As per Intent Market Research, the Inhalation and Nasal Spray Generic Drugs Market was valued at USD 29.3 Billion in 2024-e and will surpass USD 48.5 Billion by 2030; growing at a CAGR of 8.8% during 2025-2030.

The inhalation and nasal spray generic drugs market is witnessing significant growth due to the increasing prevalence of respiratory diseases, allergies, and other chronic conditions that require long-term management. As healthcare systems worldwide seek cost-effective alternatives to branded medications, the demand for generic inhalation devices and nasal sprays has risen. These drugs offer patients a more affordable treatment option for conditions such as asthma, Chronic Obstructive Pulmonary Disease (COPD), and allergic rhinitis. The market is segmented into product types, applications, end-users, routes of administration, and regions, each contributing to the overall growth of the sector.

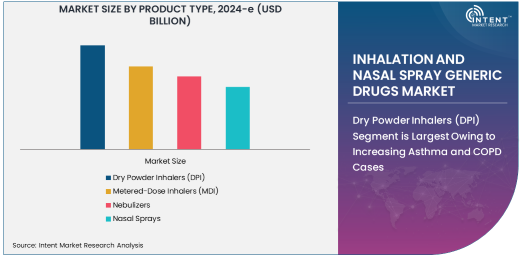

Dry Powder Inhalers (DPI) Segment is Largest Owing to Increasing Asthma and COPD Cases

Dry powder inhalers (DPIs) have emerged as the dominant product type in the inhalation and nasal spray generic drugs market. These devices are preferred by patients due to their ease of use, portability, and the absence of propellants. DPIs are primarily used for delivering medications to manage asthma and COPD, both of which are chronic conditions with a high global prevalence. The increasing number of asthma and COPD cases, particularly in aging populations, is driving the demand for DPIs. Additionally, the growing adoption of generic DPIs in both developed and emerging markets has made them a cost-effective treatment option, further boosting their market share.

The demand for DPIs is expected to continue growing due to advancements in inhalation technology, which have made these devices more efficient and patient-friendly. Manufacturers are also focusing on improving the formulation of dry powders, making them more effective in controlling symptoms and improving patient compliance. As a result, DPIs are expected to remain the leading product type in the inhalation and nasal spray generic drugs market for the foreseeable future.

Respiratory Diseases Application is Fastest Growing Due to Rising Prevalence

Respiratory diseases, including asthma, COPD, and other chronic lung conditions, are driving the growth of the inhalation and nasal spray generic drugs market. This segment is the fastest-growing application owing to the increasing burden of respiratory illnesses worldwide. The World Health Organization (WHO) estimates that COPD is the third leading cause of death globally, and asthma affects approximately 262 million people. The rising incidence of these diseases, particularly in emerging markets where smoking and air pollution rates are high, is accelerating the demand for inhalation therapies.

Additionally, the shift toward generic inhalation therapies has been a major factor in making treatments more accessible to a larger population. With the growing number of patients needing long-term management of respiratory conditions, the demand for affordable, effective medications delivered via inhalers and nasal sprays is expected to increase. This trend will continue to drive the respiratory diseases segment's growth in the coming years.

Homecare Settings End-User is Largest Owing to Rising Self-Management Trends

The homecare settings end-user segment holds the largest share in the inhalation and nasal spray generic drugs market. With the increasing preference for home-based healthcare and self-management of chronic conditions, more patients are opting for homecare settings to manage their respiratory conditions. Advances in inhalation technology have made it easier for patients to use inhalers and nebulizers at home, reducing the need for frequent hospital visits.

In addition to the convenience and cost-effectiveness of homecare, there is a rising trend of patient empowerment, where individuals take a more active role in managing their health. This has led to a growing demand for respiratory treatments that can be administered at home, further solidifying the dominance of the homecare settings segment. The segment's growth is also supported by insurance policies and government initiatives that promote home healthcare solutions, making it a key driver in the inhalation and nasal spray generic drugs market.

Pulmonary Route of Administration is Fastest Growing Due to Effectiveness in Respiratory Treatments

The pulmonary route of administration is the fastest-growing segment in the inhalation and nasal spray generic drugs market. This route allows for direct delivery of drugs to the lungs, making it particularly effective for treating respiratory diseases such as asthma and COPD. Pulmonary administration ensures fast onset of action and better drug absorption, which is crucial for managing acute symptoms and preventing exacerbations in chronic conditions.

Advancements in inhaler technology and the introduction of more efficient formulations have contributed to the growing popularity of pulmonary drug delivery systems. Additionally, the rising focus on non-invasive treatments for chronic respiratory conditions and the growing preference for inhalation therapies over oral medications have fueled the growth of this segment. As a result, the pulmonary route of administration is expected to maintain its rapid growth trajectory in the coming years.

North America Region is Largest Owing to Advanced Healthcare Infrastructure

North America dominates the inhalation and nasal spray generic drugs market, owing to its advanced healthcare infrastructure, high healthcare spending, and a large patient population suffering from respiratory diseases. The United States, in particular, accounts for a significant share of the market due to its well-established healthcare system, high adoption of innovative drug delivery systems, and a growing elderly population. The prevalence of asthma, COPD, and other respiratory conditions is also higher in North America, driving the demand for inhalation and nasal spray medications.

The strong regulatory framework in North America, along with the increasing availability of generic drugs, has played a key role in expanding access to affordable treatment options. The North American market is expected to maintain its dominance, driven by a combination of patient needs, healthcare policies, and ongoing advancements in respiratory drug delivery technologies.

Competitive Landscape and Leading Companies

The competitive landscape of the inhalation and nasal spray generic drugs market is characterized by the presence of several global pharmaceutical companies, including Teva Pharmaceutical Industries Ltd., Mylan (now part of Viatris Inc.), Cipla Limited, and Sandoz, among others. These companies are focusing on expanding their product portfolios through the development of generic inhalation devices and nasal sprays to cater to the growing demand for affordable treatments.

In addition to product innovation, strategic partnerships, mergers, and acquisitions are key strategies employed by leading players to strengthen their market position. For instance, Teva has made significant strides in the generic inhalation market through the development of generic versions of branded inhalers. Similarly, Cipla and Mylan are focusing on expanding their respiratory portfolios to meet the increasing demand for inhalation and nasal spray therapies. As the market continues to grow, competition is expected to intensify, with companies striving to offer more effective and cost-efficient solutions for respiratory disease management.

Recent Developments:

- Teva launched its generic version of Advair Diskus, expanding its respiratory portfolio and reinforcing its position in the inhalation drugs market.

- Viatris received FDA approval for its generic version of Symbicort, a treatment for asthma and COPD, signaling strong growth prospects in the inhalation drug sector.

- Cipla received EU approval for a new inhaler aimed at improving asthma management, marking a key step in its expansion in the European respiratory drug market.

- Sun Pharma has launched a generic nasal spray for allergy relief in the U.S., capitalizing on the growing demand for affordable allergy treatments.

- Aurobindo Pharma expanded its respiratory portfolio by introducing a new generic MDI for the treatment of asthma and COPD in key international markets.

List of Leading Companies:

- Teva Pharmaceutical Industries Ltd.

- Mylan (now part of Viatris Inc.)

- Sandoz (A Novartis Division)

- Cipla Limited

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy’s Laboratories

- Apotex Inc.

- Glenmark Pharmaceuticals

- Hikma Pharmaceuticals

- Aurobindo Pharma

- Zydus Cadila

- Perrigo Company

- Fresenius Kabi

- Endo International

- Amgen Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 29.3 Billion |

|

Forecasted Value (2030) |

USD 48.5 Billion |

|

CAGR (2025 – 2030) |

8.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Inhalation and Nasal Spray Generic Drugs Market By Product Type (Dry Powder Inhalers, Metered-Dose Inhalers, Nebulizers, Nasal Sprays), By Application (Respiratory Diseases, Allergies, Asthma, Chronic Obstructive Pulmonary Disease, Other Applications), By End-User (Hospitals, Clinics, Homecare Settings, Other End-Users), By Route of Administration (Pulmonary, Nasal, Other Routes) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Teva Pharmaceutical Industries Ltd., Mylan (now part of Viatris Inc.), Sandoz (A Novartis Division), Cipla Limited, Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories, Apotex Inc., Glenmark Pharmaceuticals, Hikma Pharmaceuticals, Aurobindo Pharma, Zydus Cadila, Perrigo Company, Fresenius Kabi, Endo International, Amgen Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Inhalation and Nasal Spray Generic Drugs Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Dry Powder Inhalers (DPI) |

|

4.2. Metered-Dose Inhalers (MDI) |

|

4.3. Nebulizers |

|

4.4. Nasal Sprays |

|

5. Inhalation and Nasal Spray Generic Drugs Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Respiratory Diseases |

|

5.2. Allergies |

|

5.3. Asthma |

|

5.4. Chronic Obstructive Pulmonary Disease (COPD) |

|

5.5. Other Applications |

|

6. Inhalation and Nasal Spray Generic Drugs Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Clinics |

|

6.3. Homecare Settings |

|

6.4. Other End-Users |

|

7. Inhalation and Nasal Spray Generic Drugs Market, by Route of Administration (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Pulmonary |

|

7.2. Nasal |

|

7.3. Other Routes |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Inhalation and Nasal Spray Generic Drugs Market, by Product Type |

|

8.2.7. North America Inhalation and Nasal Spray Generic Drugs Market, by Application |

|

8.2.8. North America Inhalation and Nasal Spray Generic Drugs Market, by End-User |

|

8.2.9. North America Inhalation and Nasal Spray Generic Drugs Market, by Route of Administration |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Inhalation and Nasal Spray Generic Drugs Market, by Product Type |

|

8.2.10.1.2. US Inhalation and Nasal Spray Generic Drugs Market, by Application |

|

8.2.10.1.3. US Inhalation and Nasal Spray Generic Drugs Market, by End-User |

|

8.2.10.1.4. US Inhalation and Nasal Spray Generic Drugs Market, by Route of Administration |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Teva Pharmaceutical Industries Ltd. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Mylan (now part of Viatris Inc.) |

|

10.3. Sandoz (A Novartis Division) |

|

10.4. Cipla Limited |

|

10.5. Sun Pharmaceutical Industries Ltd. |

|

10.6. Dr. Reddy’s Laboratories |

|

10.7. Apotex Inc. |

|

10.8. Glenmark Pharmaceuticals |

|

10.9. Hikma Pharmaceuticals |

|

10.10. Aurobindo Pharma |

|

10.11. Zydus Cadila |

|

10.12. Perrigo Company |

|

10.13. Fresenius Kabi |

|

10.14. Endo International |

|

10.15. Amgen Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Inhalation and Nasal Spray Generic Drugs Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Inhalation and Nasal Spray Generic Drugs Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Inhalation and Nasal Spray Generic Drugs Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA