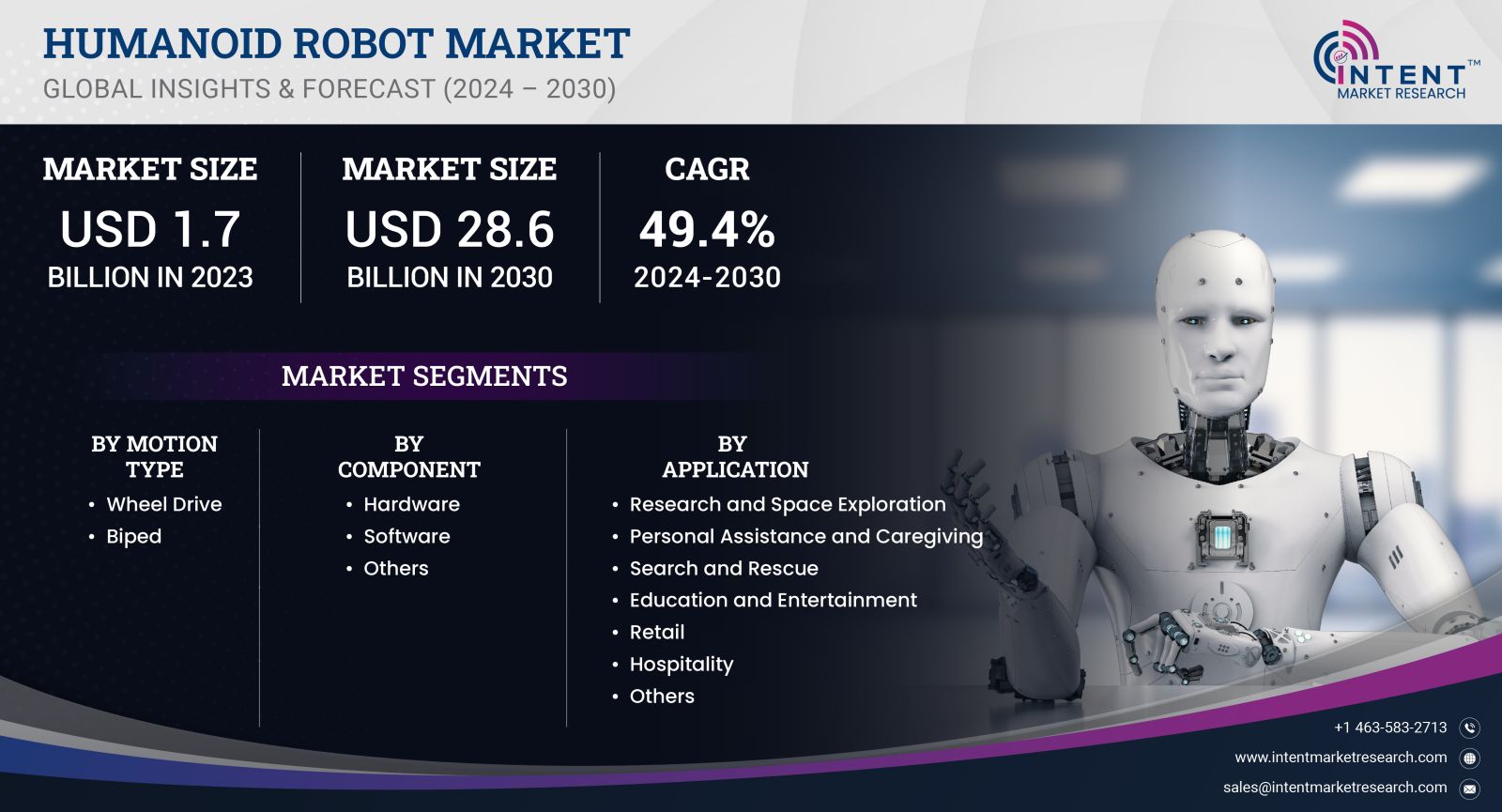

As per Intent Market Research, the Humanoid Robot Market was valued at USD 1.7 billion in 2023-e and will surpass USD 28.6 billion by 2030; growing at a CAGR of 49.4% during 2024 - 2030.

The humanoid robot market has witnessed significant advancements over the past decade, driven by rapid technological innovation, increasing investments in research and development, and the growing adoption of automation across various sectors. Humanoid robots, designed to emulate human movements and interactions, find applications in healthcare, education, customer service, entertainment, and research. This growth is primarily fueled by the need for automation, the rise of artificial intelligence, and the increasing demand for robots in everyday life.

As we move into this new era, the humanoid robot market is expected to expand its horizons, offering unprecedented capabilities that extend beyond basic functionalities. In this context, a detailed analysis of the subsegments reveals interesting insights into market dynamics, highlighting which areas are poised for remarkable growth.

Service Robots Segment is Fastest Growing Owing to Increased Demand in Healthcare

The service robots segment, particularly humanoid robots in healthcare, is witnessing the fastest growth in the humanoid robot market. Healthcare institutions are increasingly adopting humanoid robots for various applications, including patient assistance, rehabilitation, and administrative tasks. These robots can interact with patients, providing companionship and support while also helping healthcare providers manage routine tasks. The need for efficient and reliable patient care, especially in aging populations and during health crises, has further accelerated this trend.

The growing acceptance of robots as caregivers is reshaping the healthcare landscape, offering benefits like enhanced patient experience and improved operational efficiency. Humanoid robots such as SoftBank's Pepper and Boston Dynamics' Spot are being deployed in hospitals and care facilities worldwide, revolutionizing how care is delivered. As the healthcare sector continues to evolve and prioritize patient-centered care, the adoption of humanoid robots is expected to see a surge, with a projected CAGR of around 30% for this subsegment during the forecast period.

Entertainment Robots Segment is Largest Owing to Robust Adoption in Gaming and Media

Within the entertainment robots segment, humanoid robots designed for gaming and media stand out as the largest subsegment. The demand for interactive entertainment experiences has led to significant investments in humanoid robotics, particularly for applications in theme parks, gaming arenas, and media production. These robots are designed to engage users through immersive experiences, blending physical presence with advanced AI capabilities. Companies like Sony and Disney have pioneered the use of humanoid robots in their attractions and productions, showcasing their ability to create captivating narratives and enhance audience engagement.

The success of humanoid robots in entertainment is attributed to their unique ability to interact with humans, providing a sense of companionship and excitement that traditional media cannot offer. As the gaming and entertainment industries continue to innovate, the use of humanoid robots is expected to expand, with a market valuation projected to exceed $3 billion by 2030. This segment's growth is driven by evolving consumer preferences for interactive and personalized entertainment experiences, making it a key focus area for investors and developers.

Industrial Robots Segment is Largest Owing to Broad Manufacturing Applications

In the industrial robots segment, humanoid robots used in manufacturing processes emerge as the largest subsegment. The integration of humanoid robots into production lines has transformed traditional manufacturing by enhancing productivity, precision, and safety. These robots are capable of performing complex tasks alongside human workers, facilitating the shift towards collaborative robotics—an approach that emphasizes human-robot cooperation. Industries such as automotive, electronics, and consumer goods have embraced humanoid robots to streamline operations, reduce labor costs, and maintain competitiveness in a rapidly evolving market.

The significant investment in automation and smart factories has propelled the growth of humanoid robots in the industrial sector. With capabilities ranging from assembly and quality control to packaging and logistics, humanoid robots are proving indispensable in improving operational efficiency. The segment is projected to maintain a strong growth trajectory, with a CAGR of around 25% through 2030, reflecting the ongoing trend towards automation and Industry 4.0 initiatives.

Defense and Security Robots Segment is Fastest Growing Owing to Increasing Security Concerns

The defense and security robots segment, particularly humanoid robots utilized for surveillance and reconnaissance, is experiencing the fastest growth due to escalating global security concerns. Governments and military organizations are increasingly investing in advanced humanoid robots to enhance their defense capabilities, allowing for safer operations in potentially hazardous environments. These robots are equipped with sophisticated sensors and AI algorithms that enable real-time data analysis and threat detection, making them valuable assets in various defense scenarios.

The use of humanoid robots in defense applications offers numerous advantages, including the ability to conduct missions that may be too dangerous for human personnel. As geopolitical tensions rise and the need for effective security solutions intensifies, the defense and security robots segment is expected to flourish, with a projected CAGR of approximately 28% during the forecast period. The integration of cutting-edge technologies, such as machine learning and computer vision, will further bolster the effectiveness and reliability of these robots in critical operations.

Educational Robots Segment is Fastest Growing Owing to Increasing Adoption in Learning Environments

In the educational robots segment, humanoid robots designed for teaching and learning purposes are witnessing the fastest growth. Educational institutions are increasingly integrating humanoid robots into their curricula to facilitate interactive and engaging learning experiences. These robots can assist in teaching complex subjects, provide personalized tutoring, and foster social skills development in students. The effectiveness of humanoid robots in enhancing learning outcomes and student engagement is driving their adoption in schools and universities worldwide.

The rapid evolution of technology and the growing emphasis on STEM (Science, Technology, Engineering, and Mathematics) education have contributed to the rise of humanoid robots in educational settings. As educators seek innovative ways to captivate students and prepare them for future careers, the demand for humanoid robots is expected to surge, with a projected CAGR of around 32% through 2030. This growth signifies a shift towards embracing robotics as an essential tool for modern education, providing students with hands-on learning opportunities in a dynamic environment.

Asia-Pacific Region is Fastest Growing Owing to Rapid Technological Advancements

The Asia-Pacific region stands out as the fastest-growing market for humanoid robots, driven by rapid technological advancements and increasing investments in robotics research. Countries like Japan, China, and South Korea are at the forefront of humanoid robot development, fueled by strong government support and a thriving technology ecosystem. The rising demand for automation in various sectors, including manufacturing, healthcare, and entertainment, has accelerated the adoption of humanoid robots in the region.

Japan, renowned for its robotics expertise, continues to lead the market with innovative humanoid solutions, while China is making significant strides in scaling production capabilities. The Asia-Pacific region is projected to experience a remarkable CAGR of around 29% from 2024 to 2030, reflecting its pivotal role in shaping the future of humanoid robotics. As businesses in this region seek to enhance operational efficiency and improve customer experiences, the demand for humanoid robots is expected to surge, positioning Asia-Pacific as a key player in the global market.

Competitive Landscape and Leading Companies

The humanoid robot market is characterized by intense competition, with numerous players vying for market share through innovation, strategic partnerships, and expanding product portfolios. Key companies driving growth in this sector include:

- SoftBank Robotics - Known for its humanoid robot, Pepper, SoftBank Robotics focuses on creating robots that can engage with humans in social environments, revolutionizing customer service and education.

- Boston Dynamics - A pioneer in robotics, Boston Dynamics is recognized for its advanced robotic systems, including humanoid robots that excel in mobility and manipulation tasks.

- Honda Motor Co., Ltd. - With its Asimo robot, Honda has been a leader in humanoid robotics, emphasizing mobility and functionality in various applications.

- UBTECH Robotics - Specializing in humanoid robotics, UBTECH has developed robots for education, entertainment, and service, with a focus on AI integration.

- Toyota Motor Corporation - Toyota is actively involved in humanoid robot development, aiming to enhance mobility and assistive technologies in healthcare and elder care.

- Kawasaki Heavy Industries - Known for its industrial robots, Kawasaki is also exploring humanoid robotics for applications in manufacturing and service sectors.

- Neato Robotics - Focused on home automation, Neato develops humanoid robots designed for cleaning and other household tasks, showcasing the versatility of humanoid robotics.

- Shadow Robot Company - Specializing in robotic hands and manipulation, Shadow Robot Company is pushing the boundaries of humanoid robot capabilities in industrial applications.

- RoboDynamics - A newer player in the market, RoboDynamics focuses on developing affordable humanoid robots for educational and service applications.

- Pal Robotics - Pal Robotics specializes in developing humanoid robots for research and commercial use, emphasizing interaction and assistive capabilities.

The competitive landscape is marked by strategic alliances and partnerships, as companies collaborate to enhance their technological capabilities and broaden their market reach. With the humanoid robot market poised for significant growth, companies are focusing on innovation and customer-centric solutions to remain competitive in this dynamic environment.

Report Objectives:

The report will help you answer some of the most critical questions in the humanoid robot market. A few of them are as follows:

- What are the key drivers, restraints, opportunities, and challenges influencing the market growth?

- What are the prevailing technology trends in the humanoid robot market?

- What is the size of the humanoid robot market based on segments, sub-segments, and regions?

- What is the size of different market segments across key regions: North America, Europe, Asia Pacific, Latin America, Middle East & Africa?

- What are the market opportunities for stakeholders after analyzing key market trends?

- Who are the leading market players and what are their market share and core competencies?

- What is the degree of competition in the market and what are the key growth strategies adopted by leading players?

- What is the competitive landscape of the market, including market share analysis, revenue analysis, and a ranking of key players?

Report Scope:

|

Report Features |

Description |

|

Market Size (2023-e) |

USD 1.7 billion |

|

Forecasted Value (2030) |

USD 28.6 billion |

|

CAGR (2024-2030) |

49.4% |

|

Base Year for Estimation |

2023-e |

|

Historic Year |

2022 |

|

Forecast Period |

2024-2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Humanoid Robot Market By Component (Software, Hardware), By Motion Type (Wheel Drive, Biped), By Application (Education and Entertainment, Search and Rescue, Research and Space Exploration, Retail, Hospitality) |

|

Regional Analysis |

North America (US, Canada), Europe (Germany, France, UK, Spain, Italy & Rest of Europe), Asia Pacific (China, Japan, South Korea, India, and rest of Asia Pacific), Latin America (Brazil, Mexico, Argentina, & Rest of Latin America), Middle East & Africa (Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1.Introduction |

|

1.1.Market Definition |

|

1.2.Scope of the Study |

|

1.3.Research Assumptions |

|

1.4.Study Limitations |

|

2.Research Methodology |

|

2.1.Research Approach |

|

2.1.1.Top-Down Method |

|

2.1.2.Bottom-Up Method |

|

2.1.3.Factor Impact Analysis |

|

2.2.Insights & Data Collection Process |

|

2.2.1.Secondary Research |

|

2.2.2.Primary Research |

|

2.3.Data Mining Process |

|

2.3.1.Data Analysis |

|

2.3.2.Data Validation and Revalidation |

|

2.3.3.Data Triangulation |

|

3.Executive Summary |

|

3.1.Major Markets & Segments |

|

3.2.Highest Growing Regions and Respective Countries |

|

3.3.Impact of Growth Drivers & Inhibitors |

|

3.4.Regulatory Overview by Country |

|

4.Humanoid Robot Market, by Motion Type (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

4.1. Wheel Drive |

|

4.2. Biped |

|

5.Humanoid Robot Market, by Component (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

5.1.Hardware |

|

5.1.1.Sensors |

|

5.1.2.Actuators |

|

5.1.3.Control System/Controller |

|

5.1.4.Power Source |

|

5.2.Software |

|

5.3.Others |

|

6.Humanoid Robot Market, by Application (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

6.1.Research and Space Exploration |

|

6.2.Personal Assistance and Caregiving |

|

6.3.Search and Rescue |

|

6.4.Education and Entertainment |

|

6.5.Retail |

|

6.6.Hospitality |

|

6.7.Others |

|

7.Regional Analysis (Market Size & Forecast: USD Billion, 2024 – 2030) |

|

7.1.Regional Overview |

|

7.2.North America |

|

7.2.1.Regional Trends & Growth Drivers |

|

7.2.2.Barriers & Challenges |

|

7.2.3.Opportunities |

|

7.2.4.Factor Impact Analysis |

|

7.2.5.Technology Trends |

|

7.2.6.North America Humanoid Robot Market, by Motion Type |

|

7.2.7.North America Humanoid Robot Market, by Component |

|

7.2.8.North America Humanoid Robot Market, by Application |

|

*Similar segmentation will be provided at each regional level |

|

7.3.By Country |

|

7.3.1.US |

|

7.3.1.1.US Humanoid Robot Market, by Motion Type |

|

7.3.1.2.US Humanoid Robot Market, by Component |

|

7.3.1.3.US Humanoid Robot Market, by Application |

|

7.3.2.Canada |

|

*Similar segmentation will be provided at each regional and country level |

|

7.4.Europe |

|

7.5.APAC |

|

7.6 Latin America |

|

7.7.Middle East & Africa |

|

8.Competitive Landscape |

|

8.1.Overview of the Key Players |

|

8.2.Competitive Ecosystem |

|

8.2.1.Platform Manufacturers |

|

8.2.2.Subsystem Manufacturers |

|

8.2.3.Service Providers |

|

8.2.4.Software Providers |

|

8.3.Company Share Analysis |

|

8.4.Company Benchmarking Matrix |

|

8.4.1.Strategic Overview |

|

8.4.2.Product Innovations |

|

8.5.Start-up Ecosystem |

|

8.6.Strategic Competitive Insights/ Customer Imperatives |

|

8.7.ESG Matrix/ Sustainability Matrix |

|

8.8.Manufacturing Network |

|

8.8.1.Locations |

|

8.8.2.Supply Chain and Logistics |

|

8.8.3.Product Flexibility/Customization |

|

8.8.4.Digital Transformation and Connectivity |

|

8.8.5.Environmental and Regulatory Compliance |

|

8.9.Technology Readiness Level Matrix |

|

8.10.Technology Maturity Curve |

|

8.11.Buying Criteria |

|

9.Company Profiles |

|

9.1.SoftBank Robotics |

|

9.1.1.Company Overview |

|

9.1.2.Company Financials |

|

9.1.3.Product/Service Portfolio |

|

9.1.4.Recent Developments |

|

9.1.5.IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2.Hajime Research Institute |

|

9.3.Toyota Motor |

|

9.4.Kawada Robotics |

|

9.5.Honda Motor 9.6.PAL Robotics 9.7.HYULIM Robot 9.8.Hanson Robotics 9.9.Robotis 9.10.Kawada robotics |

|

10.Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Humanoid Robot Market. In the process, the analysis was also done to estimate the parent market and relevant adjacencies to major the impact of them on the humanoid robot Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the humanoid robot ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Estimation

A combination of top-down and bottom-up approaches was utilized to estimate the overall size of the humanoid robot market. These methods were also employed to estimate the size of various subsegments within the market. The market size estimation methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size estimates, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size estimate

NA