As per Intent Market Research, the Hydrogen Refueling Station Market was valued at USD 2.4 billion in 2023 and will surpass USD 8.9 billion by 2030; growing at a CAGR of 20.4% during 2024 - 2030.

The hydrogen refueling station market is experiencing rapid growth as the demand for hydrogen-powered vehicles and industrial applications rises. Hydrogen is increasingly viewed as a viable alternative to traditional fossil fuels, particularly in the automotive and public transportation sectors. Hydrogen refueling stations play a key role in supporting the widespread adoption of hydrogen fuel cell vehicles (FCVs) by providing the infrastructure necessary for refueling these vehicles. This market is driven by government initiatives to reduce carbon emissions, advancements in hydrogen technology, and growing investments in hydrogen infrastructure globally.

The development of hydrogen refueling stations is closely tied to the growth of the hydrogen economy, with an emphasis on clean energy sources. As the adoption of hydrogen-powered vehicles expands, so does the need for an efficient refueling network to support this transition. The market is expected to witness significant growth, driven by innovations in refueling technologies, particularly in compression, liquefaction, and cryogenic methods. The increasing use of hydrogen in sectors such as automotive, public transportation, and industrial applications is also fueling the demand for hydrogen refueling stations worldwide.

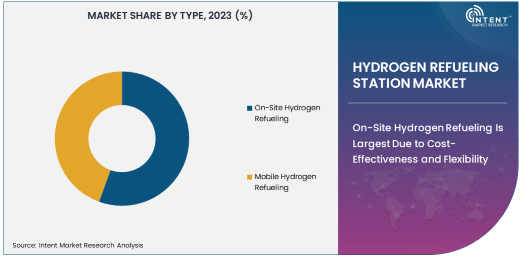

On-Site Hydrogen Refueling Is Largest Due to Cost-Effectiveness and Flexibility

On-site hydrogen refueling is the largest segment in the hydrogen refueling station market. This method allows hydrogen to be produced and dispensed at the same location, making it more cost-effective and operationally efficient compared to other refueling methods. On-site refueling stations can directly supply hydrogen to fuel cell vehicles and industrial applications, which reduces transportation costs and minimizes the need for extensive logistics networks.

The growing number of hydrogen-powered vehicles, particularly in regions like Europe and Asia, has made on-site hydrogen refueling stations a preferred choice for fuel providers and vehicle owners. On-site refueling provides more flexibility in managing hydrogen production and storage, ensuring that the fuel is readily available when needed. As the market for hydrogen fuel cells expands, on-site refueling is expected to remain a dominant solution due to its lower operating costs and ability to meet increasing demand in key markets.

Automotive End-Use Industry Is Largest, Driven by Fuel Cell Vehicle Adoption

The automotive industry is the largest end-use sector in the hydrogen refueling station market. With the rise of fuel cell vehicles (FCVs) as a clean energy alternative to traditional internal combustion engine vehicles, the demand for hydrogen refueling infrastructure has surged. Major automobile manufacturers are making significant investments in hydrogen fuel cell technology, and governments are providing subsidies and incentives to encourage the adoption of FCVs to reduce carbon emissions and reliance on fossil fuels.

The automotive sector’s dominance in the hydrogen refueling station market is closely tied to the global shift towards sustainable transportation. Hydrogen-powered vehicles offer longer driving ranges and shorter refueling times compared to battery-electric vehicles, making them particularly attractive for commercial transportation. As more automakers launch FCVs and governments implement stricter emissions regulations, the demand for hydrogen refueling stations in the automotive industry is expected to continue growing.

Compression Technology Is Fastest Growing Due to Its Efficiency in Hydrogen Storage and Dispensing

Compression technology is the fastest-growing technology in the hydrogen refueling station market. This method involves compressing hydrogen gas to high pressures, allowing for efficient storage and rapid dispensing into hydrogen-powered vehicles. Compressed hydrogen is the most commonly used form of hydrogen in refueling stations due to its relatively simple infrastructure and high energy density.

The adoption of compression technology is growing as hydrogen fuel cell vehicles become more popular, particularly in regions where high-performance, cost-effective refueling stations are in demand. Compression technology is highly efficient in terms of hydrogen storage and dispensing, making it the preferred choice for many refueling stations, particularly in the automotive and public transportation sectors. As hydrogen-powered vehicles continue to grow in popularity, compression technology is expected to remain a key enabler for the expansion of hydrogen refueling stations.

Compressed Hydrogen Storage Type Is Largest Due to Infrastructure and Cost Benefits

Compressed hydrogen is the largest storage type in the hydrogen refueling station market. It involves storing hydrogen gas under high pressure, allowing for more compact storage and efficient transportation. Compressed hydrogen is commonly used in on-site refueling stations and mobile hydrogen refueling units due to its lower cost and relatively simple storage infrastructure compared to liquid hydrogen or metal hydride storage.

The ease of handling and infrastructure for compressed hydrogen makes it the most viable option for large-scale hydrogen refueling operations. As the hydrogen economy grows and the number of hydrogen-powered vehicles increases, compressed hydrogen will continue to play a central role in the refueling infrastructure, providing a cost-effective and scalable solution for hydrogen storage and dispensing.

Asia Pacific is Largest Region Due to Strong Hydrogen Adoption in Automotive and Industrial Sectors

Asia Pacific is the largest region in the hydrogen refueling station market, driven by significant investments in hydrogen infrastructure and the growing adoption of hydrogen fuel cell vehicles, particularly in countries like Japan, South Korea, and China. Japan and South Korea have been leaders in promoting hydrogen technology and establishing hydrogen refueling networks, with major manufacturers like Toyota, Hyundai, and Honda leading the development of hydrogen-powered vehicles.

The region’s focus on reducing carbon emissions and improving air quality is fueling the demand for hydrogen refueling stations, both for automotive and industrial applications. As China accelerates its efforts to decarbonize its transportation and industrial sectors, Asia Pacific is expected to remain the largest market for hydrogen refueling stations, with governments providing strong incentives and support for hydrogen infrastructure development.

Leading Companies and Competitive Landscape

The hydrogen refueling station market is highly competitive, with key players including Air Liquide, Linde, Shell, Toyota Tsusho Corporation, and Nel Hydrogen leading the development of hydrogen refueling technologies. These companies are focused on expanding their networks of hydrogen refueling stations, improving the efficiency and scalability of hydrogen production, and partnering with governments and automotive manufacturers to drive the adoption of hydrogen fuel cells.

The competitive landscape is characterized by collaborations and strategic partnerships between energy companies, automotive manufacturers, and infrastructure developers. These partnerships are essential for accelerating the establishment of hydrogen refueling stations and creating a sustainable hydrogen economy. As demand for hydrogen-powered vehicles and renewable energy applications grows, leading companies are poised to benefit from the expansion of hydrogen refueling infrastructure globally.

Recent Developments:

- In November 2024, Air Liquide announced the construction of a new hydrogen refueling station in California to support the growing number of hydrogen-powered vehicles on the West Coast.

- In October 2024, Linde plc launched an innovative hydrogen refueling station in Germany, offering faster refueling times and enhanced safety features.

- In September 2024, Plug Power unveiled plans to expand its hydrogen refueling station network across the U.S. to support fuel cell trucks and buses for major logistics companies.

- In August 2024, Shell Hydrogen partnered with Toyota and Hyundai to open a new hydrogen refueling station in Japan, marking a significant step in promoting hydrogen mobility.

- In July 2024, ITM Power secured funding for the development of a large-scale green hydrogen refueling station in the UK to cater to the growing demand for sustainable transport.

List of Leading Companies:

- Air Liquide

- Linde plc

- Plug Power

- Shell Hydrogen

- ITM Power

- Hydrogenics (Cummins Inc.)

- Nikola Corporation

- Ballard Power Systems

- Siemens Energy

- Mitsubishi Heavy Industries

- Toyota Tsusho Corporation

- Hyundai Motor Company

- Cummins Inc.

- PowerCell Sweden AB

- FuelCell Energy

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 2.4 billion |

|

Forecasted Value (2030) |

USD 8.9 billion |

|

CAGR (2024 – 2030) |

20.4% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Hydrogen Refueling Station Market By Type (On-Site Hydrogen Refueling, Mobile Hydrogen Refueling), By End-Use Industry (Automotive, Public Transportation, Industrial Applications), By Technology (Compression Technology, Liquefaction Technology, Cryogenic Refueling), By Storage Type (Compressed Hydrogen, Liquid Hydrogen, Metal Hydride) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Air Liquide, Linde plc, Plug Power, Shell Hydrogen, ITM Power, Hydrogenics (Cummins Inc.), Nikola Corporation, Ballard Power Systems, Siemens Energy, Mitsubishi Heavy Industries, Toyota Tsusho Corporation, Hyundai Motor Company, Cummins Inc., PowerCell Sweden AB, FuelCell Energy |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Hydrogen Refueling Station Market, by Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. On-Site Hydrogen Refueling |

|

4.2. Mobile Hydrogen Refueling |

|

5. Hydrogen Refueling Station Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Automotive |

|

5.2. Public Transportation |

|

5.3. Industrial Applications |

|

6. Hydrogen Refueling Station Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Compression Technology |

|

6.2. Liquefaction Technology |

|

6.3. Cryogenic Refueling |

|

7. Hydrogen Refueling Station Market, by Storage Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Compressed Hydrogen |

|

7.2. Liquid Hydrogen |

|

7.3. Metal Hydride |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Hydrogen Refueling Station Market, by Type |

|

8.2.7. North America Hydrogen Refueling Station Market, by End-Use Industry |

|

8.2.8. North America Hydrogen Refueling Station Market, by Technology |

|

8.2.9. North America Hydrogen Refueling Station Market, by Storage Type |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Hydrogen Refueling Station Market, by Type |

|

8.2.10.1.2. US Hydrogen Refueling Station Market, by End-Use Industry |

|

8.2.10.1.3. US Hydrogen Refueling Station Market, by Technology |

|

8.2.10.1.4. US Hydrogen Refueling Station Market, by Storage Type |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Air Liquide |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Linde plc |

|

10.3. Plug Power |

|

10.4. Shell Hydrogen |

|

10.5. ITM Power |

|

10.6. Hydrogenics (Cummins Inc.) |

|

10.7. Nikola Corporation |

|

10.8. Ballard Power Systems |

|

10.9. Siemens Energy |

|

10.10. Mitsubishi Heavy Industries |

|

10.11. Toyota Tsusho Corporation |

|

10.12. Hyundai Motor Company |

|

10.13. Cummins Inc. |

|

10.14. PowerCell Sweden AB |

|

10.15. FuelCell Energy |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Hydrogen Refueling Station Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Hydrogen Refueling Station Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Hydrogen Refueling Station Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA