- Daimler AG: A key player in heavy-duty engines, focusing on performance and emissions compliance.

- Bosch: A leading supplier of engine management and fuel injection systems that enhance ICE performance.

- Navistar International Corporation: Known for its diesel engines tailored for heavy-duty applications.

- Perkins Engines Company Limited: Specializes in diesel engines for industrial and agricultural applications.

The competitive dynamics in the ICE market are influenced by technological advancements, regulatory changes, and shifting consumer preferences. Companies are increasingly focused on enhancing fuel efficiency and reducing emissions through innovative engine designs and alternative fuels. As the market evolves, strategic partnerships and collaborations will play a pivotal role in driving growth and maintaining a competitive edge.

Report Objectives

The report will help you answer some of the most critical questions in the internal combustion engine market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the internal combustion engine market?

- What is the size of the internal combustion engine market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa?

- What are the market opportunities for stakeholders after analysing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 233.6 billion |

|

Forecasted Value (2030) |

USD 438.9 billion |

|

CAGR (2024-2030) |

9.4% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Internal Combustion Engine Market By Fuel Type (Petroleum, Natural Gas), By Vehicle Type (Passenger Car, Commercial Vehicles), By End-Use (Automotive, Marine, Aircraft) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, UAE, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Internal Combustion Engine Market, by Fuel Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Petroleum |

|

4.2.Natural Gas |

|

5.Internal Combustion Engine Market, by Vehicle Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Passenger Car |

|

5.2.Commercial Vehicles |

|

6.Internal Combustion Engine Market, by End-Use (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Automotive |

|

6.2.Marine |

|

6.3.Aircraft |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Internal Combustion Engine Market, by Fuel Type |

|

7.2.7.North America Internal Combustion Engine Market, by Vehicle Type |

|

7.2.8.North America Internal Combustion Engine Market, by End-Use |

|

*Similar Segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Internal Combustion Engine Market, by Fuel Type |

|

7.3.1.2.US Internal Combustion Engine Market, by Vehicle Type |

|

7.3.1.3.US Internal Combustion Engine Market, by End-Use |

|

7.3.2.Canada |

|

7.3.3.Mexico |

|

*Similar Segmentation will be provided at each country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6.Latin America |

|

7.7.Middle East & Africa |

|

8. Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.AB Volvo |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.BMW |

|

9.3.Briggs & Stratton |

|

9.4.Cummins |

|

9.5.Ford Motor Company |

|

9.6.General Motors |

|

9.7.Stellantis NV |

|

9.8.Hyundai Motor Company |

|

9.9.MAN SE |

|

9.10.Rolls-Royce |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyse data on the Internal Combustion Engine Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to measure the impact of them on the internal combustion engine market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the internal combustion engine ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the internal combustion engine market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA