As per Intent Market Research, the In-Vehicle Payment Services Market was valued at USD 2.6 Billion in 2024-e and will surpass USD 7.7 Billion by 2030; growing at a CAGR of 19.9% during 2025 - 2030.

The in-vehicle payment services market has emerged as a crucial component of the evolving connected car ecosystem, driven by technological advancements in digital payment systems and the increasing demand for seamless, cashless transactions. This market allows drivers to make payments directly from their vehicles, enhancing convenience and streamlining various in-car services, such as fuel purchases, toll payments, and parking fees. As the automotive industry increasingly integrates advanced technology into vehicles, the demand for in-vehicle payment solutions is set to grow significantly, driven by the need for secure, efficient, and user-friendly payment methods.

The in-vehicle payment services market is evolving rapidly as vehicle manufacturers, payment solution providers, and other stakeholders collaborate to create an integrated ecosystem. With the rise of electric vehicles (EVs), increased connectivity, and a shift towards smart cities, in-vehicle payment solutions offer significant potential to revolutionize the way payments are made for various services, contributing to both convenience and efficiency for consumers and businesses alike. The market is also seeing strong interest from industries such as automotive manufacturing, tolling, and parking management, all of which benefit from this evolving payment technology.

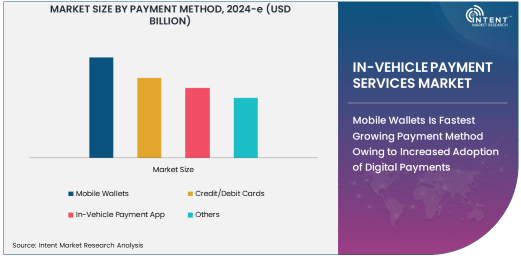

Mobile Wallets Is Fastest Growing Payment Method Owing to Increased Adoption of Digital Payments

Mobile wallets are the fastest growing payment method in the in-vehicle payment services market, driven by the widespread adoption of smartphones and digital payment systems. With mobile wallets, users can securely store payment information and make transactions directly from their smartphones, which can be easily integrated into vehicle systems via Bluetooth or near-field communication (NFC). This seamless integration enables drivers to complete payments for fuel, tolls, parking, and other services without needing to carry physical cards or cash.

The growth of mobile wallets is also fueled by the increasing preference for contactless payments, as consumers seek quicker, safer, and more convenient alternatives to traditional payment methods. The ease of use, combined with the ability to integrate loyalty programs and other digital services, positions mobile wallets as a key enabler of the in-vehicle payment services market. Additionally, the expansion of mobile wallet platforms like Apple Pay, Google Pay, and Samsung Pay into new markets is expected to continue driving this segment’s growth, making it an essential component of the future in-vehicle payment landscape.

Passenger Cars Are Largest Vehicle Type Owing to High Adoption of Connected Features

Passenger cars are the largest vehicle type in the in-vehicle payment services market, driven by the rapid adoption of connected car technologies and advanced infotainment systems in consumer vehicles. As more consumers demand enhanced driving experiences, automakers are integrating in-vehicle payment solutions into their vehicles to provide seamless access to a range of services, from fuel payments to toll collection and parking solutions. This has positioned passenger cars as the leading segment in the market, particularly in developed regions where connected car technology is more prevalent.

Passenger cars also represent a large portion of the global vehicle fleet, which further supports the dominance of this segment in the market. With the increasing trend toward electric vehicles (EVs) and smart cities, passenger cars are expected to continue driving demand for in-vehicle payment solutions. As more automakers incorporate these technologies into their offerings, the growth of the passenger car segment in the in-vehicle payment services market is expected to remain robust, contributing to the overall expansion of the market.

Fuel Payments Are Largest Application Owing to Consumer Demand for Convenience

Fuel payments are the largest application segment in the in-vehicle payment services market, owing to the universal need for convenient and efficient payment solutions at fuel stations. With in-vehicle payment systems, drivers can pay for fuel directly from their vehicles without needing to swipe cards or use cash. This enhances convenience, reduces wait times, and improves the overall fueling experience. Additionally, the adoption of these solutions is increasing as consumers seek faster, touchless ways to pay for everyday services like fuel.

The growth of fuel payments is also supported by advancements in vehicle connectivity and the growing number of fuel stations that offer digital payment solutions. As fuel stations implement contactless payment systems and integrate with in-vehicle payment technologies, this application segment will continue to expand. With a global shift towards cashless payments and the increasing number of connected cars, the demand for in-vehicle fuel payment solutions is set to rise, positioning it as a key contributor to the market's growth.

Automotive Manufacturers Are Largest End-Use Industry Owing to Integration of Payment Systems in Vehicles

Automotive manufacturers are the largest end-use industry in the in-vehicle payment services market, as they are the primary developers and integrators of payment solutions within vehicles. Automakers are increasingly incorporating connected payment systems into their vehicles, allowing drivers to access various payment services directly from the car’s infotainment system. This integration enables manufacturers to offer value-added services to consumers, enhancing the overall driving experience and providing new revenue streams through partnerships with payment solutions providers.

The automotive industry is also leading the way in innovation, working with payment service providers to develop secure, efficient, and user-friendly in-vehicle payment systems. As consumer demand for connected and digital solutions grows, automotive manufacturers are in a unique position to shape the future of in-vehicle payments, driving the adoption of these technologies across all vehicle segments. The increasing importance of digital features in vehicles ensures that automotive manufacturers will remain the largest end-user in the market, spearheading the development and deployment of payment systems.

North America Is Largest Region Owing to Advanced Technological Infrastructure

North America is the largest region in the in-vehicle payment services market, driven by advanced technological infrastructure, high consumer demand for connected car features, and a favorable regulatory environment for digital payments. The U.S. and Canada are at the forefront of adopting in-vehicle payment technologies, with widespread use of mobile wallets, credit/debit card integration, and advanced infotainment systems in vehicles. Additionally, the region’s high rate of electric vehicle adoption and the increasing number of smart cities contribute to the growth of in-vehicle payment solutions.

In North America, the increasing focus on contactless payments and the growing infrastructure for digital payments, including fuel stations, toll booths, and parking lots, further enhance the demand for in-vehicle payment services. As automakers and payment solution providers continue to collaborate on creating seamless, secure payment systems, North America is expected to remain the leading region in the in-vehicle payment services market for the foreseeable future.

Competitive Landscape and Leading Companies

The in-vehicle payment services market is highly competitive, with key players including automotive manufacturers, technology providers, and payment solution companies. Leading companies such as Visa, Mastercard, Apple, Google, and Continental are at the forefront of developing and deploying in-vehicle payment solutions. These companies are working closely with automakers to integrate secure and convenient payment systems into vehicles, offering drivers a seamless payment experience for a variety of services.

To stay competitive, companies are focusing on technological innovations, including the development of more advanced payment systems, enhanced security features, and the expansion of their services across regions. Strategic partnerships and collaborations between automakers and payment solution providers are becoming more common, enabling a stronger ecosystem for in-vehicle payments. As the market continues to grow, companies that can offer secure, user-friendly, and efficient payment solutions will lead the market, shaping the future of in-vehicle payment services.

Recent Developments:

- BMW Group launched a new in-car payment system that allows customers to pay for fuel, tolls, and parking directly from their car's infotainment system.

- Mastercard partnered with leading automakers to integrate secure in-vehicle payment solutions using biometric authentication for added convenience.

- General Motors (GM) introduced a new payment app that lets drivers pay for a variety of services, including charging electric vehicles and tolls, without leaving their vehicle.

- Apple Inc. launched an update for Apple CarPlay to integrate in-vehicle payment systems, allowing users to make payments for retail purchases, parking, and fuel directly through the interface.

- Volkswagen Group expanded its in-vehicle payment system to include payment for car washes, parking, and food delivery, enhancing the convenience for drivers.

List of Leading Companies:

- Mastercard

- Visa Inc.

- BMW Group

- Ford Motor Company

- Daimler AG

- General Motors (GM)

- Tesla, Inc.

- Volkswagen Group

- Qualcomm Incorporated

- Apple Inc.

- Google LLC

- Shell

- ExxonMobil

- TomTom International BV

- Stripe Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.6 Billion |

|

Forecasted Value (2030) |

USD 7.7 Billion |

|

CAGR (2025 – 2030) |

19.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global In-Vehicle Payment Services Market by Payment Method (Mobile Wallets, Credit/Debit Cards, In-Vehicle Payment App), by Vehicle Type (Passenger Cars, Commercial Vehicles, Electric Vehicles), by Application (Fuel Payments, Toll Payments, Parking Payments), by End-Use Industry (Automotive Manufacturers, Payment Solutions Providers), and by Region |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Mastercard, Visa Inc., BMW Group, Ford Motor Company, Daimler AG, General Motors (GM), Volkswagen Group, Qualcomm Incorporated, Apple Inc., Google LLC, Shell, ExxonMobil, Stripe Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. In-Vehicle Payment Services Market, by Payment Method (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Mobile Wallets |

|

4.2. Credit/Debit Cards |

|

4.3. In-Vehicle Payment App |

|

4.4. Others |

|

5. In-Vehicle Payment Services Market, by Vehicle Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Passenger Cars |

|

5.2. Commercial Vehicles |

|

5.3. Electric Vehicles |

|

5.4. Others |

|

6. In-Vehicle Payment Services Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Fuel Payments |

|

6.2. Toll Payments |

|

6.3. Parking Payments |

|

6.4. Others |

|

7. In-Vehicle Payment Services Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Automotive Manufacturers |

|

7.2. Payment Solutions Providers |

|

7.3. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America In-Vehicle Payment Services Market, by Payment Method |

|

8.2.7. North America In-Vehicle Payment Services Market, by Vehicle Type |

|

8.2.8. North America In-Vehicle Payment Services Market, by Application |

|

8.2.9. North America In-Vehicle Payment Services Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US In-Vehicle Payment Services Market, by Payment Method |

|

8.2.10.1.2. US In-Vehicle Payment Services Market, by Vehicle Type |

|

8.2.10.1.3. US In-Vehicle Payment Services Market, by Application |

|

8.2.10.1.4. US In-Vehicle Payment Services Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Mastercard |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Visa Inc. |

|

10.3. BMW Group |

|

10.4. Ford Motor Company |

|

10.5. Daimler AG |

|

10.6. General Motors (GM) |

|

10.7. Tesla, Inc. |

|

10.8. Volkswagen Group |

|

10.9. Qualcomm Incorporated |

|

10.10. Apple Inc. |

|

10.11. Google LLC |

|

10.12. Shell |

|

10.13. ExxonMobil |

|

10.14. TomTom International BV |

|

10.15. Stripe Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the In-Vehicle Payment Services Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the In-Vehicle Payment Services Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the In-Vehicle Payment Services Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA