As per Intent Market Research, the Optical Coherence Tomography Devices Market was valued at USD 1.4 Billion in 2024-e and will surpass USD 2.6 Billion by 2030; growing at a CAGR of 11.0% during 2025 - 2030.

The Optical Coherence Tomography (OCT) Devices Market is witnessing significant growth driven by the increasing adoption of non-invasive imaging technologies in various medical fields. With its ability to deliver high-resolution cross-sectional images, OCT has become a cornerstone in diagnostics, especially in ophthalmology. The market's expansion is further fueled by technological advancements, increasing healthcare expenditures, and growing applications across multiple specialties.

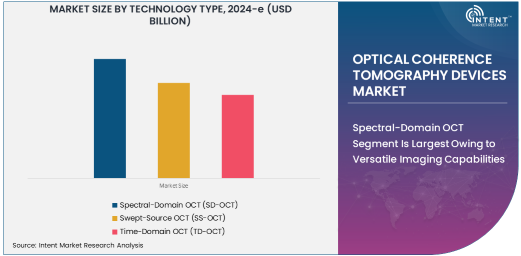

Spectral-Domain OCT Segment Is Largest Owing to Versatile Imaging Capabilities

Spectral-Domain Optical Coherence Tomography (SD-OCT) dominates the technology segment due to its widespread use in ophthalmology and other diagnostic applications. Known for its superior image resolution and faster data acquisition compared to Time-Domain OCT, SD-OCT is an essential tool for detecting retinal diseases and monitoring disease progression.

Its ability to provide detailed structural analysis of the retina, choroid, and optic nerve makes it indispensable in both clinical and research settings. Additionally, advancements in software integration and real-time imaging features have further solidified SD-OCT's position as the technology of choice for practitioners worldwide.

Handheld OCT Devices Segment Is Fastest Growing Owing to Portability and Accessibility

Handheld OCT devices are experiencing the fastest growth in the product type segment, driven by their portability and ease of use in diverse clinical environments. These devices are particularly valuable in pediatric ophthalmology, emergency care, and remote settings where traditional tabletop systems are less feasible.

The ability to perform high-quality imaging on immobile or uncooperative patients has expanded the application of handheld OCT devices. Increasing adoption in rural and underserved areas, coupled with technological enhancements that maintain image quality while reducing device size, is propelling this segment forward.

Ophthalmology Segment Is Largest Owing to Rising Prevalence of Eye Disorders

Ophthalmology remains the largest application segment, as OCT is a gold standard for diagnosing and managing conditions such as glaucoma, age-related macular degeneration, and diabetic retinopathy. The precision and reliability of OCT in detecting subtle changes in the retina and optic nerve have made it indispensable in routine eye care.

The growing burden of vision disorders globally, particularly in aging populations, continues to drive demand for ophthalmology-focused OCT devices. Furthermore, the integration of AI-powered analytics with OCT systems is enhancing diagnostic accuracy and expanding their utility in eye care practices.

Research and Academic Institutes Segment Is Fastest Growing Owing to Innovation Focus

Research and academic institutes represent the fastest-growing end-use industry segment, fueled by the increasing use of OCT in preclinical studies and the development of advanced imaging applications. These institutions play a pivotal role in exploring new uses for OCT beyond traditional medical applications, such as in material science and industrial research.

The availability of funding for biomedical research and collaborations between academia and industry are accelerating innovation in OCT technology. This segment's growth is further supported by the rising number of clinical trials leveraging OCT to evaluate therapeutic interventions.

North America Is Largest Region Owing to Advanced Healthcare Systems

North America holds the largest share in the Optical Coherence Tomography Devices Market, driven by its robust healthcare infrastructure, high adoption of advanced medical technologies, and significant investment in research and development. The region's focus on early diagnosis and preventive care further supports the widespread use of OCT devices.

The strong presence of key manufacturers, coupled with favorable reimbursement policies and growing awareness about the benefits of OCT in medical imaging, ensures North America remains at the forefront of this market.

Competitive Landscape and Key Players

The Optical Coherence Tomography Devices Market is marked by intense competition, with leading companies such as Carl Zeiss Meditec AG, Heidelberg Engineering GmbH, and Topcon Corporation driving innovation and market growth. These players focus on enhancing device performance, integrating AI technologies, and expanding their product portfolios to meet diverse clinical needs.

Emerging players and startups are also contributing to the competitive dynamics by introducing cost-effective and portable OCT solutions. Strategic partnerships, mergers, and investments in R&D are common strategies employed by companies to strengthen their market presence and address the growing demand for advanced OCT devices across multiple applications.

Recent Developments:

- Carl Zeiss Meditec AG launched a next-generation OCT device with enhanced imaging capabilities for retinal diagnostics.

- Topcon Corporation unveiled a cloud-based OCT solution to enable remote analysis and data sharing for ophthalmology practices.

- Optovue, Inc. introduced a new AI-driven feature in its OCT systems to improve diagnostic accuracy in glaucoma management.

- Heidelberg Engineering GmbH expanded its product line with a portable OCT device designed for use in rural healthcare settings.

- NIDEK Co., Ltd. partnered with a university research team to develop advanced OCT technology for early cancer detection.

List of Leading Companies:

- Carl Zeiss Meditec AG

- Heidelberg Engineering GmbH

- Topcon Corporation

- Canon Medical Systems Corporation

- Optovue, Inc.

- NIDEK Co., Ltd.

- Leica Microsystems (Danaher Corporation)

- Agfa-Gevaert Group

- Thorlabs, Inc.

- Santec Corporation

- Optopol Technology Sp. z o.o.

- Tomey Corporation

- BaySpec, Inc.

- Wasatch Photonics, Inc.

- Phoenix Research Labs

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.4 Billion |

|

Forecasted Value (2030) |

USD 2.6 Billion |

|

CAGR (2025 – 2030) |

11.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Optical Coherence Tomography Devices Market by Technology Type (Spectral-Domain OCT (SD-OCT), Swept-Source OCT (SS-OCT), Time-Domain OCT (TD-OCT)), by Product Type (Handheld OCT Devices, Tabletop OCT Devices, Catheter-Based OCT Devices), by Application (Ophthalmology, Cardiovascular Imaging, Dermatology, Dentistry, Oncology), by End-Use Industry (Hospitals and Clinics, Ambulatory Surgical Centers, Research and Academic Institutes) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Carl Zeiss Meditec AG, Heidelberg Engineering GmbH, Topcon Corporation, Canon Medical Systems Corporation, Optovue, Inc., NIDEK Co., Ltd., Agfa-Gevaert Group, Thorlabs, Inc., Santec Corporation, Optopol Technology Sp. z o.o., Tomey Corporation, BaySpec, Inc., Phoenix Research Labs |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Optical Coherence Tomography Devices Market, by Technology Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Spectral-Domain OCT (SD-OCT) |

|

4.2. Swept-Source OCT (SS-OCT) |

|

4.3. Time-Domain OCT (TD-OCT) |

|

5. Optical Coherence Tomography Devices Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Handheld OCT Devices |

|

5.2. Tabletop OCT Devices |

|

5.3. Catheter-Based OCT Devices |

|

6. Optical Coherence Tomography Devices Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Ophthalmology |

|

6.2. Cardiovascular Imaging |

|

6.3. Dermatology |

|

6.4. Dentistry |

|

6.5. Oncology |

|

7. Optical Coherence Tomography Devices Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals and Clinics |

|

7.2. Ambulatory Surgical Centers |

|

7.3. Research and Academic Institutes |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Optical Coherence Tomography Devices Market, by Technology Type |

|

8.2.7. North America Optical Coherence Tomography Devices Market, by Product Type |

|

8.2.8. North America Optical Coherence Tomography Devices Market, by Application |

|

8.2.9. North America Optical Coherence Tomography Devices Market, by End-Use Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Optical Coherence Tomography Devices Market, by Technology Type |

|

8.2.10.1.2. US Optical Coherence Tomography Devices Market, by Product Type |

|

8.2.10.1.3. US Optical Coherence Tomography Devices Market, by Application |

|

8.2.10.1.4. US Optical Coherence Tomography Devices Market, by End-Use Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Carl Zeiss Meditec AG |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Heidelberg Engineering GmbH |

|

10.3. Topcon Corporation |

|

10.4. Canon Medical Systems Corporation |

|

10.5. Optovue, Inc. |

|

10.6. NIDEK Co., Ltd. |

|

10.7. Leica Microsystems (Danaher Corporation) |

|

10.8. Agfa-Gevaert Group |

|

10.9. Thorlabs, Inc. |

|

10.10. Santec Corporation |

|

10.11. Optopol Technology Sp. z o.o. |

|

10.12. Tomey Corporation |

|

10.13. BaySpec, Inc. |

|

10.14. Wasatch Photonics, Inc. |

|

10.15. Phoenix Research Labs |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Global Optical Coherence Tomography Devices Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Global Optical Coherence Tomography Devices Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Global Optical Coherence Tomography Devices Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA