As per Intent Market Research, the HVAC Equipment Market was valued at USD 170.2 billion in 2024-e and will surpass USD 247.1 billion by 2030; growing at a CAGR of 6.4% during 2024 - 2030.

The HVAC (Heating, Ventilation, and Air Conditioning) equipment market has witnessed significant growth over the years due to the rising demand for climate control solutions in residential, commercial, and industrial settings. The increasing focus on energy-efficient technologies, the growing trend of smart homes, and the need for better indoor air quality are driving the demand for advanced HVAC systems. These systems are not only designed to provide comfort but are also becoming increasingly integral to improving energy efficiency and sustainability, making them crucial for both new construction and renovation projects across various sectors.

As building codes and regulations evolve globally, there is an increasing shift toward incorporating energy-efficient HVAC systems that help reduce energy consumption, operating costs, and carbon footprints. In addition, technological advancements, such as smart HVAC systems that can be controlled remotely, are further revolutionizing the market by enhancing user experience and providing additional energy-saving benefits. The market is poised to continue expanding as consumers, businesses, and governments prioritize environmental sustainability, cost-efficiency, and healthier living environments.

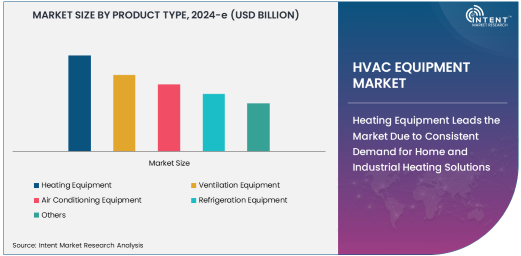

Heating Equipment Leads the Market Due to Consistent Demand for Home and Industrial Heating Solutions

Heating equipment is one of the largest and most consistently demanded segments in the HVAC equipment market. The growing need for indoor heating solutions, especially in colder climates, has driven the demand for various heating systems, including furnaces, boilers, heat pumps, and electric heaters. Both residential and industrial applications rely heavily on heating equipment to maintain comfortable temperatures during colder months and ensure efficient operations in commercial and industrial environments.

Heating systems are an essential component in the overall comfort and safety of households, offices, and manufacturing plants. In residential applications, consumers prioritize energy-efficient and cost-effective solutions that can maintain warmth during winter months without increasing their energy bills. Similarly, industrial facilities demand robust heating solutions to ensure production processes are not compromised by cold temperatures. With the increasing focus on sustainability, energy-efficient heating systems, such as those using heat pumps or smart technology, are gaining popularity due to their ability to reduce operational costs and minimize environmental impact.

Smart HVAC Systems Are Gaining Traction as the Fastest Growing Segment

Among the different technologies available in the HVAC equipment market, smart HVAC systems are rapidly gaining popularity and becoming the fastest growing segment. The integration of Internet of Things (IoT) technology into HVAC systems enables users to remotely control and monitor their heating, ventilation, and air conditioning systems via mobile applications, voice commands, and smart home platforms. This level of control enhances convenience, energy efficiency, and system performance, making smart HVAC systems highly attractive to residential, commercial, and industrial consumers.

Smart HVAC systems offer significant advantages, including automated adjustments to temperature and air quality based on occupancy, time of day, and user preferences. These systems can also integrate with home automation systems, allowing homeowners to create personalized comfort zones, monitor energy usage, and optimize system performance. Additionally, these systems offer predictive maintenance capabilities, which reduce the likelihood of system failure and extend the lifespan of HVAC equipment. As a result, the demand for smart HVAC systems is expected to continue growing, driven by consumer preference for convenience, energy savings, and enhanced control over their environment.

Commercial Sector Shows Strong Demand for Air Conditioning Equipment

Among the various end-users of HVAC systems, the commercial sector is showing strong demand for air conditioning equipment. The need for climate control in offices, retail stores, restaurants, hotels, hospitals, and other commercial spaces is growing, especially in regions with extreme temperatures. Air conditioning is no longer just a luxury; it is a necessity for businesses to provide a comfortable and productive environment for employees, customers, and visitors.

The commercial sector’s focus on energy-efficient air conditioning solutions is contributing to the growth of the air conditioning equipment segment. With rising energy costs and increasing pressure to reduce carbon emissions, businesses are seeking air conditioning systems that consume less energy and offer better performance. The adoption of energy-efficient air conditioning technologies, such as variable refrigerant flow (VRF) systems and air-source heat pumps, is helping companies reduce operating costs and improve sustainability. In addition, the growing popularity of smart air conditioning systems in commercial buildings further boosts the demand for advanced HVAC solutions.

Asia Pacific Emerges as the Fastest Growing Region in the HVAC Equipment Market

The Asia Pacific region is experiencing the fastest growth in the HVAC equipment market. With rapid urbanization, increasing industrialization, and rising disposable incomes, demand for HVAC equipment in countries such as China, India, and Japan is on the rise. The region’s expanding commercial and residential sectors are driving the need for modern HVAC systems that can efficiently meet the region’s diverse climate conditions.

In countries like India and China, the increasing number of residential and commercial buildings, coupled with a growing focus on energy efficiency, has contributed to the rapid adoption of HVAC systems. The rising awareness of air quality, coupled with the need to maintain comfortable indoor environments, has further accelerated the demand for HVAC equipment in this region. Additionally, government initiatives aimed at promoting energy efficiency and sustainability, along with increasing investments in infrastructure development, are expected to further propel the growth of the HVAC market in the Asia Pacific region.

Competitive Landscape: Key Players and Market Dynamics

The HVAC equipment market is highly competitive, with several key players dominating the industry. Leading companies in the market include Daikin Industries, Carrier Global Corporation, Johnson Controls, Trane Technologies, and Lennox International. These companies are focusing on product innovations, technological advancements, and strategic partnerships to expand their market presence. The adoption of energy-efficient technologies, such as heat pumps, smart HVAC systems, and air-source heat pumps, is a key area of focus for these market leaders as they aim to meet the growing demand for sustainable and cost-effective HVAC solutions.

In addition to the established players, several regional and niche players are also contributing to the growth of the HVAC market. These companies are focusing on providing customized solutions tailored to specific regional requirements and emerging market trends. The market is witnessing increased competition from startups and innovative companies offering new technologies, such as IoT-enabled HVAC systems, which can provide added value to consumers through improved energy efficiency and ease of use. As the market continues to evolve, manufacturers are expected to invest in research and development to stay ahead of the competition and meet the evolving needs of customers in an increasingly sustainability-conscious environment.

Recent Developments:

- Carrier Global Corporation unveiled a new line of smart HVAC systems designed to improve energy efficiency in commercial buildings.

- Daikin Industries Ltd. launched a new range of air conditioning units using eco-friendly refrigerants for better environmental sustainability.

- Trane Technologies plc announced the expansion of their HVAC solutions for residential homes, focusing on energy-saving features and smart controls.

- Honeywell International Inc. introduced advanced HVAC systems with integrated sensors that optimize temperature and air quality automatically.

- LG Electronics Inc. showcased a new energy-efficient HVAC unit with advanced air filtration technology aimed at improving indoor air quality.

List of Leading Companies:

- Carrier Global Corporation

- Daikin Industries Ltd.

- Trane Technologies plc

- Johnson Controls International plc

- Lennox International Inc.

- Rheem Manufacturing Company

- York International Corporation

- LG Electronics Inc.

- Mitsubishi Electric Corporation

- Bosch Thermotechnology Corp.

- Emerson Electric Co.

- Fujitsu General Ltd.

- Samsung Electronics Co.

- Honeywell International Inc.

- Panasonic Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 170.2 billion |

|

Forecasted Value (2030) |

USD 247.1 billion |

|

CAGR (2025 – 2030) |

6.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

HVAC Equipment Market By Product Type (Heating Equipment, Ventilation Equipment, Air Conditioning Equipment, Refrigeration Equipment), By Component (Compressors, Heat Exchangers, Air Handling Units, Chillers, Fans & Blowers), By End-User (Residential, Commercial, Industrial), By Application (New Construction, Retrofitting, Renovation), By Technology (Traditional HVAC Systems, Smart HVAC Systems, Energy-efficient HVAC Systems) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Carrier Global Corporation, Daikin Industries Ltd., Trane Technologies plc, Johnson Controls International plc, Lennox International Inc., Rheem Manufacturing Company, York International Corporation, LG Electronics Inc., Mitsubishi Electric Corporation, Bosch Thermotechnology Corp., Emerson Electric Co., Fujitsu General Ltd., Samsung Electronics Co., Honeywell International Inc., Panasonic Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. HVAC Equipment Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Heating Equipment |

|

4.2. Ventilation Equipment |

|

4.3. Air Conditioning Equipment |

|

4.4. Refrigeration Equipment |

|

4.5. Others |

|

5. HVAC Equipment Market, by Component (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Compressors |

|

5.2. Heat Exchangers |

|

5.3. Air Handling Units |

|

5.4. Chillers |

|

5.5. Fans & Blowers |

|

5.6. Others |

|

6. HVAC Equipment Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Residential |

|

6.2. Commercial |

|

6.3. Industrial |

|

7. HVAC Equipment Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. New Construction |

|

7.2. Retrofitting |

|

7.3. Renovation |

|

8. HVAC Equipment Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Traditional HVAC Systems |

|

8.2. Smart HVAC Systems |

|

8.3. Energy-efficient HVAC Systems |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America HVAC Equipment Market, by Product Type |

|

9.2.7. North America HVAC Equipment Market, by Component |

|

9.2.8. North America HVAC Equipment Market, by End-User |

|

9.2.9. North America HVAC Equipment Market, by Application |

|

9.2.10. North America HVAC Equipment Market, by Technology |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US HVAC Equipment Market, by Product Type |

|

9.2.11.1.2. US HVAC Equipment Market, by Component |

|

9.2.11.1.3. US HVAC Equipment Market, by End-User |

|

9.2.11.1.4. US HVAC Equipment Market, by Application |

|

9.2.11.1.5. US HVAC Equipment Market, by Technology |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Carrier Global Corporation |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Daikin Industries Ltd. |

|

11.3. Trane Technologies plc |

|

11.4. Johnson Controls International plc |

|

11.5. Lennox International Inc. |

|

11.6. Rheem Manufacturing Company |

|

11.7. York International Corporation |

|

11.8. LG Electronics Inc. |

|

11.9. Mitsubishi Electric Corporation |

|

11.10. Bosch Thermotechnology Corp. |

|

11.11. Emerson Electric Co. |

|

11.12. Fujitsu General Ltd. |

|

11.13. Samsung Electronics Co. |

|

11.14. Honeywell International Inc. |

|

11.15. Panasonic Corporation |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the HVAC Equipment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the HVAC Equipment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the HVAC Equipment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA