As per Intent Market Research, the Optogenetics Market was valued at USD 1.9 Billion in 2024-e and will surpass USD 5.3 Billion by 2030; growing at a CAGR of 18.1% during 2025 - 2030.

The Optogenetics Market is witnessing rapid growth due to its transformative impact on neuroscience, genetic research, and drug discovery. Optogenetics is a powerful technique that uses light to control cells within living tissue, typically neurons, which has revolutionized how researchers study and treat various diseases. The integration of optogenetic tools, actuators, and sensors into research and medical applications is enabling advancements in understanding complex biological processes. As the technology evolves and new applications emerge, the optogenetics market is expected to continue its expansion across healthcare, biotechnology, and academic research.

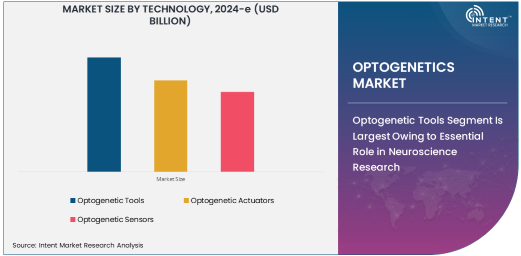

Optogenetic Tools Segment Is Largest Owing to Essential Role in Neuroscience Research

Optogenetic tools are the largest segment in the market, driven by their crucial role in neuroscience research. These tools enable precise control of specific neuronal populations using light, allowing researchers to study the function of neurons in real-time and gain insights into brain activities and neurological disorders.

The demand for optogenetic tools is primarily fueled by the increasing prevalence of neurological diseases, including Parkinson's disease, Alzheimer's disease, and epilepsy, as well as the need for better models to understand brain functions. Their ability to manipulate neurons with high precision has made them indispensable in neuroscience labs worldwide, securing their position as the dominant technology in the optogenetics market.

Optogenetic Actuators Segment Is Fastest Growing Owing to Advancements in Cell Control

Optogenetic actuators are the fastest-growing segment in the optogenetics market, owing to their ability to drive cellular responses with light. These actuators, such as channelrhodopsins and halorhodopsins, are genetically engineered proteins that are sensitive to light, enabling the control of ion flow across cell membranes.

The increasing use of optogenetic actuators in both basic research and therapeutic applications is driving this growth. In particular, their application in drug discovery and the development of new therapies for neurological diseases is accelerating demand. As advancements in optogenetic actuators lead to greater precision and efficiency, this segment is poised for continued expansion in both research and clinical applications.

Neuroscience Research Segment Is Largest Application Owing to Demand for Brain Mapping

Neuroscience research is the largest application segment in the optogenetics market, driven by the growing interest in mapping brain functions and understanding complex neurological diseases. Optogenetics offers a unique advantage in studying brain circuits and behaviors by allowing researchers to control individual neurons or groups of neurons with light, providing insights into memory, cognition, and neural communication.

The increasing focus on developing targeted treatments for neurological disorders, coupled with the need for high-fidelity models of brain activity, ensures that neuroscience research remains the largest and most vital application of optogenetics. The ability to manipulate neuronal activity with unprecedented accuracy has made optogenetics a critical tool in advancing brain research.

Academic and Research Institutions Segment Is Largest End-Use Industry Owing to Extensive Research Activities

Academic and research institutions represent the largest end-use industry for optogenetics, as these entities are at the forefront of advancing the technology. Universities and research labs around the world are utilizing optogenetic tools to conduct groundbreaking research in fields such as neuroscience, genetics, and cell biology.

The continuous funding for academic research, coupled with the increasing demand for sophisticated research tools, has propelled the academic sector as the leading end-user. Moreover, the collaborative nature of academic research often leads to rapid developments in optogenetics, further driving the market in this sector.

North America Is Largest Region Owing to High Research Investment and Healthcare Advancements

North America leads the optogenetics market, supported by its well-established healthcare infrastructure, high levels of research investment, and strong presence of academic and biotechnology institutions. The region's commitment to neuroscience research and drug discovery has accelerated the adoption of optogenetic technologies, especially in labs and clinical research settings.

In addition to a thriving research environment, North America's robust healthcare and biotechnology sectors contribute to the widespread use of optogenetics in drug development and therapeutic applications. These factors combine to make North America the largest market for optogenetics globally.

Competitive Landscape and Key Players

The Optogenetics Market is highly competitive, with key players such as Optogenetics Inc., Circuit Therapeutics, and Lumos Technologies leading the charge in the development of innovative optogenetic tools and technologies. These companies focus on creating high-performance actuators and sensors to meet the growing demand in neuroscience, genetics, and drug discovery.

The market is characterized by continuous technological advancements and strategic collaborations between academic, research, and commercial entities. Leading companies are investing heavily in R&D to refine optogenetic products, enhance their capabilities, and expand their applications. The increasing number of clinical trials and research collaborations further fuels competition in the optogenetics market.

Recent Developments:

- Synchronicity Pharmaceuticals announced the launch of a new optogenetic actuator for precise control of gene expression in neural cells.

- Thermo Fisher Scientific acquired a leading optogenetics tool manufacturer to enhance its capabilities in the genetic research sector.

- Carl Zeiss AG introduced a new imaging system designed for optogenetic research, offering enhanced resolution and data capture capabilities.

- Merck Group launched an optogenetics kit tailored for neuroscience research, enabling advanced cellular manipulation using light.

- Bluebird Bio, Inc. entered into a partnership with a biotech company to integrate optogenetics into their gene therapy development pipeline for neurological diseases.

List of Leading Companies:

- Optogenetics Technologies

- Synchronicity Pharmaceuticals

- Merck Group

- Synthego Corporation

- Emd Millipore (Merck KGaA)

- Thorlabs, Inc.

- GenSight Biologics

- Bluebird Bio, Inc.

- Channel Biosciences

- Carl Zeiss AG

- Bionova Scientific

- Quantum Biosystems

- Addgene

- Array Biopharma (Pfizer)

- Life Technologies (Thermo Fisher Scientific)

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.9 Billion |

|

Forecasted Value (2030) |

USD 5.3 Billion |

|

CAGR (2025 – 2030) |

18.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Optogenetics Market by Technology (Optogenetic Tools, Optogenetic Actuators, Optogenetic Sensors), by Application (Neuroscience Research, Genetic Research, Drug Discovery), by End-Use Industry (Healthcare and Medical, Academic and Research Institutions, Biotechnology) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Optogenetics Technologies, Synchronicity Pharmaceuticals, Merck Group, Synthego Corporation, Emd Millipore (Merck KGaA), Thorlabs, Inc., Bluebird Bio, Inc., Channel Biosciences, Carl Zeiss AG, Bionova Scientific, Quantum Biosystems, Addgene, Life Technologies (Thermo Fisher Scientific) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Optogenetics Market, by Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Compound Microscopes |

|

4.2. Stereo Microscopes |

|

4.3. Digital Microscopes |

|

4.4. Confocal Microscopes |

|

5. Optogenetics Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Healthcare and Medical |

|

5.2. Academic and Research |

|

5.3. Industrial and Manufacturing |

|

6. Optogenetics Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Biomedical Research |

|

6.2. Clinical Diagnostics |

|

6.3. Quality Control and Assurance |

|

6.4. Material Science |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Optogenetics Market, by Type |

|

7.2.7. North America Optogenetics Market, by End-Use Industry |

|

7.2.8. North America Optogenetics Market, by Application |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Optogenetics Market, by Type |

|

7.2.9.1.2. US Optogenetics Market, by End-Use Industry |

|

7.2.9.1.3. US Optogenetics Market, by Application |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Optogenetics Technologies |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Synchronicity Pharmaceuticals |

|

9.3. Merck Group |

|

9.4. Synthego Corporation |

|

9.5. Emd Millipore (Merck KGaA) |

|

9.6. Thorlabs, Inc. |

|

9.7. GenSight Biologics |

|

9.8. Bluebird Bio, Inc. |

|

9.9. Channel Biosciences |

|

9.10. Carl Zeiss AG |

|

9.11. Bionova Scientific |

|

9.12. Quantum Biosystems |

|

9.13. Addgene |

|

9.14. Array Biopharma (Pfizer) |

|

9.15. Life Technologies (Thermo Fisher Scientific) |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Global Optogenetics Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Global Optogenetics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Global Optogenetics Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA