As per Intent Market Research, the Infection Control Market was valued at USD 25.5 Billion in 2024-e and will surpass USD 43.7 Billion by 2030; growing at a CAGR of 9.4% during 2025 - 2030.

The infection control market plays a critical role in preventing the spread of healthcare-associated infections (HAIs) and ensuring patient safety across various healthcare settings. Infection control products are vital for maintaining hygiene, minimizing contamination, and safeguarding healthcare workers and patients alike. With the increasing prevalence of infectious diseases and the ongoing global health challenges, the demand for effective infection control solutions has surged. Products such as disinfectants, sterilization equipment, and personal protective equipment (PPE) are essential in infection control protocols, particularly within hospitals and healthcare facilities, where the risk of infections is high. These products contribute to the overall safety of patients, healthcare providers, and visitors.

The market is diverse, with various segments addressing specific needs within infection control. Disinfectants and sterilization equipment form the backbone of infection control programs, while PPE provides critical protection for frontline healthcare workers. The demand for these products is driven by stricter healthcare regulations, heightened awareness of infectious diseases, and ongoing efforts to improve infection prevention strategies. As healthcare systems worldwide continue to focus on improving patient care and minimizing infections, the infection control market is poised for continued growth.

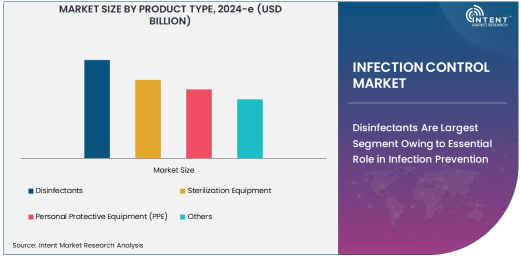

Disinfectants Are Largest Segment Owing to Essential Role in Infection Prevention

Disinfectants are the largest product type in the infection control market, primarily due to their essential role in preventing the spread of harmful pathogens in healthcare environments. Disinfectants are widely used to clean surfaces, medical equipment, and other environments where the risk of contamination is high. The demand for disinfectants has been significantly boosted by the increasing awareness of healthcare-associated infections (HAIs) and the need for stringent infection control measures. Hospitals, healthcare facilities, and clinics rely heavily on disinfectants to maintain hygiene and reduce the transmission of diseases caused by bacteria, viruses, and fungi.

The efficacy and versatility of disinfectants make them indispensable in healthcare settings. The wide variety of disinfectant products available, including those in liquid, aerosol, and wipe forms, allows healthcare providers to effectively address different types of infections and contamination risks. Additionally, the ongoing focus on preventing outbreaks of diseases such as COVID-19 has further amplified the demand for disinfectants, ensuring their continued dominance in the infection control market.

Sterilization Equipment Is Fastest Growing Segment Owing to Increased Focus on Medical Device Sterilization

Sterilization equipment is the fastest growing segment within the infection control market, driven by the increasing demand for high-quality sterilization of medical devices, surgical instruments, and other healthcare materials. As medical technology continues to advance, the need for sterilization equipment has expanded, with hospitals and healthcare facilities requiring more efficient and effective sterilization methods to ensure patient safety. Technologies such as autoclaves, dry heat sterilizers, and gas sterilizers are widely used in healthcare environments to achieve the highest standards of cleanliness and prevent infection transmission.

The rise in surgeries, medical procedures, and complex treatments has created a greater need for sterilization equipment to guarantee that instruments and tools are free from pathogens. This trend is further accelerated by the increasing regulatory standards regarding infection control and sterilization processes. As healthcare facilities prioritize patient safety and strive to comply with stringent infection prevention guidelines, the sterilization equipment segment is expected to see substantial growth.

Personal Protective Equipment (PPE) Is Critical for Healthcare Workers, Driving Market Demand

Personal protective equipment (PPE) is a vital product type in the infection control market, particularly in the wake of the COVID-19 pandemic, where healthcare workers were on the frontlines of the fight against infectious diseases. PPE includes items such as gloves, masks, gowns, face shields, and respirators, all of which are designed to provide protection against exposure to infectious agents. As the importance of safeguarding healthcare workers from pathogens has become more evident, the demand for PPE has surged.

In addition to protecting healthcare workers, PPE is also critical for preventing the spread of infections between patients and staff. Hospitals and healthcare facilities rely on PPE to maintain a safe working environment, especially in high-risk areas such as intensive care units (ICUs) and emergency departments. The ongoing global health crises and heightened awareness of infection control measures have made PPE an indispensable component of infection control strategies. The market for PPE is expected to continue growing as healthcare systems focus on improving their preparedness for future outbreaks and health emergencies.

Hospitals Lead the End-Use Industry for Infection Control Products

Hospitals are the largest end-use industry for infection control products, as these facilities are the most likely to encounter high-risk infection scenarios due to the concentration of patients with various health conditions. Hospitals play a crucial role in infection prevention and control, using disinfectants, sterilization equipment, and PPE to minimize the spread of infections among patients, healthcare providers, and visitors. Given the critical nature of healthcare services, hospitals must adhere to strict infection control protocols to ensure patient safety and comply with regulatory standards.

Hospitals are also key drivers of innovation and demand in the infection control market, as they continually adopt new technologies and practices to improve infection prevention measures. With the increasing prevalence of HAIs and the rise of antibiotic-resistant bacteria, hospitals remain a central hub for infection control solutions, ensuring their role as the largest end-use industry in the market.

North America Is Largest Region Owing to Advanced Healthcare Infrastructure and Regulatory Standards

North America is the largest region in the infection control market, driven by its well-established healthcare infrastructure and strict regulatory standards for infection prevention. The United States, in particular, leads the market with its advanced healthcare system, where infection control is a high priority. Healthcare facilities across North America are required to meet stringent infection control regulations set by agencies such as the Centers for Disease Control and Prevention (CDC) and the Occupational Safety and Health Administration (OSHA), which has led to increased demand for infection control products.

In addition to regulatory standards, the growing prevalence of healthcare-associated infections (HAIs) in the region has further emphasized the importance of effective infection control measures. The rapid adoption of advanced technologies in healthcare facilities and the ongoing focus on improving patient safety are key factors driving the demand for infection control products in North America. As the region continues to prioritize infection prevention and control, North America will maintain its position as the largest market for infection control solutions.

Leading Companies and Competitive Landscape

The infection control market is competitive, with several prominent players leading the way in the development and supply of infection control products. Key companies such as 3M, Johnson & Johnson, STERIS Corporation, Ecolab, and Medtronic are at the forefront of the market, offering a wide range of disinfectants, sterilization equipment, and PPE solutions. These companies leverage their expertise in healthcare and product innovation to meet the increasing demand for infection control solutions across hospitals, healthcare facilities, and other end-use industries.

The competitive landscape is characterized by a focus on innovation, regulatory compliance, and quality assurance, as companies strive to offer the most effective and safe infection control products. Additionally, strategic partnerships, acquisitions, and collaborations between manufacturers, healthcare providers, and research institutions are common, as players seek to expand their market reach and improve product offerings. As the market continues to evolve, leading companies will play a crucial role in shaping the future of infection control practices globally.

Recent Developments:

- STERIS Corporation launched a new line of sterilization equipment, improving safety and efficiency in infection control in hospitals and laboratories.

- 3M introduced a breakthrough disinfectant solution that reduces the transmission of hospital-acquired infections, enhancing patient safety and cleanliness.

- Ecolab Inc. expanded its infection control portfolio with an advanced antimicrobial coating for medical devices to reduce the risk of infections.

- Kimberly-Clark launched an innovative range of PPE products, including masks and gloves, designed to provide better protection for healthcare workers.

- Becton, Dickinson and Company received FDA approval for its new automated infection control system, which improves hospital hygiene and reduces infection rates.

List of Leading Companies:

- 3M Company

- STERIS Corporation

- Kimberly-Clark Corporation

- Johnson & Johnson

- CLEANHANDS

- Getinge Group

- Ecolab Inc.

- Becton, Dickinson and Company

- Parker Hannifin Corporation

- Hygiene Group

- Mölnlycke Health Care AB

- Medtronic PLC

- Belimed

- Advanced Sterilization Products (ASP)

- Ecolab Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 25.5 Billion |

|

Forecasted Value (2030) |

USD 43.7 Billion |

|

CAGR (2025 – 2030) |

9.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Infection Control Market by Product Type (Disinfectants, Sterilization Equipment, Personal Protective Equipment (PPE)); End-Use Industry (Hospitals, Healthcare Facilities) and by Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

3M Company, STERIS Corporation, Kimberly-Clark Corporation, Johnson & Johnson, CLEANHANDS, Getinge Group, Becton, Dickinson and Company, Parker Hannifin Corporation, Hygiene Group, Mölnlycke Health Care AB, Medtronic PLC, Belimed, Ecolab Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Infection Control Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Disinfectants |

|

4.2. Sterilization Equipment |

|

4.3. Personal Protective Equipment (PPE) |

|

4.4. Others |

|

5. Infection Control Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Hospitals |

|

5.2. Healthcare Facilities |

|

5.3. Others |

|

6. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Regional Overview |

|

6.2. North America |

|

6.2.1. Regional Trends & Growth Drivers |

|

6.2.2. Barriers & Challenges |

|

6.2.3. Opportunities |

|

6.2.4. Factor Impact Analysis |

|

6.2.5. Technology Trends |

|

6.2.6. North America Infection Control Market, by Product Type |

|

6.2.7. North America Infection Control Market, by End-Use Industry |

|

6.2.8. By Country |

|

6.2.8.1. US |

|

6.2.8.1.1. US Infection Control Market, by Product Type |

|

6.2.8.1.2. US Infection Control Market, by End-Use Industry |

|

6.2.8.2. Canada |

|

6.2.8.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

6.3. Europe |

|

6.4. Asia-Pacific |

|

6.5. Latin America |

|

6.6. Middle East & Africa |

|

7. Competitive Landscape |

|

7.1. Overview of the Key Players |

|

7.2. Competitive Ecosystem |

|

7.2.1. Level of Fragmentation |

|

7.2.2. Market Consolidation |

|

7.2.3. Product Innovation |

|

7.3. Company Share Analysis |

|

7.4. Company Benchmarking Matrix |

|

7.4.1. Strategic Overview |

|

7.4.2. Product Innovations |

|

7.5. Start-up Ecosystem |

|

7.6. Strategic Competitive Insights/ Customer Imperatives |

|

7.7. ESG Matrix/ Sustainability Matrix |

|

7.8. Manufacturing Network |

|

7.8.1. Locations |

|

7.8.2. Supply Chain and Logistics |

|

7.8.3. Product Flexibility/Customization |

|

7.8.4. Digital Transformation and Connectivity |

|

7.8.5. Environmental and Regulatory Compliance |

|

7.9. Technology Readiness Level Matrix |

|

7.10. Technology Maturity Curve |

|

7.11. Buying Criteria |

|

8. Company Profiles |

|

8.1. 3M Company |

|

8.1.1. Company Overview |

|

8.1.2. Company Financials |

|

8.1.3. Product/Service Portfolio |

|

8.1.4. Recent Developments |

|

8.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

8.2. STERIS Corporation |

|

8.3. Kimberly-Clark Corporation |

|

8.4. Johnson & Johnson |

|

8.5. CLEANHANDS |

|

8.6. Getinge Group |

|

8.7. Ecolab Inc. |

|

8.8. Becton, Dickinson and Company |

|

8.9. Parker Hannifin Corporation |

|

8.10. Hygiene Group |

|

8.11. Mölnlycke Health Care AB |

|

8.12. Medtronic PLC |

|

8.13. Belimed |

|

8.14. Advanced Sterilization Products (ASP) |

|

8.15. Ecolab Inc. |

|

9. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Infection Control Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Infection Control Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Infection Control Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA