As per Intent Market Research, the Home Medical Equipment Market was valued at USD 38.6 Billion in 2024-e and will surpass USD 70.5 Billion by 2030; growing at a CAGR of 9.0% during 2025-2030.

The home medical equipment market has witnessed rapid growth in recent years, driven by the increasing demand for at-home healthcare solutions. As healthcare systems focus on reducing costs and providing more personalized care, the market has shifted towards home-based treatments and monitoring. This shift is largely supported by technological advancements, aging populations, and the rising prevalence of chronic conditions. Home medical equipment includes a wide array of devices designed for individuals to use at home, helping them manage and monitor their health conditions without frequent hospital visits. Key segments of this market include mobility aids, respiratory equipment, home care beds, and monitoring devices, which cater to a wide variety of needs across different patient demographics.

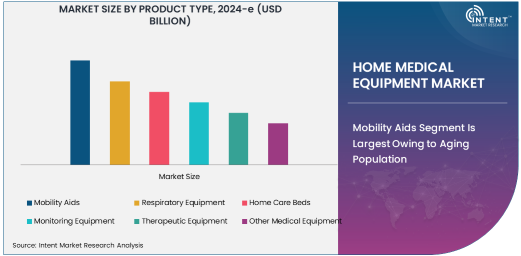

Mobility Aids Segment Is Largest Owing to Aging Population

The mobility aids segment holds the largest share of the home medical equipment market, owing to the aging population and increasing incidence of mobility-related disorders. Products such as wheelchairs, walkers, and scooters have become essential for elderly patients or individuals with physical disabilities, enabling them to maintain independence and quality of life. The growing demand for mobility aids is further fueled by the global trend towards aging societies, especially in developed regions such as North America and Europe. Mobility aids are critical for improving the mobility and overall well-being of individuals with limited movement capabilities, making them indispensable in the home healthcare space.

The availability of advanced features like ergonomic designs, lightweight materials, and easy portability has further enhanced the demand for mobility aids. In addition, the convenience of using these devices at home, combined with their affordability compared to hospital stays or nursing home care, contributes to the segment's dominance. The growing awareness and need for mobility solutions are expected to continue driving the demand for mobility aids, solidifying its position as the largest subsegment in the market.

Respiratory Equipment Segment Is Fastest Growing Owing to Rising Respiratory Disorders

The respiratory equipment segment is the fastest growing within the home medical equipment market, driven primarily by the increasing prevalence of respiratory disorders such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea. This growth is further accelerated by the rising air pollution levels, aging populations, and growing awareness of the importance of home-based respiratory care. Devices like oxygen concentrators, nebulizers, CPAP machines, and ventilators are becoming increasingly essential for managing respiratory conditions, particularly for those who prefer to receive care at home rather than in healthcare facilities.

Technological innovations have also played a significant role in the rapid growth of this segment. Modern respiratory equipment is becoming more compact, user-friendly, and efficient, making it suitable for home use. Additionally, the rising focus on preventative care, coupled with the growing healthcare burden, has pushed the demand for respiratory devices to new heights. As a result, the respiratory equipment segment is expected to continue expanding at a robust pace, outpacing other product categories in the home medical equipment market.

Homecare Settings Segment Is Largest Owing to Increased Adoption of Home Healthcare Solutions

The homecare settings segment is the largest in terms of end-user industry, as more patients prefer receiving care at home rather than in hospitals or nursing homes. The increasing adoption of home healthcare solutions is primarily driven by the rising cost of hospital stays, a shift toward patient-centric care, and advancements in telemedicine and remote monitoring. Homecare settings offer patients a more comfortable, familiar, and cost-effective environment for managing their conditions, making it an attractive option for both patients and healthcare providers.

In homecare settings, medical equipment such as mobility aids, respiratory devices, and monitoring tools is crucial for managing chronic diseases, rehabilitation, and post-operative care. The growing prevalence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders further drives the demand for home-based care. As healthcare systems around the world focus on reducing hospital admissions and providing more home-based care options, the homecare settings segment will continue to be the largest end-user industry for home medical equipment.

Chronic Disease Management Application Is Largest Owing to Prevalence of Chronic Conditions

Chronic disease management is the largest application segment within the home medical equipment market. The increasing prevalence of chronic conditions such as diabetes, hypertension, cardiovascular diseases, and respiratory disorders has made chronic disease management a critical aspect of healthcare. Home medical equipment plays a pivotal role in managing these diseases, allowing patients to monitor vital signs, administer medications, and track progress from the comfort of their homes. This reduces the need for frequent hospital visits and enhances the quality of life for patients living with long-term conditions.

As the global population ages and the burden of chronic diseases continues to rise, the demand for home-based chronic disease management solutions is expected to grow. This will drive continued investment in the development of medical devices and equipment designed for long-term monitoring, medication administration, and patient care. Chronic disease management is projected to remain the largest application segment, with significant growth expected in regions with aging populations and high rates of chronic disease.

Direct Sales Segment Is Largest Owing to Personalized Approach

The direct sales distribution channel is the largest segment in the home medical equipment market, owing to its personalized approach to customer service. Direct sales enable healthcare providers to offer tailored solutions to patients, ensuring that the equipment meets their specific medical needs. Additionally, patients receive hands-on demonstrations and training on how to use the devices, which enhances customer satisfaction and promotes proper usage. Direct sales are particularly important in markets with well-established healthcare systems, such as North America and Europe, where patients have access to healthcare professionals who can assess their needs.

In addition, direct sales allow manufacturers to maintain closer relationships with their customers, enabling them to offer ongoing support, product maintenance, and upgrades. The emphasis on patient education, combined with the need for reliable and effective home healthcare solutions, will ensure that the direct sales segment continues to lead the market.

North America Is Largest Region Owing to Strong Healthcare Infrastructure

North America holds the largest share of the home medical equipment market, driven by its strong healthcare infrastructure, advanced technological capabilities, and high healthcare expenditure. The region has a well-developed healthcare system that promotes home-based care solutions, supported by private and public healthcare policies. The aging population, combined with a growing number of individuals with chronic diseases, further contributes to the high demand for home medical equipment in the region.

Additionally, the presence of key market players, along with the increasing adoption of advanced healthcare technologies, strengthens the market position of North America. As more patients in the U.S. and Canada opt for home healthcare solutions, the demand for various home medical equipment types, including mobility aids, respiratory devices, and monitoring equipment, is expected to rise.

Competitive Landscape

The home medical equipment market is highly competitive, with several leading companies dominating the industry. Major players such as Philips Healthcare, Medtronic, Invacare Corporation, and ResMed are key contributors to the market's growth. These companies are investing heavily in product innovation, strategic partnerships, and acquisitions to expand their product portfolios and strengthen their market positions. The competitive landscape is characterized by a focus on improving patient care, enhancing product functionality, and expanding access to home medical equipment through various distribution channels.

As the market continues to evolve, companies are increasingly leveraging digital technologies, such as remote patient monitoring and telemedicine, to offer more integrated and comprehensive home healthcare solutions. Furthermore, partnerships with healthcare providers, insurance companies, and homecare agencies will play a crucial role in maintaining competitive advantage and expanding market share in the growing home medical equipment sector

Recent Developments:

|

Philips Healthcare recently announced the launch of its new AI-based patient monitoring system, aimed at improving real-time patient care in home healthcare settings. |

|

Medtronic unveiled a new series of portable oxygen concentrators for patients requiring respiratory support at home, providing advanced features for better oxygen management. |

|

Fresenius Medical Care entered into a strategic partnership with a leading telemedicine platform to expand its home dialysis offerings, enhancing remote patient monitoring capabilities. |

|

Invacare Corporation introduced a new line of lightweight mobility scooters, designed for better comfort and ease of use for senior citizens in home healthcare environments. |

|

GE Healthcare expanded its product portfolio with a next-generation portable ultrasound machine, making it easier for home healthcare providers to conduct in-home diagnostics |

List of Leading Companies:

- Philips Healthcare

- Medtronic PLC

- Invacare Corporation

- Baxter International

- ResMed

- GE Healthcare

- Siemens Healthineers

- Hill-Rom Holdings, Inc.

- Fresenius Medical Care

- Air Products and Chemicals, Inc.

- Drive DeVilbiss Healthcare

- Ameda Inc.

- CareFusion (Acquired by BD)

- Omron Healthcare, Inc.

- Johnson & Johnson Medical Devices

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 38.6 Billion |

|

Forecasted Value (2030) |

USD 70.5 Billion |

|

CAGR (2025 – 2030) |

9.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Home Medical Equipment Market By Product Type (Mobility Aids, Respiratory Equipment, Home Care Beds, Monitoring Equipment, Therapeutic Equipment), By End-User Industry (Hospitals, Homecare Settings, Nursing Homes, Ambulatory Surgical Centers, Rehabilitation Centers), By Application (Chronic Disease Management, Post-operative Care, Respiratory Therapy, Physical Rehabilitation, Cardiac Care, Palliative Care), and By Distribution Channel (Direct Sales, Online Retail, Pharmacies, Third-party Distributors, Hospitals/Healthcare Centers); Global Insights & Forecast (2023 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Philips Healthcare, Medtronic PLC, Invacare Corporation, Baxter International, ResMed, GE Healthcare, Siemens Healthineers, Hill-Rom Holdings, Inc., Fresenius Medical Care, Air Products and Chemicals, Inc., Drive DeVilbiss Healthcare, Ameda Inc., CareFusion (Acquired by BD), Omron Healthcare, Inc., Johnson & Johnson Medical Devices |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Home Medical Equipment Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Mobility Aids |

|

4.2. Respiratory Equipment |

|

4.3. Home Care Beds |

|

4.4. Monitoring Equipment |

|

4.5. Therapeutic Equipment |

|

4.6. Other Medical Equipment |

|

5. Home Medical Equipment Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Hospitals |

|

5.2. Homecare Settings |

|

5.3. Nursing Homes |

|

5.4. Ambulatory Surgical Centers |

|

5.5. Rehabilitation Centers |

|

6. Home Medical Equipment Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Chronic Disease Management |

|

6.2. Post-operative Care |

|

6.3. Respiratory Therapy |

|

6.4. Physical Rehabilitation |

|

6.5. Cardiac Care |

|

6.6. Palliative Care |

|

7. Home Medical Equipment Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Direct Sales |

|

7.2. Online Retail |

|

7.3. Pharmacies |

|

7.4. Third-party Distributors |

|

7.5. Hospitals/Healthcare Centers |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Home Medical Equipment Market, by Product Type |

|

8.2.7. North America Home Medical Equipment Market, by End-User Industry |

|

8.2.8. North America Home Medical Equipment Market, by Application |

|

8.2.9. North America Home Medical Equipment Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Home Medical Equipment Market, by Product Type |

|

8.2.10.1.2. US Home Medical Equipment Market, by End-User Industry |

|

8.2.10.1.3. US Home Medical Equipment Market, by Application |

|

8.2.10.1.4. US Home Medical Equipment Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Philips Healthcare |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Medtronic PLC |

|

10.3. Invacare Corporation |

|

10.4. Baxter International |

|

10.5. ResMed |

|

10.6. GE Healthcare |

|

10.7. Siemens Healthineers |

|

10.8. Hill-Rom Holdings, Inc. |

|

10.9. Fresenius Medical Care |

|

10.10. Air Products and Chemicals, Inc. |

|

10.11. Drive DeVilbiss Healthcare |

|

10.12. Ameda Inc. |

|

10.13. CareFusion (Acquired by BD) |

|

10.14. Omron Healthcare, Inc. |

|

10.15. Johnson & Johnson Medical Devices |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Home Medical Equipment Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Home Medical Equipment Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Home Medical Equipment Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA