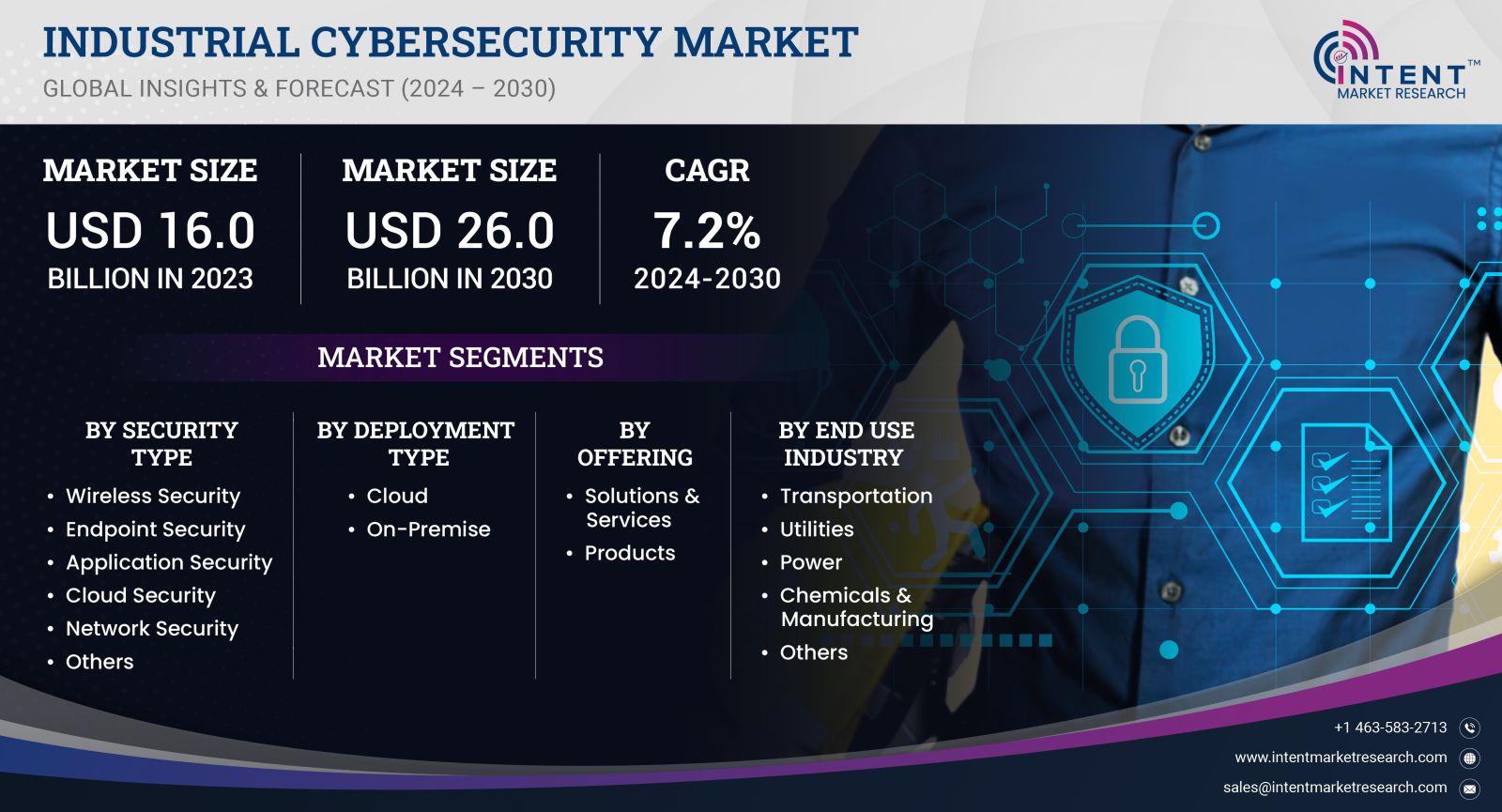

As per Intent Market Research, the Industrial Cybersecurity Market was valued at USD 16.0 billion in 2023-e and will surpass USD 26.0 billion by 2030; growing at a CAGR of 7.2% during 2024 - 2030.

The industrial cybersecurity market is experiencing rapid growth as organizations increasingly recognize the importance of securing their operational technology (OT) environments against cyber threats. As industries become more interconnected through the Internet of Things (IoT) and Industry 4.0 initiatives, the attack surface for cybercriminals expands significantly. Cybersecurity breaches in industrial settings can lead to severe operational disruptions, financial losses, and compromised safety.

The push for enhanced security measures in sectors such as manufacturing, energy, transportation, and utilities underscores the growing recognition of industrial cybersecurity as a critical component of business resilience. As a result, organizations are investing in robust cybersecurity frameworks, threat detection technologies, and employee training programs to safeguard their assets and ensure compliance with increasingly stringent regulations. This overview delves into the key subsegments of the industrial cybersecurity market, highlighting areas of significant growth and opportunity.

Network Security Segment is Largest Owing to Increasing Threat Landscape

The network security segment emerges as the largest in the industrial cybersecurity market, driven by the need to protect critical infrastructure from escalating cyber threats. With the rise of connected devices and systems in industrial environments, safeguarding networks against unauthorized access, data breaches, and malware attacks has become paramount. Network security solutions encompass firewalls, intrusion detection systems (IDS), and intrusion prevention systems (IPS), all designed to monitor and control network traffic and prevent malicious activities.

As industries increasingly rely on interconnected networks for operational efficiency, the complexity of securing these systems grows. Organizations are investing heavily in advanced network security measures to ensure the integrity, availability, and confidentiality of their data. The network security segment is projected to maintain its dominance in the industrial cybersecurity market, with an anticipated CAGR of around 25% through 2030. This growth is indicative of the urgent need for comprehensive security strategies that encompass both IT and OT environments, providing organizations with the resilience necessary to combat evolving cyber threats.

Endpoint Security Segment is Fastest Growing Owing to Proliferation of IoT Devices

The endpoint security segment is the fastest growing within the industrial cybersecurity market, driven by the proliferation of Internet of Things (IoT) devices in industrial environments. As organizations adopt IoT technologies to enhance operational efficiency and gain real-time insights, the number of endpoints vulnerable to cyber attacks has surged. Endpoint security solutions, including antivirus software, endpoint detection and response (EDR), and mobile device management (MDM), are essential for protecting these devices from malware, ransomware, and other cyber threats.

The increasing interconnectedness of devices has necessitated a shift in cybersecurity strategies, as traditional perimeter-based security models become inadequate in addressing modern threats. The endpoint security segment is projected to experience a CAGR of approximately 28% during the forecast period, reflecting the urgent need for robust protection against evolving cyber risks. Organizations are recognizing that securing endpoints is critical to maintaining the integrity of their operations, making this subsegment a focal point for investment and innovation in the industrial cybersecurity landscape.

Application Security Segment is Largest Owing to Criticality in Operational Technology

The application security segment stands out as the largest within the industrial cybersecurity market, primarily due to the critical role applications play in managing and controlling industrial processes. As industries become more reliant on software applications for various operational tasks, the need to secure these applications against vulnerabilities and cyber threats has become increasingly important. Application security solutions encompass a range of practices, including secure coding, application testing, and runtime protection, aimed at safeguarding the software lifecycle.

With the rise of cloud-based applications and remote access solutions, the security of applications in industrial environments has become paramount. Vulnerabilities in applications can lead to unauthorized access, data breaches, and disruptions to operations. The application security segment is expected to maintain its prominence in the industrial cybersecurity market, with a projected CAGR of around 23% from 2024 to 2030. Organizations are prioritizing investment in application security to ensure that their software systems are resilient against cyber threats, thereby safeguarding their operations and data integrity.

Cloud Security Segment is Fastest Growing Owing to Increased Adoption of Cloud Technologies

The cloud security segment is the fastest growing in the industrial cybersecurity market, fueled by the increasing adoption of cloud technologies across various industrial sectors. As organizations migrate their operations to cloud environments for enhanced scalability, flexibility, and cost-effectiveness, the need to secure these cloud infrastructures becomes critical. Cloud security solutions address concerns related to data breaches, unauthorized access, and compliance, ensuring that sensitive information remains protected in the cloud.

The rise of hybrid and multi-cloud environments has introduced new complexities in securing cloud-based applications and data. Organizations are investing in cloud security solutions, including encryption, access management, and threat detection, to mitigate the risks associated with cloud adoption. The cloud security segment is projected to grow at an impressive CAGR of approximately 30% through 2030, highlighting the urgency for robust security measures that can keep pace with the rapid evolution of cloud technologies in industrial settings. As organizations embrace digital transformation, securing cloud environments will be a top priority.

Consulting Services Segment is Largest Owing to Growing Demand for Expertise

In the industrial cybersecurity market, the consulting services segment is recognized as the largest, driven by the increasing demand for expert guidance in implementing effective cybersecurity strategies. Organizations often face challenges in navigating the complexities of industrial cybersecurity, leading to a growing reliance on consulting firms to provide tailored solutions and best practices. These services encompass risk assessments, vulnerability management, compliance audits, and incident response planning, enabling organizations to strengthen their cybersecurity posture.

The demand for consulting services is further fueled by the evolving regulatory landscape, as organizations seek to comply with industry standards and regulations related to cybersecurity. Consulting firms offer valuable expertise in aligning cybersecurity initiatives with organizational goals, thereby enhancing overall resilience. The consulting services segment is projected to experience a CAGR of approximately 22% during the forecast period, underscoring the critical role of expert guidance in navigating the dynamic industrial cybersecurity landscape.

North America Region is Largest Owing to Established Industrial Base

The North America region emerges as the largest market for industrial cybersecurity, primarily due to its established industrial base and high adoption of advanced technologies. The region is home to numerous industries, including manufacturing, energy, transportation, and utilities, all of which are increasingly recognizing the need to secure their operational technology environments. The presence of key market players, robust regulatory frameworks, and significant investments in cybersecurity solutions further bolster North America’s position as a leader in the industrial cybersecurity market.

As industries in North America continue to evolve and adopt digital transformation strategies, the demand for comprehensive cybersecurity solutions is expected to grow. The region is projected to maintain a significant market share, with an anticipated CAGR of around 24% from 2024 to 2030. The growing awareness of cyber threats and the importance of securing critical infrastructure are driving investments in industrial cybersecurity, making North America a focal point for innovation and development in this field.

Competitive Landscape and Leading Companies

The industrial cybersecurity market is highly competitive, characterized by the presence of numerous players striving for market share through innovation, strategic partnerships, and the development of comprehensive security solutions. The leading companies in this sector include:

- Palo Alto Networks - Renowned for its advanced cybersecurity solutions, Palo Alto Networks offers a range of services, including network security and endpoint protection, tailored for industrial environments.

- Cisco Systems, Inc. - A global leader in IT and network security, Cisco provides comprehensive cybersecurity solutions that encompass industrial networks and operational technology.

- McAfee, LLC - Specializing in endpoint security and threat detection, McAfee delivers robust cybersecurity solutions designed to protect industrial operations from evolving threats.

- FireEye, Inc. - Known for its threat intelligence and incident response services, FireEye offers tailored solutions to safeguard industrial systems against advanced cyber attacks.

- Fortinet, Inc. - Fortinet provides integrated cybersecurity solutions, including firewalls and endpoint security, catering to the unique needs of industrial sectors.

- Honeywell International Inc. - With a strong focus on industrial automation and cybersecurity, Honeywell offers solutions designed to secure critical infrastructure and operational technology.

- Kaspersky Lab - A leader in cybersecurity solutions, Kaspersky provides a range of products aimed at protecting industrial environments from cyber threats.

- IBM Corporation - IBM offers a suite of cybersecurity services, including threat intelligence and consulting, helping organizations strengthen their security posture in industrial settings.

- Siemens AG - Siemens combines its expertise in industrial automation with cybersecurity solutions, ensuring the security of operational technology across various sectors.

- Check Point Software Technologies - Known for its cybersecurity software and hardware solutions, Check Point provides advanced protection for industrial networks and systems.

The competitive landscape is marked by continuous innovation and collaboration, as companies strive to develop cutting-edge solutions that address the unique challenges of industrial cybersecurity. As the market continues to evolve, organizations will increasingly prioritize cybersecurity investments to safeguard their operations, driving growth and competition in this dynamic sector.

Report Objectives

The report will help you answer some of the most critical questions in the Industrial Cybersecurity Market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the industrial cybersecurity market?

- What is the size of the industrial cybersecurity market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analysing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 16.0 billion |

|

Forecasted Value (2030) |

USD 26.0 billion |

|

CAGR (2024-2030) |

7.2% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Industrial Cybersecurity Market By Deployment Type (On-Premise, Cloud), By Security Type (Network Security, Application Security, Endpoint Security), By Offering (Solutions & Services, Products), By End-use Industry (Utilities, Power, Healthcare, Oil and Gas, Chemicals & Manufacturing) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Industrial Cybersecurity Market, by Security Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1.Wireless Security |

|

4.2.Endpoint Security |

|

4.3.Application Security |

|

4.4.Cloud Security |

|

4.5.Network Security |

|

4.6.Others |

|

5.Industrial Cybersecurity Market, by Deployment Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Cloud |

|

5.2.On-Premise |

|

6.Industrial Cybersecurity Market, by Offering (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1. Solutions & Services |

|

6.2. Products |

|

7.Industrial Cybersecurity Market, by End Use Industry (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Transportation |

|

7.2.Utilities |

|

7.3.Power |

|

7.4.Chemicals & Manufacturing |

|

7.5.Others |

|

8.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

8.1.Regional Overview |

|

8.2.North America |

|

8.2.1.Regional Trends & Growth Drivers |

|

8.2.2.Barriers & Challenges |

|

8.2.3.Opportunities |

|

8.2.4.Factor Impact Analysis |

|

8.2.5.Technology Trends |

|

8.2.6.North America Industrial Cybersecurity Market, by Security Type |

|

8.2.7.North America Industrial Cybersecurity Market, by Offering |

|

8.2.8.North America Industrial Cybersecurity Market, by Deployment Type |

|

8.2.9.North America Industrial Cybersecurity Market, by End Use Industry |

|

*Similar segmentation will be provided at each regional level |

|

8.3.By Country |

|

8.3.1.US |

|

8.3.1.1.US Industrial Cybersecurity Market, by Security Type |

|

8.3.1.2.US Industrial Cybersecurity Market, by Deployment Type |

|

8.3.1.3.US Industrial Cybersecurity Market, by Offering |

|

8.3.1.4.US Industrial Cybersecurity Market, by End Use Industry |

|

8.3.2.Canada |

|

*Similar segmentation will be provided at each country level |

|

8.4.Europe |

|

8.5.APAC |

|

8.6.Latin America |

|

8.7.Middle East & Africa |

|

9.Competitive Landscape |

|

9.1.Overview of the Key Players |

|

9.2.Competitive Ecosystem |

|

9.2.1.Platform Manufacturers |

|

9.2.2.Subsystem Manufacturers |

|

9.2.3.Service Providers |

|

9.2.4.Software Providers |

|

9.3.Company Share Analysis |

|

9.4.Company Benchmarking Matrix |

|

9.4.1.Strategic Overview |

|

9.4.2.Product Innovations |

|

9.5.Start-up Ecosystem |

|

9.6.Strategic Competitive Insights/ Customer Imperatives |

|

9.7.ESG Matrix/ Sustainability Matrix |

|

9.8.Manufacturing Network |

|

9.8.1.Locations |

|

9.8.2.Supply Chain and Logistics |

|

9.8.3.Product Flexibility/Customization |

|

9.8.4.Digital Transformation and Connectivity |

|

9.8.5.Environmental and Regulatory Compliance |

|

9.9.Technology Readiness Level Matrix |

|

9.10.Technology Maturity Curve |

|

9.11.Buying Criteria |

|

10.Company Profiles |

|

10.1.Honeywell |

|

10.1.1.Company Overview |

|

10.1.2.Company Financials |

|

10.1.3.Product/Service Portfolio |

|

10.1.4.Recent Developments |

|

10.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2.Dell |

|

10.3.Schneider Electric |

|

10.4.Cisco |

|

10.5.Broadcom |

|

|

|

10.6.IBM |

|

10.7.ABB |

|

10.8.McAfee |

|

10.9.Rockwell Automation |

|

10.10.Siemens |

|

11.Appendix |

A comprehensive market research approach was employed to gather and analyse data on the industrial cybersecurity market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the industrial cybersecurity Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the industrial cybersecurity ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the industrial cybersecurity market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimates.

NA