As per Intent Market Research, the Geriatric Medicines Market was valued at USD 16.1 billion in 2024-e and will surpass USD 36.8 billion by 2030; growing at a CAGR of 12.5% during 2025 - 2030.

The geriatric medicines market caters to the growing healthcare needs of the elderly population, focusing on specialized drug therapies for chronic conditions and age-related diseases. As the global aging population continues to rise, the demand for medications specifically designed for older adults, such as those for cardiovascular diseases, diabetes, pain management, and dementia, is escalating. This market is pivotal in addressing the unique medical challenges faced by seniors, including polypharmacy, comorbidities, and age-associated physiological changes. The increase in life expectancy, along with a higher prevalence of chronic diseases, further drives the growth of this market.

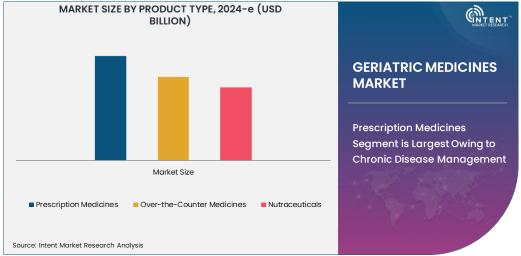

Prescription Medicines Segment is Largest Owing to Chronic Disease Management

Prescription medicines dominate the geriatric medicines market, driven by the need to manage chronic conditions that affect older adults, such as hypertension, diabetes, and cardiovascular diseases. As seniors often have multiple health concerns that require ongoing treatment, prescription medications remain the most effective option for managing these conditions. Cardiovascular drugs, anti-hypertensive drugs, and anti-diabetic medications are among the most prescribed categories for elderly patients, reflecting the high incidence of heart diseases and diabetes in this demographic. This segment is expected to continue to grow as more elderly people require prescription medications to maintain their quality of life.

Prescription medications are especially important for managing complex medical needs in elderly patients. With a rise in multi-morbidity in seniors, these drugs are designed to not only treat individual diseases but also manage their interactions and side effects. This is especially critical for the elderly, as their bodies process drugs differently, often leading to an increased risk of drug-drug interactions. Pharmaceutical companies continue to develop new and safer drugs to meet the growing demands of this segment, making prescription medicines a key focus area in the geriatric healthcare sector.

Cardiovascular Drugs Segment is Largest Owing to Prevalence of Heart Diseases

Cardiovascular drugs represent the largest subsegment within the drug class category, owing to the high prevalence of heart-related diseases among the elderly. Heart diseases, including hypertension, coronary artery disease, and heart failure, are among the leading causes of morbidity and mortality in older adults. This segment includes a range of drug types, such as beta-blockers, ACE inhibitors, diuretics, and statins, which are essential in controlling blood pressure, improving heart function, and reducing the risk of cardiovascular events. Given the aging global population and the rise in lifestyle diseases, cardiovascular drugs are projected to maintain their dominant position in the market.

The cardiovascular drugs market benefits from ongoing advancements in pharmacological treatments aimed at improving cardiovascular health. This is particularly significant for seniors who often suffer from multiple cardiac issues. In addition to traditional therapies, new treatments such as novel anticoagulants and cholesterol-lowering agents continue to emerge, further driving market growth. The effectiveness of these medications in preventing complications such as strokes and heart attacks significantly contributes to their widespread use among the elderly.

Oral Medications Segment is Fastest Growing Due to Ease of Use

Among the different routes of administration, oral medications are the fastest growing in the geriatric medicines market. This growth is primarily driven by the ease of use and convenience that oral drugs offer, especially for elderly patients who may face challenges with injectables or topical treatments. Oral medications, which include pills, capsules, and liquids, are often preferred because they allow for self-administration without the need for specialized medical assistance. Moreover, the wide availability of oral drugs for chronic conditions, such as diabetes and hypertension, makes them the go-to solution for elderly patients.

The fast growth of the oral medications segment is also fueled by advancements in drug formulations that make oral drugs more effective and easier to consume. For instance, extended-release tablets, liquid formulations, and combination therapies allow seniors to manage multiple conditions with fewer doses. As the demand for geriatric medications continues to rise, manufacturers are focusing on developing oral medications that are not only effective but also easier for the elderly to take, addressing their unique needs.

Hospitals & Healthcare Providers Segment is Largest Due to Clinical Care Needs

The hospitals and healthcare providers segment is the largest within the end-user industry in the geriatric medicines market. Hospitals are often the first point of contact for elderly patients dealing with acute health conditions, comorbidities, or emergencies related to chronic diseases. Given the complexity of geriatric care, healthcare providers play a critical role in diagnosing, prescribing, and managing the medications required to treat various conditions in elderly patients. Hospitals, which offer a comprehensive range of medical services, are integral in ensuring that seniors receive appropriate care and medication.

Additionally, hospitals and healthcare providers serve as essential facilities for administering complex drug therapies, such as chemotherapy, dialysis, or injectable treatments that are more difficult to manage outside a clinical setting. With the growing elderly population, hospitals and healthcare facilities are increasingly investing in geriatric care services and specialized units to address the health needs of seniors, thus contributing to the expansion of this segment.

Retail Pharmacies Segment is Largest Owing to Accessibility and Convenience

Retail pharmacies are the largest distribution channel in the geriatric medicines market, as they provide easy access to both prescription and over-the-counter medications. Retail pharmacies offer seniors the convenience of purchasing medications with minimal effort, often close to their homes. This accessibility, along with the ability to consult with pharmacists about proper drug use and potential side effects, makes retail pharmacies a popular choice for elderly patients. Furthermore, retail pharmacies often offer medication management services, such as blister packaging, home delivery, and medication synchronization, which are tailored to the needs of elderly individuals.

The retail pharmacy market is further bolstered by the increasing presence of online pharmacies, which offer additional convenience for seniors who may have mobility issues or difficulty visiting physical stores. Online pharmacies are growing rapidly, providing both prescription and over-the-counter drugs directly to consumers, often with the added benefit of home delivery and lower prices. The continued expansion of both traditional and online retail pharmacies will continue to drive the growth of this distribution channel.

North America is Largest Region Due to High Healthcare Spending and Aging Population

North America is the largest region in the geriatric medicines market, primarily due to its aging population and high healthcare expenditure. The United States, in particular, has a large senior population that relies heavily on prescription medications to manage chronic conditions, including heart disease, diabetes, and arthritis. Additionally, North America’s well-established healthcare infrastructure, coupled with significant investments in senior care, further supports the demand for geriatric medicines. The region also benefits from strong pharmaceutical research and development, ensuring that the latest medications are available to cater to the evolving needs of the elderly population.

Moreover, healthcare policies in North America have evolved to support aging populations, with numerous government programs, such as Medicare and Medicaid, offering subsidized access to medications and healthcare services for seniors. The high adoption of healthcare technology and the presence of major pharmaceutical companies further position North America as a key player in the geriatric medicines market.

Competitive Landscape and Leading Companies

The competitive landscape in the geriatric medicines market is marked by a high level of activity, with major pharmaceutical companies continually expanding their portfolios to cater to the elderly population. Key players include Pfizer, Merck & Co., Johnson & Johnson, and Novartis, all of which have developed specific drug treatments targeting geriatric patients. These companies are increasingly focusing on innovations such as combination therapies, extended-release formulations, and personalized medicine to address the unique health concerns of seniors.

Additionally, the market is witnessing increased collaboration between pharmaceutical companies, healthcare providers, and research institutions to develop new therapies for geriatric conditions. As the market continues to expand, companies are also investing in telehealth and homecare services to better cater to the growing elderly population. The competitive environment is expected to become even more dynamic as more companies enter the market, and the demand for geriatric medicines rises globally.

Recent Developments:

- Pfizer Inc. launched a new anti-hypertensive drug for the geriatric population, aimed at improving cardiovascular health in seniors.

- Novartis received FDA approval for its new anti-dementia medication designed to slow the progression of Alzheimer's disease in elderly patients.

- AstraZeneca expanded its portfolio with a new pain management solution for elderly patients with osteoarthritis.

- Johnson & Johnson partnered with a healthcare technology company to enhance its geriatric care offerings through digital health monitoring systems.

- Merck & Co., Inc. announced a merger with a biotechnology firm focused on developing advanced therapies for age-related diseases like dementia and osteoporosis

List of Leading Companies:

- Pfizer Inc.

- Novartis AG

- Johnson & Johnson

- Sanofi S.A.

- Merck & Co., Inc.

- Roche Holding AG

- AstraZeneca PLC

- GlaxoSmithKline PLC

- Eli Lilly and Co.

- Bayer AG

- AbbVie Inc.

- Bristol Myers Squibb

- Teva Pharmaceutical Industries Ltd.

- Mylan NV

- Amgen Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 16.1 Billion |

|

Forecasted Value (2030) |

USD 36.8 Billion |

|

CAGR (2025 – 2030) |

12.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Geriatric Medicines Market By Product Type (Prescription Medicines, Over-the-Counter Medicines, Nutraceuticals), By Drug Class (Cardiovascular Drugs, Pain Management Drugs, Anti-Diabetic Drugs, Anti-Hypertensive Drugs, Anti-Dementia Drugs, Respiratory Drugs), By Route of Administration (Oral Medications, Injectables, Topical Medications), By End-User Industry (Hospitals & Healthcare Providers, Long-Term Care Facilities, Homecare Agencies, Pharmacies, Government Agencies), and By Distribution Channel (Retail Pharmacies, Online Pharmacies, Hospital Pharmacies, Government Agencies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Pfizer Inc., Novartis AG, Johnson & Johnson, Sanofi S.A., Merck & Co., Inc., Roche Holding AG, AstraZeneca PLC, GlaxoSmithKline PLC, Eli Lilly and Co., Bayer AG, AbbVie Inc., Bristol Myers Squibb, Teva Pharmaceutical Industries Ltd., Mylan NV, Amgen Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Geriatric Medicines Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Prescription Medicines |

|

4.2. Over-the-Counter Medicines |

|

4.3. Nutraceuticals |

|

5. Geriatric Medicines Market, by Drug Class (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Cardiovascular Drugs |

|

5.2. Pain Management Drugs |

|

5.3. Anti-Diabetic Drugs |

|

5.4. Anti-Hypertensive Drugs |

|

5.5. Anti-Dementia Drugs |

|

5.6. Respiratory Drugs |

|

6. Geriatric Medicines Market, by Route of Administration (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Oral Medications |

|

6.2. Injectables |

|

6.3. Topical Medications |

|

7. Geriatric Medicines Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals & Healthcare Providers |

|

7.2. Long-Term Care Facilities |

|

7.3. Homecare Agencies |

|

7.4. Pharmacies |

|

7.5. Government Agencies |

|

8. Geriatric Medicines Market, by Distribution Channel (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Retail Pharmacies |

|

8.2. Online Pharmacies |

|

8.3. Hospital Pharmacies |

|

8.4. Government Agencies |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Geriatric Medicines Market, by Product Type |

|

9.2.7. North America Geriatric Medicines Market, by Drug Class |

|

9.2.8. North America Geriatric Medicines Market, by Route of Administration |

|

9.2.9. North America Geriatric Medicines Market, by End-User Industry |

|

9.2.10. North America Geriatric Medicines Market, by Distribution Channel |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Geriatric Medicines Market, by Product Type |

|

9.2.11.1.2. US Geriatric Medicines Market, by Drug Class |

|

9.2.11.1.3. US Geriatric Medicines Market, by Route of Administration |

|

9.2.11.1.4. US Geriatric Medicines Market, by End-User Industry |

|

9.2.11.1.5. US Geriatric Medicines Market, by Distribution Channel |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Pfizer Inc. |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Novartis AG |

|

11.3. Johnson & Johnson |

|

11.4. Sanofi S.A. |

|

11.5. Merck & Co., Inc. |

|

11.6. Roche Holding AG |

|

11.7. AstraZeneca PLC |

|

11.8. GlaxoSmithKline PLC |

|

11.9. Eli Lilly and Co. |

|

11.10. Bayer AG |

|

11.11. AbbVie Inc. |

|

11.12. Bristol Myers Squibb |

|

11.13. Teva Pharmaceutical Industries Ltd. |

|

11.14. Mylan NV |

|

11.15. Amgen Inc. |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Geriatric Medicines Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Geriatric Medicines Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Geriatric Medicines Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA