As per Intent Market Research, the Home Rehabilitation Products and Services Market was valued at USD 9.7 Billion in 2024-e and will surpass USD 19.0 Billion by 2030; growing at a CAGR of 10.1% during 2025-2030.

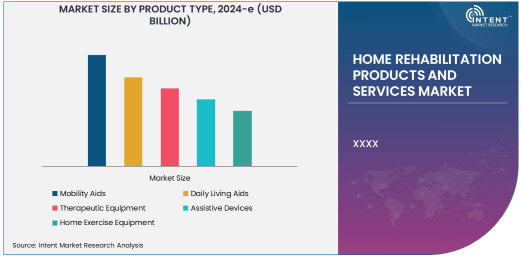

The home rehabilitation products and services market is witnessing rapid growth due to the increasing demand for healthcare services at home, particularly for elderly individuals, those with chronic diseases, and people recovering from surgeries. The market encompasses various product types, including mobility aids, daily living aids, therapeutic equipment, assistive devices, and home exercise equipment. Additionally, advancements in technology and the growing trend toward at-home physical therapy and recovery contribute to market expansion. Increasing awareness of the benefits of rehabilitation at home and rising healthcare costs in hospitals have led many patients to seek effective home care solutions.

Mobility Aids Segment Is Largest Owing to Rising Elderly Population

Among the various product types, mobility aids have emerged as the largest subsegment in the home rehabilitation market. This segment includes products such as walkers, wheelchairs, and scooters, designed to assist individuals with limited mobility. The rising elderly population globally is the primary driver for this segment's growth, as older adults often face mobility challenges due to age-related conditions like arthritis, stroke, or general frailty. As the global elderly population continues to increase, the demand for mobility aids is expected to remain strong, with continued advancements in product design improving user comfort and convenience.

Mobility aids also play a critical role in enhancing the quality of life for people recovering from surgeries or physical injuries. As more healthcare providers shift toward offering rehabilitation solutions in homecare settings, mobility aids remain essential for facilitating independent living and ensuring patients can move around safely. The ongoing technological innovations and the incorporation of smart features, such as sensor-based monitoring systems, are further driving the growth of this segment.

Elderly Care Segment Is Fastest Growing Owing to Aging Population

The elderly care sector is the fastest-growing end-user industry in the home rehabilitation market. This can be attributed to the increasing aging population globally, which is creating a higher demand for homecare products and services tailored to the needs of older individuals. According to estimates, the global elderly population will double by 2050, significantly impacting the healthcare market. With many elderly individuals preferring to receive care in the comfort of their homes rather than institutional settings, the need for specialized home rehabilitation products like mobility aids, daily living aids, and therapeutic equipment has skyrocketed.

Elderly care involves not only medical care but also emotional and physical support, making rehabilitation products particularly important for these individuals. With a growing focus on improving elderly quality of life and encouraging independence, the elderly care segment is expected to continue growing rapidly. The shift toward homecare solutions has been supported by policy changes and technological advancements, making it more accessible and effective for elderly patients to receive rehabilitation therapies at home.

Stroke Rehabilitation Is Fastest Growing Application Due to Increased Stroke Incidence

Among the various applications, stroke rehabilitation is the fastest-growing area within the home rehabilitation market. With the rising incidence of stroke worldwide, the need for specialized rehabilitation products and services has surged. Stroke rehabilitation focuses on helping individuals recover motor skills, regain speech, and improve cognitive abilities post-stroke. In-home rehabilitation solutions have proven to be particularly effective for stroke recovery, as they allow patients to receive personalized care while remaining in a familiar and comfortable environment.

Technological advancements in stroke rehabilitation products, such as robotic therapy devices and virtual reality-based therapies, are further fueling the growth of this application. These products offer more engaging and targeted treatments, contributing to quicker and more comprehensive recovery. With stroke rates increasing due to factors like aging populations and lifestyle-related conditions, this segment’s rapid growth is expected to continue over the next decade.

Online Retail Is Fastest Growing Distribution Channel

Among the various distribution channels, online retail has emerged as the fastest-growing channel for home rehabilitation products. The convenience of purchasing products online and the ability to access a wide range of rehabilitation equipment have made online platforms increasingly popular for consumers. This growth is particularly evident in the post-COVID-19 era, where online shopping has become the preferred method of purchasing healthcare products due to safety concerns and ease of access.

Consumers now have the option to compare different products, read reviews, and even receive consultations online, making the purchase process smoother and more efficient. Additionally, online platforms often offer home delivery services, providing added convenience for customers who require home rehabilitation products. As e-commerce continues to expand, this channel is expected to play a key role in the distribution of home rehabilitation products worldwide.

North America Is Largest Region Owing to Advanced Healthcare Infrastructure

North America currently holds the largest share of the home rehabilitation products and services market. The region’s advanced healthcare infrastructure, high disposable incomes, and increasing elderly population contribute to its dominance. In particular, the United States represents a significant portion of this market, with a large demand for home healthcare products driven by the aging Baby Boomer generation and a shift toward home-based care models. Additionally, favorable reimbursement policies and widespread insurance coverage further facilitate market growth in the region.

North America’s technological advancements in home rehabilitation products and services also contribute to the region’s leadership. The availability of sophisticated devices, including smart mobility aids, therapeutic equipment, and home exercise tools, ensures that North America continues to be the largest market for home rehabilitation products and services.

Competitive Landscape

The home rehabilitation products and services market is highly competitive, with several global players striving to maintain their market position through innovation, strategic partnerships, and geographic expansion. Leading companies in this market include Invacare Corporation, Össur, Medline Industries, Inc., Drive DeVilbiss Healthcare, and Sunrise Medical. These companies have strengthened their portfolios through product innovations, such as mobility aids, therapeutic equipment, and home exercise devices, catering to the growing demand for home healthcare solutions.

The competitive landscape is also characterized by collaborations between healthcare providers, rehabilitation centers, and product manufacturers to offer comprehensive homecare solutions. Additionally, with the rapid growth of e-commerce, companies are increasingly focusing on strengthening their online presence to cater to a broader customer base. The integration of digital platforms, personalized patient care services, and technological advancements such as remote monitoring systems and robotic devices are expected to further intensify competition in the coming years.

Recent Developments:

- Invacare Corporation launched a new line of innovative home rehabilitation products aimed at enhancing patient mobility and comfort during rehabilitation.

- Össur acquired a leading company specializing in physical therapy equipment, strengthening its portfolio of rehabilitation services.

- Medline Industries, Inc. partnered with major hospitals to distribute its line of home rehabilitation aids, helping streamline patient recovery at home.

- Drive DeVilbiss Healthcare received FDA approval for a new advanced therapeutic equipment designed for post-surgical rehabilitation.

- Sunrise Medical introduced a new series of mobility aids focused on elderly care, offering personalized solutions for home rehabilitation.

List of Leading Companies:

- Invacare Corporation

- Össur

- Medline Industries, Inc.

- Drive DeVilbiss Healthcare

- Sunrise Medical

- Dynarex Corporation

- Carex Health Brands

- Hill-Rom Holdings, Inc.

- Stryker Corporation

- Arjo

- Handicare Group

- Omron Healthcare

- Patterson Medical

- Hanger Inc.

- RehabMart

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 9.7 Billion |

|

Forecasted Value (2030) |

USD 19.0 Billion |

|

CAGR (2025 – 2030) |

10.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Home Rehabilitation Products and Services Market by Product Type (Mobility Aids, Daily Living Aids, Therapeutic Equipment, Assistive Devices, Home Exercise Equipment), By End-User Industry (Elderly Care, Physical Therapy Centers, Hospitals, Homecare Settings, Rehabilitation Centers), By Application (Physical Rehabilitation, Occupational Therapy, Post-surgical Recovery, Stroke Rehabilitation, Chronic Pain Management), and By Distribution Channel (Online Retail, Pharmacies, Direct Sales, Third-Party Distributors, Healthcare Providers); Global Insights & Forecast (2023 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Invacare Corporation, Össur, Medline Industries, Inc., Drive DeVilbiss Healthcare, Sunrise Medical, Dynarex Corporation, Carex Health Brands, Hill-Rom Holdings, Inc., Stryker Corporation, Arjo, Handicare Group, Omron Healthcare, Patterson Medical, Hanger Inc., RehabMart |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Home Rehabilitation Products and Services Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Mobility Aids |

|

4.2. Daily Living Aids |

|

4.3. Therapeutic Equipment |

|

4.4. Assistive Devices |

|

4.5. Home Exercise Equipment |

|

5. Home Rehabilitation Products and Services Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Elderly Care |

|

5.2. Physical Therapy Centers |

|

5.3. Hospitals |

|

5.4. Homecare Settings |

|

5.5. Rehabilitation Centers |

|

6. Home Rehabilitation Products and Services Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Physical Rehabilitation |

|

6.2. Occupational Therapy |

|

6.3. Post-surgical Recovery |

|

6.4. Stroke Rehabilitation |

|

6.5. Chronic Pain Management |

|

7. Home Rehabilitation Products and Services Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Online Retail |

|

7.2. Pharmacies |

|

7.3. Direct Sales |

|

7.4. Third-Party Distributors |

|

7.5. Healthcare Providers |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Home Rehabilitation Products and Services Market, by Product Type |

|

8.2.7. North America Home Rehabilitation Products and Services Market, by End-User Industry |

|

8.2.8. North America Home Rehabilitation Products and Services Market, by Application |

|

8.2.9. North America Home Rehabilitation Products and Services Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Home Rehabilitation Products and Services Market, by Product Type |

|

8.2.10.1.2. US Home Rehabilitation Products and Services Market, by End-User Industry |

|

8.2.10.1.3. US Home Rehabilitation Products and Services Market, by Application |

|

8.2.10.1.4. US Home Rehabilitation Products and Services Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Invacare Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Össur |

|

10.3. Medline Industries, Inc. |

|

10.4. Drive DeVilbiss Healthcare |

|

10.5. Sunrise Medical |

|

10.6. Dynarex Corporation |

|

10.7. Carex Health Brands |

|

10.8. Hill-Rom Holdings, Inc. |

|

10.9. Stryker Corporation |

|

10.10. Arjo |

|

10.11. Handicare Group |

|

10.12. Omron Healthcare |

|

10.13. Patterson Medical |

|

10.14. Hanger Inc. |

|

10.15. RehabMart |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Home Rehabilitation Products and Services Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Home Rehabilitation Products and Services Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Home Rehabilitation Products and Services Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA