As per Intent Market Research, the Infant Nutrition Market was valued at USD 52.5 Billion in 2024-e and will surpass USD 94.4 Billion by 2030; growing at a CAGR of 10.3% during 2025-2030.

The global infant nutrition market has seen significant expansion in recent years, driven by an increased focus on infant health, rising awareness among parents about proper nutrition, and technological advancements in food production. As the demand for healthy and nutritious products for infants continues to grow, the market is diversifying to cater to different age groups, dietary needs, and distribution channels. Key subsegments like infant formula, baby food, and infant cereals are expected to dominate, with various players innovating to meet the rising demand.

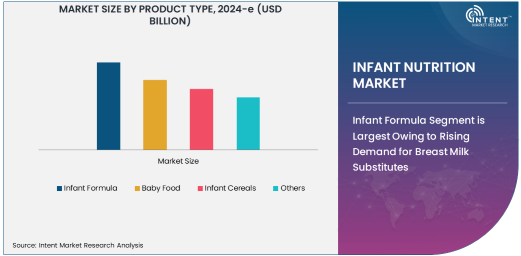

Infant Formula Segment is Largest Owing to Rising Demand for Breast Milk Substitutes

Infant formula is the largest segment in the global infant nutrition market due to the increasing preference for breast milk substitutes, especially in regions where breastfeeding may not be viable. This demand is particularly driven by urbanization, working mothers, and the increased awareness about the nutritional benefits of infant formula. Infant formula provides a balanced mix of essential nutrients required for infant growth, including proteins, fats, vitamins, and minerals, making it a preferred choice for many parents globally. The segment's growth is further fueled by the strong presence of leading global players offering customized formula options based on specific needs such as lactose intolerance, digestive problems, and low birth weight.

Innovation in infant formula continues to grow, with companies introducing organic, non-GMO, and allergy-free variants, addressing both safety concerns and the growing demand for natural products. Additionally, regions such as North America and Europe are witnessing high demand for premium and specialized infant formulas, contributing to the continued expansion of this subsegment. These trends make the infant formula segment a crucial driver of the overall infant nutrition market.

0-6 Months Age Group is Fastest Growing Due to Increased Focus on Early Childhood Nutrition

The 0-6 months age group is the fastest-growing segment within the infant nutrition market, primarily due to increased awareness surrounding the importance of early childhood nutrition. During this period, infants require a rich nutrient profile to support rapid physical and cognitive development, which has led to a surge in demand for products tailored to meet the nutritional needs of newborns. The demand for breast milk substitutes, especially in countries with low breastfeeding rates, has further accelerated the growth of infant formula in this age group.

Additionally, healthcare organizations and governments are promoting exclusive breastfeeding for the first six months of life. However, the availability of infant formula has played a vital role in ensuring that infants receive adequate nutrition in regions where breastfeeding is not an option. This has led to significant growth in the sales of products designed specifically for infants aged 0-6 months, making it a key focus area for companies in the infant nutrition sector.

Online Retail Channel is Fastest Growing Due to E-Commerce Growth

Online retail has emerged as the fastest-growing distribution channel for infant nutrition products. The growth of e-commerce platforms, increased internet penetration, and the convenience offered by online shopping have led to a surge in online sales of baby food, infant formula, and related products. E-commerce provides consumers with easy access to a wide variety of infant nutrition products, often with the added benefit of home delivery, which appeals to busy parents. Moreover, the increasing number of online platforms offering product reviews and recommendations has further enhanced consumer confidence in purchasing infant nutrition products online.

The shift towards online retail is also supported by the growing trend of parents seeking more personalized products, which can be more easily found and purchased through digital channels. As more parents turn to online shopping for convenience and better pricing, the online retail segment is expected to continue growing rapidly, reshaping the way infant nutrition products are sold globally.

Home Care End-Use is Largest Due to Parental Preference for Home-Based Feeding

The home care end-use segment is the largest within the infant nutrition market, as parents continue to prefer feeding their infants at home. This preference is driven by a combination of factors, including convenience, cost-effectiveness, and the desire for personalized care. With the increasing number of working mothers and families seeking flexibility, the demand for home-based feeding solutions is on the rise. Home care products such as infant formula, baby food, and infant cereals are becoming essential in households that value both convenience and nutrition.

Furthermore, the growing trend of parents opting for ready-to-feed and easy-to-prepare baby food options has boosted the home care market. Companies are increasingly focusing on developing ready-to-use products that require minimal preparation, making it easier for parents to provide nutritious food to their babies at home.

Proteins Ingredient is Largest in Infant Nutrition Owing to Nutritional Benefits

Proteins are the largest segment in the ingredients category of the infant nutrition market. Protein is a critical nutrient for infants, supporting their rapid growth and development during the early stages of life. Proteins help in building strong muscles, tissues, and vital organs, making them essential for infants’ overall development. Infant formula and baby food products are formulated with specific protein content to meet the nutritional needs of infants at different stages.

With the rise in awareness regarding infant health and the importance of balanced nutrition, parents are more inclined to choose products rich in proteins to ensure their babies receive the necessary nutrients for healthy growth. As a result, protein-based products are becoming more widely used in the global infant nutrition market.

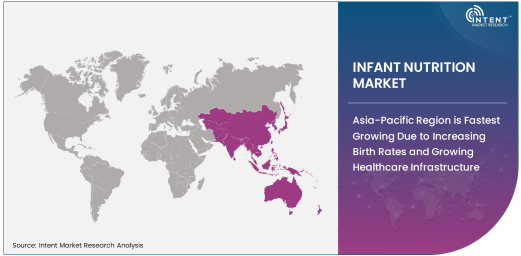

Asia-Pacific Region is Fastest Growing Due to Increasing Birth Rates and Growing Healthcare Infrastructure

The Asia-Pacific region is the fastest-growing market for infant nutrition, driven by rising birth rates, economic growth, and improvements in healthcare infrastructure. Countries like China, India, and Indonesia are experiencing a surge in the demand for infant nutrition products as disposable incomes rise and middle-class populations expand. Moreover, with improved access to healthcare and an increasing focus on reducing infant mortality rates, parents are placing more emphasis on providing their children with proper nutrition from an early age.

The region's growing e-commerce market, along with rising awareness about infant health and nutrition, further supports the growth of the infant nutrition market in Asia-Pacific. As a result, this region is anticipated to continue experiencing the fastest growth globally, with key companies expanding their operations and product offerings to cater to the growing demand in the region.

Competitive Landscape and Leading Companies

The infant nutrition market is characterized by a highly competitive landscape with several global companies vying for market share. Leading players include Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition (acquired by Reckitt Benckiser), and FrieslandCampina. These companies have a strong presence in both developed and emerging markets, offering a range of products such as infant formula, baby food, and cereals to cater to various nutritional needs.

Innovation and product diversification are key strategies employed by these companies to maintain their competitive edge. Additionally, these companies are increasingly focusing on acquiring smaller regional players and expanding their product portfolios to include organic and specialty nutrition products. The competitive landscape is expected to remain dynamic, with continued growth driven by technological advancements, consumer trends, and the evolving regulatory environment in different regions.

Recent Developments:

- Nestlé has introduced a new range of organic infant formulas to cater to the growing demand for natural and organic baby food options.

- Danone expanded its footprint in the infant nutrition market with the acquisition of an organic baby food brand to bolster its portfolio in North America.

- Abbott Laboratories received FDA approval for a new formula designed for infants with specific digestive issues, enhancing its product offerings in the U.S.

- FrieslandCampina has entered into a partnership with leading hospitals to conduct research on infant nutrition, aiming to improve the quality of its formulas.

- Mead Johnson launched a new line of probiotic-infused baby food aimed at improving digestive health for infants, meeting growing consumer demand for gut health-focused products.

List of Leading Companies:

- Nestlé S.A.

- Danone S.A.

- Abbott Laboratories

- Mead Johnson Nutrition

- Arla Foods

- FrieslandCampina

- The Kraft Heinz Company

- Yakult Honsha Co.

- Heinz (part of Kraft Heinz)

- Perrigo Company

- Fonterra Co-operative Group

- Hero Group

- Lactalis Group

- Beingmate Baby & Child Food Co. Ltd.

- Bellamy’s Organic

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 52.5 Billion |

|

Forecasted Value (2030) |

USD 94.4 Billion |

|

CAGR (2025 – 2030) |

10.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Infant Nutrition Market By Product Type (Infant Formula, Baby Food, Infant Cereals), By Age Group (0-6 Months, 6-12 Months, 12+ Months), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online Retail, Specialty Stores), By End-Use (Hospitals, Home Care), By Ingredients (Carbohydrates, Proteins, Fats, Vitamins & Minerals) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition, Arla Foods, FrieslandCampina, The Kraft Heinz Company, Yakult Honsha Co., Heinz (part of Kraft Heinz), Perrigo Company, Fonterra Co-operative Group, Hero Group, Lactalis Group, Beingmate Baby & Child Food Co. Ltd., Bellamy’s Organic |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Infant Nutrition Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Infant Formula |

|

4.2. Baby Food |

|

4.3. Infant Cereals |

|

4.4. Others |

|

5. Infant Nutrition Market, by Age Group (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. 0-6 Months |

|

5.2. 6-12 Months |

|

5.3. 12+ Months |

|

6. Infant Nutrition Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Supermarkets/Hypermarkets |

|

6.2. Pharmacies/Drug Stores |

|

6.3. Online Retail |

|

6.4. Specialty Stores |

|

7. Infant Nutrition Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Home Care |

|

8. Infant Nutrition Market, by Ingredients (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Carbohydrates |

|

8.2. Proteins |

|

8.3. Fats |

|

8.4. Vitamins & Minerals |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Infant Nutrition Market, by Product Type |

|

9.2.7. North America Infant Nutrition Market, by Age Group |

|

9.2.8. North America Infant Nutrition Market, by Distribution Channel |

|

9.2.9. North America Infant Nutrition Market, by End-Use |

|

9.2.10. North America Infant Nutrition Market, by Ingredients |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Infant Nutrition Market, by Product Type |

|

9.2.11.1.2. US Infant Nutrition Market, by Age Group |

|

9.2.11.1.3. US Infant Nutrition Market, by Distribution Channel |

|

9.2.11.1.4. US Infant Nutrition Market, by End-Use |

|

9.2.11.1.5. US Infant Nutrition Market, by Ingredients |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Nestlé S.A. |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Danone S.A. |

|

11.3. Abbott Laboratories |

|

11.4. Mead Johnson Nutrition |

|

11.5. Arla Foods |

|

11.6. FrieslandCampina |

|

11.7. The Kraft Heinz Company |

|

11.8. Yakult Honsha Co. |

|

11.9. Heinz (part of Kraft Heinz) |

|

11.10. Perrigo Company |

|

11.11. Fonterra Co-operative Group |

|

11.12. Hero Group |

|

11.13. Lactalis Group |

|

11.14. Beingmate Baby & Child Food Co. Ltd. |

|

11.15. Bellamy’s Organic |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Infant Nutrition Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Infant Nutrition Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Infant Nutrition Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA