As per Intent Market Research, the Industrial X-Ray Market was valued at USD 7.1 Billion in 2024-e and will surpass USD 11.2 Billion by 2030; growing at a CAGR of 7.9% during 2025-2030.

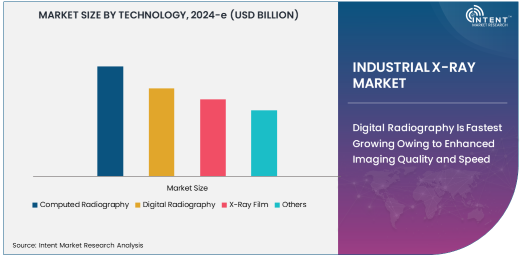

The industrial X-ray market plays a significant role in various industries by providing advanced imaging solutions for non-destructive testing, medical diagnostics, security inspection, and more. Among the available technologies, computed radiography (CR) holds the largest market share due to its ability to offer high-quality imaging at a lower cost compared to other X-ray technologies. CR combines the benefits of digital imaging with the simplicity of conventional film-based systems, making it a popular choice across a wide range of applications, particularly in industries like manufacturing, aerospace, and automotive.

The demand for computed radiography is driven by its versatility and ease of use in both portable and fixed configurations. This technology allows for the inspection of materials and components without causing any damage, which is critical for industries focused on maintaining product integrity and safety. As industries continue to prioritize efficiency and cost-effective solutions, computed radiography remains the dominant technology in the industrial X-ray market.

Digital Radiography Is Fastest Growing Owing to Enhanced Imaging Quality and Speed

Digital radiography (DR) is the fastest growing segment in the industrial X-ray market, primarily due to its superior imaging quality, faster processing times, and increased flexibility. DR provides high-resolution images that are instantly available for analysis, which significantly speeds up the inspection process. This technology is increasingly favored in non-destructive testing (NDT) applications, where quick results are essential for quality control and regulatory compliance.

The growth of the digital radiography segment is also supported by the growing demand for automated and integrated inspection solutions. As industries such as aerospace, automotive, and oil & gas require more advanced and precise inspection techniques, the speed and quality offered by DR make it the preferred choice. Additionally, the shift towards digital systems helps reduce the reliance on traditional film, further boosting the adoption of DR technology.

Non-Destructive Testing (NDT) Is Largest Application Due to Critical Quality Assurance Needs

The non-destructive testing (NDT) application is the largest segment within the industrial X-ray market, driven by its essential role in quality control and safety inspections across various industries. NDT techniques, including X-ray imaging, allow manufacturers to detect defects, structural weaknesses, or other potential issues in materials and components without causing any harm to the objects being tested. This is crucial for industries like aerospace, automotive, and oil & gas, where the safety and reliability of products are paramount.

As industries continue to focus on enhancing safety standards and improving the durability of products, the demand for non-destructive testing solutions is expected to rise. X-ray technology plays a key role in these efforts by providing detailed internal imaging that helps engineers and inspectors identify flaws that may not be visible through traditional visual inspection methods. Consequently, NDT remains the largest application for industrial X-ray systems, contributing significantly to the market’s growth.

Portable X-Ray Product Type Is Largest Due to Flexibility and Convenience

Among the various product types, portable X-ray systems dominate the industrial X-ray market due to their flexibility and convenience in a wide range of applications. Portable X-ray machines offer the advantage of mobility, allowing them to be used in diverse environments, from construction sites to remote locations in oil & gas operations. These systems are especially valuable for industries that require on-site inspections and where transportability is a key factor.

The portable X-ray segment continues to expand as advancements in technology make these systems more lightweight, compact, and easy to use. Their ability to provide high-quality imaging in the field without the need for bulky equipment makes them an essential tool for industries that need to conduct immediate inspections. As industrial operations increasingly require rapid and on-site inspection solutions, portable X-ray systems are expected to retain their dominant position in the market.

Healthcare End-User Is Largest Due to Growing Medical Diagnostic Demands

In the industrial X-ray market, the healthcare sector is the largest end-user, driven by the rising demand for medical diagnostics and imaging technologies. X-ray systems are widely used in hospitals, clinics, and diagnostic centers for imaging bones, tissues, and organs to diagnose various medical conditions. With the global increase in healthcare spending and the aging population, the demand for advanced imaging technologies continues to grow, particularly in the areas of medical diagnostics and orthopedics.

In addition to traditional uses in diagnostics, the healthcare sector is witnessing an increased demand for digital radiography and portable X-ray systems to enhance accessibility and improve patient care. The growing adoption of advanced X-ray technologies, such as 3D imaging and digital fluoroscopy, further fuels the healthcare sector’s prominence as the largest end-user of industrial X-ray systems.

North America Region Is Largest Owing to Advanced Healthcare Infrastructure and Industrial Demand

The North America region holds the largest share in the industrial X-ray market, largely due to the presence of a well-established healthcare infrastructure and a strong industrial base. The United States, in particular, is a major contributor to the demand for industrial X-ray systems, driven by both the healthcare sector's need for advanced medical diagnostics and the industrial sector’s emphasis on quality control and non-destructive testing. The region’s stringent regulatory standards and emphasis on safety and quality assurance further support the growth of the industrial X-ray market.

Additionally, North America's ongoing investment in technological innovation and research, coupled with the expansion of industries like aerospace, automotive, and oil & gas, continues to drive the demand for industrial X-ray systems. As industries seek more efficient, cost-effective, and reliable inspection solutions, the North American market is expected to remain a leader in the adoption of X-ray technologies.

Leading Companies and Competitive Landscape

The industrial X-ray market is highly competitive, with several prominent players leading the charge in technological innovation and market share. Key companies include GE Healthcare, Siemens Healthineers, Nikon Corporation, Shimadzu Corporation, and Varex Imaging Corporation. These companies focus on delivering advanced X-ray solutions across various sectors, from healthcare and aerospace to automotive and manufacturing.

The competitive landscape is shaped by ongoing investments in research and development to improve imaging quality, reduce radiation exposure, and enhance system portability. Companies are also focusing on expanding their product portfolios to cater to specific industry needs, such as portable X-ray machines for on-site inspections. As demand for advanced, efficient, and cost-effective X-ray solutions continues to rise, these leading companies are likely to engage in strategic partnerships, mergers, and acquisitions to maintain their market leadership.

Recent Developments:

- General Electric (GE) Healthcare launched a new range of high-definition digital X-ray systems for enhanced diagnostic imaging.

- Siemens Healthineers completed the acquisition of a leading X-ray technology firm to expand its industrial inspection offerings.

- Canon Medical Systems Corporation unveiled an advanced portable X-ray system designed for use in emergency medical services.

- Fujifilm Holdings Corporation announced a breakthrough in X-ray detector technology, improving image resolution and reducing radiation exposure.

- Carestream Health entered into a strategic partnership with a major aerospace company to provide X-ray inspection systems for aircraft parts.

List of Leading Companies:

- General Electric (GE) Healthcare

- Siemens Healthineers

- Philips Healthcare

- Canon Medical Systems Corporation

- Shimadzu Corporation

- Fujifilm Holdings Corporation

- Hitachi Ltd.

- Carestream Health

- PerkinElmer, Inc.

- Agfa-Gevaert Group

- Varex Imaging Corporation

- Anke Medical Equipment Co., Ltd.

- NDT Systems Inc.

- Nikon Corporation

- YXLON International GmbH

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 7.1 Billion |

|

Forecasted Value (2030) |

USD 11.2 Billion |

|

CAGR (2025 – 2030) |

7.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Industrial X-Ray Market By Technology (Computed Radiography, Digital Radiography, X-Ray Film), By Product Type (Portable X-Ray, Fixed X-Ray), By Application (Non-Destructive Testing, Medical Diagnostics, Security Inspection, Industrial Inspection), and By End-User (Manufacturing, Healthcare, Aerospace, Automotive, Oil & Gas) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

General Electric (GE) Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems Corporation, Shimadzu Corporation, Fujifilm Holdings Corporation, Hitachi Ltd., Carestream Health, PerkinElmer, Inc., Agfa-Gevaert Group, Varex Imaging Corporation, Anke Medical Equipment Co., Ltd., NDT Systems Inc., Nikon Corporation, YXLON International GmbH |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Industrial X-Ray Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Computed Radiography |

|

4.2. Digital Radiography |

|

4.3. X-Ray Film |

|

4.4. Others |

|

5. Industrial X-Ray Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Portable X-Ray |

|

5.2. Fixed X-Ray |

|

5.3. Others |

|

6. Industrial X-Ray Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Non-Destructive Testing (NDT) |

|

6.2. Medical Diagnostics |

|

6.3. Security Inspection |

|

6.4. Industrial Inspection |

|

6.5. Others |

|

7. Industrial X-Ray Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Manufacturing |

|

7.2. Healthcare |

|

7.3. Aerospace |

|

7.4. Automotive |

|

7.5. Oil & Gas |

|

7.6. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Industrial X-Ray Market, by Technology |

|

8.2.7. North America Industrial X-Ray Market, by Product Type |

|

8.2.8. North America Industrial X-Ray Market, by Application |

|

8.2.9. North America Industrial X-Ray Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Industrial X-Ray Market, by Technology |

|

8.2.10.1.2. US Industrial X-Ray Market, by Product Type |

|

8.2.10.1.3. US Industrial X-Ray Market, by Application |

|

8.2.10.1.4. US Industrial X-Ray Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. General Electric (GE) Healthcare |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Siemens Healthineers |

|

10.3. Philips Healthcare |

|

10.4. Canon Medical Systems Corporation |

|

10.5. Shimadzu Corporation |

|

10.6. Fujifilm Holdings Corporation |

|

10.7. Hitachi Ltd. |

|

10.8. Carestream Health |

|

10.9. PerkinElmer, Inc. |

|

10.10. Agfa-Gevaert Group |

|

10.11. Varex Imaging Corporation |

|

10.12. Anke Medical Equipment Co., Ltd. |

|

10.13. NDT Systems Inc. |

|

10.14. Nikon Corporation |

|

10.15. YXLON International GmbH |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Industrial X-Ray Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Industrial X-Ray Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Industrial X-Ray Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA