As per Intent Market Research, the Home Insurance Market was valued at USD 129.8 Billion in 2024-e and will surpass USD 201.9 Billion by 2030; growing at a CAGR of 6.5% during 2025-2030.

The home insurance market is vital to providing financial protection for homeowners, renters, landlords, and real estate investors. It covers various risks, including property damage, liability claims, and other unforeseen incidents that could affect property owners. With the increasing frequency of natural disasters and rising property values, home insurance has become more essential than ever. The market is diverse, with different policy types, coverage options, and distribution channels catering to various consumer needs. The competition is also intensifying with leading insurance providers continuously innovating their offerings to attract new customers.

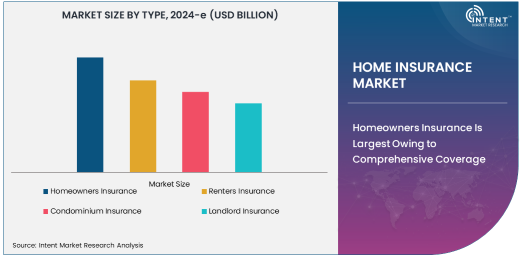

Homeowners Insurance Is Largest Owing to Comprehensive Coverage

Among the different types of home insurance, homeowners insurance is the largest subsegment in the market. It provides comprehensive protection, covering both the structure of the home and personal belongings inside. This broad coverage is appealing to homeowners who seek financial security against property damage, theft, fire, and liability risks. Homeowners insurance also often includes options for additional protection such as natural disaster coverage, making it a go-to option for those seeking extensive coverage for their property.

The increasing awareness of risks such as fire, flooding, and vandalism, along with rising home values, has propelled the demand for homeowners insurance. As homes become more valuable and the cost of repairs escalates, homeowners are increasingly opting for these policies to mitigate financial risks. With a robust customer base and steady demand, homeowners insurance continues to dominate the market, particularly in developed regions where property ownership is high.

Structural Coverage Is Largest Owing to Risk Mitigation

Within coverage options, structural coverage is the largest segment, as it provides protection against significant property damage. This type of coverage is crucial for homeowners, especially in areas susceptible to natural disasters such as earthquakes, storms, or flooding. Structural coverage ensures that the home itself is protected, including the foundation, walls, and roof, against unforeseen circumstances. With rising environmental concerns and increasing instances of natural disasters, structural coverage has become a must-have for homeowners seeking peace of mind.

The growing focus on protecting the physical assets of a home has led to the popularity of this coverage. It acts as the foundation of home insurance policies, with many homeowners opting to enhance their policies by adding structural protection. Additionally, insurers are continuously working to expand their structural coverage options, introducing new policy variants to address emerging risks, such as extreme weather events linked to climate change.

Residential Homeowners Segment Is Largest Owing to High Property Ownership

When considering the end-users of home insurance, residential homeowners represent the largest segment. Homeownership rates in many countries, especially in North America and Europe, remain high, making homeowners the key consumers of home insurance products. This group typically seeks full protection for their properties, with preferences for comprehensive coverage that includes both structural and personal property insurance. As real estate prices continue to rise, homeowners are prioritizing insurance policies that offer robust protection against potential losses.

Residential homeowners benefit from various insurance policy options tailored to their needs, and insurers often provide discounts or incentives for bundling policies, such as combining home and auto insurance. The demand for residential homeowners' insurance remains strong due to the increasing value of properties and a growing awareness of the risks associated with homeownership. This segment’s continued expansion is expected to drive the growth of the overall home insurance market.

Direct Sales Segment Is Fastest Growing Owing to Online Integration

In the distribution channel segment, direct sales are the fastest growing owing to the increasing adoption of digital platforms. The rise of e-commerce and online platforms has made it easier for consumers to research and purchase insurance policies directly from insurers. Direct sales channels have gained popularity due to their convenience, as customers can compare prices, read policy details, and secure coverage without involving intermediaries. Many insurance providers have integrated advanced online tools that allow for quick policy quoting, purchase, and claims processing.

The growth of the direct sales segment is being driven by the younger generation’s preference for online shopping and the ease of access to digital resources. This trend is expected to continue as digital technology continues to evolve, offering consumers personalized insurance options tailored to their specific needs. Moreover, insurers are increasingly leveraging social media and targeted digital marketing campaigns to attract customers, further fueling the growth of this distribution channel.

North America Is Largest Region Owing to High Property Ownership and Insurance Penetration

In terms of geography, North America remains the largest region in the home insurance market, owing to high property ownership rates and widespread insurance penetration. The United States, in particular, has a large number of homeowners, which drives demand for comprehensive home insurance policies. Additionally, the region’s relatively high rates of natural disasters, such as hurricanes and wildfires, increase the need for robust coverage options, further propelling the growth of the home insurance market.

Moreover, the presence of major insurance providers in North America ensures that a broad range of home insurance products are available to consumers, which further supports the region's dominance. The mature insurance market in North America also serves as a benchmark for global trends, with many new developments and innovations originating from this region.

Leading Companies and Competitive Landscape

The home insurance market is highly competitive, with several leading companies offering a wide array of policies to cater to the diverse needs of consumers. Some of the top players in the market include State Farm Insurance, Allstate Insurance, Geico Insurance, Liberty Mutual Insurance, and Progressive Insurance. These companies have established themselves as leaders by offering comprehensive coverage options, excellent customer service, and innovative solutions such as online policy management and claims processing.

In addition to large insurers, new players are entering the market, leveraging technology to disrupt traditional models with more flexible and user-friendly insurance offerings. Insurers are also partnering with technology companies to enhance their digital platforms, streamline claims processing, and offer more tailored policies. As the market continues to grow, competition is expected to intensify, with companies focusing on digital transformation, customer engagement, and innovation to capture market share. The evolution of direct sales channels, especially through online platforms, will continue to play a crucial role in shaping the competitive landscape of the home insurance market.

Recent Developments:

- State Farm Insurance: Announced a new partnership with a smart home device provider to offer policy discounts for customers who install smart security systems.

- Allstate Insurance: Launched a new eco-friendly home insurance policy for homeowners who use sustainable building materials.

- Liberty Mutual Insurance: Acquired a leading tech startup specializing in home damage prediction using AI to enhance their claims process.

- AXA Insurance: Introduced a bundled coverage package for homeowners that includes standard coverage plus additional protection against climate-related events.

- Chubb Insurance: Expanded its global home insurance footprint by entering the Southeast Asian market, providing tailored solutions for high-net-worth individuals.

List of Leading Companies:

- State Farm Insurance

- Allstate Insurance

- Geico Insurance

- Progressive Insurance

- Nationwide Insurance

- Farmers Insurance

- Travelers Insurance

- Liberty Mutual Insurance

- American Family Insurance

- USAA Insurance

- AXA Insurance

- Zurich Insurance

- Chubb Insurance

- Tokio Marine Insurance

- Aviva Insurance

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 129.8 Billion |

|

Forecasted Value (2030) |

USD 201.9 Billion |

|

CAGR (2025 – 2030) |

6.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Home Insurance Market By Type (Homeowners Insurance, Renters Insurance, Condominium Insurance, Landlord Insurance), By Coverage (Structural Coverage, Content Coverage, Liability Coverage, Natural Disasters Coverage, Personal Property Coverage), By End-User (Residential Homeowners, Renters, Landlords, Real Estate Investors), and By Distribution Channel (Direct Sales, Online Sales, Brokers, Agents); Global Insights & Forecast (2023 – 2030) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

State Farm Insurance, Allstate Insurance, Geico Insurance, Progressive Insurance, Nationwide Insurance, Farmers Insurance, Travelers Insurance, Liberty Mutual Insurance, American Family Insurance, USAA Insurance, AXA Insurance, Zurich Insurance, Chubb Insurance, Tokio Marine Insurance, Aviva Insurance |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Home Insurance Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Homeowners Insurance |

|

4.2. Renters Insurance |

|

4.3. Condominium Insurance |

|

4.4. Landlord Insurance |

|

5. Home Insurance Market, by Coverage (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Structural Coverage |

|

5.2. Content Coverage |

|

5.3. Liability Coverage |

|

5.4. Natural Disasters Coverage |

|

5.5. Personal Property Coverage |

|

6. Home Insurance Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Residential Homeowners |

|

6.2. Renters |

|

6.3. Landlords |

|

6.4. Real Estate Investors |

|

7. Home Insurance Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Direct Sales |

|

7.2. Online Sales |

|

7.3. Brokers |

|

7.4. Agents |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Home Insurance Market, by Type |

|

8.2.7. North America Home Insurance Market, by Coverage |

|

8.2.8. North America Home Insurance Market, by End-User |

|

8.2.9. North America Home Insurance Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Home Insurance Market, by Type |

|

8.2.10.1.2. US Home Insurance Market, by Coverage |

|

8.2.10.1.3. US Home Insurance Market, by End-User |

|

8.2.10.1.4. US Home Insurance Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. State Farm Insurance |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Allstate Insurance |

|

10.3. Geico Insurance |

|

10.4. Progressive Insurance |

|

10.5. Nationwide Insurance |

|

10.6. Farmers Insurance |

|

10.7. Travelers Insurance |

|

10.8. Liberty Mutual Insurance |

|

10.9. American Family Insurance |

|

10.10. USAA Insurance |

|

10.11. AXA Insurance |

|

10.12. Zurich Insurance |

|

10.13. Chubb Insurance |

|

10.14. Tokio Marine Insurance |

|

10.15. Aviva Insurance |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Home Insurance Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Home Insurance Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Home Insurance Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA