As per Intent Market Research, the Geriatric Care Services Market was valued at USD 1,041.1 billion in 2024-e and will surpass USD 2,391.3 billion by 2030; growing at a CAGR of 12.6% during 2025 - 2030.

The global geriatric care services market has been expanding rapidly due to the rising aging population and increasing demand for specialized healthcare services. As people live longer, the need for a range of care services, from in-home healthcare to nursing and long-term care, has grown. This sector includes various service types such as home healthcare, assisted living, and hospice care, each catering to different needs of elderly individuals. The market continues to evolve, driven by both demographic trends and technological advancements that aim to improve care delivery and accessibility. Geriatric care services are instrumental in ensuring that older adults live healthier, safer lives, and that their care needs are met as they age.

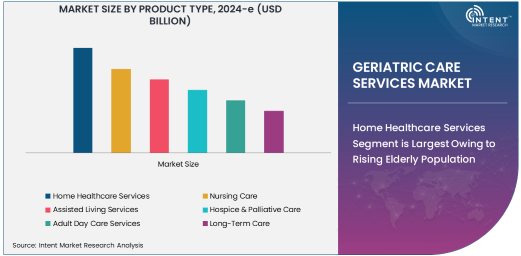

Home Healthcare Services Segment is Largest Owing to Rising Elderly Population

Among the product types in geriatric care services, home healthcare services represent the largest segment. The increasing elderly population globally, especially in developed regions, has led to a surge in demand for home healthcare. Elderly individuals often prefer receiving care in the comfort of their own homes rather than moving into facilities. Home healthcare includes a variety of services such as nursing care, physical therapy, personal care, and monitoring of chronic conditions. This segment benefits from advancements in telemedicine, allowing healthcare providers to monitor patients remotely, reducing hospital visits and associated healthcare costs. Additionally, the preference for personalized care tailored to individual needs has made home healthcare a top choice.

Telehealth Services Segment is Fastest Growing Owing to Technological Advancements

Telehealth services have seen tremendous growth in recent years, making it the fastest growing segment in the geriatric care services market. This trend is driven by advances in digital health technologies and the growing adoption of remote monitoring tools for elderly patients. Telehealth services allow caregivers and healthcare professionals to remotely monitor the health of senior citizens, provide virtual consultations, and offer follow-up care. This not only improves access to healthcare but also reduces the need for elderly individuals to travel for in-person visits. The COVID-19 pandemic accelerated the adoption of telehealth, and its benefits, such as convenience, accessibility, and cost-effectiveness, have contributed to its continued expansion in the geriatric care space.

Hospitals & Healthcare Providers Segment is Largest End-User Industry Owing to Need for Specialized Geriatric Care

Hospitals and healthcare providers form the largest end-user industry within the geriatric care services market. The demand for specialized geriatric care services has increased in hospitals due to the rising prevalence of chronic diseases, mobility issues, and other health concerns in the aging population. Healthcare providers, including hospitals and private care facilities, are integral in delivering the medical treatments and therapies needed by elderly patients. Hospitals are well-equipped to provide both emergency and ongoing care, including advanced treatments for those with multiple health issues, making them a crucial part of the healthcare landscape for the elderly. As the elderly population grows, healthcare providers continue to invest in specialized services for aging individuals.

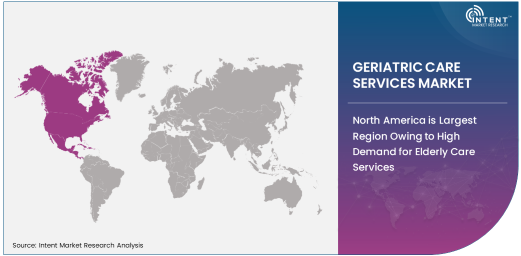

North America is Largest Region Owing to High Demand for Elderly Care Services

North America is the largest region in the geriatric care services market, primarily driven by the aging population in countries like the United States and Canada. The demand for senior care services in this region is substantial, given the high life expectancy and large elderly population. North American countries also have well-established healthcare infrastructure, which makes it easier for elderly individuals to access a wide range of care options, from in-home care to long-term institutional care. The rise of chronic diseases such as diabetes and cardiovascular issues further boosts the demand for geriatric care. Additionally, the region’s advancements in healthcare technologies, including telemedicine, are making geriatric care more accessible and efficient, further strengthening its position as the largest market.

Leading Companies and Competitive Landscape

The competitive landscape in the geriatric care services market includes a number of leading players that are well-established in providing various care services for the elderly. Companies like Brookdale Senior Living, Amedisys Inc., LHC Group, and Addus HomeCare dominate the market with their extensive network of healthcare providers and homecare agencies. These companies continue to expand their services through mergers, acquisitions, and partnerships to tap into new regions and strengthen their offerings. In addition, some companies have embraced digital health solutions such as telehealth and remote monitoring to cater to the increasing demand for more efficient and accessible care. With the growing adoption of technology in healthcare services, companies that invest in innovations like AI-powered healthcare solutions, personalized care, and telemedicine are expected to maintain a competitive edge in the geriatric care services market

Recent Developments:

- Brookdale Senior Living launched a new telehealth service for elderly patients, improving healthcare access and allowing remote monitoring.

- Amedisys, Inc. announced the acquisition of a leading home healthcare provider, expanding its service offerings in geriatric care.

- Visiting Angels expanded its reach with new franchising opportunities, enabling better access to in-home care services across various regions.

- Addus HomeCare Corporation received regulatory approval for a partnership with state agencies to enhance elderly care services in underserved areas.

- Kindred Healthcare integrated advanced AI-driven patient monitoring technologies into its service offerings, improving the quality of care for elderly patients.

List of Leading Companies:

- Brookdale Senior Living, Inc.

- Amedisys, Inc.

- LHC Group, Inc.

- Amedisys Healthcare Solutions

- Addus HomeCare Corporation

- Comfort Keepers

- Kindred Healthcare

- The Ensign Group

- Visiting Angels

- Sunrise Senior Living

- Genesis HealthCare

- The Good Samaritan Society

- Senior Care Centers of America

- Omnicare, Inc.

- Bayada Home Health Care

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1,041.1 Billion |

|

Forecasted Value (2030) |

USD 2,391.3 Billion |

|

CAGR (2025 – 2030) |

12.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Geriatric Care Services Market By Product Type (Home Healthcare Services, Nursing Care, Assisted Living Services, Hospice & Palliative Care, Adult Day Care Services, Long-Term Care), By Service Type (In-Home Care Services, Facility-Based Care, Telehealth Services, Rehabilitation Services), By End-User Industry (Hospitals & Healthcare Providers, Homecare Agencies, Assisted Living Facilities, Nursing Homes, Government Agencies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Brookdale Senior Living, Inc., Amedisys, Inc., LHC Group, Inc., Amedisys Healthcare Solutions, Addus HomeCare Corporation, Comfort Keepers, Kindred Healthcare, The Ensign Group, Visiting Angels, Sunrise Senior Living, Genesis HealthCare, The Good Samaritan Society, Senior Care Centers of America, Omnicare, Inc., Bayada Home Health Care |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Geriatric Care Services Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Home Healthcare Services |

|

4.2. Nursing Care |

|

4.3. Assisted Living Services |

|

4.4. Hospice & Palliative Care |

|

4.5. Adult Day Care Services |

|

4.6. Long-Term Care |

|

5. Geriatric Care Services Market, by Service Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. In-Home Care Services |

|

5.2. Facility-Based Care |

|

5.3. Telehealth Services |

|

5.4. Rehabilitation Services |

|

6. Geriatric Care Services Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Hospitals & Healthcare Providers |

|

6.2. Homecare Agencies |

|

6.3. Assisted Living Facilities |

|

6.4. Nursing Homes |

|

6.5. Government Agencies |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Geriatric Care Services Market, by Product Type |

|

7.2.7. North America Geriatric Care Services Market, by Service Type |

|

7.2.8. North America Geriatric Care Services Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Geriatric Care Services Market, by Product Type |

|

7.2.9.1.2. US Geriatric Care Services Market, by Service Type |

|

7.2.9.1.3. US Geriatric Care Services Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Brookdale Senior Living, Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Amedisys, Inc. |

|

9.3. LHC Group, Inc. |

|

9.4. Amedisys Healthcare Solutions |

|

9.5. Addus HomeCare Corporation |

|

9.6. Comfort Keepers |

|

9.7. Kindred Healthcare |

|

9.8. The Ensign Group |

|

9.9. Visiting Angels |

|

9.10. Sunrise Senior Living |

|

9.11. Genesis HealthCare |

|

9.12. The Good Samaritan Society |

|

9.13. Senior Care Centers of America |

|

9.14. Omnicare, Inc. |

|

9.15. Bayada Home Health Care |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Geriatric Care Services Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Geriatric Care Services Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Geriatric Care Services Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA