As per Intent Market Research, the Glass Filter Market was valued at USD 3.0 billion in 2024-e and will surpass USD 5.8 billion by 2030; growing at a CAGR of 10.0% during 2025 - 2030.

The global glass filter market is an essential segment within the broader optical component industry, with increasing applications in fields like healthcare, aerospace, automotive, and scientific research. Glass filters are designed to selectively pass light of specific wavelengths while blocking others, thus enabling precise control over light in various optical systems. The market for glass filters has seen significant growth due to technological advancements in optical systems, growing demand for high-precision imaging, and a rising need for environmental monitoring systems. As industries such as healthcare, automotive, and electronics continue to expand, the demand for specialized optical filters like UV and IR filters, along with innovations in filtration technology, is set to increase significantly in the coming years.

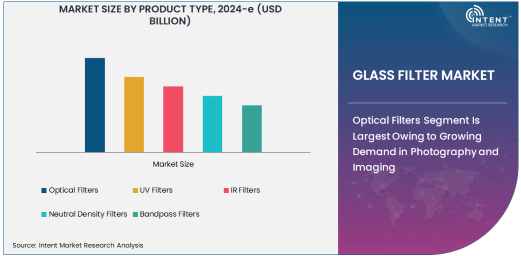

Optical Filters Segment Is Largest Owing to Growing Demand in Photography and Imaging

Among the various product types in the glass filter market, optical filters are the largest segment. Optical filters are used across a broad range of applications, including in optical systems, photography, spectroscopy, and environmental monitoring. The demand for high-quality optical filters is driven largely by the continuous advancements in photography and imaging technologies, particularly in the consumer electronics and healthcare industries. Optical filters enhance the clarity, color, and definition of images, making them indispensable for cameras, scanners, and imaging systems. Furthermore, the healthcare sector, particularly in diagnostic imaging, relies on optical filters to enhance image quality during medical procedures like MRI and CT scans.

In addition to photography, optical filters are widely used in scientific research and optical sensing. As technologies continue to evolve, the demand for optical filters in scientific experiments that require precision light transmission is also increasing. The growing interest in high-definition imaging and the increasing use of optical systems in multiple sectors has contributed significantly to the dominance of optical filters in the market.

Automotive Industry Is Fastest Growing Owing to Adoption of Advanced Driver Assistance Systems (ADAS)

The automotive sector is the fastest-growing end-user industry for glass filters, driven largely by the increasing adoption of advanced driver assistance systems (ADAS) and other automotive technologies. ADAS technologies, including cameras, sensors, and LIDAR systems, rely on optical filters to ensure accurate data collection for features such as automatic braking, lane departure warnings, and autonomous driving. As vehicles become smarter and more connected, the role of glass filters in ensuring clear and precise optical sensing continues to grow.

Moreover, as consumer demand for electric vehicles (EVs) rises, automakers are also leveraging optical filters in battery management systems and charging stations, further expanding their applications. The automotive industry's increasing reliance on optical filters for safety, convenience, and energy efficiency is driving rapid growth in this sector, positioning it as one of the key drivers of the overall glass filter market's expansion.

Spectroscopy Application Is Largest Owing to Increased Use in Scientific Research

In the application segment, spectroscopy is the largest segment within the glass filter market. Spectroscopy is widely used across scientific research, pharmaceuticals, environmental monitoring, and chemical analysis to identify the composition of materials. Glass filters, especially bandpass filters and UV filters, are critical components in spectroscopy systems, as they allow precise control of light wavelength and energy levels, enabling accurate readings and data collection.

The increasing use of spectroscopy in various industries, including in laboratories and research institutions, drives the demand for specialized optical filters. As the need for high-precision instruments grows in applications like environmental monitoring and pharmaceutical research, the demand for glass filters used in spectroscopic techniques continues to rise, solidifying its position as the largest application within the market.

Direct Sales Distribution Channel Is Largest Due to High-Value Transactions and Custom Solutions

In the distribution channel segment, direct sales is the largest and most significant channel for glass filters. Direct sales are especially prevalent in industries that require specialized filters, such as aerospace, medical imaging, and scientific research. Customers in these sectors often seek tailored solutions that meet their specific needs, which is best facilitated through direct sales channels. Furthermore, high-value transactions in industries like aerospace and medical devices make direct sales the preferred distribution method, as it ensures a more personalized approach and access to technical support for complex product requirements.

Moreover, direct sales allow manufacturers to maintain better control over pricing, branding, and customer relationships, which is particularly beneficial in the highly competitive glass filter market. The focus on custom solutions and ongoing support for end-users has solidified the prominence of direct sales in the distribution of glass filters.

Asia-Pacific Region Is Fastest Growing Owing to Increasing Industrialization and Technological Advancements

The Asia-Pacific region is the fastest-growing market for glass filters, driven by the rapid industrialization and technological advancements taking place across countries like China, Japan, and India. The region's expanding automotive industry, particularly the adoption of ADAS technologies, is driving the demand for high-quality optical filters. Furthermore, the increasing presence of global electronics manufacturers and the growing healthcare and semiconductor industries in this region are fueling the need for advanced glass filtering solutions.

China and India, with their large manufacturing sectors, are also significant contributors to the growth of the glass filter market. As these economies continue to develop and adopt new technologies, the demand for optical filters, particularly for use in automotive, consumer electronics, and industrial applications, will continue to rise, making Asia-Pacific the fastest-growing region in the global market.

Leading Companies and Competitive Landscape

Key players in the glass filter market include companies like Edmund Optics, SCHOTT AG, Thorlabs, Inc., and Hoya Corporation. These companies dominate the market through continuous product innovation, strategic partnerships, and strong global distribution networks. Leading companies invest heavily in R&D to improve the performance and versatility of their optical filters, ensuring they remain competitive in an increasingly technology-driven marketplace.

The competitive landscape is characterized by a mix of established companies and emerging players, with ongoing efforts to expand into new markets and sectors. Companies are also focusing on expanding their product offerings to include customized solutions tailored to specific industry needs, such as for medical devices, aerospace applications, and environmental monitoring systems. As the demand for high-quality glass filters continues to grow across various industries, competition will intensify, with market leaders maintaining their edge through technological advancements and strategic alliances.

Recent Developments:

- Edmund Optics has expanded its portfolio by launching a new line of optical filters designed for high-precision medical imaging applications.

- SCHOTT AG has entered into a partnership with an aerospace manufacturer to develop advanced glass filters for satellite optical systems.

- Hoya Corporation announced a significant acquisition of an optical filter manufacturer to strengthen its position in the global market for photography and imaging solutions.

- Thorlabs, Inc. unveiled a new series of custom UV filters, aimed at enhancing laboratory research and environmental monitoring.

- Nikon Corporation revealed a new range of glass filters for high-definition optical systems, targeting the growing demand in the automotive and electronics sectors

List of Leading Companies:

- Edmund Optics

- Thorlabs, Inc.

- Optical Filters, Inc.

- SCHOTT AG

- Hoya Corporation

- Andover Corporation

- Nikon Corporation

- LG Chem

- Newport Corporation

- Corning Incorporated

- Asahi Glass Co.

- Barr Associates, Inc.

- Ocean Optics, Inc.

- Melles Griot (II-VI Incorporated)

- Laser Components GmbH

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.0 Billion |

|

Forecasted Value (2030) |

USD 5.8 Billion |

|

CAGR (2025 – 2030) |

10.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Glass Filter Market Product Type (Optical Filters, UV Filters, IR Filters, Neutral Density Filters, Bandpass Filters), End-User Industry (Automotive, Healthcare & Medical, Electronics & Semiconductors, Energy & Power, Consumer Goods, Aerospace & Defense), Application (Optical Systems, Photography & Imaging, Spectroscopy, Light Pollution Control, Environmental Monitoring, Scientific Research), and Distribution Channel (Direct Sales, Online Retail, Distributors, Specialty Stores, Wholesale Markets) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Edmund Optics, Thorlabs, Inc., Optical Filters, Inc., SCHOTT AG, Hoya Corporation, Andover Corporation, Nikon Corporation, LG Chem, Newport Corporation, Corning Incorporated, Asahi Glass Co., Barr Associates, Inc., Ocean Optics, Inc., Melles Griot (II-VI Incorporated), Laser Components GmbH |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Glass Filter Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Optical Filters |

|

4.2. UV Filters |

|

4.3. IR Filters |

|

4.4. Neutral Density Filters |

|

4.5. Bandpass Filters |

|

5. Glass Filter Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Automotive |

|

5.2. Healthcare & Medical |

|

5.3. Electronics & Semiconductors |

|

5.4. Energy & Power |

|

5.5. Consumer Goods |

|

5.6. Aerospace & Defense |

|

6. Glass Filter Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Optical Systems |

|

6.2. Photography & Imaging |

|

6.3. Spectroscopy |

|

6.4. Light Pollution Control |

|

6.5. Environmental Monitoring |

|

6.6. Scientific Research |

|

7. Glass Filter Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Direct Sales |

|

7.2. Online Retail |

|

7.3. Distributors |

|

7.4. Specialty Stores |

|

7.5. Wholesale Markets |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Glass Filter Market, by Product Type |

|

8.2.7. North America Glass Filter Market, by End-User Industry |

|

8.2.8. North America Glass Filter Market, by Application |

|

8.2.9. North America Glass Filter Market, by Distribution Channel |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Glass Filter Market, by Product Type |

|

8.2.10.1.2. US Glass Filter Market, by End-User Industry |

|

8.2.10.1.3. US Glass Filter Market, by Application |

|

8.2.10.1.4. US Glass Filter Market, by Distribution Channel |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Edmund Optics |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Thorlabs, Inc. |

|

10.3. Optical Filters, Inc. |

|

10.4. SCHOTT AG |

|

10.5. Hoya Corporation |

|

10.6. Andover Corporation |

|

10.7. Nikon Corporation |

|

10.8. LG Chem |

|

10.9. Newport Corporation |

|

10.10. Corning Incorporated |

|

10.11. Asahi Glass Co. |

|

10.12. Barr Associates, Inc. |

|

10.13. Ocean Optics, Inc. |

|

10.14. Melles Griot (II-VI Incorporated) |

|

10.15. Laser Components GmbH |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Glass Filter Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Glass Filter Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Glass Filter Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA