As per Intent Market Research, the Insecticides Market was valued at USD 13.6 billion in 2023 and will surpass USD 21.5 billion by 2030; growing at a CAGR of 6.7% during 2024 - 2030.

Several factors are driving the expansion of the insecticides market, including the rising demand for food security and the need for sustainable farming practices. As farmers face challenges from pest resistance and environmental regulations, there is a growing emphasis on the development of more efficient and eco-friendly insecticides. This trend is evident in the shift towards biopesticides and the integration of digital technology in pest management. With advancements in agricultural practices and a heightened focus on sustainability, the insecticides market is poised for continued growth in the coming years..

Pyrethroids Segment is Largest Owing to Versatile Applications and Effectiveness

The pyrethroids segment holds the largest share in the insecticides market, primarily due to their versatility and effectiveness in controlling a wide range of insect pests. Pyrethroids are synthetic chemicals modeled after naturally occurring pyrethrins, which are extracted from chrysanthemum flowers. These insecticides are known for their rapid knockdown effect and residual activity, making them a preferred choice for farmers across various crops. The extensive application of pyrethroids in both agricultural and non-agricultural settings, such as residential pest control, has contributed significantly to their market dominance.

The popularity of pyrethroids can be attributed to their low toxicity to mammals and their effectiveness against various insects, including aphids, caterpillars, and beetles. As farmers increasingly adopt integrated pest management strategies, pyrethroids remain a cornerstone in pest control programs, helping to minimize crop losses while ensuring compliance with safety regulations. The combination of effectiveness, safety, and versatility positions the pyrethroids segment as a key driver of growth in the insecticides market.

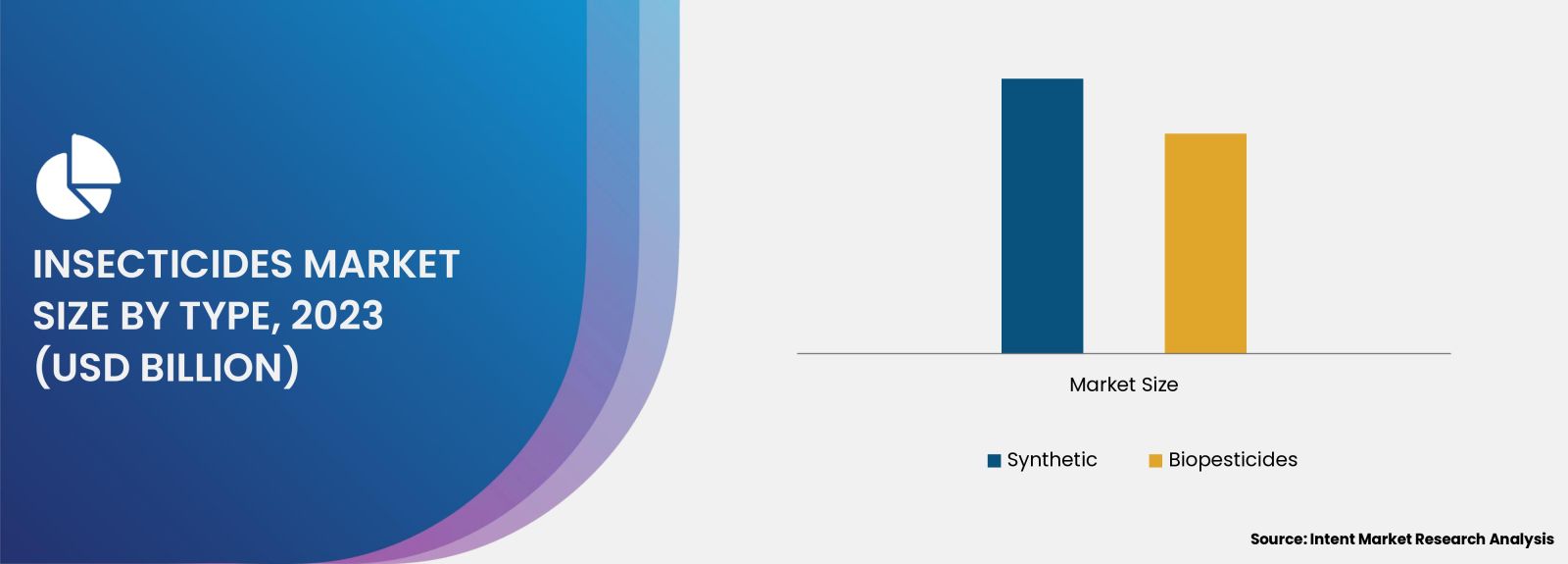

Biopesticides Segment is Fastest Growing Owing to Rising Demand for Eco-Friendly Solutions

The biopesticides segment is the fastest-growing category within the insecticides market, reflecting a shift towards more sustainable and environmentally friendly pest management solutions. Biopesticides are derived from natural organisms or organic materials, including bacteria, fungi, and plant extracts, and are increasingly favored by growers seeking to minimize chemical residues on crops. The rising awareness of the negative environmental impacts associated with synthetic pesticides has fueled the demand for biopesticides, particularly among organic farmers and those practicing sustainable agriculture.

The growth of the biopesticides segment is supported by advancements in research and development, leading to the formulation of highly effective products that can compete with traditional insecticides. Biopesticides not only reduce the reliance on synthetic chemicals but also help preserve beneficial insect populations, contributing to a balanced ecosystem. As consumer demand for organic produce continues to rise, the biopesticides segment is expected to witness significant growth, positioning itself as a vital component of modern pest management practices.

Foliar Application Segment is Largest Owing to Direct Pest Control

The foliar application segment is a significant contributor to the insecticides market, holding the largest share due to its direct and effective approach to pest control. Foliar application involves the spraying of insecticides directly onto the leaves of plants, allowing for immediate contact with pests. This method is particularly beneficial for controlling pests that infest the foliage, such as aphids, thrips, and spider mites. The efficiency and speed of foliar application make it a preferred choice for farmers seeking timely intervention against pest outbreaks.

The dominance of the foliar application segment can be attributed to its versatility in various crop types, including vegetables, fruits, and grains. As farmers increasingly recognize the importance of timely pest control to protect yield and quality, foliar application remains a widely adopted practice. With advancements in spray technologies and formulations designed for enhanced absorption and efficacy, the foliar application segment is expected to maintain its leading position in the insecticides market.

Seed Treatment Segment is Fastest Growing Owing to Enhanced Crop Protection

The seed treatment segment is the fastest-growing category in the insecticides market, driven by the increasing emphasis on crop protection from the earliest stages of growth. Seed treatments involve applying insecticides directly to seeds before planting, providing early defense against insect pests that may threaten germination and seedling development. This proactive approach helps ensure strong crop establishment and reduces the risk of pest damage during critical growth phases.

The rise of the seed treatment segment is supported by the growing adoption of high-value and specialty crops that require enhanced protection from pests. Farmers are increasingly recognizing the benefits of seed treatments in improving yield potential and reducing reliance on in-season pest control measures. As research continues to yield innovative seed treatment formulations, this segment is expected to experience substantial growth, aligning with broader trends in precision agriculture and integrated pest management.

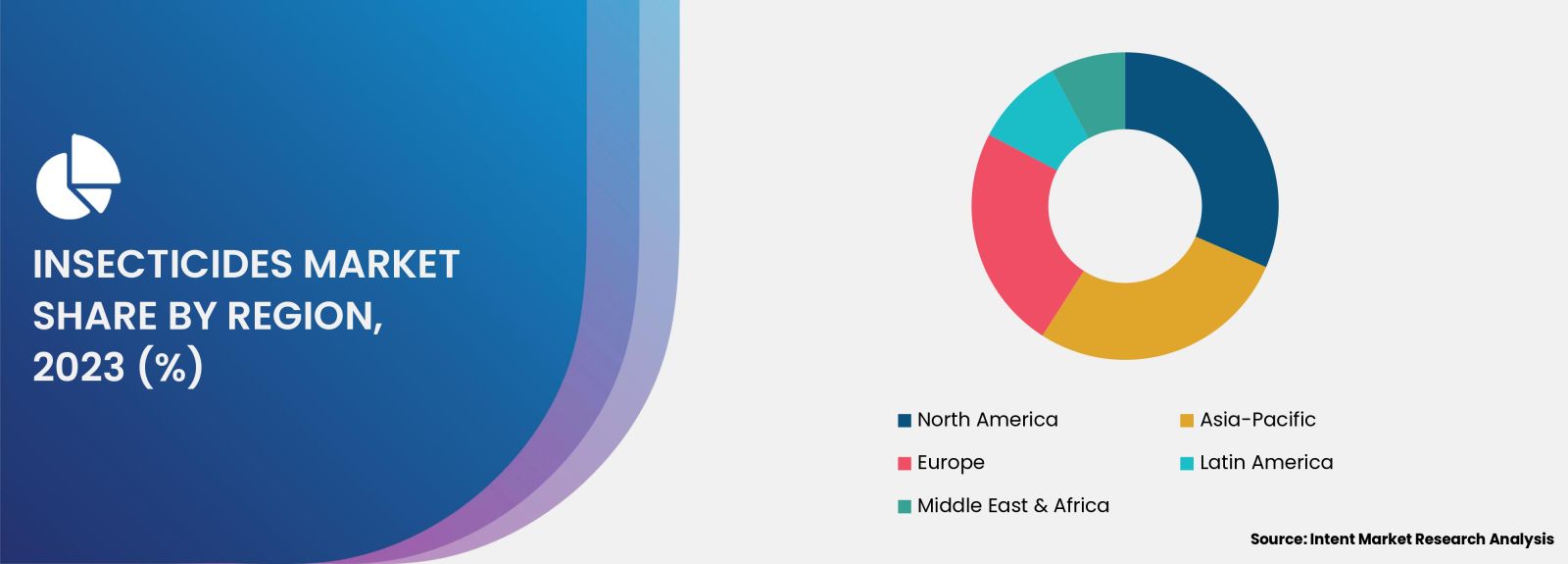

Asia-Pacific is Fastest Growing Region Owing to Expanding Agricultural Sector

The Asia-Pacific region is emerging as the fastest-growing market for insecticides, driven by the expansion of the agricultural sector and the increasing need for effective pest management solutions. Countries such as China and India are witnessing significant growth in agricultural production, necessitating the use of insecticides to protect crops from pest infestations. The rising population and changing dietary preferences are further propelling the demand for higher agricultural yields, leading to increased investment in pest control technologies.

Moreover, the Asia-Pacific region is experiencing a shift towards sustainable agriculture, with farmers increasingly adopting integrated pest management practices that incorporate both chemical and biological control methods. The growing awareness of environmental sustainability and food safety is driving the demand for biopesticides and eco-friendly insecticides. As agricultural practices continue to evolve, the Asia-Pacific region is expected to play a pivotal role in shaping the future of the global insecticides market.

Competitive Landscape of Leading Companies

The competitive landscape of the insecticides market is characterized by a diverse array of companies actively engaged in the research, development, and marketing of insecticide products. The top companies in this sector include:

- BASF SE: A leading global chemical company, BASF offers a wide range of insecticides, including innovative formulations aimed at sustainable pest management.

- Syngenta AG: Known for its extensive portfolio of crop protection products, Syngenta focuses on developing effective insecticides that address the needs of modern agriculture.

- Bayer AG: Bayer is a global leader in crop science, providing a comprehensive range of insecticides designed for various crops and pest challenges.

- FMC Corporation: FMC specializes in agricultural solutions, including insecticides that promote sustainable farming practices and effective pest control.

- Corteva Agriscience: Corteva offers a diverse range of insecticides that prioritize efficacy, safety, and environmental sustainability for farmers worldwide.

- Adama Agricultural Solutions Ltd.: Adama is known for its cost-effective crop protection solutions, including insecticides tailored to different agricultural settings.

- Nufarm Limited: Nufarm develops and markets a variety of insecticides, focusing on innovative solutions that meet the demands of farmers globally.

- UPL Limited: UPL provides a comprehensive portfolio of agricultural products, including insecticides that support effective pest management strategies.

- Sumitomo Chemical Co., Ltd.: Sumitomo Chemical is involved in the production of insecticides, contributing to the global agricultural market with advanced formulations.

- Mitsui Chemicals, Inc.: Mitsui Chemicals develops agricultural chemicals, including insecticides aimed at enhancing crop protection and yield.

The competitive landscape of the insecticides market is marked by continuous innovation and investment in research and development. Companies are increasingly focusing on developing new formulations and technologies that enhance efficacy while minimizing environmental impact. Collaborations and partnerships among agricultural technology firms and chemical manufacturers are also driving advancements in insecticide solutions. As the market evolves, competition is expected to intensify, with a strong emphasis on delivering effective and sustainable pest management solutions to meet the growing demands of the agricultural sector.

Report Objectives:

The report will help you answer some of the most critical questions in the Insecticides Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Insecticides Market?

- What is the size of the Insecticides Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 13.6 billion |

|

Forecasted Value (2030) |

USD 21.5 billion |

|

CAGR (2024 – 2030) |

6.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Insecticides Market By Type (Synthetic, Biopesticides), By Formulation (Liquid Formulations, Solid Formulations), and By Application (Agriculture, Public Health, Gardening and Horticulture) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Insecticides Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Synthetic |

|

4.1.1. Organophosphates |

|

4.1.2. Pyrethroids |

|

4.1.3. Neonicotinoids |

|

4.1.4. Carbamates |

|

4.1.5. Others |

|

4.2. Biopesticides |

|

4.2.1. Microbial Insecticides |

|

4.2.2. Plant-Incorporated Protectants (PIPs) |

|

4.2.3. Biochemical Insecticides |

|

4.2.4. Others |

|

5. Insecticides Market, by Formulation (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Liquid Formulations |

|

5.1.1. Emulsifiable Concentrates (EC) |

|

5.1.2. Suspended Concentrates (SC) |

|

5.1.3. Solutions |

|

5.2. Solid Formulations |

|

5.2.1. Granules |

|

5.2.2. Powders |

|

5.2.3. Baits |

|

6. Insecticides Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Agriculture |

|

6.1.1. Crop Protection |

|

6.1.2. Fruit and Vegetable Cultivation |

|

6.1.3. Field Crops |

|

6.2. Public Health |

|

6.2.1. Vector Control |

|

6.2.2. Household Pest Control |

|

6.2.3. Industrial Pest Control |

|

6.3. Gardening and Horticulture |

|

6.4. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Insecticides Market, by Type |

|

7.2.7. North America Insecticides Market, by Formulation |

|

7.2.8. North America Insecticides Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Insecticides Market, by Type |

|

7.2.9.1.2. US Insecticides Market, by Formulation |

|

7.2.9.1.3. US Insecticides Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. BASF |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Bayer |

|

9.3. Corteva |

|

9.4. DuPont |

|

9.5. FMC Corporation |

|

9.6. Nufarm |

|

9.7. Sumitomo Chemical |

|

9.8. Syngenta |

|

9.9. UPL Limited |

|

9.10. Valent U.S.A. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Insecticides Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Insecticides Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Insecticides ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Insecticides Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA