As per Intent Market Research, the Infectious Respiratory Disease Diagnostics Market was valued at USD 11.7 Billion in 2024-e and will surpass USD 18.0 Billion by 2030; growing at a CAGR of 7.6% during 2025 - 2030.

The Infectious Respiratory Disease Diagnostics market is a crucial segment of the broader infectious disease diagnostics industry, driven by the increasing incidence of respiratory infections caused by bacteria, viruses, and fungi. Respiratory diseases, such as influenza, pneumonia, tuberculosis, and more recently COVID-19, remain a major cause of morbidity and mortality globally. The demand for rapid, accurate, and efficient diagnostic solutions has escalated as healthcare systems seek to better manage and contain the spread of infectious respiratory diseases. In response, the market for diagnostic technologies such as PCR-based diagnostics, immunoassays, and microarrays has expanded significantly, with innovations aimed at improving diagnostic accuracy, speed, and accessibility.

As the world faces an ongoing rise in respiratory infections, especially in the wake of global pandemics like COVID-19, the role of diagnostic tools has never been more critical. Advances in diagnostic technologies have led to the development of high-sensitivity, rapid-result tests that can be used both in hospital settings and point-of-care environments. These innovations not only enhance early detection but also aid in the appropriate treatment of patients, reducing the spread of infections and improving overall public health outcomes. This market continues to evolve, with increasing emphasis on next-generation diagnostics capable of detecting multiple pathogens simultaneously and providing more comprehensive insights into the respiratory health of patients.

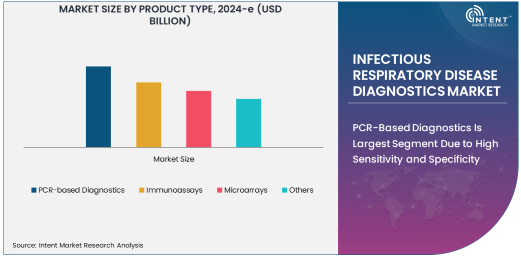

PCR-Based Diagnostics Is Largest Segment Due to High Sensitivity and Specificity

PCR-based diagnostics represent the largest segment in the infectious respiratory disease diagnostics market, owing to their high sensitivity, specificity, and versatility. Polymerase chain reaction (PCR) technology is widely used to detect respiratory pathogens, particularly for viral and bacterial infections. PCR is considered the gold standard for the diagnosis of many infectious diseases, including respiratory diseases such as COVID-19, influenza, and tuberculosis, due to its ability to detect even minute amounts of pathogen DNA or RNA.

The global demand for PCR-based diagnostic tests surged dramatically during the COVID-19 pandemic, highlighting their importance in respiratory disease detection. PCR tests offer fast, accurate results, which are essential for early diagnosis and timely treatment. Moreover, advancements in real-time PCR and multiplex PCR technologies have further improved diagnostic capabilities, enabling the detection of multiple pathogens in a single test. These features make PCR-based diagnostics the preferred choice for healthcare providers, especially in hospitals and clinics where rapid and reliable results are critical for effective treatment decisions. As a result, this segment is expected to maintain its dominance in the market, driven by ongoing developments and widespread adoption of PCR technology.

Immunoassays Are Fastest Growing Segment Due to Rising Demand for Point-of-Care Testing

Immunoassays represent the fastest-growing segment in the infectious respiratory disease diagnostics market, primarily due to the increasing demand for point-of-care (POC) testing and rapid diagnostics. Immunoassays are used to detect specific antibodies or antigens associated with respiratory infections, such as influenza, COVID-19, and respiratory syncytial virus (RSV). These diagnostic tests provide quick results, typically within 15-30 minutes, making them highly valuable for both clinicians and patients, especially in settings where rapid decision-making is required.

The growing shift towards decentralized healthcare, where diagnostic testing is performed outside of traditional hospital settings, is driving the adoption of immunoassay-based tests. These tests are easy to use, cost-effective, and can be deployed in various environments, including outpatient clinics, emergency departments, and even at-home settings. The increased focus on early detection and immediate treatment of respiratory infections has also fueled the demand for immunoassays, which offer rapid and reliable results, enabling faster interventions. As the market for POC testing expands, immunoassays are expected to experience significant growth, positioning them as one of the fastest-growing diagnostic tools in the infectious respiratory disease diagnostics market.

Hospitals and Clinics Are Largest End-Use Industry Due to High Volume of Respiratory Disease Cases

Hospitals and clinics are the largest end-use industry in the infectious respiratory disease diagnostics market due to the high volume of respiratory disease cases that are managed within these healthcare settings. Hospitals and clinics are at the forefront of diagnosing and treating infectious respiratory diseases, particularly in severe or complicated cases that require immediate medical attention. The widespread use of diagnostic technologies in these settings ensures early detection, which is crucial for controlling the spread of infectious respiratory diseases and improving patient outcomes.

Hospitals are equipped with advanced diagnostic technologies, including PCR-based systems, immunoassays, and microarrays, which are essential for accurate and efficient detection of respiratory pathogens. Additionally, hospitals and clinics serve as the primary locations for critical care and intensive care unit (ICU) admissions for patients with severe respiratory infections. The ongoing demand for respiratory disease diagnostics in these settings, particularly with the rise of respiratory infections during flu seasons and pandemics, positions hospitals and clinics as the largest end-user segment in this market.

North America Is Largest Region Due to Advanced Healthcare Infrastructure

North America is the largest region in the infectious respiratory disease diagnostics market, driven by its advanced healthcare infrastructure, significant investments in healthcare technologies, and a high prevalence of respiratory infections. The United States, in particular, has a well-established healthcare system that prioritizes the use of advanced diagnostic tools in the diagnosis and management of respiratory diseases. The region has seen a surge in demand for diagnostics, especially in light of the COVID-19 pandemic, which prompted widespread use of PCR-based testing and immunoassays for detecting the virus.

The presence of major global diagnostic companies, strong research and development capabilities, and favorable reimbursement policies for diagnostic tests further contribute to North America's dominance in this market. The high adoption rate of advanced diagnostic technologies in hospitals, clinics, and diagnostic laboratories in the region also supports its market leadership. As North America continues to tackle both seasonal respiratory infections and emerging threats, the demand for infectious respiratory disease diagnostics is expected to remain strong, cementing the region's position as the largest market.

Leading Companies and Competitive Landscape

The infectious respiratory disease diagnostics market is highly competitive, with several prominent players offering advanced diagnostic technologies. Key companies operating in the market include Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Siemens Healthineers, BD (Becton, Dickinson and Company), and BioMérieux. These companies are at the forefront of developing and commercializing diagnostic tools for respiratory diseases, including PCR-based platforms, immunoassays, and microarray systems.

The competitive landscape is characterized by constant innovation, with companies focusing on enhancing the speed, accuracy, and affordability of respiratory disease diagnostics. Strategic partnerships, mergers and acquisitions, and collaborations with healthcare providers are common strategies used by these companies to expand their market presence. Additionally, with the growing emphasis on point-of-care testing and decentralized healthcare, companies are investing in portable diagnostic solutions that can be used outside traditional clinical settings. As respiratory diseases continue to impact global health, leading companies will play a key role in shaping the future of diagnostic solutions in this market.

Recent Developments:

- Thermo Fisher Scientific launched a new PCR-based test for detecting COVID-19 variants, enhancing global testing efforts.

- Abbott Laboratories received FDA emergency use authorization for its rapid antigen test to detect respiratory infections, including flu and COVID-19.

- Siemens Healthineers expanded its portfolio with a new diagnostic platform for detecting respiratory pathogens, offering faster results and greater accuracy.

- Cepheid Inc. introduced an innovative molecular diagnostic test for tuberculosis and other respiratory infections in low-resource settings.

- bioMérieux partnered with a healthcare organization to deploy its respiratory pathogen diagnostic solutions across multiple hospitals globally.

List of Leading Companies:

- Thermo Fisher Scientific

- Abbott Laboratories

- BD (Becton, Dickinson and Company)

- Roche Diagnostics

- Siemens Healthineers

- Danaher Corporation

- Cepheid Inc.

- bioMérieux

- Hologic, Inc.

- PerkinElmer, Inc.

- Luminex Corporation

- Medtronic Plc

- Qiagen

- AbbVie Inc.

- Mettler Toledo

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 11.7 Billion |

|

Forecasted Value (2030) |

USD 18.0 Billion |

|

CAGR (2025 – 2030) |

7.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Infectious Respiratory Disease Diagnostics Market by Product Type (PCR-based Diagnostics, Immunoassays, Microarrays); Pathogen Type (Bacterial Infections, Viral Infections, Fungal Infections); End-Use Industry (Hospitals and Clinics, Diagnostic Laboratories) and by Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Thermo Fisher Scientific, Abbott Laboratories, BD (Becton, Dickinson and Company), Roche Diagnostics, Siemens Healthineers, Danaher Corporation, bioMérieux, Hologic, Inc., PerkinElmer, Inc., Luminex Corporation, Medtronic Plc, Qiagen, Mettler Toledo |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Infectious Respiratory Disease Diagnostics Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. PCR-based Diagnostics |

|

4.2. Immunoassays |

|

4.3. Microarrays |

|

4.4. Others |

|

5. Infectious Respiratory Disease Diagnostics Market, by Pathogen Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Bacterial Infections |

|

5.2. Viral Infections |

|

5.3. Fungal Infections |

|

6. Infectious Respiratory Disease Diagnostics Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals and Clinics |

|

6.2. Diagnostic Laboratories |

|

6.3. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Infectious Respiratory Disease Diagnostics Market, by Product Type |

|

7.2.7. North America Infectious Respiratory Disease Diagnostics Market, by Pathogen Type |

|

7.2.8. North America Infectious Respiratory Disease Diagnostics Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Infectious Respiratory Disease Diagnostics Market, by Product Type |

|

7.2.9.1.2. US Infectious Respiratory Disease Diagnostics Market, by Pathogen Type |

|

7.2.9.1.3. US Infectious Respiratory Disease Diagnostics Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Thermo Fisher Scientific |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Abbott Laboratories |

|

9.3. BD (Becton, Dickinson and Company) |

|

9.4. Roche Diagnostics |

|

9.5. Siemens Healthineers |

|

9.6. Danaher Corporation |

|

9.7. Cepheid Inc. |

|

9.8. bioMérieux |

|

9.9. Hologic, Inc. |

|

9.10. PerkinElmer, Inc. |

|

9.11. Luminex Corporation |

|

9.12. Medtronic Plc |

|

9.13. Qiagen |

|

9.14. AbbVie Inc. |

|

9.15. Mettler Toledo |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Infectious Respiratory Disease Diagnostics Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Infectious Respiratory Disease Diagnostics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Infectious Respiratory Disease Diagnostics Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA