As per Intent Market Research, the Geospatial Solutions Market was valued at USD 72.6 billion in 2024-e and will surpass USD 141.1 billion by 2030; growing at a CAGR of 10.0% during 2025 - 2030.

The geospatial solutions market is rapidly growing, driven by technological advancements in location-based data and the increasing need for accurate spatial information across industries. Geospatial solutions, which encompass hardware, software, and services, enable organizations to capture, analyze, and interpret geographic data for a wide range of applications, from urban planning to environmental management. The use of these solutions is expanding in industries such as agriculture, government, defense, and energy, as they enhance decision-making processes, improve operational efficiency, and support sustainable practices. The market is poised for continued growth as the demand for real-time, location-based intelligence intensifies.

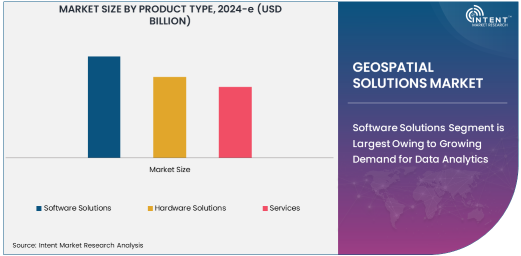

Software Solutions Segment is Largest Owing to Growing Demand for Data Analytics

Among the various product types in the geospatial solutions market, software solutions dominate due to the increasing reliance on data analytics and decision-making tools. Software platforms, including Geographic Information Systems (GIS) and geospatial data analytics tools, are essential for processing and visualizing geographic data. These tools allow businesses and government agencies to make informed decisions, such as identifying new infrastructure locations, planning agricultural operations, or managing environmental risks. Additionally, software solutions are highly scalable, customizable, and can be integrated with other systems, further increasing their adoption across industries.

The GIS software market, in particular, is seeing high demand due to its critical role in mapping and spatial analysis. With advancements in cloud computing and artificial intelligence, these software solutions are becoming even more powerful, enabling users to perform complex analyses and gain deeper insights. This growth trend is expected to continue as organizations seek to leverage data for operational optimization, disaster response, and urban planning.

Remote Sensing Technology is Fastest Growing Owing to Advancements in Satellite and Drone Data

In the technology segment, remote sensing is the fastest-growing area within geospatial solutions, fueled by advancements in satellite and drone technology. Remote sensing provides critical data for mapping, monitoring, and analyzing geographic areas, enabling more accurate predictions and insights. The use of satellites and unmanned aerial vehicles (UAVs) is becoming increasingly popular in industries such as agriculture, environmental monitoring, and disaster management. These technologies capture high-resolution imagery and provide real-time data that can be used for a variety of purposes, such as crop health monitoring, deforestation tracking, and assessing natural disaster impact.

As the cost of drone technology continues to decrease and the capabilities of satellite imagery improve, the adoption of remote sensing is expected to accelerate, with more industries relying on this technology to gain actionable intelligence. The integration of AI and machine learning with remote sensing data is enhancing its ability to detect patterns and automate decision-making processes, driving further growth in the market.

Agriculture Industry is Largest End-User Owing to Precision Farming and Sustainability Efforts

In the end-user industry segment, agriculture is the largest sector leveraging geospatial solutions. Precision farming, which uses GPS, remote sensing, and GIS, allows farmers to monitor crop conditions, optimize irrigation, and manage resources more effectively. These solutions help in improving yield, reducing costs, and ensuring sustainable agricultural practices. As climate change poses challenges to crop productivity, farmers are increasingly turning to geospatial solutions to mitigate risks such as droughts, pest infestations, and soil erosion.

Geospatial technologies also play a significant role in land-use planning and environmental monitoring within the agriculture sector, assisting in soil analysis, crop rotation planning, and optimizing land resources. The integration of AI and machine learning in geospatial tools is further enhancing the accuracy and efficiency of these applications, making agriculture a key beneficiary of geospatial solutions.

Disaster Management and Response Application is Fastest Growing Owing to Climate Change and Natural Disasters

Among the various applications of geospatial solutions, disaster management and response is the fastest-growing due to the increasing frequency of natural disasters and the growing need for effective mitigation strategies. Geospatial solutions enable authorities to assess disaster risks, manage evacuation plans, and allocate resources efficiently during emergency situations. Technologies such as remote sensing, GIS, and AI-based data analytics allow for real-time monitoring of disaster-stricken areas, providing critical information that supports timely interventions.

The demand for geospatial solutions in disaster management is expected to increase as climate change contributes to the rising frequency and intensity of natural disasters. Governments and NGOs are increasingly relying on geospatial tools to coordinate disaster relief efforts, plan for future events, and minimize the impact of such crises. The ability to predict, monitor, and respond rapidly to natural disasters will continue to drive innovation and adoption in this application.

North America is Largest Region Owing to Government Investments and Technological Advancements

Geographically, North America is the largest region for geospatial solutions, driven by significant investments from both government and private sectors. The region has seen widespread adoption of geospatial technologies in industries such as defense, agriculture, and transportation, where accurate, location-based data is crucial for operational efficiency and security. The presence of leading geospatial solution providers in the United States, coupled with government support for infrastructure and urban development, has further fueled market growth.

Additionally, North America's technological infrastructure supports the widespread implementation of advanced geospatial tools, such as remote sensing satellites and AI-powered analytics. As industries in the region continue to explore the benefits of geospatial solutions, the demand for these technologies is expected to remain robust, maintaining North America’s position as the largest market.

Competitive Landscape: Leading Companies Driving Innovation

The geospatial solutions market is highly competitive, with several global players leading innovation in the sector. Esri, Trimble, Hexagon AB, and Autodesk are some of the top companies providing advanced GIS software and geospatial services to a wide range of industries. These companies have been continuously investing in research and development to enhance the capabilities of their geospatial platforms, offering solutions that integrate AI, machine learning, and cloud computing to deliver more efficient and powerful tools.

Partnerships, acquisitions, and product launches are common in this market as companies aim to expand their market share and technological offerings. For instance, Trimble has recently acquired several firms to enhance its positioning in the geospatial software and solutions space, while Esri has expanded its cloud-based GIS solutions to meet the increasing demand for scalable and flexible geospatial analytics. As the market continues to evolve, companies that can innovate and provide integrated, user-friendly geospatial solutions will likely lead the way in this growing industry

Recent Developments:

- Esri launched the latest version of its ArcGIS software with new advanced spatial analytics capabilities, enabling more precise mapping for various industries.

- Trimble Inc. announced its acquisition of Accu-Bid to expand its geospatial and construction technology portfolio, strengthening its position in the market.

- Hexagon AB unveiled new geospatial analytics tools powered by artificial intelligence, providing enhanced data insights for urban planning and environmental management.

- Maxar Technologies received regulatory approval for its new satellite imagery platform, which will support industries like defense and agriculture with real-time, high-resolution data.

- Bentley Systems introduced a cloud-based geospatial data management solution to improve the handling and analysis of infrastructure data for large-scale projects.

List of Leading Companies:

- Esri

- Trimble Inc.

- Autodesk

- Hexagon AB

- Topcon Corporation

- Garmin Ltd.

- Intel Corporation

- Google Inc.

- Microsoft Corporation

- DigitalGlobe

- Harris Corporation

- Flir Systems

- Maxar Technologies

- Bentley Systems

- ERDAS (A Hexagon Company)

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 72.6 Billion |

|

Forecasted Value (2030) |

USD 141.1 Billion |

|

CAGR (2025 – 2030) |

10.0% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Geospatial Solutions Market By Product Type (Software Solutions, Hardware Solutions, Services), By Technology (Geographic Information System (GIS), Remote Sensing, Global Positioning System (GPS), Mapping and Navigation Technologies, Geospatial Data Analytics), By End-User Industry (Agriculture, Government & Defense, Oil & Gas, Energy & Utilities, Transportation & Logistics, Urban Planning, Environmental Management, Mining & Exploration), and By Application (Asset Management, Infrastructure Planning and Management, Environmental Monitoring, Disaster Management and Response, Smart Cities and Urban Planning, Agriculture and Land Use Management, Transportation and Logistics Management) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Esri, Trimble Inc., Autodesk, Hexagon AB, Topcon Corporation, Garmin Ltd., Intel Corporation, Google Inc., Microsoft Corporation, DigitalGlobe, Harris Corporation, Flir Systems, Maxar Technologies, Bentley Systems, ERDAS (A Hexagon Company) |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Geospatial Solutions Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Software Solutions |

|

4.2. Hardware Solutions |

|

4.3. Services |

|

5. Geospatial Solutions Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Geographic Information System (GIS) |

|

5.2. Remote Sensing |

|

5.3. Global Positioning System (GPS) |

|

5.4. Mapping and Navigation Technologies |

|

5.5. Geospatial Data Analytics |

|

6. Geospatial Solutions Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Agriculture |

|

6.2. Government & Defense |

|

6.3. Oil & Gas |

|

6.4. Energy & Utilities |

|

6.5. Transportation & Logistics |

|

6.6. Urban Planning |

|

6.7. Environmental Management |

|

6.8. Mining & Exploration |

|

7. Geospatial Solutions Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Asset Management |

|

7.2. Infrastructure Planning and Management |

|

7.3. Environmental Monitoring |

|

7.4. Disaster Management and Response |

|

7.5. Smart Cities and Urban Planning |

|

7.6. Agriculture and Land Use Management |

|

7.7. Transportation and Logistics Management |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Geospatial Solutions Market, by Product Type |

|

8.2.7. North America Geospatial Solutions Market, by Technology |

|

8.2.8. North America Geospatial Solutions Market, by End-User Industry |

|

8.2.9. North America Geospatial Solutions Market, by Application |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Geospatial Solutions Market, by Product Type |

|

8.2.10.1.2. US Geospatial Solutions Market, by Technology |

|

8.2.10.1.3. US Geospatial Solutions Market, by End-User Industry |

|

8.2.10.1.4. US Geospatial Solutions Market, by Application |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Esri |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Trimble Inc. |

|

10.3. Autodesk |

|

10.4. Hexagon AB |

|

10.5. Topcon Corporation |

|

10.6. Garmin Ltd. |

|

10.7. Intel Corporation |

|

10.8. Google Inc. |

|

10.9. Microsoft Corporation |

|

10.10. DigitalGlobe |

|

10.11. Harris Corporation |

|

10.12. Flir Systems |

|

10.13. Maxar Technologies |

|

10.14. Bentley Systems |

|

10.15. ERDAS (A Hexagon Company) |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Geospatial Imagery Analytics Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Geospatial Imagery Analytics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Geospatial Imagery Analytics Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA