As per Intent Market Research, the Inhalation Anesthesia Market was valued at USD 1.7 Billion in 2024-e and will surpass USD 2.4 Billion by 2030; growing at a CAGR of 5.3% during 2025-2030.

The global inhalation anesthesia market is poised for steady growth as the demand for surgical procedures continues to rise, particularly within hospitals and outpatient care settings. Inhalational anesthesia is a crucial component of modern medicine, allowing for controlled sedation during surgeries while maintaining patient safety. Key drivers of this market include the increasing prevalence of chronic diseases, rising surgical volume, advancements in anesthetic agents, and growing awareness surrounding patient safety and procedural efficiency. The market is segmented by product type, application, end-user, route of administration, and region, with significant developments across each segment.

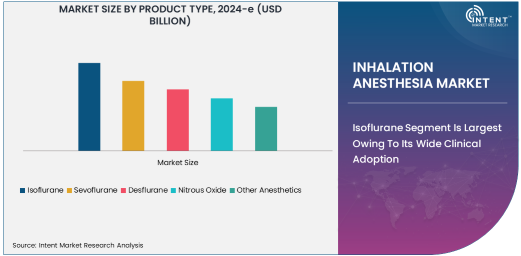

Isoflurane Segment Is Largest Owing To Its Wide Clinical Adoption

Isoflurane remains the largest segment within the inhalation anesthesia market, primarily due to its longstanding presence and effectiveness in clinical settings. Isoflurane is known for its balanced anesthetic properties, offering a reliable and stable inhalation agent for general anesthesia. It is commonly used for a variety of surgeries, including those in both high-risk and routine procedures, due to its favorable pharmacokinetic profile, including rapid onset and recovery. The product’s broad acceptance and versatility in both human and veterinary anesthesia have cemented its position as the most commonly used anesthetic gas globally.

The ease of use, affordability, and established safety profile of isoflurane make it the preferred choice across hospitals and surgical centers. It is also frequently used for outpatient surgeries and procedures requiring shorter recovery periods. Its role in reducing the risks associated with anesthesia-related complications, combined with extensive clinical research backing its use, enables isoflurane to maintain its dominance in the market.

General Anesthesia Segment Is Fastest Growing Owing To Increasing Surgical Procedures

The general anesthesia application segment is experiencing the fastest growth, driven by the increasing volume of surgeries globally. General anesthesia is essential for performing major and complex surgeries across various specialties, such as orthopedics, neurosurgery, and cardiology. As healthcare infrastructure improves and surgical techniques become more advanced, the demand for general anesthesia continues to rise. The segment’s growth is further fueled by the rising prevalence of chronic diseases such as cancer, heart disease, and neurological disorders, which necessitate surgical intervention.

General anesthesia provides a comprehensive solution for maintaining unconsciousness and preventing pain during procedures, making it indispensable in modern medicine. With the growing healthcare needs, especially in emerging markets, the demand for general anesthesia agents like isoflurane, sevoflurane, and others is expected to expand significantly. Hospitals, surgical centers, and outpatient clinics increasingly rely on general anesthesia for safe and effective patient management, further contributing to its rapid growth.

Hospitals Segment Is Largest End-User Owing To High Surgical Demand

Hospitals are the largest end-user of inhalation anesthesia agents, driven by the high volume of surgical procedures performed annually. Hospitals serve as the epicenter for critical care and complex surgeries, where the demand for anesthetic drugs is consistently high. The growth of hospitals as end-users is closely linked to the increasing number of surgeries, including elective and emergency surgeries, and the rising prevalence of age-related illnesses that require surgical intervention. Hospitals invest significantly in anesthesia machines and related technologies to ensure patient safety during surgery, further driving the consumption of inhalation anesthetics.

The steady rise in hospital admissions and the increasing complexity of surgeries requiring general anesthesia contribute to the dominance of hospitals in this market segment. Additionally, the growing focus on patient recovery, reducing anesthesia-related complications, and ensuring a seamless surgical experience further consolidates hospitals as the leading end-users of inhalation anesthesia. Hospitals remain the backbone of the anesthesia market, providing the infrastructure necessary to support large volumes of anesthetic agents.

Inhalation Route of Administration Is Largest Owing To Its Efficiency

The inhalation route of administration holds the largest share in the market due to its established and efficient role in delivering anesthesia during surgeries. Inhalation anesthesia allows for precise control over anesthetic depth and provides a rapid onset of action. It is particularly beneficial for maintaining anesthesia during prolonged procedures, offering a safe and effective method for both induction and maintenance of anesthesia. Inhalation agents such as isoflurane, sevoflurane, and nitrous oxide are commonly administered through vaporizer systems, allowing for easy and adjustable delivery based on patient needs.

Inhalation anesthesia is preferred for its predictable pharmacodynamics, with agents being rapidly eliminated from the body post-procedure, resulting in minimal recovery time. As a result, patients benefit from quicker post-surgical recovery and shorter hospital stays. The widespread use of inhalation anesthesia, especially in hospitals and surgical centers, cements its dominance in the market, with ongoing innovation to improve delivery systems and optimize patient care.

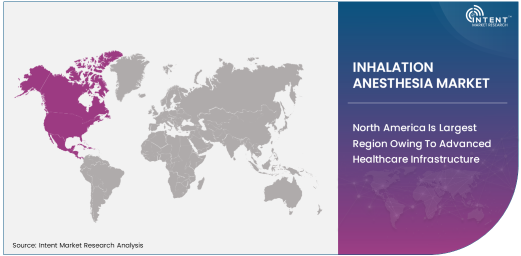

North America Is Largest Region Owing To Advanced Healthcare Infrastructure

North America leads the global inhalation anesthesia market, owing to its advanced healthcare infrastructure, high surgical volume, and robust demand for anesthesia products. The region boasts a high concentration of hospitals, surgical centers, and outpatient facilities, which drive the demand for inhalation anesthetics. The presence of leading companies in the market, along with the implementation of stringent healthcare standards and regulations, further reinforces North America's position as the largest market. Additionally, the region benefits from significant healthcare spending, especially in the United States, where the healthcare system continues to support cutting-edge medical technologies, including anesthesia systems.

The growing number of surgeries in North America, driven by the aging population and the high incidence of chronic diseases, fuels the demand for inhalation anesthesia. Furthermore, ongoing advancements in anesthetic agents, as well as increasing patient safety awareness, are contributing to the market's expansion in this region. North America’s well-established healthcare system, coupled with a strong regulatory framework, positions it as a key hub for inhalation anesthesia consumption and product innovation.

Leading Companies and Competitive Landscape

The inhalation anesthesia market is highly competitive, with numerous global players leading the way in product innovation and market share. Key companies in this space include AbbVie Inc., Baxter International Inc., Drägerwerk AG, Fresenius Kabi, and Merck & Co., among others. These companies are focused on enhancing their product portfolios, expanding their geographical footprint, and ensuring regulatory compliance to meet the growing demand for safe and effective anesthesia solutions. Additionally, leading firms are investing in research and development to improve the pharmacokinetic properties of anesthetic agents, ensuring faster onset, better recovery times, and fewer side effects.

Mergers, acquisitions, and partnerships are common in the market, as companies seek to consolidate their presence and expand their product offerings. With the rising demand for more eco-friendly and sustainable anesthesia options, companies are also exploring ways to reduce environmental impact by developing low-emission anesthetic agents. As the market grows, competition among existing players is expected to intensify, encouraging further innovation, strategic collaborations, and increased market penetration to maintain leadership in the global inhalation anesthesia market.

Recent Developments:

- AbbVie announced the acquisition of Allergan’s inhalation anesthesia portfolio, including sevoflurane, to strengthen its position in the global anesthesia market.

- Baxter International received FDA approval for a new inhalation anesthesia machine designed to improve safety and reduce environmental impact during surgeries.

- Fresenius Kabi Launches New Anesthetic Gases – Fresenius Kabi launched a new line of inhalational anesthetic agents, expanding its portfolio to meet increasing demand in surgical and procedural settings.

- Medtronic Partners with GE Healthcare for Anesthesia Solutions – Medtronic and GE Healthcare formed a strategic partnership to deliver advanced anesthesia delivery systems and devices, enhancing patient care in hospital settings.

- Piramal Enterprises Invests in Advanced Anesthesia Technologies – Piramal Enterprises invested in expanding its anesthetic gas production capabilities, focusing on developing more efficient and eco-friendly inhalation anesthetic agents.

List of Leading Companies:

- AbbVie Inc.

- Baxter International Inc.

- Halocarbon Products Corporation

- Linde Healthcare

- Meda AB

- Piramal Enterprises Ltd.

- Drägerwerk AG & Co. KGaA

- Fresenius Kabi

- Air Products and Chemicals, Inc.

- General Electric (GE) Healthcare

- Merck & Co., Inc.

- Smiths Medical

- Johnson & Johnson

- Medtronic

- Halyard Health

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.7 Billion |

|

Forecasted Value (2030) |

USD 2.4 Billion |

|

CAGR (2025 – 2030) |

5.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Inhalation Anesthesia Market By Product Type (Isoflurane, Sevoflurane, Desflurane, Nitrous Oxide), By Application (General Anesthesia, Sedation, Pain Management, Procedural Sedation), By End-User (Hospitals, Ambulatory Surgical Centers, Clinics, Homecare Settings), By Route of Administration (Inhalation, Intravenous) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

AbbVie Inc., Baxter International Inc., Halocarbon Products Corporation, Linde Healthcare, Meda AB, Piramal Enterprises Ltd., Drägerwerk AG & Co. KGaA, Fresenius Kabi, Air Products and Chemicals, Inc., General Electric (GE) Healthcare, Merck & Co., Inc., Smiths Medical, Johnson & Johnson, Medtronic, Halyard Health |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Inhalation Anesthesia Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Isoflurane |

|

4.2. Sevoflurane |

|

4.3. Desflurane |

|

4.4. Nitrous Oxide |

|

4.5. Other Anesthetics |

|

5. Inhalation Anesthesia Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. General Anesthesia |

|

5.2. Sedation |

|

5.3. Pain Management |

|

5.4. Procedural Sedation |

|

5.5. Other Applications |

|

6. Inhalation Anesthesia Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Ambulatory Surgical Centers |

|

6.3. Clinics |

|

6.4. Homecare Settings |

|

6.5. Other End-Users |

|

7. Inhalation Anesthesia Market, by Route of Administration (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Inhalation |

|

7.2. Intravenous |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Inhalation Anesthesia Market, by Product Type |

|

8.2.7. North America Inhalation Anesthesia Market, by Application |

|

8.2.8. North America Inhalation Anesthesia Market, by End-User |

|

8.2.9. North America Inhalation Anesthesia Market, by Route of Administration |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Inhalation Anesthesia Market, by Product Type |

|

8.2.10.1.2. US Inhalation Anesthesia Market, by Application |

|

8.2.10.1.3. US Inhalation Anesthesia Market, by End-User |

|

8.2.10.1.4. US Inhalation Anesthesia Market, by Route of Administration |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. AbbVie Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Baxter International Inc. |

|

10.3. Halocarbon Products Corporation |

|

10.4. Linde Healthcare |

|

10.5. Meda AB |

|

10.6. Piramal Enterprises Ltd. |

|

10.7. Drägerwerk AG & Co. KGaA |

|

10.8. Fresenius Kabi |

|

10.9. Air Products and Chemicals, Inc. |

|

10.10. General Electric (GE) Healthcare |

|

10.11. Merck & Co., Inc. |

|

10.12. Smiths Medical |

|

10.13. Johnson & Johnson |

|

10.14. Medtronic |

|

10.15. Halyard Health |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Inhalation Anesthesia Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Inhalation Anesthesia Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Inhalation Anesthesia Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA