As per Intent Market Research, the Industrial Filtration Market was valued at USD 23.5 Billion in 2024-e and will surpass USD 38.8 Billion by 2030; growing at a CAGR of 7.4% during 2025-2030.

The industrial filtration market plays a crucial role in various sectors, ensuring the removal of unwanted particles, contaminants, and pollutants from air, liquid, gas, and oil streams. As industries face increasing regulatory requirements and growing demands for cleaner and more efficient processes, the need for high-performance filtration solutions has surged. Filtration systems are essential in applications such as chemical processing, water treatment, and food and beverage production, where maintaining product purity, process efficiency, and environmental standards is critical. The market continues to expand as industries move towards more sustainable practices, adopt new technologies, and integrate advanced filtration solutions for better operational outcomes.

Key trends driving growth include the rise of stricter environmental regulations, the need for operational efficiency, and the growing awareness of health and safety. The adoption of high-tech filtration systems that can handle extreme conditions, improve product quality, and reduce maintenance costs is also accelerating the market. As industries strive for sustainability, the focus is shifting towards filtration systems that minimize waste and energy consumption while improving overall process performance.

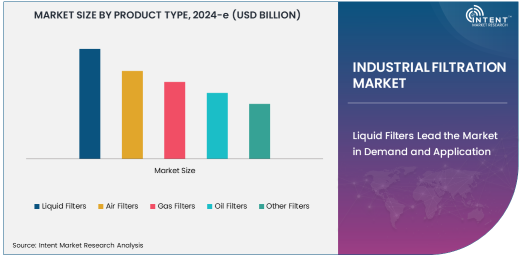

Liquid Filters Lead the Market in Demand and Application

Liquid filters hold the largest share of the industrial filtration market, primarily due to their wide-ranging applications in industries such as chemical & petrochemical, food & beverage, and pharmaceuticals. Liquid filtration is crucial for removing particulates and impurities from various fluids used in industrial processes, ensuring product quality and operational efficiency. Industries such as pharmaceuticals rely heavily on liquid filtration to ensure that active ingredients and final products are free from contaminants, while the food and beverage industry uses liquid filtration to guarantee the purity of ingredients like water, oils, and syrups.

The demand for liquid filters has been further spurred by the growth of the water and wastewater treatment sector, where filtration plays an integral role in ensuring the removal of harmful contaminants before water is released back into the environment. Technological advancements in filter materials and designs, along with the increasing complexity of industrial processes, are expected to continue driving the growth of the liquid filters segment. Their versatility and importance across various industries make them the cornerstone of the industrial filtration market.

Synthetic Filters Gain Popularity Due to Versatility

Among the various filtration media, synthetic filters are experiencing significant growth due to their adaptability and effectiveness in diverse industrial applications. Made from materials like polyester, nylon, and polypropylene, synthetic filters offer superior filtration performance, durability, and cost-effectiveness, making them highly suitable for air, gas, and liquid filtration applications. These filters are designed to trap a wide range of contaminants, from fine particles to larger debris, and can be tailored to meet specific filtration needs in industries such as automotive, food & beverage, and pharmaceuticals.

The increasing demand for synthetic filters is also driven by the need for sustainable filtration solutions. These filters often have a longer operational life, reducing the frequency of replacements and contributing to waste reduction. Moreover, synthetic filters can be engineered to meet the specific requirements of challenging industrial environments, including high-temperature, high-pressure, and chemically aggressive conditions. As industries seek more efficient and environmentally friendly filtration solutions, synthetic filters are expected to remain a leading choice for a variety of applications.

Chemical & Petrochemical Industry Drives Market Growth

The chemical and petrochemical industry is the largest end-use sector in the industrial filtration market, owing to its complex operations that require the effective separation of solids, liquids, and gases. Filtration plays a vital role in the production of chemicals, petrochemicals, and refined products by removing impurities from process streams and ensuring the purity of final products. In this industry, filtration solutions are used to manage the filtration of fluids, gases, and oils, which are critical in production processes such as distillation, solvent recovery, and filtration of catalysts.

The chemical and petrochemical industry also benefits from advancements in filtration media and technologies that improve operational efficiency, reduce energy consumption, and minimize waste. The continued growth of the global chemical and petrochemical sectors, driven by the increasing demand for specialty chemicals, fuels, and materials, is expected to further fuel the need for industrial filtration solutions. As industrial processes become more sophisticated and environmentally regulated, the demand for high-performance filtration systems will remain a key driver of market expansion.

Asia-Pacific Emerges as the Fastest Growing Region

The Asia-Pacific region is expected to be the fastest-growing market for industrial filtration, driven by the rapid industrialization and growing manufacturing activities in countries like China, India, and Japan. As the region expands its manufacturing base, particularly in sectors such as automotive, chemicals, and food processing, the demand for efficient filtration systems has surged. Furthermore, the growing focus on environmental sustainability and stricter regulations regarding pollution control are compelling industries to adopt advanced filtration technologies.

In addition to industrial growth, the increasing investment in water and wastewater treatment infrastructure in countries like China and India has further boosted the demand for filtration systems. The region's burgeoning middle class and its growing focus on clean water and air are contributing to the rise of industrial filtration solutions in a variety of applications. As industrialization accelerates and environmental concerns increase, Asia-Pacific is poised to remain the fastest-growing region in the industrial filtration market.

Competitive Landscape and Key Players

The industrial filtration market is highly competitive, with key players including Donaldson Company, Inc., 3M Company, Parker Hannifin Corporation, Camfil Group, and Filtration Group Corporation, among others. These companies offer a broad range of filtration solutions across various industries, including air, liquid, and gas filtration, and are known for their technological innovations and high-quality products.

To stay competitive, companies are focusing on enhancing product offerings, investing in research and development for new filtration materials, and expanding their geographic presence. Mergers and acquisitions, strategic partnerships, and collaborations with end-users are key strategies employed by leading players to strengthen their market position. The competitive landscape is also characterized by an increasing shift towards eco-friendly, sustainable solutions that reduce energy consumption and waste, aligning with the growing emphasis on environmental sustainability in industrial operations.

Recent Developments:

- Donaldson Company, Inc. introduced a new range of high-performance liquid filters designed to improve the efficiency of water treatment systems in industrial plants.

- 3M Company launched an innovative air filtration product line aimed at enhancing indoor air quality in manufacturing facilities.

- Parker Hannifin Corporation expanded its filtration portfolio with new filtration solutions designed for the automotive and power generation industries.

- Eaton Corporation unveiled a new gas filtration system to help industries meet stringent emission standards in oil and gas operations.

- Pall Corporation introduced a new filtration technology for the pharmaceutical industry, aimed at improving the purity of active pharmaceutical ingredients (APIs).

List of Leading Companies:

- Donaldson Company, Inc.

- Parker Hannifin Corporation

- 3M Company

- Filtration Group

- Eaton Corporation

- Cummins Filtration

- Pall Corporation

- AAF International

- Camfil AB

- Green Filter

- MANN+HUMMEL Group

- Graver Technologies

- Siemens AG

- Hydac International GmbH

- Veolia Environnement S.A.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 23.5 Billion |

|

Forecasted Value (2030) |

USD 38.8 Billion |

|

CAGR (2025 – 2030) |

7.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Industrial Filtration Market By Product Type (Liquid Filters, Air Filters, Gas Filters, Oil Filters), By Filtration Media (Synthetic Filters, Metal Filters, Ceramic Filters, Fiberglass Filters), By End-Use Industry (Chemical & Petrochemical, Food & Beverage, Pharmaceuticals, Water & Wastewater Treatment, Automotive, Power Generation, Pulp & Paper, Mining & Minerals) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Donaldson Company, Inc., Parker Hannifin Corporation, 3M Company, Filtration Group, Eaton Corporation, Cummins Filtration, Pall Corporation, AAF International, Camfil AB, Green Filter, MANN+HUMMEL Group, Graver Technologies, Siemens AG, Hydac International GmbH, Veolia Environnement S.A. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Industrial Filtration Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Liquid Filters |

|

4.2. Air Filters |

|

4.3. Gas Filters |

|

4.4. Oil Filters |

|

4.5. Other Filters |

|

5. Industrial Filtration Market, by Filtration Media (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Synthetic Filters |

|

5.2. Metal Filters |

|

5.3. Ceramic Filters |

|

5.4. Fiberglass Filters |

|

5.5. Other Media |

|

6. Industrial Filtration Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Chemical & Petrochemical |

|

6.2. Food & Beverage |

|

6.3. Pharmaceuticals |

|

6.4. Water & Wastewater Treatment |

|

6.5. Automotive |

|

6.6. Power Generation |

|

6.7. Pulp & Paper |

|

6.8. Mining & Minerals |

|

6.9. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Industrial Filtration Market, by Product Type |

|

7.2.7. North America Industrial Filtration Market, by Filtration Media |

|

7.2.8. North America Industrial Filtration Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Industrial Filtration Market, by Product Type |

|

7.2.9.1.2. US Industrial Filtration Market, by Filtration Media |

|

7.2.9.1.3. US Industrial Filtration Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Donaldson Company, Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Parker Hannifin Corporation |

|

9.3. 3M Company |

|

9.4. Filtration Group |

|

9.5. Eaton Corporation |

|

9.6. Cummins Filtration |

|

9.7. Pall Corporation |

|

9.8. AAF International |

|

9.9. Camfil AB |

|

9.10. Green Filter |

|

9.11. MANN+HUMMEL Group |

|

9.12. Graver Technologies |

|

9.13. Siemens AG |

|

9.14. Hydac International GmbH |

|

9.15. Veolia Environnement S.A. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Industrial Filtration Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Industrial Filtration Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Industrial Filtration Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA