As per Intent Market Research, the Integrated Delivery Network Market was valued at USD 8.8 billion in 2024-e and will surpass USD 22.8 billion by 2030; growing at a CAGR of 14.5% during 2025 - 2030.

The integrated delivery network (IDN) market is undergoing a transformative phase as healthcare systems evolve toward more coordinated and patient-centric care. IDNs, which are networks of healthcare providers that collaborate to offer a full spectrum of care, are becoming essential in delivering cost-effective and efficient healthcare services. This model integrates various components such as hospitals, physician groups, outpatient services, and rehabilitation centers to ensure seamless patient experiences and optimize clinical outcomes. The increasing focus on value-based care, rather than fee-for-service, has further driven the growth of IDNs, making them a cornerstone of modern healthcare delivery.

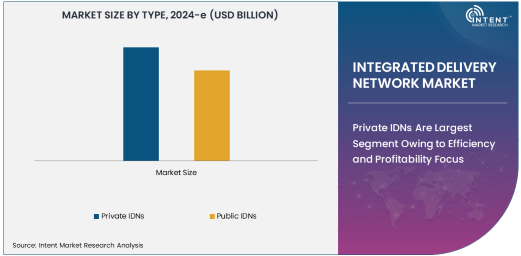

The market for integrated delivery networks is characterized by a variety of types and services, ranging from acute care to home healthcare, which offer different levels of care tailored to patient needs. Public and private IDNs serve as the backbone for different healthcare models, with private IDNs typically focusing on efficiency and profitability, while public IDNs cater more to community health and broader access. Additionally, the shift toward outpatient services and home healthcare, along with an increased focus on preventive services, is shaping the future of this market. As healthcare systems globally continue to adapt to patient-centered and value-driven approaches, the IDN market is poised for continued growth.

Private IDNs Are Largest Segment Owing to Efficiency and Profitability Focus

Private Integrated Delivery Networks (IDNs) represent the largest segment in the market, primarily due to their focus on operational efficiency, profitability, and patient-centered care. These privately-owned networks often bring together a range of healthcare providers, including hospitals, outpatient services, and specialty care, with a strong emphasis on financial sustainability. The private IDN model tends to leverage advanced technology, streamlined processes, and economies of scale to provide high-quality care at competitive costs, which is particularly attractive in the current healthcare environment that emphasizes value-based care.

Private IDNs often benefit from their ability to make faster decisions and implement innovative healthcare solutions without the constraints that may affect public IDNs. This flexibility enables them to optimize patient care while maintaining profitability. Moreover, these networks are expanding rapidly due to their ability to attract investment, establish partnerships with insurance companies, and offer specialized services that are highly valued by patients and providers alike. The growth in private IDNs is expected to continue as demand for efficient and comprehensive care increases across urban and suburban areas.

Outpatient Services Are Fastest Growing Service Type Due to Shift Toward Ambulatory Care

Outpatient services are the fastest-growing service type within the integrated delivery network market, driven by the increasing shift toward ambulatory care. As healthcare systems seek to reduce costs and improve patient convenience, outpatient services have become a preferred option for many non-emergency treatments, diagnostic procedures, and minor surgeries. Outpatient care offers patients the flexibility of receiving treatment without the need for overnight hospitalization, which has proven to be both cost-effective and efficient. The growing preference for minimally invasive procedures and advances in technology have further fueled the demand for outpatient services.

The rise in outpatient services is closely tied to the trend of hospitals consolidating outpatient clinics and surgery centers into IDNs to streamline patient care and reduce costs. This move allows for better coordination of services, enhanced patient management, and improved outcomes, which aligns with the broader goals of integrated care. As the focus on reducing hospital readmissions and shortening recovery times grows, outpatient services are expected to become a dominant component of integrated delivery networks, particularly in urban settings where demand is high.

Hospitals Are Largest End-User Segment Owing to Comprehensive Care Needs

Hospitals represent the largest end-user segment in the integrated delivery network market, due to their critical role in providing a wide range of comprehensive care services. Hospitals are at the center of IDNs, acting as hubs for acute care, specialty treatments, and emergency services. They are key players in delivering essential services to both inpatient and outpatient populations, and their integration with other healthcare providers within IDNs allows for a more coordinated approach to patient care.

The importance of hospitals within IDNs lies in their ability to offer complex medical services, while also coordinating with ambulatory surgical centers, physician groups, and home healthcare providers to ensure a continuous and comprehensive care experience for patients. As hospitals continue to adopt value-based care models, they are becoming even more integral to the success of IDNs by focusing on improving patient outcomes, reducing costs, and enhancing patient satisfaction. The growing demand for integrated healthcare delivery systems ensures that hospitals will remain a central component of IDNs across all regions.

Investor-Owned IDNs Are Largest Ownership Type Due to Profit Maximization and Growth

Investor-owned integrated delivery networks (IDNs) are the largest ownership type in the market, driven by their focus on maximizing profitability and sustaining growth. These networks, owned by private equity firms or publicly traded companies, are increasingly taking on larger shares of the healthcare market. Investor-owned IDNs typically emphasize operational efficiencies, innovative business models, and streamlined services to improve margins while expanding the reach of healthcare services.

The key advantage of investor-owned IDNs is their ability to attract capital and investments, enabling rapid expansion and the adoption of advanced technologies. With a focus on profitability, these networks are also more inclined to develop new services, enter new markets, and establish partnerships that enhance their competitive edge. Additionally, investor-owned IDNs often benefit from economies of scale, which allow them to provide care at lower costs while maintaining high service standards. This ability to quickly scale and innovate makes investor-owned IDNs a dominant force in the integrated delivery network market.

Urban Care Settings Are Largest Market Segment Owing to Higher Population Density

Urban care settings dominate the integrated delivery network market, primarily due to the higher population density and greater demand for healthcare services in cities. Urban areas tend to have a more advanced healthcare infrastructure, with a concentration of hospitals, outpatient clinics, and specialized care providers. The high population density in urban regions means that there is a consistent demand for healthcare services, driving the growth of integrated delivery networks in these areas.

The concentration of healthcare providers and institutions in urban areas also enables the efficient delivery of coordinated care, with better access to specialized services, healthcare technology, and advanced treatments. As healthcare systems continue to move toward more integrated, patient-centered models, urban care settings are expected to remain the dominant segment in the IDN market. Furthermore, urban populations often have higher levels of insurance coverage and access to healthcare, which further supports the growth of integrated delivery networks in these regions.

Direct Sales Are Largest Distribution Channel Due to Strategic Partnerships and Integration

Direct sales are the largest distribution channel in the integrated delivery network market, as they enable healthcare providers to build strategic relationships with pharmaceutical companies, medical device manufacturers, and other service providers. Direct sales channels facilitate the integration of new services, equipment, and technologies within IDNs, allowing healthcare networks to streamline their offerings and enhance patient care. Additionally, direct sales enable IDNs to negotiate better pricing, maintain consistent supply chains, and ensure the timely delivery of medical products and services.

The direct sales model is particularly effective in the healthcare industry, where partnerships between service providers and product manufacturers are essential to improving service quality. IDNs leverage direct sales to establish long-term relationships with their suppliers and enhance the coordination of care. As the trend toward value-based healthcare continues to grow, the importance of direct sales in the distribution of healthcare services and products is likely to increase.

North America Is Largest Region Owing to Advanced Healthcare Systems and High Demand

North America is the largest region in the integrated delivery network market, largely due to the presence of advanced healthcare infrastructure, high demand for integrated services, and the adoption of value-based care models. The U.S., in particular, has seen significant growth in IDNs, driven by the consolidation of healthcare providers and the push for more coordinated care solutions. The region’s well-established healthcare systems and high levels of healthcare expenditure make it an ideal environment for the growth of integrated delivery networks.

North America is also home to several large private and public IDNs, which continue to expand their service offerings to meet the growing demand for more efficient, patient-centered care. The U.S. market is particularly notable for its rapid adoption of technology and digital health solutions, which are integral to the success of IDNs. As healthcare systems in North America continue to prioritize integrated, cost-effective care, the demand for IDNs is expected to remain strong, with further expansion in both urban and rural areas.

Competitive Landscape and Leading Companies

The integrated delivery network market is competitive, with several key players driving growth and innovation. Leading companies include large healthcare systems such as HCA Healthcare, Kaiser Permanente, and Ascension Health, all of which have extensive networks of hospitals, outpatient services, and physician groups. These organizations are leading the charge in transforming healthcare delivery by focusing on value-based care models and enhancing patient outcomes.

In addition to traditional healthcare giants, new entrants and technology-driven companies are increasingly entering the market to capitalize on the shift toward integrated care. Companies like Cerner Corporation and Allscripts Healthcare Solutions, which provide digital solutions for healthcare integration, play a significant role in the development of IDNs by offering advanced IT systems that improve the coordination of care. The market remains highly competitive, with players focusing on expansion, strategic partnerships, and technological innovation to maintain a competitive edge. As the demand for more integrated healthcare services increases, competition is expected to intensify, with companies seeking to provide comprehensive, patient-centered care across diverse regions and care settings.

Recent Developments:

- In December 2024, HCA Healthcare announced an expansion of its integrated delivery network in the southeastern United States, including new outpatient services and rehabilitation centers.

- In November 2024, Kaiser Permanente launched a new program aimed at improving preventive care and reducing hospital admissions through integrated care models.

- In October 2024, Cleveland Clinic partnered with several outpatient surgical centers to expand its IDN and improve the coordination of care for patients undergoing elective procedures.

- In September 2024, Ascension Health introduced a new telemedicine platform integrated into its IDN to provide virtual care options for rural and underserved populations.

- In August 2024, Advocate Aurora Health received recognition for its innovative integrated delivery network, which focuses on improving patient outcomes through data-sharing and care coordination.

List of Leading Companies:

- HCA Healthcare, Inc.

- Ascension Health

- Tenet Healthcare Corporation

- Kaiser Permanente

- Universal Health Services, Inc.

- Community Health Systems, Inc.

- Mayo Clinic

- Trinity Health

- Cleveland Clinic

- McLaren Health Care

- Advocate Aurora Health

- Banner Health

- Providence Health & Services

- Partners HealthCare

- Dignity Health

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 8.8 Billion |

|

Forecasted Value (2030) |

USD 22.8 Billion |

|

CAGR (2025 – 2030) |

14.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Integrated Delivery Network Market by Type (Private IDNs, Public IDNs), Service Type (Acute Care Services, Outpatient Services, Long-Term Care, Home Healthcare Services, Preventive Services), End-User (Hospitals, Ambulatory Surgical Centers, Physician Groups, Rehabilitation Centers), Ownership Type (Investor-Owned, Non-Profit), Care Setting (Urban, Rural) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

HCA Healthcare, Inc., Ascension Health, Tenet Healthcare Corporation, Kaiser Permanente, Universal Health Services, Inc., Community Health Systems, Inc., Mayo Clinic, Trinity Health, Cleveland Clinic, McLaren Health Care, Advocate Aurora Health, Banner Health, Providence Health & Services, Partners HealthCare, Dignity Health |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Integrated Delivery Network Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Private IDNs |

|

4.2. Public IDNs |

|

5. Integrated Delivery Network Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Acute Care Services |

|

5.2. Outpatient Services |

|

5.3. Long-Term Care |

|

5.4. Home Healthcare Services |

|

5.5. Preventive Services |

|

6. Integrated Delivery Network Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Ambulatory Surgical Centers |

|

6.3. Physician Groups |

|

6.4. Rehabilitation Centers |

|

7. Integrated Delivery Network Market, by Ownership Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Investor-Owned |

|

7.2. Non-Profit |

|

8. Integrated Delivery Network Market, by Care Setting (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Urban |

|

8.2. Rural |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Integrated Delivery Network Market, by Type |

|

9.2.7. North America Integrated Delivery Network Market, by Service Type |

|

9.2.8. North America Integrated Delivery Network Market, by End-User |

|

9.2.9. North America Integrated Delivery Network Market, by Ownership Type |

|

9.2.10. North America Integrated Delivery Network Market, by Care Setting |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Integrated Delivery Network Market, by Type |

|

9.2.11.1.2. US Integrated Delivery Network Market, by Service Type |

|

9.2.11.1.3. US Integrated Delivery Network Market, by End-User |

|

9.2.11.1.4. US Integrated Delivery Network Market, by Ownership Type |

|

9.2.11.1.5. US Integrated Delivery Network Market, by Care Setting |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. HCA Healthcare, Inc. |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Ascension Health |

|

11.3. Tenet Healthcare Corporation |

|

11.4. Kaiser Permanente |

|

11.5. Universal Health Services, Inc. |

|

11.6. Community Health Systems, Inc. |

|

11.7. Mayo Clinic |

|

11.8. Trinity Health |

|

11.9. Cleveland Clinic |

|

11.10. McLaren Health Care |

|

11.11. Advocate Aurora Health |

|

11.12. Banner Health |

|

11.13. Providence Health & Services |

|

11.14. Partners HealthCare |

|

11.15. Dignity Health |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Integrated Delivery Network Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Integrated Delivery Network Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Integrated Delivery Network Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA