As per Intent Market Research, the Hormone Replacement Therapy Market was valued at USD 21.4 Billion in 2024-e and will surpass USD 36.3 Billion by 2030; growing at a CAGR of 7.9% during 2025-2030.

The hormone replacement therapy (HRT) market is poised for significant growth, driven by the increasing awareness of hormonal imbalances, aging-related conditions, and advancements in therapeutic options. HRT involves the administration of hormones to treat various endocrine disorders, such as menopause, hypogonadism, and thyroid-related issues. With a broad range of applications in the medical field, HRT plays a crucial role in improving the quality of life for individuals experiencing hormonal deficiencies. The market is expected to continue expanding as healthcare professionals and patients increasingly turn to HRT as a reliable treatment option.

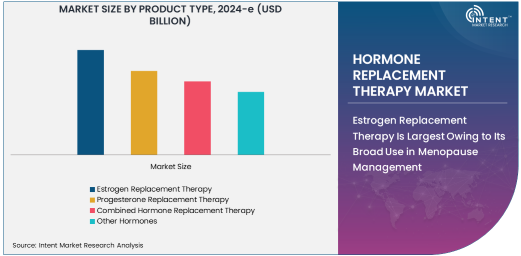

Estrogen Replacement Therapy Is Largest Owing to Its Broad Use in Menopause Management

Among the various product types, estrogen replacement therapy is the largest segment within the hormone replacement therapy market. Estrogen therapy has been widely used for decades to manage menopausal symptoms, such as hot flashes, mood swings, and vaginal dryness. As a central treatment for menopause, estrogen replacement plays a critical role in improving the quality of life for women undergoing this natural transition. The large number of women entering menopause annually, coupled with the rising awareness around HRT, ensures that estrogen replacement remains a dominant choice in the market.

The growing preference for estrogen therapy is further fueled by its ability to treat multiple menopausal symptoms and prevent long-term complications such as osteoporosis. Healthcare providers are also promoting estrogen-based treatments for younger women who experience early menopause, ensuring that the segment continues to expand. As research and formulations improve, the availability of more advanced estrogen replacement therapies, including bioidentical hormones, is expected to drive further market growth.

Menopause Application Is Fastest Growing Owing to Increased Awareness

The menopause application segment is the fastest-growing in the hormone replacement therapy market. Menopause, a natural biological process marking the end of a woman’s menstrual cycles, often brings with it a host of uncomfortable symptoms. With increasing awareness of the benefits of HRT for alleviating these symptoms, the demand for HRT, particularly estrogen therapy, has surged. Women are increasingly seeking medical advice to manage menopause more effectively, thus propelling the growth of the menopause-focused segment.

The rising prevalence of early menopause, due to factors such as lifestyle changes and medical interventions, further accelerates demand for hormone replacement therapies in this application. In addition, societal shifts, including a more open discussion about women's health, have contributed to a higher adoption rate of HRT treatments. As the healthcare community focuses on improving women's quality of life during menopause, this segment is expected to see continued robust growth, making it a central focus for HRT manufacturers.

Hospitals & Clinics Are the Largest Distribution Channel for Hormone Replacement Therapy

Among distribution channels, hospitals & clinics remain the largest segment for hormone replacement therapy. These institutions play a pivotal role in providing prescription-based HRT treatments under the guidance of medical professionals. Hospitals and clinics are well-equipped to offer comprehensive consultation services, conduct hormone level testing, and deliver personalized treatment plans. The ongoing support from healthcare providers ensures that patients receive appropriate doses and monitor any potential side effects.

Hospitals and clinics have long been the preferred setting for patients seeking reliable and medically supervised HRT treatments. With growing demand for HRT among aging populations, healthcare facilities are expanding their hormone treatment offerings, contributing to the continued dominance of this distribution channel. Furthermore, hospitals provide the added benefit of in-person consultations, which remain a critical aspect of patient care in the HRT process.

Women End-User Segment Leads Due to High Demand for Menopause and Aging Solutions

The women end-user segment is the largest in the hormone replacement therapy market. Women, particularly those going through menopause or experiencing hormonal imbalances, are the primary recipients of HRT treatments. Estrogen-based therapies, in particular, are used extensively to alleviate menopausal symptoms and support bone health, making them essential for aging women. As the female population continues to age, the need for HRT solutions is expected to grow, making women the dominant end-user group.

Additionally, with increasing awareness about the benefits of early intervention, more women are seeking HRT treatments at earlier stages of menopause or peri-menopause. This growing awareness, combined with the rising incidence of conditions like osteoporosis and heart disease in postmenopausal women, continues to support the market demand for hormone replacement therapies targeted at women.

North America Leads the Global Hormone Replacement Therapy Market

North America is the largest region in the global hormone replacement therapy market. The region benefits from a well-established healthcare infrastructure, a high level of awareness about menopause and related conditions, and a large consumer base of women seeking menopause management solutions. The increasing number of women entering menopause each year, coupled with widespread insurance coverage for HRT treatments, ensures sustained market growth. Additionally, the regulatory environment in North America is favorable for hormone-based therapies, which boosts the availability of these treatments in the region.

With a highly developed healthcare system and robust research activities, North America remains a hub for innovation in hormone replacement therapies. The market in this region is also influenced by a growing preference for bioidentical hormones, which are perceived to be safer and more natural, contributing to a growing demand for advanced HRT options.

Competitive Landscape and Leading Companies

The hormone replacement therapy market is highly competitive, with several key players dominating the landscape. Leading companies such as Pfizer Inc., Eli Lilly and Company, Abbott Laboratories, and Bayer AG are focusing on product innovations, partnerships, and acquisitions to maintain their competitive edge. These companies invest heavily in research and development to create advanced therapies, such as bioidentical hormones and combination therapies, which have gained popularity for their perceived safety and effectiveness.

In addition to large multinational corporations, smaller specialized companies are also playing a significant role in the market, particularly in the development of niche products targeting specific hormonal disorders. As the demand for hormone replacement therapies continues to rise, companies are expanding their product portfolios and focusing on personalized treatment options to cater to individual patient needs. The competitive dynamics are expected to intensify as new players enter the market, driving further advancements in hormone replacement therapies.

Recent Developments:

- Pfizer launched a new bioidentical estrogen therapy product aimed at reducing menopausal symptoms in December 2024.

- Eli Lilly announced a partnership with a biotech firm to develop an advanced hormone replacement therapy for male hypogonadism in January 2025.

- Mylan received regulatory approval for a new progesterone replacement therapy treatment for post-menopausal women in October 2024.

- Bayer AG introduced a new hormone patch designed to deliver combined therapy for both estrogen and progesterone in early 2025.

- Teva Pharmaceutical Industries acquired a smaller hormone therapy manufacturer to expand its portfolio in the menopausal segment in November 2024.

List of Leading Companies:

- Pfizer Inc.

- Novartis International AG

- Eli Lilly and Company

- Abbott Laboratories

- Mylan N.V.

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Johnson & Johnson

- Merck & Co., Inc.

- HRA Pharma

- Procter & Gamble

- Aspen Pharmacare

- Sanofi

- GSK

- Allergan

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 21.4 Billion |

|

Forecasted Value (2030) |

USD 36.3 Billion |

|

CAGR (2025 – 2030) |

7.9% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Hormone Replacement Therapy Market By Product Type (Estrogen Replacement Therapy, Progesterone Replacement Therapy, Combined Hormone Replacement Therapy), By Application (Menopause, Hypogonadism, Thyroid Disorders, Adrenal Insufficiency), By End-User (Women, Men, Elderly Population), By Distribution Channel (Hospitals & Clinics, Retail Pharmacies, Online Pharmacies, Homecare), and By Region; Global Insights & Forecast (2023 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Pfizer Inc., Novartis International AG, Eli Lilly and Company, Abbott Laboratories, Mylan N.V., Bayer AG, Teva Pharmaceutical Industries Ltd., Johnson & Johnson, Merck & Co., Inc., HRA Pharma, Procter & Gamble, Aspen Pharmacare, Sanofi, GSK, Allergan |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Hormone Replacement Therapy Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Estrogen Replacement Therapy |

|

4.2. Progesterone Replacement Therapy |

|

4.3. Combined Hormone Replacement Therapy |

|

4.4. Other Hormones |

|

5. Hormone Replacement Therapy Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Menopause |

|

5.2. Hypogonadism |

|

5.3. Thyroid Disorders |

|

5.4. Adrenal Insufficiency |

|

5.5. Others |

|

6. Hormone Replacement Therapy Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Women |

|

6.2. Men |

|

6.3. Elderly Population |

|

7. Hormone Replacement Therapy Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals & Clinics |

|

7.2. Retail Pharmacies |

|

7.3. Online Pharmacies |

|

7.4. Homecare |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Hormone Replacement Therapy Market, by Product Type |

|

8.2.7. North America Hormone Replacement Therapy Market, by Application |

|

8.2.8. North America Hormone Replacement Therapy Market, by End-User |

|

8.2.9. North America Hormone Replacement Therapy Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Hormone Replacement Therapy Market, by Product Type |

|

8.2.10.1.2. US Hormone Replacement Therapy Market, by Application |

|

8.2.10.1.3. US Hormone Replacement Therapy Market, by End-User |

|

8.2.10.1.4. US Hormone Replacement Therapy Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Pfizer Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Novartis International AG |

|

10.3. Eli Lilly and Company |

|

10.4. Abbott Laboratories |

|

10.5. Mylan N.V. |

|

10.6. Bayer AG |

|

10.7. Teva Pharmaceutical Industries Ltd. |

|

10.8. Johnson & Johnson |

|

10.9. Merck & Co., Inc. |

|

10.10. HRA Pharma |

|

10.11. Procter & Gamble |

|

10.12. Aspen Pharmacare |

|

10.13. Sanofi |

|

10.14. GSK |

|

10.15. Allergan |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Hormone Replacement Therapy Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Hormone Replacement Therapy Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Hormone Replacement Therapy Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA