As per Intent Market Research, the Oral Clinical Nutrition Supplements Market was valued at USD 4.8 Billion in 2024-e and will surpass USD 9.8 Billion by 2030; growing at a CAGR of 12.6% during 2025 - 2030.

The Oral Clinical Nutrition Supplements Market is expanding rapidly as an increasing number of individuals seek nutritional support through oral supplementation to address specific health needs. Products such as protein, vitamin & mineral, carbohydrate, and fiber supplements play a key role in treating conditions like malnutrition, post-surgery recovery, cancer, and gastrointestinal disorders. These nutritional supplements are essential for patients who need to recover, maintain strength, and improve overall health after illness or surgical procedures. As healthcare providers and home care facilities recognize the benefits of targeted oral supplementation, the market is seeing an upward trajectory.

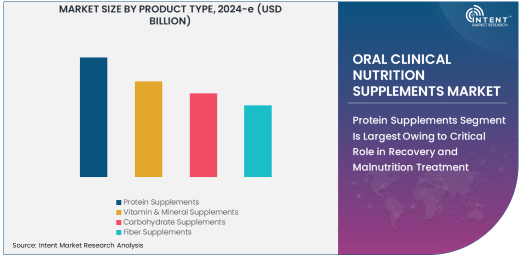

Protein Supplements Segment Is Largest Owing to Critical Role in Recovery and Malnutrition Treatment

The protein supplements segment is the largest within the oral clinical nutrition supplements market, primarily because protein is a fundamental nutrient essential for the body’s recovery and maintenance. Protein supplements are widely used in the treatment of malnutrition and post-surgery recovery, where patients need additional protein to promote healing, tissue repair, and muscle mass maintenance.

Protein supplements are increasingly prescribed to patients who are unable to meet their nutritional requirements through food alone, particularly in cases of malnutrition, chronic illness, and post-operative care. The role of protein in boosting immune function and enhancing recovery speeds makes this segment the largest, with consistent demand from healthcare providers, home care providers, and hospitals alike.

Vitamin & Mineral Supplements Segment Is Fastest Growing Owing to Widespread Nutrient Deficiencies

The vitamin & mineral supplements segment is the fastest-growing in the oral clinical nutrition supplements market, driven by the growing awareness of widespread nutrient deficiencies, particularly in aging populations and patients recovering from surgery or illness. Essential vitamins and minerals are critical to various bodily functions, including immune health, bone strength, and cellular repair.

Many individuals are unable to meet their vitamin and mineral needs through diet alone, leading to increased reliance on supplements to address deficiencies. As healthcare providers recognize the importance of restoring vital nutrients, vitamin and mineral supplements have become integral in managing malnutrition and supporting overall health, making this segment the fastest-growing in the market.

Malnutrition Treatment Segment Is Largest Application Owing to Rising Prevalence and Impact

Malnutrition treatment is the largest application in the oral clinical nutrition supplements market, as the global prevalence of malnutrition remains high, especially in developing countries, the elderly, and individuals with chronic diseases. Oral nutritional supplements that include protein, vitamins, and other nutrients are essential for correcting deficiencies and supporting recovery in malnourished individuals.

The increasing recognition of malnutrition as a critical factor in health complications is driving demand for effective oral supplements that address these nutritional gaps. Malnutrition treatment continues to be the dominant application, with healthcare providers focused on providing patients with the necessary nutrition to improve health outcomes and reduce complications associated with poor nutrition.

Healthcare Providers Segment Is Largest End-Use Industry Owing to Prescribed Nutritional Support

The healthcare providers segment is the largest end-use industry in the oral clinical nutrition supplements market, as hospitals, clinics, and outpatient care centers are the primary settings where these supplements are prescribed. Healthcare providers play a central role in diagnosing patients with nutritional deficiencies and recommending appropriate supplements, such as protein and vitamin/mineral formulations, to aid in recovery and improve overall health.

In hospitals, where patients undergoing surgery or treatment for chronic illnesses require nutritional support, oral clinical nutrition supplements are essential in ensuring that patients meet their nutritional needs. The increasing awareness of the importance of nutrition in healthcare and the availability of specialized products continue to drive the dominance of healthcare providers in this market.

North America Is Largest Region Owing to Advanced Healthcare Infrastructure and High Demand

North America is the largest region in the oral clinical nutrition supplements market, driven by advanced healthcare infrastructure, high levels of awareness about the importance of nutrition, and a large population of elderly individuals who often require nutritional supplementation. The region’s healthcare systems are well-equipped to diagnose and treat malnutrition and related conditions, leading to the widespread use of oral clinical nutrition supplements across various healthcare settings.

Additionally, North America’s emphasis on preventive healthcare and improving patient outcomes through nutritional support contributes to the growth of the market in this region. The extensive availability of high-quality supplements and the increasing demand for personalized nutritional care ensure North America’s dominance in the market.

Competitive Landscape and Key Players

The Oral Clinical Nutrition Supplements Market is highly competitive, with leading companies such as Abbott Laboratories, Nestlé Health Science, Danone Nutricia, and Fresenius Kabi dominating the industry. These companies offer a wide range of nutritional supplement products tailored for different health conditions, such as malnutrition, post-surgery recovery, and cancer care.

The competitive landscape is characterized by continuous product innovation, with firms focusing on improving the bioavailability, taste, and convenience of their supplements. Partnerships between pharmaceutical companies and healthcare providers, along with growing investments in research and development, are driving product advancements. The market is also seeing an increasing number of smaller players entering the field, which intensifies competition and expands consumer options in the oral clinical nutrition supplements sector.

Recent Developments:

- Nestlé Health Science launched a new protein-rich oral nutritional supplement for patients recovering from surgery or illness.

- Abbott Laboratories introduced an oral clinical nutrition supplement designed for cancer patients to meet their specific dietary needs.

- Danone S.A. expanded its product line with a new fiber supplement aimed at individuals with gastrointestinal disorders.

- Fresenius Kabi AG launched an innovative oral supplement focused on post-surgery recovery, offering an improved formula for faster healing.

- Mead Johnson Nutrition introduced a new line of oral nutritional supplements designed for the elderly to help manage chronic conditions and prevent malnutrition.

List of Leading Companies:

- Abbott Laboratories

- Nestlé Health Science

- Danone S.A.

- Fresenius Kabi AG

- Mead Johnson Nutrition (Reckitt Benckiser)

- Otsuka Pharmaceutical Co., Ltd.

- B. Braun Melsungen AG

- Targeted Nutrition (Nestlé)

- Perrigo Company

- GlaxoSmithKline

- Oricare Healthcare

- Nutricia (Danone)

- Health Support Ltd.

- Amway (Nutrilite)

- Herbalife Nutrition Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 4.8 Billion |

|

Forecasted Value (2030) |

USD 9.8 Billion |

|

CAGR (2025 – 2030) |

12.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Oral Clinical Nutrition Supplements Market by Product Type (Protein Supplements, Vitamin & Mineral Supplements, Carbohydrate Supplements, Fiber Supplements), by Application (Malnutrition Treatment, Post-Surgery Recovery, Cancer Care, Gastrointestinal Disorders), by End-Use Industry (Healthcare Providers, Home Care Providers, Hospitals & Clinics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Abbott Laboratories, Nestlé Health Science, Danone S.A., Fresenius Kabi AG, Mead Johnson Nutrition (Reckitt Benckiser), Otsuka Pharmaceutical Co., Ltd., Targeted Nutrition (Nestlé), Perrigo Company, GlaxoSmithKline, Oricare Healthcare, Nutricia (Danone), Health Support Ltd., Herbalife Nutrition Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Oral Clinical Nutrition Supplements Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Protein Supplements |

|

4.2. Vitamin & Mineral Supplements |

|

4.3. Carbohydrate Supplements |

|

4.4. Fiber Supplements |

|

5. Oral Clinical Nutrition Supplements Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Malnutrition Treatment |

|

5.2. Post-Surgery Recovery |

|

5.3. Cancer Care |

|

5.4. Gastrointestinal Disorders |

|

6. Oral Clinical Nutrition Supplements Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Healthcare Providers |

|

6.2. Home Care Providers |

|

6.3. Hospitals & Clinics |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Oral Clinical Nutrition Supplements Market, by Product Type |

|

7.2.7. North America Oral Clinical Nutrition Supplements Market, by Application |

|

7.2.8. North America Oral Clinical Nutrition Supplements Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Oral Clinical Nutrition Supplements Market, by Product Type |

|

7.2.9.1.2. US Oral Clinical Nutrition Supplements Market, by Application |

|

7.2.9.1.3. US Oral Clinical Nutrition Supplements Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Abbott Laboratories |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Nestlé Health Science |

|

9.3. Danone S.A. |

|

9.4. Fresenius Kabi AG |

|

9.5. Mead Johnson Nutrition (Reckitt Benckiser) |

|

9.6. Otsuka Pharmaceutical Co., Ltd. |

|

9.7. B. Braun Melsungen AG |

|

9.8. Targeted Nutrition (Nestlé) |

|

9.9. Perrigo Company |

|

9.10. GlaxoSmithKline |

|

9.11. Oricare Healthcare |

|

9.12. Nutricia (Danone) |

|

9.13. Health Support Ltd. |

|

9.14. Amway (Nutrilite) |

|

9.15. Herbalife Nutrition Ltd. |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Global Oral Clinical Nutrition Supplements Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Global Oral Clinical Nutrition Supplements Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Global Oral Clinical Nutrition Supplements Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA