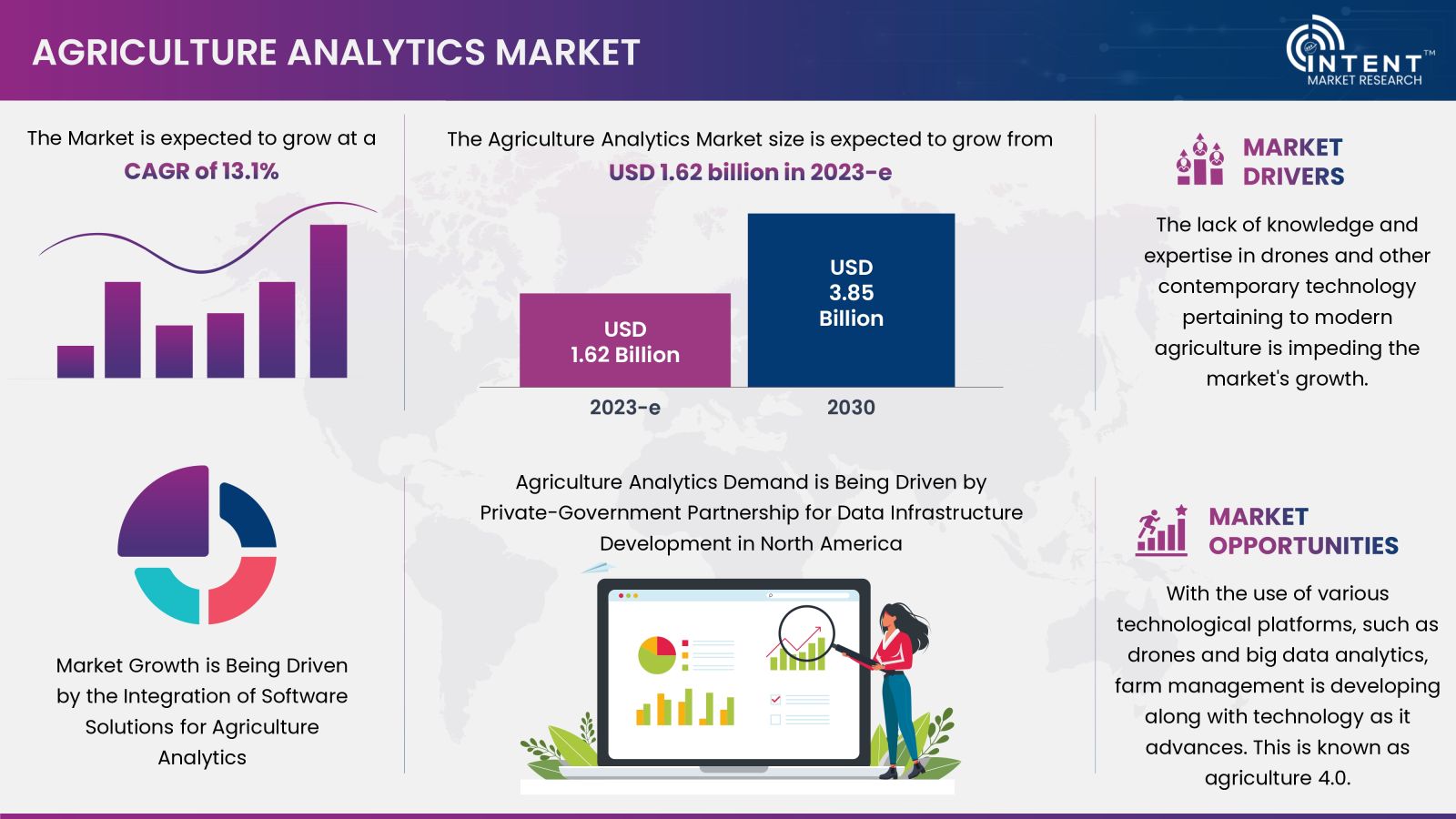

According to Intent Market Research, the Agriculture Analytics Market is expected to grow from USD 1.62 billion in 2023-e at a CAGR of 13.1% to touch USD 3.85 billion by 2030. Prominent players include IBM, Microsoft, Bayer, Deere & Company, Oracle, SAP, Trimble, Farmers Edge, Accenture, IBF Servizi, DeLaval, Agrivi, DTN, and Raven Industries. The surge in demand for integrating advance technology associated with every segment of the agriculture is driving market growth.

Click here to: Get FREE Sample Pages of this Report

Agriculture analytics is a multidisciplinary program of agriculture and data analytics, in which precision agriculture (PA) is a farming management concept based on observing, measuring, and responding to inter- and intra-field variability in crops. Precision agriculture is also sometimes referred to as precision farming, satellite agriculture, as-needed farming, and site-specific crop management (SSCM).

Using data from their solar-powered Internet of Things (IoT) sensors and AI-powered satellite imagery, agriculture technology analytics developed a crop and soil management tool that reverses soil degradation by monitoring the soil's levels of nitrogen, phosphorus and potassium (NPK), moisture, fertility, and pH as well as early detection of crop pests and diseases. Through this data, the farmer can understand and start the healing journey of their soil.

Agriculture Analytics Market Dynamics

Rising Acceptance of Agriculture Analytics Despite Multiple Obstacles is Nurturing the Market Growth

Farmers in Europe and North America are at the forefront of global agricultural technology adoption, with approximately 61% currently utilizing or intending to implement at least one agtech product within the forthcoming two years.

The principal impediments to the adoption of farm-management systems for farmers in North America are elevated expenses and an ambiguous return on investment, with approximately 52% and 40% respectively. In contrast, European farmers, while also primarily concerned about high costs, cite the intricacies associated with installation and utilization as another substantial hindrance to adoption, with approximately 48% and 32% respectively. Farmers in South America, who have a 50% rate of agricultural technology adoption, demonstrate disparities in adoption rates across various countries within the region.

These farmers express the greatest apprehension regarding trust in online purchasing processes (33%). The lowest level of AgTech product adoption is observed in Asia, where only around 9% of farmers are using or planning to use at least one AgTech product; there is also variation in adoption rates among countries within this region.

Agriculture Analytics Market Segment Insights

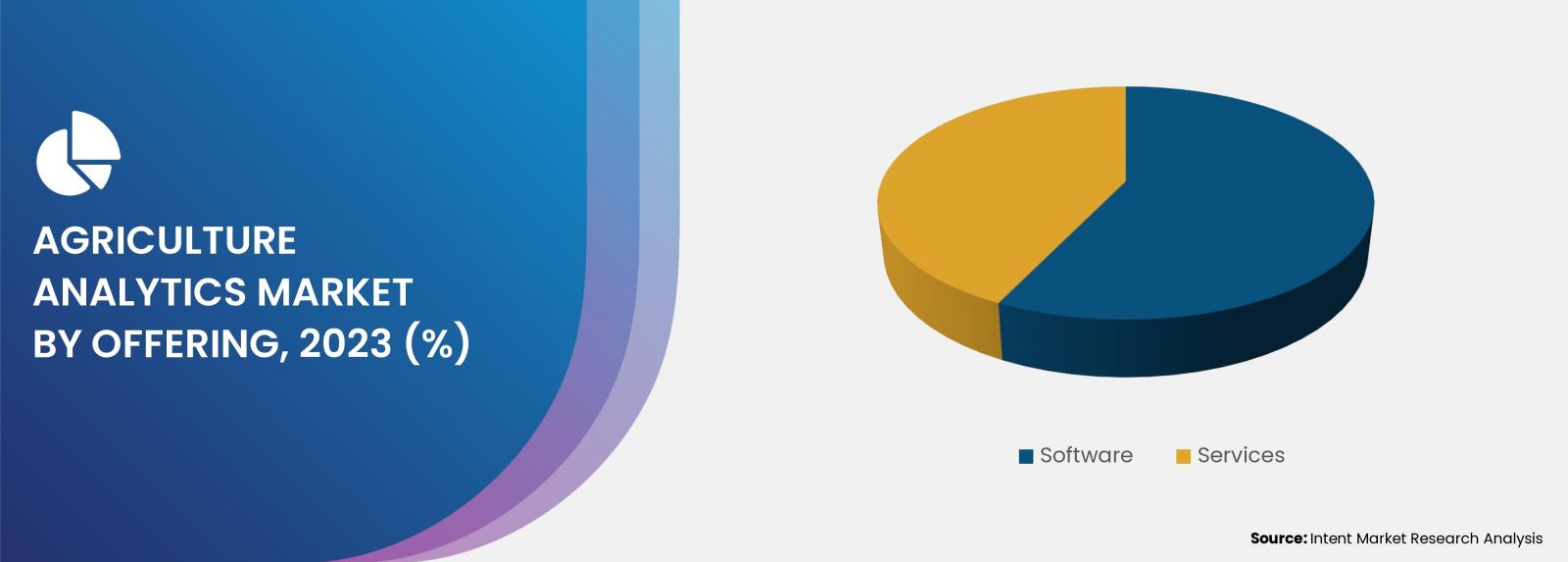

Integration of Software for Agriculture Solutions is Raising Market Growth

In the digital era, technology emerges as a transformative force, offering Farm Management Software (FMS) as a powerful tool to navigate the complexities of modern agriculture, standing at 21%, closely followed by a 15% utilization rate of remote-sensing and precision agriculture hardware. Technologies related to sustainability, such as those that measure carbon emissions and sequestration, as well as those that monitor and optimize irrigation systems, along with automation and robotics technologies which are still in their nascent stages have a relatively low adoption rate of approximately 5%.

Data Analytics and Big Data is Driving the Growth of Agriculture Analytics Market

Based on technology, the data analytics and big data segment is expected to grow at the highest CAGR during the forecast period. The potential for big data to revolutionize the agricultural sector is contingent upon the establishment of a cloud-based ecosystem equipped with appropriate tools and software capable of integrating diverse data sources. These tools must possess the capacity to consolidate data pertaining to climate, agronomy, water, farm equipment, supply chain, weeds, and nutrients, among other factors, in order to assist farmers in decision-making processes.

The utilization of big data and a cloud-based ecosystem can provide farmers with valuable insights that can enhance their farming practices. The amalgamation of various data sources empowers them to make informed decisions concerning crop management, resource allocation, and yield optimization which ultimately results in augmented productivity and profitability within the agricultural sector. Therefore, the data analytics and big data plays major role in market expansion over the period.

Many Leading Companies Are Focusing on Precision Agriculture due to its Wide Use Which is Responsible for the Market Growth

The precision farming segment is expected to witness the highest growth during the forecast period. Nowadays, precision agriculture incorporates crop management software and technical equipment. Sensitivity-enabled equipment is also deployed on the fields to gather meticulous data on weather patterns, crop analysis, soil testing, and plot measurement for the precision agriculture practices.

Global market players are showing their interest in precision agriculture, and also noticing that government are funding in technology development for precision agriculture. In February 2024, the federal government unveiled a USD 42.5 billion initiative to bolster broadband access, with potentially transformative implications for agriculture and small businesses.

Regional Insights

Private-Government Partnership for the Development of Data Infrastructure in North America is Driving the Demand for Agriculture Analytics

Modernizing US agricultural data infrastructure will better equip farmers and the U.S. Department of Agriculture (USDA) with tools to adapt, innovate, and ensure a food-secure future given the increasingly dynamic conditions in which the sector operates. Growth in North America is concentrated on the agricultural data infrastructure, which can also be expedited by managing data through public-private partnerships. These partnerships offer the advantage of utilizing US government authorities for resources and data protection, as well as the private sector's flexibility in protecting proprietary information.

Competitive Landscape

Rising Attention by the Key Players and Startups for Agriculture 4.0 is driving the Agriculture Analytics Market

A lot of new and established businesses have been developing in recent years to help with agriculture 4.0 management in different ways. Artificial intelligence-driven predictive analytics, blockchain-based supply chain management, and drone-assisted crop monitoring have all revolutionized agricultural practices. By employing these new-age technologies, farmers and other stakeholders in the agricultural ecosystem can enhance operational efficiency, reduce wastage, ensure traceability, and elevate overall agricultural produce quality. Some of the companies operating in this market include Accenture, Ag Leader Technology, Agremo, AgriBotix, Agrivi, Bayer, Conservis, Deere & Company, DeLaval, DTN, Farmer's Business Network, Farmers Edge, Gamaya, Gro Intelligence, IBF Servizi, IBM, Microsoft, Oracle, Proagrica, Raven Industries, SAP, SAS, Stesalit Systems, Taranis, and Trimble.

Get your custom research report today

Agriculture Analytics Market Coverage

The report provides key insights into the agriculture analytics market, and it focuses on technological developments, trends, and initiatives taken by the government. In this sector, the analysis delves into market drivers, restraints, opportunities, and other pertinent factors. The report also scrutinizes key players and the competitive landscape in the agriculture analytics market.

Report Scope

|

Report Features |

Description |

|

Market Value (2023-e) |

USD 1.62 billion |

|

Forecast Revenue (2030) |

USD 3.85 billion |

|

CAGR (2024-2030) |

13.1% |

|

Base Year for Estimation |

2023-e |

|

Historical Period |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

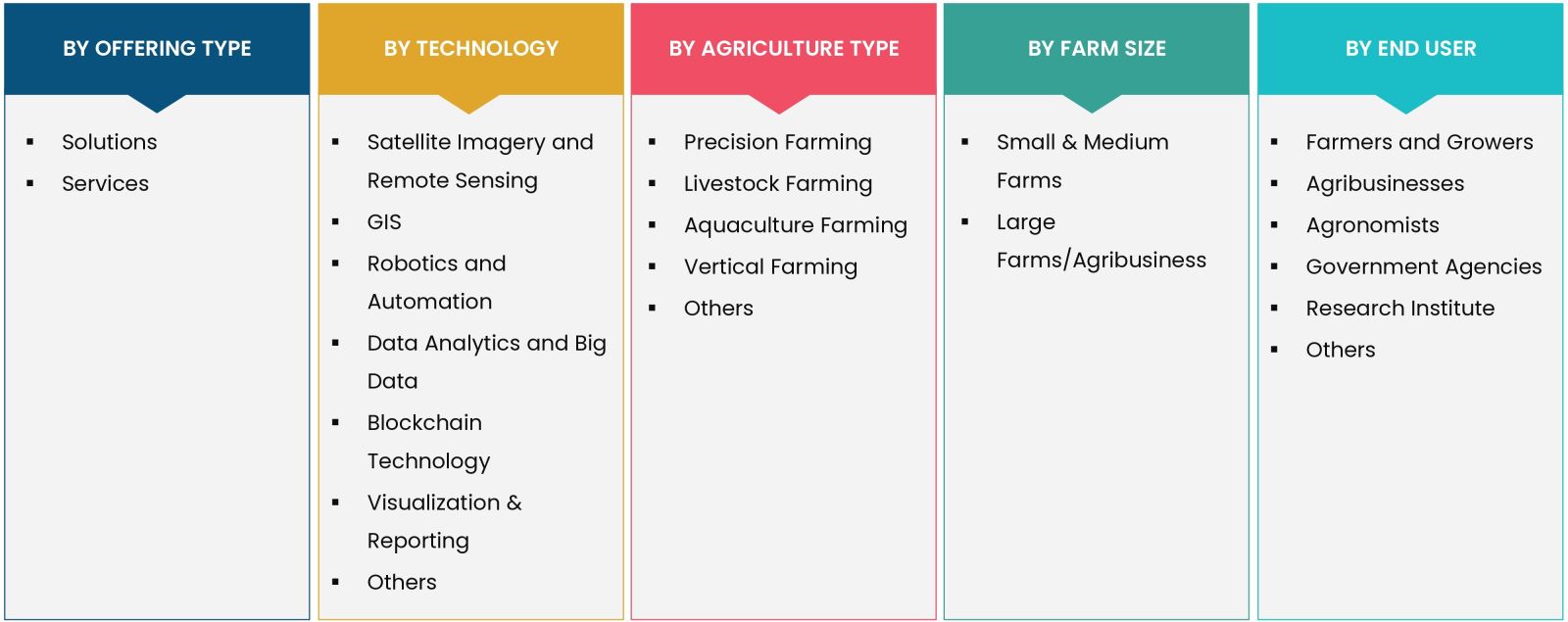

Segments Covered |

Agriculture Analytics Market By Offering Type (Solutions, Services), By Technology (Satellite Imagery & Remote Sensing, Geographic Information System, Robotics & Automation, Data Analytics, & Big Data, Blockchain Technology, Visualization & Reporting), By Agriculture Type (Precision Farming, Livestock Farming, Aquaculture Farming, Vertical Farming), By Farm Size (Small & Medium Farms, Large Farms/Agribusiness), By End User (Farmers & Growers, Agribusinesses, Agronomists) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Italy and Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, and rest of Asia-Pacific), Latin America (Brazil, Mexico, Argentina, and Rest of Latin America), Middle East and Africa (Saudi Arabia, South Africa, United Arab Emirates, and Rest of MEA) |

|

Competitive Landscape |

Accenture, Ag Leader Technology, Agremo, Agrivi, Bayer, Conservis, Deere & Company, DeLaval, DTN, Farmer's Business Network, Farmers Edge Inc., Gamaya, Gro Intelligence, IBF Servizi, IBM, Microsoft, Oracle, Proagrica, Raven Industries, SAP, SAS, Stesalit Systems, Taranis, and Trimble |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. |

|

Purchase Options |

We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) |

|

1.Introduction |

|

1.1.Key Research Objectives |

|

1.2.Market Definition |

|

1.3.Report Scope |

|

1.4.Currency & Conversion |

|

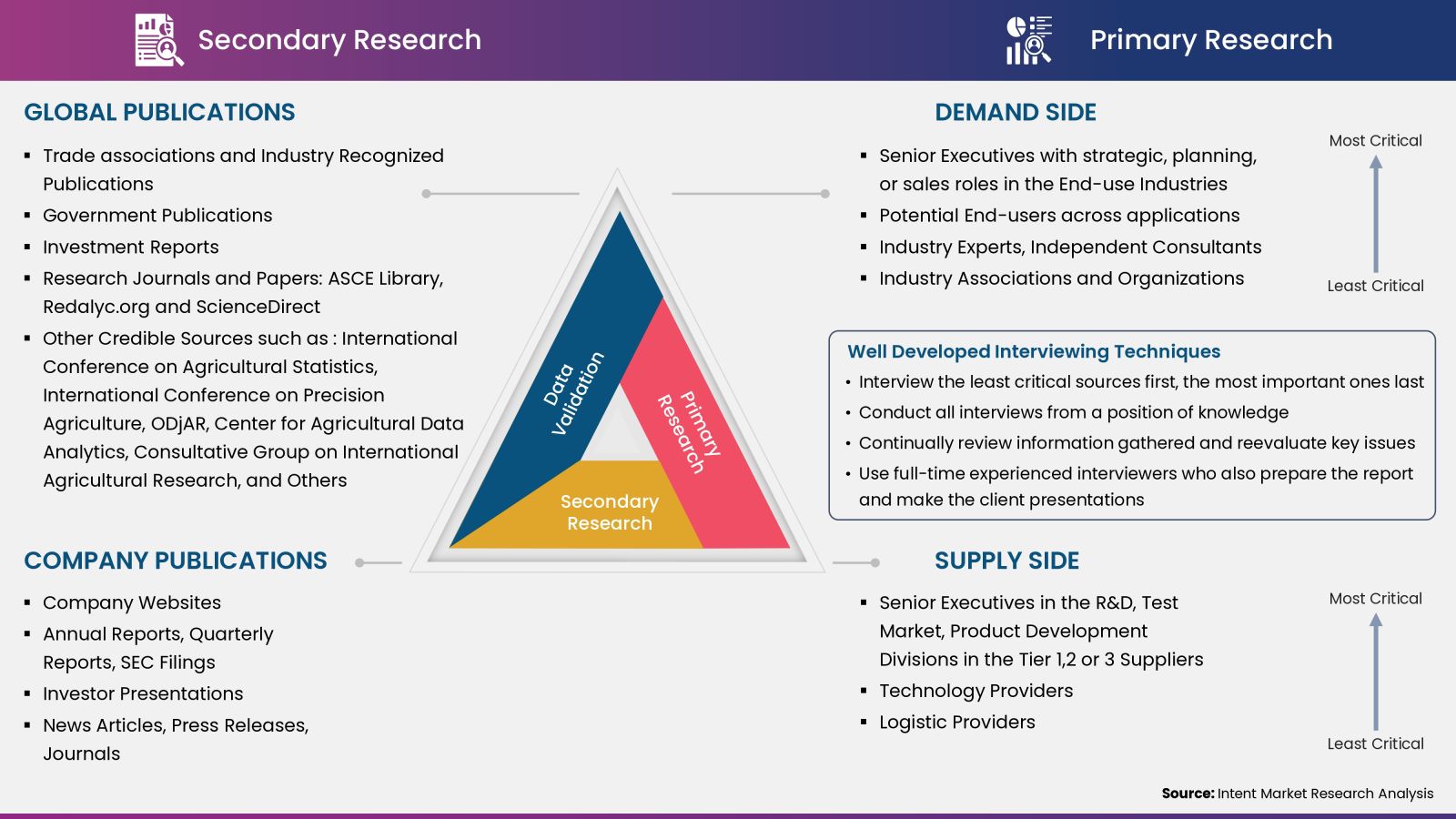

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

4.Premium Insights |

|

4.1.Overview of the Agriculture Sector |

|

4.2.Use Case Analysis |

|

4.2.1.Trimble Inc. - Agriculture Analytics |

|

4.2.2.Deere & Company - Agriculture Analytics |

|

4.2.3.IBM - Agriculture Analytics |

|

4.3.Agriculture Analytics Solutions in Development |

|

4.4.Supply Chain OG Agriculture Analytics Market |

|

4.5.Regulatory Framework |

|

4.6.Reimbursement Scenario of Agriculture Analytics Market |

|

4.7.Technological Advancement & Future Opportunity Analysis |

|

5.Generative AI Market, by Offering (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Introduction |

|

5.2.Solutions |

|

5.3.Services |

|

6.Generative AI Market, by Technology (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Introduction |

|

6.2.Satellite Imagery And Remote Sensing |

|

6.3.Geographic Information System (GIS) |

|

6.4.Data Analytics And Big Data |

|

6.5.Robotics and Automation |

|

6.6.Blockchain Technology |

|

6.7.Visualization & Reporting |

|

6.8.Others |

|

7.Generative AI Market, by Agriculture Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Introduction |

|

7.2.Precision Farming |

|

7.3.Livestock Farming |

|

7.4.Vertical Farming |

|

7.5.Aquaculture Farming |

|

7.6.Others |

|

8.Generative AI Market, by Farm Size (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Introduction |

|

8.2.Small and Medium Farms |

|

8.3.Large Farms/Agribusiness |

|

9.Generative AI Market, by End User (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

9.1.Introduction |

|

9.2.Farmers and Growers |

|

9.3.Agribusinesses |

|

9.4.Agronomists |

|

9.5.Government Departments |

|

9.6.Research Institutes |

|

9.7.Others |

|

10.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

10.1.Regional Overview |

|

10.2.North America |

|

10.2.1.Regional Trends & Growth Drivers |

|

10.2.1.1.Investments in Agricultural Innovation by the Government |

|

10.2.1.2.Management of Knowledge and Commercialization in Agricultural Research |

|

10.2.2.Barriers & Challenges |

|

10.2.2.1.Labor Shortage in Canada within Agriculture Sector |

|

10.2.2.2.Low Confidence at Farmer-level to Use Sophisticated Agricultural Instruments |

|

10.2.3.Opportunities |

|

10.2.3.1.Increasing Financial Assistance by Governments for Precision Agriculture |

|

10.2.3.2.Changes by Policymakers to Increase Adoption Rate of Precision Agriculture |

|

10.2.4.North America Generative AI Market, by Offering |

|

10.2.5.North America Generative AI Market, by Technology |

|

10.2.6.North America Generative AI Market, by Agriculture Type |

|

10.2.7.North America Generative AI Market, by Farm Size |

|

10.2.8.North America Generative AI Market, by End User |

|

*Similar segmentation will be provided at each regional level |

|

10.3.By Country |

|

10.3.1.US |

|

10.3.1.1.US Generative AI Market, by Offering |

|

10.3.1.2.US Generative AI Market, by Technology |

|

10.3.1.3.US Generative AI Market, by Agriculture Type |

|

10.3.1.4.US Generative AI Market, by Farm Size |

|

10.3.1.5.US Generative AI Market, by End User |

|

10.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

10.4.Europe |

|

10.4.1.United Kingdom |

|

10.4.2.Germany |

|

10.4.3.France |

|

10.4.4.Italy |

|

10.4.5.Rest of Europe |

|

10.5.APAC |

|

10.5.1.China |

|

10.5.2.India |

|

10.5.3.South Korea |

|

10.5.4.Rest of Asia Pacific |

|

10.6.Latin America |

|

10.6.1.Brazil |

|

10.6.2.Mexico |

|

10.6.3.Argentina |

|

10.6.4.Rest of Latin America |

|

10.7.Middle East & Africa |

|

10.7.1.United Arab Emirates |

|

10.7.2.Saudi Arabia |

|

10.7.3.South Africa |

|

10.7.4.Rest of Middle East & Africa |

|

11.Competitive Landscape |

|

11.1.Introduction |

|

11.2.Company Market Share Analysis |

|

11.3.Key Strategic Development |

|

11.3.1.Overview |

|

11.3.2.Acquisition |

|

11.3.3.Business Expansion & Contraction |

|

11.3.4.Collaboration & Their Expansion |

|

11.3.5.Product Launch & Development |

|

12.Company Profiles |

|

12.1.Leading Companies |

|

12.1.1.Accenture |

|

12.1.1.1.Company Overview |

|

12.1.1.2.Company Financials |

|

12.1.1.3.Product/Service Portfolio |

|

12.1.1.4.Recent Developments |

|

12.1.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

12.1.2.AGRIVI |

|

12.1.3.Bayer |

|

12.1.4.Deere & Company |

|

12.1.5.DeLaval |

|

12.1.6.DTN |

|

12.1.7.Farmers Edge Inc. |

|

12.1.8.IBF Servizi |

|

12.1.9.IBM |

|

12.1.10.Microsoft |

|

12.1.11.Oracle |

|

12.1.12.Raven Industries |

|

12.1.13.SAP |

|

12.1.14.SAS |

|

12.1.15.Trimble |

|

12.2.Emerging Companies |

|

12.2.1.Ag Leader Technology |

|

12.2.1.1.Company Overview |

|

12.2.1.2.Recent Developments |

|

12.2.1.3.IMR Analysis |

|

12.2.2.Agremo |

|

12.2.3.AgriBotix |

|

12.2.4.Conservis |

|

12.2.5.Farmer's Business Network |

|

12.2.6.Gamaya |

|

12.2.7.Gro Intelligence |

|

12.2.8.Proagrica |

|

12.2.9.Stesalit Systems |

|

12.2.10.Taranis |

|

13.Appendix |

|

13.1.Discussion Guidelines |

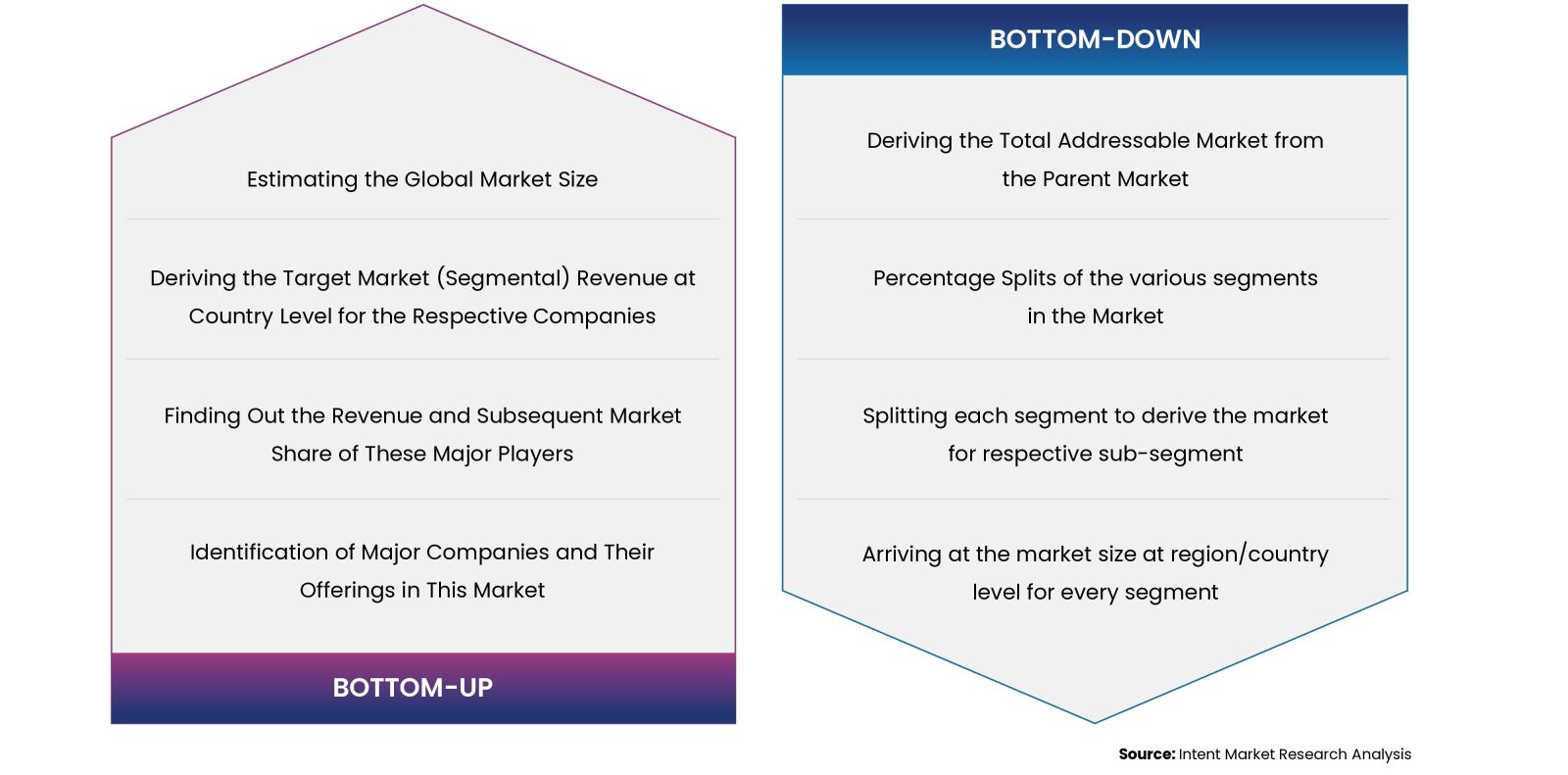

Intent Market Research employs a rigorous methodology to minimize residual errors by carefully defining the scope, validating findings through primary research, and consistently updating our in-house database. This dynamic approach allows us to capture ongoing market fluctuations and adapt to evolving market uncertainties.

The research factors used in our methodology vary depending on the specific market being analyzed. To begin with, we incorporate both demand and supply side information into our model to identify and address market gaps. Additionally, we also employ approaches such as Macro-Indicator Analysis, Factor Analysis, Value Chain-Based Sizing, and forecasting to further increase the accuracy of the numbers and validate the findings.

Research Approach

- Secondary Research Approach: During the initial phase of the research process, we acquire and accumulate extensive data continuously. This data is carefully filtered and validated through a variety of secondary sources.

- Primary Research Approach: Following the consolidation of data gathered through secondary research, we initiate a validation process to verify all the market numbers, and assumptions and validate the findings by engaging with subject matter experts.

Data Collection, Analysis and Interpretation:

Research Methodology

Our market research methodology utilizes both top-down and bottom-up approaches to segment and estimate quantitative aspects of the market. We also employ multi-perspective analysis, examining the market from distinct viewpoints.