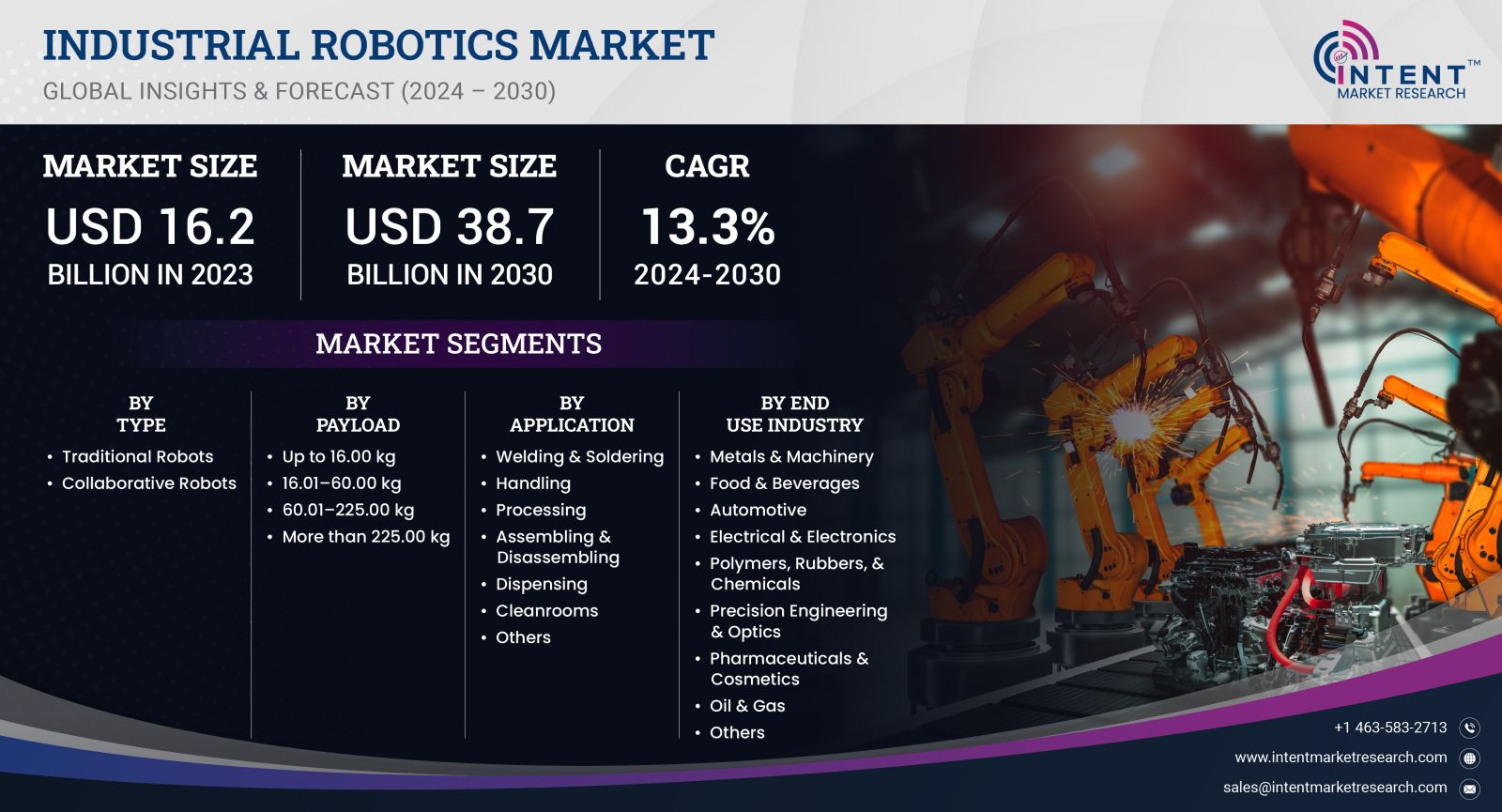

As per Intent Market Research, the Industrial Robotics Market was valued at USD 16.2 billion in 2023-e and will surpass USD 38.7 billion by 2030; growing at a CAGR of 13.3% during 2024 - 2030.

The Industrial Robotics market is rapidly evolving, driven by the increasing demand for automation across various industries. As businesses strive for greater efficiency, productivity, and precision, the adoption of industrial robots has surged. These robots play a crucial role in automating repetitive and hazardous tasks, allowing human workers to focus on more complex activities. The integration of advanced technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) is further enhancing the capabilities of industrial robots, making them more adaptable and intelligent. The global industrial robotics market is projected to witness significant growth, driven by technological advancements and the rising need for smart manufacturing solutions.The increasing need for automation in manufacturing processes, coupled with the growth of industries such as automotive, electronics, and food and beverage, is propelling this growth. By 2030

Articulated Robots Segment is Largest Owing to Versatility and Flexibility

The articulated robots segment is the largest within the Industrial Robotics market, primarily due to their versatility and flexibility in performing a wide range of tasks. Articulated robots, characterized by their multi-joint structure, can easily mimic human arm movements, making them suitable for applications such as assembly, welding, painting, and packaging. Their ability to operate in confined spaces and perform complex tasks with high precision has made them a preferred choice for many industries.

Additionally, the increasing demand for automation in manufacturing processes is driving the growth of articulated robots. As companies look to improve operational efficiency and product quality, the adoption of these robots has become essential. The advancements in robotic technology, including improved sensors and control systems, are enhancing the capabilities of articulated robots, ensuring that this segment remains dominant in the Industrial Robotics market.

Collaborative Robots (Cobots) Segment is Fastest Growing Owing to Human-Robot Collaboration

The collaborative robots (cobots) segment is recognized as the fastest-growing area within the Industrial Robotics market, driven by the increasing focus on human-robot collaboration in manufacturing environments. Cobots are designed to work alongside human operators, assisting them in tasks while ensuring safety and efficiency. Their ability to perform repetitive tasks allows human workers to focus on more complex and value-added activities, fostering a more productive workplace.

The growth of cobots is also attributed to their ease of use and implementation. Unlike traditional industrial robots, cobots are typically smaller, lighter, and more user-friendly, making them accessible for small and medium-sized enterprises (SMEs) that may have previously considered automation too complex or costly. As the demand for flexible and adaptable automation solutions continues to rise, the cobots segment is expected to witness significant growth, positioning it as a key driver of innovation within the Industrial Robotics market.

Cartesian Robots Segment is Largest Owing to Precision and Efficiency

The Cartesian robots segment holds a significant share in the Industrial Robotics market, primarily due to their high precision and efficiency in linear motion tasks. Cartesian robots, also known as gantry robots, utilize a three-axis system to perform pick-and-place operations, assembly, and material handling with exceptional accuracy. Their simple design and ease of programming make them suitable for a variety of applications across different industries, including electronics, automotive, and logistics.

Moreover, the growing need for automation in repetitive tasks is driving the demand for Cartesian robots. As industries seek to enhance productivity while minimizing errors and downtime, the adoption of Cartesian robots is becoming increasingly prevalent. The continuous advancements in robotic technologies, including enhanced sensors and control algorithms, are further solidifying the position of the Cartesian robots segment as a leading player in the Industrial Robotics market.

Mobile Robots Segment is Fastest Growing Owing to Logistics Automation

The mobile robots segment is emerging as the fastest-growing area within the Industrial Robotics market, driven by the increasing demand for logistics automation in warehouses and distribution centers. Mobile robots, equipped with advanced navigation systems and AI technologies, can autonomously transport materials and products within facilities, optimizing workflow and reducing operational costs. The rise of e-commerce and the need for efficient supply chain management are significantly contributing to the growth of this segment.

Additionally, the ability of mobile robots to navigate dynamic environments and adapt to changing layouts enhances their appeal in various industries. As companies seek to streamline their logistics operations and improve delivery speeds, the adoption of mobile robots is expected to accelerate. This segment's growth reflects the broader trend towards automation in logistics and supply chain management, positioning it as a vital component of the Industrial Robotics market.

Fastest Growing Region: Asia-Pacific Region

The Asia-Pacific region is emerging as the fastest-growing market for Industrial Robotics, driven by rapid industrialization and increasing investments in automation technologies. Countries such as China, Japan, and South Korea are leading this growth, with a strong focus on upgrading manufacturing capabilities and integrating advanced robotics solutions. The rise of smart factories and the adoption of Industry 4.0 principles are propelling significant demand for industrial robotics in the region.

Moreover, government initiatives aimed at promoting technological innovation and enhancing manufacturing competitiveness are further accelerating the adoption of robotics solutions. As industries in the Asia-Pacific region strive for greater efficiency and productivity, the demand for industrial robotics is expected to rise substantially. This growth trajectory underscores the region's critical role in shaping the future of the global industrial robotics landscape.

Competitive Landscape

The competitive landscape of the Industrial Robotics market is characterized by a mix of established players and innovative startups, all vying for market share in this rapidly evolving industry. Key companies such as ABB, KUKA, Fanuc, and Yaskawa Electric Corporation lead the market, offering a comprehensive range of robotic solutions tailored to various applications. These companies invest heavily in research and development to enhance their product offerings, focusing on integrating advanced technologies such as AI, machine learning, and IoT into their robotics systems.

In addition to established players, numerous emerging companies are entering the market with niche products and innovative solutions that address specific industry needs. The market is witnessing a trend towards strategic partnerships, collaborations, and acquisitions, as companies seek to expand their technological capabilities and market presence. As the demand for industrial robotics continues to grow across multiple sectors, the competitive landscape is expected to remain dynamic, fostering ongoing innovation and advancements in robotic technologies.

Top 10 Companies in the Industrial Robotics Market

- ABB Ltd.

A global leader in robotics and automation, ABB offers a wide range of industrial robots designed to improve productivity and efficiency across various sectors. - KUKA AG

KUKA specializes in industrial robotics and automation solutions, focusing on innovation and customization to meet the specific needs of its clients. - Fanuc Corporation

Fanuc is renowned for its advanced robotics and automation technologies, providing solutions that enhance operational efficiency in manufacturing. - Yaskawa Electric Corporation

Yaskawa offers a diverse portfolio of industrial robots and automation solutions, emphasizing precision and reliability in various applications. - Mitsubishi Electric Corporation

Mitsubishi Electric provides a comprehensive range of robotic solutions, focusing on enhancing automation and productivity in industrial settings. - Universal Robots

A pioneer in collaborative robotics, Universal Robots specializes in lightweight, flexible robots designed to work alongside human operators. - Omron Corporation

Omron offers innovative automation solutions, including robotics and control systems, to enhance productivity and operational efficiency. - Siemens AG

Siemens provides a wide range of automation and digitalization solutions, integrating robotics technologies into its offerings to optimize manufacturing processes. - Epson Robotics

Epson specializes in compact and precise industrial robots, focusing on applications in electronics, pharmaceuticals, and food processing. - Denso Robotics

Denso offers a comprehensive range of industrial robots and automation solutions, emphasizing efficiency and precision in manufacturing processes.

As the Industrial Robotics market continues to evolve, these leading companies are driving innovation and shaping the future of industrial automation technologies. The competitive landscape is expected to remain dynamic, with ongoing developments that enhance the capabilities and efficiency of industrial robotics across multiple sectors.

Report Objectives:

The report will help you answer some of the most critical questions in the Industrial Robotics Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the industrial robotics market?

- What is the size of the industrial robotics market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 16.2 billion |

|

Forecasted Value (2030) |

USD 38.7 billion |

|

CAGR (2024-2030) |

13.3% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Industrial Robotics Market By Type (Collaborative, Traditional), By Payload (Up to 16.00 Kg, 16.01-60.00 Kg, 60.01-225.00 Kg, More than 225 Kg), By Application (Welding & Soldering, Assembling & Disassembling, Handling, Dispensing, Processing, Cleanrooms), By End Use Industry (Electrical & Electronics, Automotive, Metals & Machinery, Food & Beverages, Pharmaceuticals & Cosmetics, Oil & Gas) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Industrial Robotics Market, by Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Traditional Robots |

|

4.1.1.Cylindrical Robots |

|

4.1.2.Cartesian Robots |

|

4.1.3.Articulated Robots |

|

4.1.4.Parallel Robots |

|

4.1.5.SCARA Robots |

|

4.1.6.Others |

|

4.2.Collaborative Robots |

|

5.Industrial Robotics Market, by Payload (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Up to 16.00 kg |

|

5.2.16.01–60.00 kg |

|

5.3.60.01–225.00 kg |

|

5.4.More than 225.00 kg |

|

6.Industrial Robotics Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Welding & Soldering |

|

6.2.Handling |

|

6.3.Processing |

|

6.4.Assembling & Disassembling |

|

6.5.Dispensing |

|

6.6.Cleanrooms |

|

6.7.Others |

|

7.Industrial Robotics Market, by End Use Industry (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Metals & Machinery |

|

7.2.Food & Beverages |

|

7.3.Automotive |

|

7.4.Electrical & Electronics |

|

7.5.Polymers, Rubbers, & Chemicals |

|

7.6.Precision Engineering & Optics |

|

7.7.Pharmaceuticals & Cosmetics |

|

7.8.Oil & Gas |

|

7.9.Others |

|

8.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Regional Overview |

|

8.2.North America |

|

8.2.1.Regional Trends & Growth Drivers |

|

8.2.2.Barriers & Challenges |

|

8.2.3.Opportunities |

|

8.2.4.Factor Impact Analysis |

|

8.2.5.Technology Trends |

|

8.2.6.North America Industrial Robotics Market, by Type |

|

8.2.7.North America Industrial Robotics Market, by Payload |

|

8.2.8.North America Industrial Robotics Market, by End Use Industry |

|

8.2.9.North America Industrial Robotics Market, by Application |

|

*Similar segmentation will be provided at each regional level |

|

8.3.By Country |

|

8.3.1.US |

|

8.3.1.1.US Industrial Robotics Market, by Type |

|

8.3.1.2.US Industrial Robotics Market, by Payload |

|

8.3.1.3.US Industrial Robotics Market, by End Use Industry |

|

8.3.1.4.US Industrial Robotics Market, by Application |

|

8.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

8.4.Europe |

|

8.5.APAC |

|

8.6.Latin America |

|

8.7.Middle East & Africa |

|

9.Competitive Landscape |

|

9.1.Overview of the Key Players |

|

9.2.Competitive Ecosystem |

|

9.2.1.Platform Manufacturers |

|

9.2.2.Subsystem Manufacturers |

|

9.2.3.Service Providers |

|

9.2.4.Software Providers |

|

9.3.Company Share Analysis |

|

9.4.Company Benchmarking Matrix |

|

9.4.1.Strategic Overview |

|

9.4.2.Product Innovations |

|

9.5.Start-up Ecosystem |

|

9.6.Strategic Competitive Insights/ Customer Imperatives |

|

9.7.ESG Matrix/ Sustainability Matrix |

|

9.8.Manufacturing Network |

|

9.8.1.Locations |

|

9.8.2.Supply Chain and Logistics |

|

9.8.3.Product Flexibility/Customization |

|

9.8.4.Digital Transformation and Connectivity |

|

9.8.5.Environmental and Regulatory Compliance |

|

9.9.Technology Readiness Level Matrix |

|

9.10.Technology Maturity Curve |

|

9.11.Buying Criteria |

|

10.Company Profiles |

|

10.1.Techman Robot Corporation |

|

10.1.1.Company Overview |

|

10.1.2.Company Financials |

|

10.1.3.Product/Service Portfolio |

|

10.1.4.Recent Developments |

|

10.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2.Kawasaki Heavy Industries |

|

10.3.Seiko Epson Corporation |

|

10.4.Dürr Group |

|

10.5.Nachi Fujikoshi Corporation 10.6.Mitsubishi Electric 10.7.Denso Corporation 10.8.Kuka AG 10.9.Yaskawa Electric Corporation 10.10.Hyundai Robotics |

|

11.Appendix |

A comprehensive market research approach was employed to gather and analyse data on the Industrial Robotics Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the industrial robotics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the industrial robotics ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the industrial robotics market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA