As per Intent Market Research, the Oral Care Market was valued at USD 43.9 Billion in 2024-e and will surpass USD 64.3 Billion by 2030; growing at a CAGR of 6.5% during 2025 - 2030.

The Oral Care Market is growing rapidly as consumers become more conscious of the importance of maintaining oral hygiene and aesthetics. With increasing awareness of the link between oral health and overall well-being, there is a rising demand for a variety of oral care products such as toothpaste, toothbrushes, mouthwash, dental floss, and teeth whitening solutions. This market is driven by the need for preventive care, the growing emphasis on aesthetics, and the increasing availability of innovative products. Both healthcare providers and consumer retail industries are expanding their portfolios to meet the rising demand for effective and user-friendly oral care solutions.

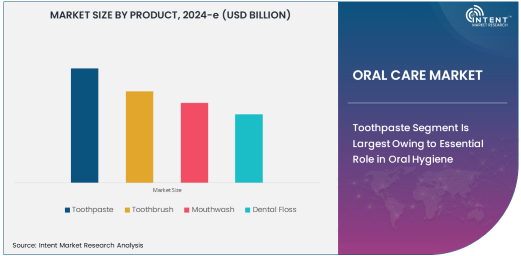

Toothpaste Segment Is Largest Owing to Essential Role in Oral Hygiene

Toothpaste is the largest product segment in the oral care market, primarily because it is an essential component of daily oral hygiene routines. Toothpaste serves multiple functions, including cleaning teeth, preventing cavities, freshening breath, and combating plaque and gum disease. The widespread use of toothpaste across various demographics, combined with innovations in formulations (such as fluoride, natural ingredients, and whitening agents), cements its dominance in the market.

Toothpaste continues to be a high-demand product in the oral care market, with consumers increasingly seeking specialized variants such as toothpaste for sensitive teeth, whitening, and tartar control. The consistent need for toothpaste in daily oral hygiene routines ensures its position as the largest and most significant product category in the oral care market.

Teeth Whitening Products Segment Is Fastest Growing Owing to Increasing Consumer Focus on Aesthetic Care

The teeth whitening products segment is the fastest-growing in the oral care market, fueled by the increasing desire for cosmetic dental solutions. Teeth whitening products, including toothpaste, gels, strips, and professional treatments, have gained widespread popularity as consumers prioritize aesthetics and a brighter smile.

The growing use of teeth whitening products is driven by the accessibility of at-home solutions and the influence of social media and celebrity culture, which often promote white, healthy-looking teeth as an essential aspect of personal appearance. As consumer awareness of oral aesthetics rises, the demand for teeth whitening products continues to grow, making this segment the fastest-expanding in the market.

Preventive Care Segment Is Largest Application Owing to Focus on Oral Health Maintenance

The preventive care application segment is the largest in the oral care market, as consumers increasingly prioritize the prevention of dental issues such as cavities, gum disease, and tooth decay. Preventive care products such as toothpaste, mouthwash, and floss are critical in maintaining oral health and avoiding costly dental treatments.

With rising awareness of the importance of maintaining oral hygiene from an early age, preventive care is becoming a key aspect of daily routines. The focus on prevention, supported by the growing availability of targeted oral care products, is driving the dominance of this segment in the overall oral care market.

Consumer Retail Segment Is Largest End-Use Industry Owing to Widespread Accessibility

The consumer retail industry is the largest end-use segment in the oral care market, driven by the easy availability of oral care products in supermarkets, pharmacies, and online platforms. With the increasing demand for daily oral hygiene products, retailers are expanding their offerings to include a wide range of toothpaste, toothbrushes, mouthwash, and other oral care products.

The convenience of purchasing oral care products through various retail channels, including e-commerce platforms, has further fueled the market growth. Additionally, the rise of subscription services for oral care products has made it even easier for consumers to maintain regular oral care regimens, cementing the consumer retail sector as the largest end-use industry in the market.

North America Is Largest Region Owing to High Consumer Awareness and Healthcare Access

North America is the largest region in the oral care market, driven by high consumer awareness of oral hygiene, advanced healthcare infrastructure, and a strong focus on aesthetics. The region's well-established dental care systems and high disposable incomes allow for greater accessibility to a wide range of oral care products, making it a key market for manufacturers.

Additionally, North America's preference for preventive care and aesthetic-focused oral treatments, coupled with the availability of premium oral care brands, supports the continued growth of the oral care market in this region. The focus on innovation and new product offerings ensures that North America maintains its position as the largest market globally.

Competitive Landscape and Key Players

The Oral Care Market is highly competitive, with key players such as Colgate-Palmolive, Procter & Gamble, Johnson & Johnson, and Unilever leading the industry. These companies dominate the market by offering a broad portfolio of oral care products, including toothpaste, toothbrushes, mouthwash, and whitening solutions, catering to various consumer needs.

The competitive landscape is marked by continuous product innovation, including the introduction of eco-friendly products, personalized oral care solutions, and the integration of advanced technologies such as smart toothbrushes. Companies are also expanding their reach through strategic partnerships, acquisitions, and digital marketing campaigns to enhance their market presence and meet the evolving demands of global consumers.

Recent Developments:

- Procter & Gamble launched a new line of toothpaste with advanced whitening technology, focusing on both aesthetics and oral health benefits.

- Johnson & Johnson entered a partnership with a dental technology company to develop next-gen electric toothbrushes with AI-powered features.

- Unilever introduced a new sustainable toothbrush made from biodegradable materials as part of its commitment to reducing plastic waste.

- Colgate-Palmolive announced the acquisition of a leading brand in the natural oral care space, expanding its portfolio of organic products.

- GlaxoSmithKline launched an innovative mouthwash that targets both plaque buildup and bad breath for a more comprehensive oral care regimen.

List of Leading Companies:

- Procter & Gamble Co.

- Colgate-Palmolive Company

- Johnson & Johnson

- GlaxoSmithKline plc

- Unilever

- Kimberly-Clark Corporation

- Henkel AG & Co. KGaA

- Church & Dwight Co., Inc.

- Lion Corporation

- Dabur International Ltd.

- Himalaya Herbal Healthcare

- Church & Dwight Co., Inc.

- Marvis (Lush)

- Quip

- Ranir LLC

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 43.9 Billion |

|

Forecasted Value (2030) |

USD 64.3 Billion |

|

CAGR (2025 – 2030) |

6.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Oral Care Market by Product (Toothpaste, Toothbrush, Mouthwash, Dental Floss, Teeth Whitening Products), by End-Use Industry (Consumer Retail, Healthcare Providers), by Application (Preventive Care, Therapeutic Care, Aesthetic Care) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Procter & Gamble Co., Colgate-Palmolive Company, Johnson & Johnson, GlaxoSmithKline plc, Unilever, Kimberly-Clark Corporation, Church & Dwight Co., Inc., Lion Corporation, Dabur International Ltd., Himalaya Herbal Healthcare, Church & Dwight Co., Inc., Marvis (Lush), Ranir LLC |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Oral Care Market, by Product (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Toothpaste |

|

4.2. Toothbrush |

|

4.3. Mouthwash |

|

4.4. Dental Floss |

|

4.5. Teeth Whitening Products |

|

5. Oral Care Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Consumer Retail |

|

5.2. Healthcare Providers |

|

6. Oral Care Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Preventive Care |

|

6.2. Therapeutic Care |

|

6.3. Aesthetic Care |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Oral Care Market, by Product |

|

7.2.7. North America Oral Care Market, by End-Use Industry |

|

7.2.8. North America Oral Care Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Oral Care Market, by Product |

|

7.2.9.1.2. US Oral Care Market, by End-Use Industry |

|

7.2.9.1.3. US Oral Care Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Procter & Gamble Co. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Colgate-Palmolive Company |

|

9.3. Johnson & Johnson |

|

9.4. GlaxoSmithKline plc |

|

9.5. Unilever |

|

9.6. Kimberly-Clark Corporation |

|

9.7. Henkel AG & Co. KGaA |

|

9.8. Church & Dwight Co., Inc. |

|

9.9. Lion Corporation |

|

9.10. Dabur International Ltd. |

|

9.11. Himalaya Herbal Healthcare |

|

9.12. Church & Dwight Co., Inc. |

|

9.13. Marvis (Lush) |

|

9.14. Quip |

|

9.15. Ranir LLC |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Global Oral Care Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Global Oral Care Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Global Oral Care Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA