As per Intent Market Research, the Generic Drugs Market was valued at USD 431.1 billion in 2024-e and will surpass USD 775.8 billion by 2030; growing at a CAGR of 8.8% during 2025 - 2030.

The generic drugs market plays a pivotal role in the global healthcare industry by providing affordable alternatives to branded pharmaceutical products. Generic drugs, which are bioequivalent to their branded counterparts, are expected to experience robust growth due to the increasing emphasis on reducing healthcare costs and the rising prevalence of chronic diseases. With the expiration of patents for several blockbuster drugs, generic drug manufacturers are capitalizing on this opportunity to provide cost-effective treatment options. This market is also witnessing growing demand in emerging economies, where affordability is a significant driver of healthcare access. As a result, the market is experiencing innovation in drug formulations, distribution channels, and therapeutic applications, making it a highly dynamic segment within the pharmaceutical industry.

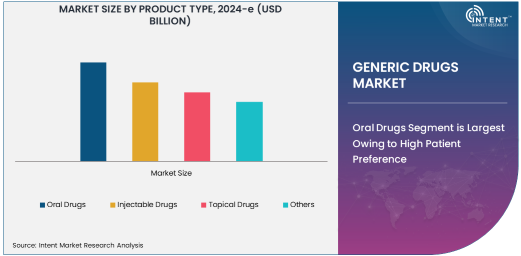

Oral Drugs Segment is Largest Owing to High Patient Preference

The oral drugs segment holds the largest share in the generic drugs market, primarily due to the widespread patient preference for oral formulations over injectables or topical applications. Oral drugs, such as tablets and capsules, are easier to administer and generally require less medical supervision. They have a longer shelf life and can be distributed more easily, contributing to their dominant presence in both retail pharmacies and hospitals. These factors make oral drugs a go-to option for treating a broad spectrum of conditions, ranging from cardiovascular diseases to infections. Furthermore, oral drugs are typically more affordable, which enhances their appeal to both patients and healthcare providers looking to reduce treatment costs.

The extensive availability and manufacturing of oral generics are also driving market growth. The continuous expansion of manufacturing facilities and the high number of patent expirations for popular oral drugs enable companies to produce generics at scale. As the demand for oral generics continues to rise, competition among pharmaceutical manufacturers is expected to intensify, leading to greater price reductions and further improving market accessibility for consumers.

Cardiovascular Diseases Segment is Fastest Growing Due to Rising Prevalence

The cardiovascular diseases (CVD) segment is the fastest growing therapeutic application in the generic drugs market, largely driven by the increasing global prevalence of heart disease and related conditions such as hypertension and stroke. CVD remains one of the leading causes of death worldwide, which results in high demand for medications that can manage these conditions effectively. As patents for high-value cardiovascular drugs expire, generic alternatives have become crucial in addressing the affordability challenges associated with these life-saving treatments. Generic drugs like statins, beta-blockers, and angiotensin-converting enzyme (ACE) inhibitors are widely used to treat heart disease, and their cost-effectiveness has led to their rapid adoption.

The growing aging population, along with the rise in unhealthy lifestyle factors such as poor diet and lack of exercise, are driving the demand for cardiovascular medications. As a result, pharmaceutical companies are increasingly focusing on the development and distribution of generic cardiovascular drugs. The expansion of these generic drugs not only improves patient access but also significantly reduces the financial burden on healthcare systems globally.

Hospitals Segment is Largest End-User Industry Due to High Volume of Prescription Drugs

The hospital segment is the largest end-user industry in the generic drugs market, largely due to the high volume of prescription drugs dispensed within hospital settings. Hospitals frequently rely on generic drugs as part of their treatment protocols, particularly for chronic conditions like diabetes, cancer, and cardiovascular diseases. The cost-effectiveness of generic drugs, coupled with their proven efficacy and safety profiles, makes them an attractive option for hospitals looking to manage their drug expenses while ensuring patient care is not compromised. Hospitals also benefit from the large-scale purchasing power they hold, which enables them to procure generic drugs in bulk at reduced prices.

Hospitals are increasingly adopting generics not only for the treatment of common conditions but also for critical care and emergency treatments. As healthcare systems around the world focus on cost reduction while maintaining treatment standards, the demand for generic drugs in hospital settings is expected to continue growing at a steady pace.

Online Sales Channel is Fastest Growing Due to E-commerce Expansion

The online sales segment has emerged as the fastest-growing distribution channel for generic drugs, driven by the rapid expansion of e-commerce platforms and increasing consumer preference for convenient shopping. Online pharmacies provide an easy and accessible way for patients to order generic drugs without leaving their homes, which is particularly important for individuals with mobility issues or those living in remote areas. The convenience of home delivery, along with the ability to compare prices across different online platforms, has made e-commerce an increasingly popular method for purchasing medications.

In addition, the ongoing shift toward digital healthcare services and telemedicine has further fueled the growth of online pharmacies. As consumers become more comfortable with online shopping, the demand for both branded and generic drugs through online channels is expected to continue its upward trajectory, presenting opportunities for growth in the global generic drugs market.

Tablets Segment is Largest Formulation Type Due to Widespread Use

The tablets segment is the largest formulation type within the generic drugs market, owing to their ease of administration, stability, and cost-effectiveness. Tablets are the most commonly prescribed form of medication for a variety of conditions, ranging from minor ailments to chronic diseases. The simplicity of tablet dosage and the ability to incorporate various active ingredients into a single dose makes tablets the preferred formulation for both patients and healthcare providers. Furthermore, generic drug manufacturers have made significant advancements in tablet production, enabling them to offer a wide variety of generic tablets that replicate the effectiveness of branded drugs.

The production of generic tablets is also less expensive compared to other formulations such as injectables or biologics. This, combined with the high demand for oral drugs, makes the tablet formulation the most dominant in the market, driving the growth of the generic drug sector.

Largest Region: North America Holds Significant Market Share

North America is the largest region for the generic drugs market, with the United States being the primary driver of demand. The U.S. has the world’s largest healthcare market, where generic drugs account for a significant portion of the total pharmaceutical expenditure. This is due to the large number of patent expirations for high-cost branded drugs, which has opened the door for generic alternatives. The regulatory environment in North America, particularly with the Food and Drug Administration (FDA), ensures that generics meet the same rigorous standards as their branded counterparts, providing consumers with affordable yet effective medication options.

Furthermore, the widespread adoption of health insurance programs, such as Medicaid and Medicare, which cover generic drug prescriptions, has significantly contributed to the growth of the generic drug market in North America. As healthcare costs continue to rise, the demand for generic drugs is expected to increase in the region, making it a key focus area for pharmaceutical companies.

Competitive Landscape and Leading Companies

The generic drugs market is highly competitive, with numerous global players vying for market share. Leading companies such as Teva Pharmaceutical Industries, Sandoz (Novartis), Mylan (Viatris), and Sun Pharmaceuticals are key players in this space, continuously innovating to meet the growing demand for affordable medications. These companies benefit from their extensive manufacturing capabilities, large product portfolios, and global distribution networks, allowing them to serve both developed and emerging markets effectively.

The competitive landscape is marked by constant mergers and acquisitions, as companies seek to expand their portfolios and gain access to new therapeutic areas. Additionally, the increasing focus on biosimilars and the development of high-quality generics for complex diseases such as cancer and diabetes are driving companies to invest in research and development. The presence of a large number of smaller, regional players further intensifies competition, offering consumers a wide range of generic drug options at competitive prices.

Recent Developments:

- Teva Pharmaceutical Industries launched a generic version of Humira (adalimumab), a top-selling biologic, as part of its biosimilars portfolio.

- Sandoz (Novartis) expanded its generic and biosimilars business by acquiring the generic division of the company Aspen Pharmacare for $1.5 billion.

- Mylan (Viatris) received approval from the FDA for its generic version of Advair Diskus, a drug used for asthma and chronic obstructive pulmonary disease (COPD).

- Cipla Ltd. entered into a strategic partnership with Biocon to develop and distribute generic insulin in the global market.

- Aurobindo Pharma completed the acquisition of Sandoz’s U.S. Dermatology Business, which includes a portfolio of generic topical treatments, expanding its reach in dermatology

List of Leading Companies:

- Teva Pharmaceutical Industries Ltd.

- Sandoz (a Novartis division)

- Mylan N.V. (now part of Viatris)

- Sun Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Lupin Pharmaceuticals Inc.

- Dr. Reddy's Laboratories Ltd.

- Amgen Inc.

- Aurobindo Pharma Ltd.

- Fresenius Kabi AG

- Apotex Inc.

- Hetero Healthcare Ltd.

- Viatris Inc.

- Torrent Pharmaceuticals Ltd.

- Zydus Cadila Healthcare Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 431.1 Billion |

|

Forecasted Value (2030) |

USD 775.8 Billion |

|

CAGR (2025 – 2030) |

8.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Global Generic Drugs Market By Product Type (Oral Drugs, Injectable Drugs, Topical Drugs), By Therapeutic Application (Cardiovascular Diseases, Diabetes, Oncology, Neurological Disorders, Infectious Diseases, Respiratory Diseases), By End-User Industry (Hospitals, Retail Pharmacies, Online Pharmacies, Clinics), By Distribution Channel (Direct Sales, Third-Party Distributors, Online Sales), By Formulation Type (Tablets, Capsules, Injections, Ointments) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Teva Pharmaceutical Industries Ltd., Sandoz (a Novartis division), Mylan N.V. (now part of Viatris), Sun Pharmaceutical Industries Ltd., Cipla Ltd., Lupin Pharmaceuticals Inc., Dr. Reddy's Laboratories Ltd., Amgen Inc., Aurobindo Pharma Ltd., Fresenius Kabi AG, Apotex Inc., Hetero Healthcare Ltd., Viatris Inc., Torrent Pharmaceuticals Ltd., Zydus Cadila Healthcare Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Generic Drugs Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Oral Drugs |

|

4.2. Injectable Drugs |

|

4.3. Topical Drugs |

|

4.4. Others |

|

5. Generic Drugs Market, by Therapeutic Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Cardiovascular Diseases |

|

5.2. Diabetes |

|

5.3. Oncology |

|

5.4. Neurological Disorders |

|

5.5. Infectious Diseases |

|

5.6. Respiratory Diseases |

|

5.7. Others |

|

6. Generic Drugs Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals |

|

6.2. Retail Pharmacies |

|

6.3. Online Pharmacies |

|

6.4. Clinics |

|

6.5. Others |

|

7. Generic Drugs Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Direct Sales |

|

7.2. Third-Party Distributors |

|

7.3. Online Sales |

|

8. Generic Drugs Market, by Formulation Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Tablets |

|

8.2. Capsules |

|

8.3. Injections |

|

8.4. Ointments |

|

8.5. Others |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Generic Drugs Market, by Product Type |

|

9.2.7. North America Generic Drugs Market, by Therapeutic Application |

|

9.2.8. North America Generic Drugs Market, by End-User Industry |

|

9.2.9. North America Generic Drugs Market, by Distribution Channel |

|

9.2.10. North America Generic Drugs Market, by Formulation Type |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Generic Drugs Market, by Product Type |

|

9.2.11.1.2. US Generic Drugs Market, by Therapeutic Application |

|

9.2.11.1.3. US Generic Drugs Market, by End-User Industry |

|

9.2.11.1.4. US Generic Drugs Market, by Distribution Channel |

|

9.2.11.1.5. US Generic Drugs Market, by Formulation Type |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Teva Pharmaceutical Industries Ltd. |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Sandoz (a Novartis division) |

|

11.3. Mylan N.V. (now part of Viatris) |

|

11.4. Sun Pharmaceutical Industries Ltd. |

|

11.5. Cipla Ltd. |

|

11.6. Lupin Pharmaceuticals Inc. |

|

11.7. Dr. Reddy's Laboratories Ltd. |

|

11.8. Amgen Inc. |

|

11.9. Aurobindo Pharma Ltd. |

|

11.10. Fresenius Kabi AG |

|

11.11. Apotex Inc. |

|

11.12. Hetero Healthcare Ltd. |

|

11.13. Viatris Inc. |

|

11.14. Torrent Pharmaceuticals Ltd. |

|

11.15. Zydus Cadila Healthcare Ltd. |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Global Generic Drugs Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Global Generic Drugs Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Global Generic Drugs Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA