As per Intent Market Research, the Infant Formula Ingredients Market was valued at USD 22.0 Billion in 2024-e and will surpass USD 37.7 Billion by 2030; growing at a CAGR of 9.4% during 2025-2030.

The infant formula ingredients market is driven by the increasing demand for safe and nutritious infant nutrition products, particularly as parents become more selective about the quality of ingredients for their infants. The market is characterized by a diverse range of ingredients, which include dairy, non-dairy, fats, proteins, and carbohydrates, each contributing to the creation of highly specialized formulas. With growing awareness of infant health, manufacturers continue to innovate with new formulations that support the specific developmental needs of infants, such as cognitive growth, immune support, and digestive health.

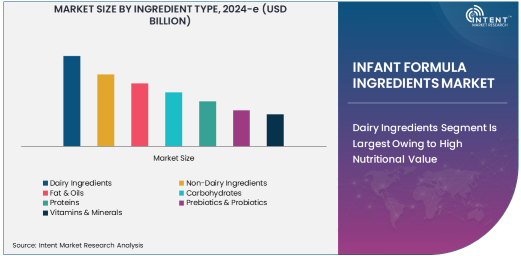

Dairy Ingredients Segment Is Largest Owing to High Nutritional Value

Dairy ingredients hold the largest share in the infant formula ingredients market. These ingredients, including milk powders, whey protein, and lactose, are widely used due to their high nutritional content, which is essential for infant growth and development. Dairy-based formulas are often preferred because they mimic the nutritional composition of breast milk, offering a balanced source of protein, fat, and carbohydrates. The presence of essential vitamins, minerals, and fatty acids in dairy ingredients also supports cognitive and physical growth, making them a preferred choice for formulating infant formulas.

Due to its rich nutritional profile, dairy ingredients dominate the market, particularly in regions with established dairy supply chains such as North America and Europe. Additionally, the continued research and development into improving dairy ingredient quality, such as fortifying formulas with omega-3 fatty acids or probiotics, is expected to further bolster this segment’s growth. The preference for dairy-based formulas, along with their proven nutritional benefits, is likely to maintain their dominance in the market for the foreseeable future.

Animal-Based Source Is Largest Due to Established Availability and Nutritional Benefits

The animal-based ingredient source segment holds the largest share in the market due to the established supply chain and proven nutritional benefits of animal-derived ingredients. Animal-based ingredients, such as whey protein, milk proteins, and lactose, are rich in essential amino acids and fatty acids, which are critical for infant development. These ingredients provide high-quality protein that is easily digestible, making them ideal for infant formulas. Additionally, animal-based ingredients are often preferred in many regions, as they are considered to be more nutritionally complete compared to plant-based alternatives.

The dominance of animal-based ingredients in the infant formula market is especially evident in North America and Europe, where dairy farming has a long-standing tradition and regulatory frameworks ensure the quality and safety of these ingredients. While plant-based alternatives are growing, animal-based ingredients remain the top choice for manufacturers due to their comprehensive nutrient profile, essential for supporting infant growth and development.

Standard Infant Formula Application Is Largest Owing to High Demand

The standard infant formula application is the largest in the market, driven by the consistent demand for baby nutrition products that are designed to closely mimic breast milk. Standard formulas are typically used for infants who are not breastfed or as a supplement to breast milk. These formulas are nutritionally balanced and contain essential ingredients such as proteins, carbohydrates, fats, and vitamins to support the overall growth and development of infants. The growing number of working mothers and the increasing awareness of infant nutrition contribute to the high demand for standard infant formulas globally.

The largest market for standard infant formula is in regions like North America and Europe, where there is strong consumer confidence in the safety and quality of formula products. Additionally, the increasing number of premature births and infants with dietary intolerances is driving the demand for specialized standard formulas tailored to meet the specific needs of these infants. As a result, this application is expected to maintain its leading position in the market.

Powder Form Is Largest Due to Convenience and Longer Shelf Life

Powdered infant formula is the largest form segment in the market, primarily due to its convenience and longer shelf life. Powdered formula is easier to store, transport, and prepare, making it an attractive choice for parents and caregivers. The powdered form also allows manufacturers to offer a more cost-effective product, which can be an important factor in regions where price sensitivity is high. Additionally, powdered formulas often come in various sizes and packaging options, making them more versatile and accessible to a larger number of consumers.

Powdered infant formula is particularly popular in regions such as North America, Europe, and parts of Asia-Pacific, where it is widely available through supermarkets, pharmacies, and online channels. This format’s dominance is expected to continue, as it remains the most practical and widely distributed option for infant nutrition.

Supermarkets & Hypermarkets Channel Is Largest Due to Wide Availability

Supermarkets and hypermarkets are the largest distribution channels for infant formula ingredients, as these retail outlets are easily accessible to consumers and offer a wide range of products. These large-scale stores provide convenient access to various infant formula brands and ingredients, with the benefit of in-store purchasing and immediate availability. The wide assortment of products, including different types of formulas and ingredients, attracts a large number of customers who prefer to shop in person for their baby nutrition needs.

In regions like North America and Europe, supermarkets and hypermarkets dominate the retail space for infant formula ingredients due to their established presence and convenience. Consumers in these regions often prefer to buy infant formula in bulk, and these retail giants cater to such demands by offering promotions, discounts, and a variety of brands. The continued growth of these retail formats, coupled with the increasing demand for infant formula, suggests that supermarkets and hypermarkets will maintain their leadership in the distribution of infant formula ingredients.

North America Region Is Largest Due to High Demand and Innovation

North America is the largest region in the infant formula ingredients market, driven by high demand for premium products, regulatory standards, and the well-established presence of major manufacturers. The region has a high birth rate and growing demand for infant nutrition, coupled with a strong preference for high-quality, scientifically-backed infant formulas. North American consumers are increasingly focused on organic, non-GMO, and fortified infant formulas, which has led to a surge in innovation and the introduction of new ingredients designed to enhance infant growth and health.

The presence of leading companies such as Nestlé, Abbott Laboratories, and Mead Johnson in the region has bolstered its market position. Additionally, regulatory frameworks in North America ensure strict quality control, ensuring the safety and nutritional adequacy of infant formula products. With ongoing investments in research and development, North America is expected to continue leading the market in terms of both product innovation and market share.

Leading Companies and Competitive Landscape

The infant formula ingredients market is highly competitive, with several global companies leading the sector. Major players include Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson & Company, and Fonterra Co-operative Group, among others. These companies have established a strong foothold in the market due to their broad product portfolios, extensive distribution networks, and commitment to research and development. These players are focused on product innovation, such as introducing organic, plant-based, and fortified formulas, to cater to the growing demand for specialized infant nutrition.

The market is also seeing a rise in partnerships and collaborations between ingredient suppliers and formula manufacturers to create customized solutions for infants with specific health needs. With increasing consumer awareness of the importance of infant nutrition, companies are investing heavily in marketing and product development to maintain their competitive edge in this rapidly evolving market.

Recent Developments:

- Nestlé has announced the launch of a new plant-based infant formula, expanding its portfolio to cater to the growing demand for plant-based, lactose-free options.

- Danone has acquired an organic infant formula brand in response to increasing consumer demand for organic and natural baby food products.

- Abbott Laboratories has expanded its production facilities for infant formula ingredients in response to the rising global demand and to enhance supply chain capabilities.

- FrieslandCampina has made significant investments in research and development to enhance the functionality of probiotics in infant formulas, aiming to improve digestive health.

- BASF has introduced new high-quality omega-3 fortified ingredients for infant formulas to support brain development and cognitive health in infants.

List of Leading Companies:

- Nestlé S.A.

- Danone S.A.

- Abbott Laboratories

- Mead Johnson & Company

- Fonterra Co-operative Group

- Arla Foods

- FrieslandCampina

- Cargill, Inc.

- Royal DSM N.V.

- Ingredion Incorporated

- China Mengniu Dairy Company

- BASF SE

- Glanbia PLC

- Kerry Group

- Synlait Milk Limited

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 22.0 Billion |

|

Forecasted Value (2030) |

USD 37.7 Billion |

|

CAGR (2025 – 2030) |

9.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Infant Formula Ingredients Market By Ingredient Type (Dairy Ingredients, Non-Dairy Ingredients, Fat & Oils, Carbohydrates, Proteins, Prebiotics & Probiotics, Vitamins & Minerals), By Source (Animal-Based, Plant-Based), By Application (Standard Infant Formula, Follow-On Formula, Specialty Infant Formula, Toddler Formula), By Form (Powder, Liquid), By Distribution Channel (Supermarkets & Hypermarkets, Online Retailers, Specialty Stores, Pharmacies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson & Company, Fonterra Co-operative Group, Arla Foods, FrieslandCampina, Cargill, Inc., Royal DSM N.V., Ingredion Incorporated, China Mengniu Dairy Company, BASF SE, Glanbia PLC, Kerry Group, Synlait Milk Limited |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Infant Formula Ingredients Market, by Ingredient Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Dairy Ingredients |

|

4.2. Non-Dairy Ingredients |

|

4.3. Fat & Oils |

|

4.4. Carbohydrates |

|

4.5. Proteins |

|

4.6. Prebiotics & Probiotics |

|

4.7. Vitamins & Minerals |

|

5. Infant Formula Ingredients Market, by Source (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Animal-Based |

|

5.2. Plant-Based |

|

6. Infant Formula Ingredients Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Standard Infant Formula |

|

6.2. Follow-On Formula |

|

6.3. Specialty Infant Formula |

|

6.4. Toddler Formula |

|

7. Infant Formula Ingredients Market, by Form (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Powder |

|

7.2. Liquid |

|

8. Infant Formula Ingredients Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Supermarkets & Hypermarkets |

|

8.2. Online Retailers |

|

8.3. Specialty Stores |

|

8.4. Pharmacies |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Infant Formula Ingredients Market, by Ingredient Type |

|

9.2.7. North America Infant Formula Ingredients Market, by Source |

|

9.2.8. North America Infant Formula Ingredients Market, by Application |

|

9.2.9. North America Infant Formula Ingredients Market, by Form |

|

9.2.10. North America Infant Formula Ingredients Market, by Distribution Channel |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Infant Formula Ingredients Market, by Ingredient Type |

|

9.2.11.1.2. US Infant Formula Ingredients Market, by Source |

|

9.2.11.1.3. US Infant Formula Ingredients Market, by Application |

|

9.2.11.1.4. US Infant Formula Ingredients Market, by Form |

|

9.2.11.1.5. US Infant Formula Ingredients Market, by Distribution Channel |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Nestlé S.A. |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Danone S.A. |

|

11.3. Abbott Laboratories |

|

11.4. Mead Johnson & Company |

|

11.5. Fonterra Co-operative Group |

|

11.6. Arla Foods |

|

11.7. FrieslandCampina |

|

11.8. Cargill, Inc. |

|

11.9. Royal DSM N.V. |

|

11.10. Ingredion Incorporated |

|

11.11. China Mengniu Dairy Company |

|

11.12. BASF SE |

|

11.13. Glanbia PLC |

|

11.14. Kerry Group |

|

11.15. Synlait Milk Limited |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Infant Formula Ingredients Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Infant Formula Ingredients Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Infant Formula Ingredients Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA