Global UV Coatings Market By Product Type (UV Cured Coatings, UV Coatings for Wood, UV Coatings for Metal, UV Coatings for Plastic, UV Coatings for Glass, UV Coatings for Paper), By Technology (UV Radiation Technology, LED UV Technology, Mercury Vapor UV Technology, Hybrid UV Technology), By End-User Industry (Automotive, Electronics, Packaging, Wood & Furniture, Industrial Equipment, Healthcare & Medical Devices), By Distribution Channel (Direct Sales, Online Retail, Distributors, Specialty Stores, Wholesale Markets), and By Region; Global Insights & Forecast (2023 – 2030)

As per Intent Market Research, the UV Coatings Market was valued at USD 9.8 billion in 2024-e and will surpass USD 21.9 billion by 2030; growing at a CAGR of 12.2% during 2025 - 2030.

The UV coatings market has grown significantly in recent years, driven by the increasing demand for fast-curing and environmentally friendly coatings. UV coatings offer exceptional durability, protection, and finish, making them ideal for a wide range of applications, from automotive parts to consumer electronics. The need for high-performance coatings in industries like automotive, packaging, and wood & furniture is escalating, owing to both technological advancements and stringent environmental regulations. With innovations in UV technology and a growing preference for eco-friendly solutions, the market is expected to continue expanding in the coming years.

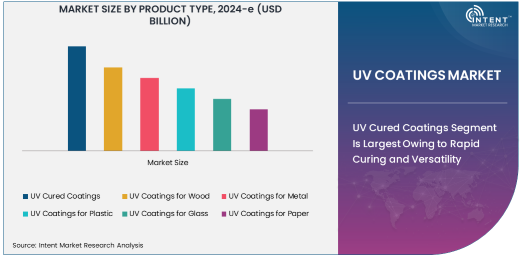

UV Cured Coatings Segment Is Largest Owing to Rapid Curing and Versatility

Among the various product types, UV cured coatings dominate the market, owing to their versatility and rapid curing capabilities. UV cured coatings are applied across a broad spectrum of industries, from automotive to electronics, due to their ability to provide an instant hardening finish when exposed to ultraviolet light. This characteristic makes UV cured coatings highly efficient, reducing production time and energy consumption. Moreover, UV cured coatings deliver excellent adhesion, wear resistance, and aesthetic qualities, which are essential in industries where durability and appearance are crucial.

The increasing demand for UV cured coatings in the automotive and electronics sectors is expected to drive substantial growth. Automotive manufacturers are particularly attracted to UV coatings due to their excellent scratch resistance, durability, and energy efficiency. Likewise, the electronics industry is benefiting from UV coatings, which provide superior protection to sensitive electronic components, ensuring longevity and performance.

LED UV Technology Segment Is Fastest Growing Due to Energy Efficiency

The LED UV technology segment is the fastest growing in the UV coatings market. LED UV technology offers a range of advantages over traditional UV curing methods, including higher energy efficiency, lower heat generation, and a longer service life. Unlike mercury vapor UV lamps, LED lamps do not require warm-up time and are instantly operational, reducing production downtime. Furthermore, LED UV technology is more environmentally friendly, as it does not produce harmful mercury emissions. These benefits make LED UV technology highly attractive to industries looking to reduce their environmental impact while optimizing curing processes.

As sustainability becomes a growing concern for manufacturers worldwide, LED UV technology has gained significant traction, particularly in packaging and electronics applications. The ability to cure coatings efficiently at lower temperatures is driving its adoption, as manufacturers aim to reduce energy consumption and improve operational efficiency.

Automotive End-User Industry Is Largest Due to Demand for Durable Coatings

The automotive industry represents the largest end-user segment for UV coatings, with manufacturers continually seeking ways to enhance the durability and performance of vehicle components. UV coatings provide superior protection against environmental stressors such as UV radiation, moisture, and abrasion, which are common challenges in the automotive sector. These coatings are used extensively for exterior and interior parts, offering a long-lasting finish that can withstand harsh conditions.

Automotive OEMs (original equipment manufacturers) and Tier 1 suppliers are increasingly adopting UV coatings to meet stringent regulatory requirements for vehicle finishes, while also reducing production time and energy consumption. This shift toward UV coatings has not only improved the aesthetics and durability of vehicles but has also contributed to the industry’s efforts to minimize its environmental footprint.

Direct Sales Distribution Channel Is Largest Due to Industry Relationships

The direct sales distribution channel is the largest in the UV coatings market, driven by strong relationships between manufacturers and end-users. Direct sales offer several advantages, including personalized service, greater control over pricing, and tailored solutions that meet the specific needs of industries like automotive, packaging, and electronics. UV coating suppliers and manufacturers often engage in direct sales to provide customers with expert advice on product selection, technical specifications, and application methods.

Additionally, direct sales allow for better communication and faster response times, which is crucial in industries that rely on efficient supply chains and high-quality products. The strong presence of direct sales in the UV coatings market is expected to continue, particularly as industries demand more specialized coating solutions.

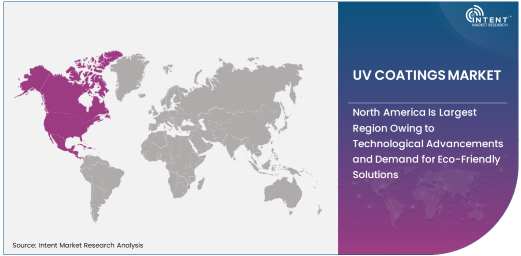

North America Is Largest Region Owing to Technological Advancements and Demand for Eco-Friendly Solutions

North America is the largest region in the UV coatings market, driven by its advanced manufacturing capabilities, high demand for eco-friendly solutions, and a growing emphasis on sustainability. The region’s automotive, packaging, and electronics industries are particularly significant consumers of UV coatings, as they seek to improve the durability and environmental performance of their products. Additionally, North America has established itself as a hub for innovation in UV coating technologies, with numerous manufacturers focusing on the development of LED and hybrid UV curing solutions.

Government regulations in North America, particularly in the United States and Canada, are also driving the adoption of UV coatings, as industries are increasingly required to minimize their environmental impact. As a result, the demand for UV coatings in the region is expected to grow steadily, with continued innovations in both product types and technologies.

Leading Companies and Competitive Landscape

The UV coatings market is highly competitive, with several global companies leading the way in terms of innovation, market share, and geographical presence. Companies like BASF SE, AkzoNobel N.V., and PPG Industries are at the forefront, offering a wide range of UV coating solutions across various industries. These players are focusing on product innovation, such as developing UV coatings with improved performance and lower environmental impact. Strategic acquisitions and partnerships are common in the industry, as companies aim to expand their product portfolios and enhance their technological capabilities.

The competitive landscape in the UV coatings market is expected to remain dynamic, with companies investing in research and development to maintain their competitive edge. As the market continues to grow, the key to success will be the ability to provide high-performance coatings that meet the evolving needs of industries while adhering to strict environmental standards

Recent Developments:

- BASF launched a new line of UV-curable coatings designed for wood and furniture applications, focusing on enhancing durability while maintaining eco-friendly standards.

- PPG Industries expanded its UV coating offerings for automotive applications, introducing a new UV-curable topcoat that enhances scratch resistance and environmental sustainability.

- AkzoNobel completed the acquisition of a major UV coatings company to broaden its portfolio and increase its footprint in the North American market.

- Sherwin-Williams introduced an advanced LED UV coating system that provides faster curing times and better energy efficiency for industrial applications.

- Hexion Inc. expanded its UV coating production capacity in Europe, aiming to meet the rising demand for sustainable coatings in the automotive and packaging sectors

List of Leading Companies:

- BASF SE

- AkzoNobel N.V.

- PPG Industries

- Sherwin-Williams

- DSM Coating Resins

- Arkema S.A.

- Hexion Inc.

- Royal DSM

- Covestro AG

- Nippon Paint Co., Ltd.

- RPM International Inc.

- Valspar Corporation

- Sika AG

- Vencorex

- Alberdingk Boley GmbH

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 9.8 Billion |

|

Forecasted Value (2030) |

USD 21.9 Billion |

|

CAGR (2025 – 2030) |

12.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global UV Coatings Market By Product Type (UV Cured Coatings, UV Coatings for Wood, UV Coatings for Metal, UV Coatings for Plastic, UV Coatings for Glass, UV Coatings for Paper), By Technology (UV Radiation Technology, LED UV Technology, Mercury Vapor UV Technology, Hybrid UV Technology), By End-User Industry (Automotive, Electronics, Packaging, Wood & Furniture, Industrial Equipment, Healthcare & Medical Devices), By Distribution Channel (Direct Sales, Online Retail, Distributors, Specialty Stores, Wholesale Markets) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

BASF SE, AkzoNobel N.V., PPG Industries, Sherwin-Williams, DSM Coating Resins, Arkema S.A., Hexion Inc., Royal DSM, Covestro AG, Nippon Paint Co., Ltd., RPM International Inc., Valspar Corporation, Sika AG, Vencorex, Alberdingk Boley GmbH |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. UV Coatings Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. UV Cured Coatings |

|

4.2. UV Coatings for Wood |

|

4.3. UV Coatings for Metal |

|

4.4. UV Coatings for Plastic |

|

4.5. UV Coatings for Glass |

|

4.6. UV Coatings for Paper |

|

5. UV Coatings Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. UV Radiation Technology |

|

5.2. LED UV Technology |

|

5.3. Mercury Vapor UV Technology |

|

5.4. Hybrid UV Technology |

|

6. UV Coatings Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Automotive |

|

6.2. Electronics |

|

6.3. Packaging |

|

6.4. Wood & Furniture |

|

6.5. Industrial Equipment |

|

6.6. Healthcare & Medical Devices |

|

7. UV Coatings Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Direct Sales |

|

7.2. Online Retail |

|

7.3. Distributors |

|

7.4. Specialty Stores |

|

7.5. Wholesale Markets |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America UV Coatings Market, by Product Type |

|

8.2.7. North America UV Coatings Market, by Technology |

|

8.2.8. North America UV Coatings Market, by End-User Industry |

|

8.2.9. North America UV Coatings Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US UV Coatings Market, by Product Type |

|

8.2.10.1.2. US UV Coatings Market, by Technology |

|

8.2.10.1.3. US UV Coatings Market, by End-User Industry |

|

8.2.10.1.4. US UV Coatings Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. BASF SE |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. AkzoNobel N.V. |

|

10.3. PPG Industries |

|

10.4. Sherwin-Williams |

|

10.5. DSM Coating Resins |

|

10.6. Arkema S.A. |

|

10.7. Hexion Inc. |

|

10.8. Royal DSM |

|

10.9. Covestro AG |

|

10.10. Nippon Paint Co., Ltd. |

|

10.11. RPM International Inc. |

|

10.12. Valspar Corporation |

|

10.13. Sika AG |

|

10.14. Vencorex |

|

10.15. Alberdingk Boley GmbH |

|

11. Appendix |

Let us connect with you TOC

A comprehensive market research approach was employed to gather and analyze data on the Global UV Coatings Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Global UV Coatings Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Global UV Coatings Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

Available Formats