As per Intent Market Research, the Industrial Valves Market was valued at USD 86.7 billion in 2023 and will surpass USD 107.6 billion by 2030; growing at a CAGR of 3.1% during 2024 - 2030.

Metal Segment is Projected to have the Largest Market Size

Metal Segment is Projected to have the Largest Market Size

Metal valves dominate the industrial valves market due to their robustness, durability, and ability to withstand high pressures and temperatures. Primarily made from materials like stainless steel, carbon steel, and brass, metal valves are widely used across various industries, including oil and gas, power generation, and chemicals. Their resistance to corrosion and mechanical wear makes them suitable for challenging environments, where reliability is paramount. As industries continue to demand equipment that meets stringent safety and efficiency standards, metal valves remain the preferred choice for critical applications, contributing significantly to their market share.

Moreover, the ongoing advancements in metallurgy and manufacturing technologies have led to the development of high-performance metal valves with enhanced features such as improved sealing capabilities and extended operational lifespans. The increasing trend towards automation in industrial processes further bolsters the demand for metal valves, as these products can be easily integrated into automated systems. As a result, the metal segment is expected to maintain its position as the largest material category in the industrial valves market, supported by its proven performance and continuous innovation.

Asia-Pacific is Expected to Witness the Fastest Growth During the Forecast Period

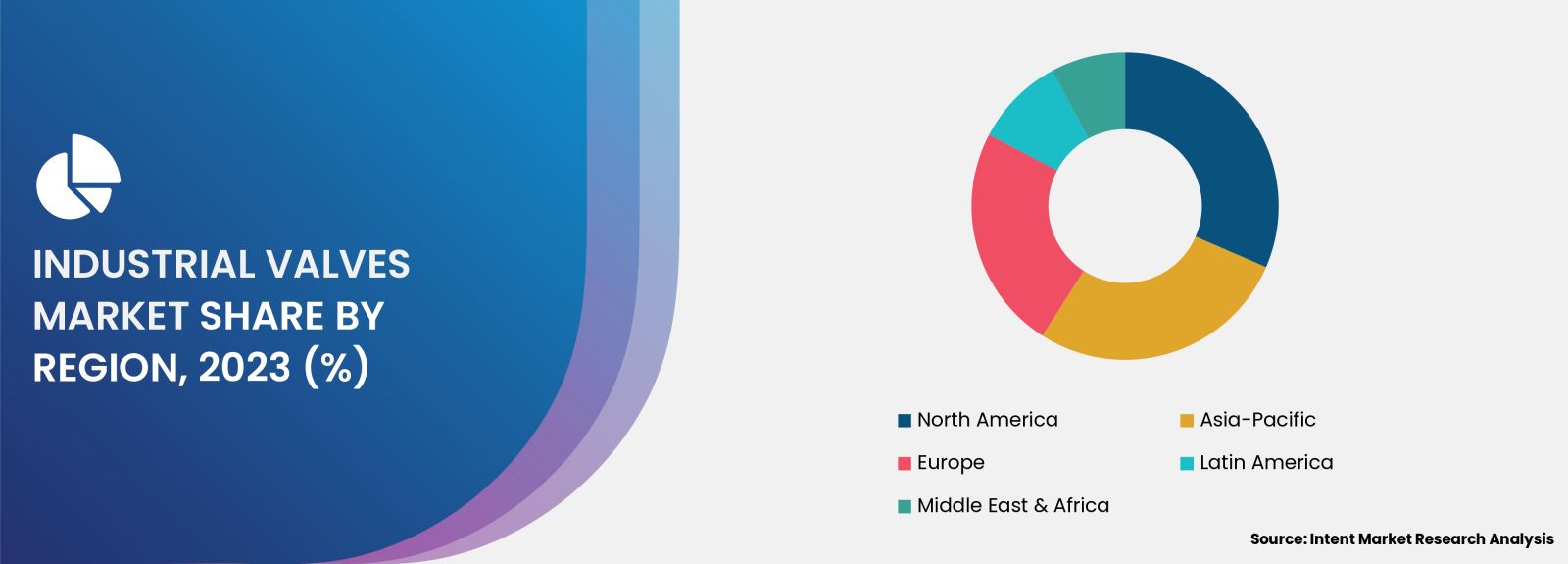

The Asia-Pacific region is projected to be the fastest-growing market for industrial valves, driven by rapid industrialization and urbanization across countries like China, India, and Southeast Asian nations. The region's expanding manufacturing sector, particularly in industries such as oil and gas, chemicals, and pharmaceuticals, is creating significant demand for efficient and reliable flow control solutions. Additionally, government initiatives aimed at infrastructure development and investment in renewable energy projects are further propelling the growth of the industrial valves market in this region.

Furthermore, increasing foreign direct investments and the establishment of manufacturing facilities in Asia-Pacific are contributing to the demand for high-quality industrial valves. As industries increasingly focus on enhancing productivity and ensuring regulatory compliance, the need for advanced valve technologies is surging. With a young and rapidly growing population demanding better infrastructure and services, the Asia-Pacific region is set to experience substantial growth in the industrial valves market, establishing itself as a key player on the global stage.

The report focuses on estimating the current market potential in terms of the total addressable market for all the segments, sub-segments, and regions. In the process, all the high-growth and upcoming technologies were identified and analyzed to measure their impact on the current and future market. The report also identifies the key stakeholders, their business gaps, and their purchasing behavior. This information is essential for developing effective marketing strategies and creating products or services that meet the needs of the target market. The report also covers a detailed analysis of the competitive landscape which includes major players, their recent developments, growth strategies, product benchmarking, and manufacturing operations among others. Also, brief insights on start-up ecosystem and emerging companies is also included as part of this report.

Report Objectives:

The report will help you answer some of the most critical questions in the Industrial Valves Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the Industrial Valves Market?

- What is the size of the Industrial Valves Market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 86.7 billion |

|

Forecasted Value (2030) |

USD 107.6 billion |

|

CAGR (2024 – 2030) |

3.1% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Industrial Valves Market By Type (Ball Valves, Gate Valves, Globe Valves, Check Valves, Butterfly Valves), By Material (Metal, Plastic, Composite), By Size (Small, Medium, Large), By End-Use (Oil & Gas, Water & Wastewater Treatment, Power Generation, Chemicals, Pharmaceuticals, Food & Beverage) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Industrial Valves Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Ball Valves |

|

4.2. Gate Valves |

|

4.3. Globe Valves |

|

4.4. Check Valves |

|

4.5. Butterfly Valves |

|

4.6. Others |

|

5. Industrial Valves Market, by Material (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Metal |

|

5.2. Plastic |

|

5.3. Composite |

|

5.4. Others |

|

6. Industrial Valves Market, by Size (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Small |

|

6.2. Medium |

|

6.3. Large |

|

7. Industrial Valves Market, by End-Use (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Oil & Gas |

|

7.2. Water & Wastewater Treatment |

|

7.3. Power Generation |

|

7.4. Chemicals |

|

7.5. Pharmaceuticals |

|

7.6. Food & Beverage |

|

7.7. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Industrial Valves Market, by Type |

|

8.2.7. North America Industrial Valves Market, by Material |

|

8.2.8. North America Industrial Valves Market, by Size |

|

8.2.9. North America Industrial Valves Market, by End-Use |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Industrial Valves Market, by Type |

|

8.2.10.1.2. US Industrial Valves Market, by Material |

|

8.2.10.1.3. US Industrial Valves Market, by Size |

|

8.2.10.1.4. US Industrial Valves Market, by End-Use |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Emerson |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Flowserve |

|

10.3. Honeywell |

|

10.4. KSB SE & Co. KGaA |

|

10.5. Metso |

|

10.6. Parker Hannifin |

|

10.7. Pentair |

|

10.8. Schlumberger |

|

10.9. SMC Corporation |

|

10.10. Valmet |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Industrial Valves Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Industrial Valves Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the Industrial Valves ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Industrial Valves Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA