As per Intent Market Research, the HPV Testing and Pap Test Market was valued at USD 3.9 Billion in 2024-e and will surpass USD 6.7 Billion by 2030; growing at a CAGR of 8.1% during 2025-2030.

The HPV testing and Pap test market is witnessing steady growth, driven by increasing awareness about cervical cancer prevention and the rise in global health initiatives aimed at improving women’s health. The demand for accurate, early-stage diagnostic tools for HPV and related cancers is pushing the growth of this market. With advancements in molecular diagnostics, HPV testing has become a crucial tool in the early detection of cervical cancer, improving the prognosis for women globally. As healthcare systems evolve and focus on preventive care, the integration of HPV testing and Pap smear testing is gaining traction in routine clinical practice.

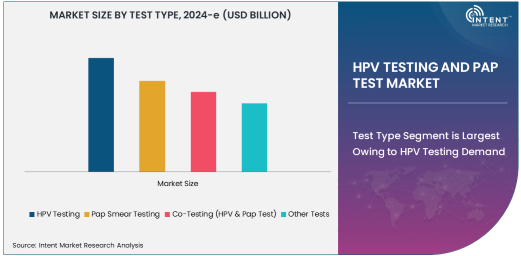

Test Type Segment is Largest Owing to HPV Testing Demand

HPV testing is the largest subsegment in the HPV testing and Pap test market, primarily driven by the growing recognition of its role in the prevention of cervical cancer. This test is used to identify high-risk types of Human Papillomavirus (HPV), which is known to cause cervical cancer. HPV testing, often used in conjunction with Pap smears, allows for more precise identification of women at risk, enabling early intervention and better management of cervical health. The adoption of HPV testing in clinical settings has significantly increased due to its ability to detect infections that may not show immediate symptoms but could lead to cancer over time.

The growing preference for HPV testing over Pap smears is also influenced by its higher sensitivity and effectiveness in detecting the virus. Many healthcare providers are moving toward HPV testing as a primary tool for cervical cancer screening, especially as guidelines for cervical cancer prevention have evolved. As healthcare systems continue to prioritize preventative care, the demand for HPV testing is expected to grow, making it a key driver of the market. This segment's expansion is also supported by technological advancements that have made HPV testing more affordable, accessible, and accurate.

Technology Segment is Fastest Growing Owing to PCR-Based HPV Testing

PCR-based HPV testing is the fastest-growing technology in the HPV testing and Pap test market due to its high accuracy and ability to detect even trace amounts of HPV DNA. Polymerase chain reaction (PCR) technology amplifies specific DNA sequences, making it possible to identify HPV infections at an earlier stage, even before symptoms appear. The precision and sensitivity of PCR-based HPV tests make them highly effective for detecting high-risk HPV types that could lead to cervical cancer, facilitating early intervention and improved patient outcomes.

PCR-based testing has gained considerable momentum due to advancements in automation and integration with laboratory systems, streamlining the testing process. As healthcare providers look for more reliable, cost-effective, and quicker diagnostic methods, PCR technology has emerged as a preferred choice. The growing preference for PCR-based HPV testing in clinical and diagnostic settings is expected to continue, making it a key contributor to the market's expansion in the coming years. This technology also benefits from continuous improvements in testing kits, further driving its adoption in both developed and emerging markets.

Application Segment in Cervical Cancer Screening is Largest Due to Increasing Focus on Early Detection

Cervical cancer screening is the largest application segment in the HPV testing and Pap test market, driven by the critical need for early detection and prevention. With cervical cancer being one of the leading causes of cancer-related deaths in women globally, there has been a substantial push for regular screenings to identify pre-cancerous changes in the cervix before they develop into full-blown cancer. HPV testing plays a vital role in this effort, as it helps identify women at high risk of developing cervical cancer, allowing for timely interventions and management.

Governments and health organizations worldwide are increasingly recommending cervical cancer screening for women starting at age 21, further fueling the demand for HPV testing. Early-stage detection through routine screening significantly reduces cervical cancer mortality rates, making it a priority in many healthcare systems. This growing emphasis on preventive care, along with the proven effectiveness of HPV testing in cervical cancer screening, solidifies its position as the largest application segment. As awareness increases and screening programs expand, this application segment is poised for continued growth.

End-User Segment in Diagnostic Laboratories is Largest Owing to High Testing Volume

Diagnostic laboratories represent the largest end-user segment in the HPV testing and Pap test market, driven by the high volume of tests conducted on a daily basis. These laboratories serve as the primary setting for HPV and Pap tests, processing a large number of samples from patients seeking screening for cervical cancer and related conditions. The growing awareness of cervical cancer prevention and the widespread adoption of HPV testing have led to an increase in the number of diagnostic tests conducted in these laboratories, making them central to the market's growth.

Diagnostic laboratories are equipped with the necessary infrastructure and technologies to perform HPV and Pap tests, including advanced PCR-based and hybrid capture testing platforms. As the demand for accurate, timely, and high-throughput testing increases, these laboratories are at the forefront of delivering these essential diagnostic services. The ongoing trend toward routine and preventive healthcare ensures that diagnostic laboratories will continue to dominate the HPV testing and Pap test market in the years to come. Their ability to handle large-scale testing while maintaining quality standards makes them a critical player in the growth of this sector.

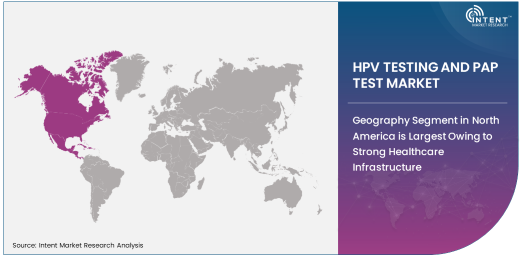

Geography Segment in North America is Largest Owing to Strong Healthcare Infrastructure

North America is the largest region in the HPV testing and Pap test market, owing to its robust healthcare infrastructure, well-established healthcare guidelines, and high awareness of cervical cancer prevention. The United States, in particular, has seen widespread adoption of HPV testing and Pap tests as part of routine screening programs, driven by government initiatives such as the Affordable Care Act and the ongoing push for preventive healthcare. The strong healthcare system, combined with advanced diagnostic technologies, has made North America the leading region for HPV testing and Pap tests.

Additionally, the presence of leading diagnostic companies and healthcare providers in North America has further accelerated market growth. With the focus on reducing cervical cancer incidence through early detection and preventive care, North America remains a key region in shaping global trends in the HPV testing market. As awareness continues to grow and health policies evolve to promote more widespread screening, North America is expected to maintain its dominant position in the market for the foreseeable future.

Competitive Landscape: Leading Companies and Market Dynamics

The HPV testing and Pap test market is highly competitive, with key players constantly innovating to offer better, faster, and more accurate testing solutions. Leading companies in the market include Roche Diagnostics, Abbott Laboratories, Hologic, Inc., BD (Becton, Dickinson and Company), and Qiagen, which are at the forefront of developing advanced testing technologies. These companies are investing heavily in research and development to improve the precision and accessibility of HPV testing, as well as expanding their product offerings to cater to diverse market needs.

The competitive dynamics of the market are driven by continuous technological advancements, mergers and acquisitions, and partnerships aimed at expanding product portfolios and geographic reach. Companies are also focusing on strengthening their presence in emerging markets, where the demand for cervical cancer screening is growing due to rising awareness and improving healthcare infrastructure. With the market's growth trajectory and the increasing focus on preventive healthcare, the competitive landscape will remain dynamic, with both established players and new entrants vying for market share.

Recent Developments:

- Roche Diagnostics launched an advanced HPV test with enhanced accuracy, allowing for faster and more reliable screening for cervical cancer.

- Hologic, Inc. received FDA approval for its new HPV testing system, which is designed to streamline the diagnostic process and reduce time-to-result for patients.

- Thermo Fisher Scientific entered a partnership with a major healthcare provider to expand access to its HPV testing platform in underserved regions.

- Siemens Healthineers acquired a molecular diagnostics company to enhance its portfolio in HPV testing and other women's health solutions.

- Qiagen unveiled a new high-throughput HPV detection solution aimed at improving screening in both clinical and research settings, improving early detection efforts.

List of Leading Companies:

- Roche Diagnostics

- Abbott Laboratories

- Hologic, Inc.

- BD (Becton, Dickinson and Company)

- Qiagen

- Thermo Fisher Scientific

- Siemens Healthineers

- Cepheid

- Grifols

- Becton Dickinson

- LabCorp

- BioMérieux

- Diagon

- Genomica

- Inovio Pharmaceuticals

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.9 Billion |

|

Forecasted Value (2030) |

USD 6.7 Billion |

|

CAGR (2025 – 2030) |

8.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

HPV Testing and Pap Test Market By Test Type (HPV Testing, Pap Smear Testing, Co-Testing), By Technology (PCR-Based HPV Testing, Hybrid Capture HPV Testing, DNA Sequencing), By Application (Cervical Cancer Screening, Preventive Healthcare, Diagnostics for HPV-Related Cancers), By End-User Industry (Hospitals and Clinics, Diagnostic Laboratories, Research Institutes, Gynecologists and OB/GYN Practices) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Roche Diagnostics, Abbott Laboratories, Hologic, Inc., BD (Becton, Dickinson and Company), Qiagen, Thermo Fisher Scientific, Siemens Healthineers, Cepheid, Grifols, Becton Dickinson, LabCorp, BioMérieux, Diagon, Genomica, Inovio Pharmaceuticals |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. HPV Testing and Pap Test Market, by Test Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. HPV Testing |

|

4.2. Pap Smear Testing |

|

4.3. Co-Testing (HPV & Pap Test) |

|

4.4. Other Tests |

|

5. HPV Testing and Pap Test Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. PCR-Based HPV Testing |

|

5.2. Hybrid Capture HPV Testing |

|

5.3. DNA Sequencing |

|

5.4. Other Technologies |

|

6. HPV Testing and Pap Test Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Cervical Cancer Screening |

|

6.2. Preventive Healthcare |

|

6.3. Diagnostics for HPV-Related Cancers |

|

6.4. Other Applications |

|

7. HPV Testing and Pap Test Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals and Clinics |

|

7.2. Diagnostic Laboratories |

|

7.3. Research Institutes |

|

7.4. Gynecologists and OB/GYN Practices |

|

7.5. Other End-Users |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America HPV Testing and Pap Test Market, by Test Type |

|

8.2.7. North America HPV Testing and Pap Test Market, by Technology |

|

8.2.8. North America HPV Testing and Pap Test Market, by Application |

|

8.2.9. North America HPV Testing and Pap Test Market, by End-User |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US HPV Testing and Pap Test Market, by Test Type |

|

8.2.10.1.2. US HPV Testing and Pap Test Market, by Technology |

|

8.2.10.1.3. US HPV Testing and Pap Test Market, by Application |

|

8.2.10.1.4. US HPV Testing and Pap Test Market, by End-User |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Roche Diagnostics |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Abbott Laboratories |

|

10.3. Hologic, Inc. |

|

10.4. BD (Becton, Dickinson and Company) |

|

10.5. Qiagen |

|

10.6. Thermo Fisher Scientific |

|

10.7. Siemens Healthineers |

|

10.8. Cepheid |

|

10.9. Grifols |

|

10.10. Becton Dickinson |

|

10.11. LabCorp |

|

10.12. BioMérieux |

|

10.13. Diagon |

|

10.14. Genomica |

|

10.15. Inovio Pharmaceuticals |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the HPV Testing and Pap Test Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the HPV Testing and Pap Test Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the HPV Testing and Pap Test Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA