As per Intent Market Research, the Genomics Market was valued at USD 26.3 billion in 2024-e and will surpass USD 89.4 billion by 2030; growing at a CAGR of 19.1% during 2025 - 2030.

The genomics market has witnessed exponential growth over the past few years, driven by advancements in technology and an increasing demand for precision medicine and personalized treatments. Genomics, which involves the study of genes and their functions, plays a crucial role in various fields such as healthcare, agriculture, and biotechnology. With the development of cutting-edge technologies, such as next-generation sequencing (NGS) and CRISPR, genomics is poised to revolutionize how diseases are diagnosed and treated. Additionally, genomic research is essential for understanding the genetic basis of diseases, discovering new drug therapies, and improving agricultural yields.

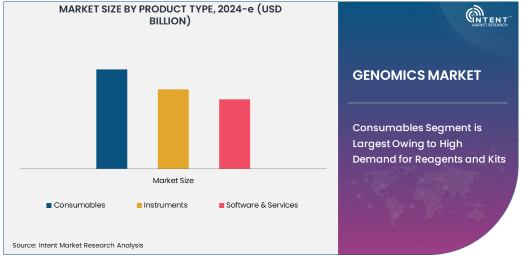

Consumables Segment is Largest Owing to High Demand for Reagents and Kits

In the genomics market, consumables have emerged as the largest subsegment, largely due to the high demand for reagents, kits, and other consumables used in genomic research. Reagents and kits are integral for the preparation of DNA and RNA samples, enabling accurate and efficient genomic analysis. Their widespread use in both research and clinical applications is driving the growth of this segment. With the increasing use of genomic tools for disease diagnostics, personalized medicine, and drug discovery, consumables are critical for supporting these applications. As the adoption of genomics in healthcare and research accelerates, the demand for consumables is expected to continue rising.

Next-Generation Sequencing (NGS) is Fastest Growing Technology Due to Precision and Efficiency

Among the various technologies in the genomics market, next-generation sequencing (NGS) is experiencing the fastest growth. NGS allows for the rapid sequencing of DNA and RNA, enabling researchers to decode genetic material quickly and accurately. The technology’s ability to produce large volumes of high-quality data in a short time has made it an invaluable tool for genomic research and diagnostics. It is particularly instrumental in personalized medicine, where genomic data is used to tailor treatments to individual patients. As the technology becomes more affordable and accessible, NGS is expected to play a pivotal role in advancing genomics research and clinical applications.

Disease Diagnostics Application is Largest Due to Widespread Adoption in Healthcare

Among the various applications of genomics, disease diagnostics stands as the largest, owing to its widespread adoption in healthcare settings. Genomic testing is increasingly being used to diagnose genetic disorders, identify cancer mutations, and detect infectious diseases. With the growing emphasis on early detection and personalized treatment plans, the demand for genomic diagnostics has surged. Advances in genomic testing technologies, such as PCR and NGS, have enabled faster, more accurate diagnoses, particularly in oncology and rare genetic diseases. As healthcare providers continue to embrace genomics for precision diagnostics, this application segment is expected to remain the dominant driver of market growth.

Pharmaceutical & Biotechnology Companies Drive Market Growth in End-User Industry

In the genomics market’s end-user industry, pharmaceutical and biotechnology companies are the largest segment. These companies rely heavily on genomics to discover new drugs, develop gene therapies, and enhance the effectiveness of existing medications. With the increasing focus on personalized medicine, pharmaceutical companies are leveraging genomic data to better understand patient responses to treatments and to create targeted therapies. Additionally, biotechnology firms are using genomic technologies such as CRISPR for gene editing and therapeutic development. As the pharmaceutical and biotechnology sectors continue to embrace genomics in drug development, this segment is poised for sustained growth in the coming years.

Largest Region: North America Leads the Genomics Market

North America is the largest region in the genomics market, driven by the strong presence of leading genomic companies and substantial investments in research and development. The United States, in particular, is home to many key players in the genomics space, such as Illumina, Thermo Fisher Scientific, and Roche Diagnostics. Additionally, the region has well-established healthcare systems that are increasingly incorporating genomic technologies for disease diagnosis, drug development, and personalized medicine. The availability of advanced infrastructure, government funding for research, and a high adoption rate of genomic technologies contribute to North America's dominance in the global market. As genomic research continues to expand, North America is expected to maintain its position as the largest market for genomics.

Competitive Landscape and Leading Companies

The competitive landscape of the genomics market is highly dynamic, with numerous companies at the forefront of technological innovation and product development. Leading companies in the genomics market include Illumina Inc., Thermo Fisher Scientific, Roche Diagnostics, Agilent Technologies, and Bio-Rad Laboratories. These companies are continuously advancing genomic technologies, developing new products, and expanding their portfolios to cater to the growing demand for genomic testing, research, and drug development.

Companies are also engaging in strategic partnerships, acquisitions, and collaborations to enhance their product offerings and market reach. For example, collaborations between pharmaceutical companies and genomics firms are becoming increasingly common, as they aim to integrate genomic data into drug discovery and clinical trials. As the genomics market continues to evolve, competition is expected to intensify, with both established players and new entrants striving to gain a competitive edge through technological innovation, product diversification, and strategic alliances.

Recent Developments:

- Illumina - Launched the NovaSeq 6000 system, offering enhanced sequencing capabilities for both research and clinical applications.

- Thermo Fisher Scientific - Acquired Mesa Biotech, expanding its molecular diagnostics portfolio, particularly in point-of-care testing.

- Roche - Partnered with Guardant Health to develop a blood-based test for detecting cancer-related genomic alterations.

- QIAGEN - Announced a new collaboration with Gilead Sciences to develop diagnostic solutions using next-gen sequencing technology.

- Oxford Nanopore Technologies - Received FDA clearance for its Flongle platform, a portable DNA sequencing device for rapid diagnostic applications

List of Leading Companies:

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- Roche Diagnostics

- Agilent Technologies

- Pacific Biosciences of California, Inc.

- Bio-Rad Laboratories

- PerkinElmer, Inc.

- QIAGEN N.V.

- BGI Group

- Thermo Fisher Scientific Inc.

- Oxford Nanopore Technologies

- Danaher Corporation

- 23andMe Inc.

- Invitae Corporation

- Guardant Health

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 26.3 Billion |

|

Forecasted Value (2030) |

USD 89.4 Billion |

|

CAGR (2025 – 2030) |

19.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Genomics Market By Product Type (Consumables, Instruments, Software & Services), By Technology (Next-Generation Sequencing, Polymerase Chain Reaction, Microarrays, CRISPR Technology, Mass Spectrometry), By Application (Disease Diagnostics, Drug Discovery & Development, Personalized Medicine, Agricultural Genomics, Forensic Applications), By End-User Industry (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Healthcare Providers, Agriculture & Environmental Research, Government Agencies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Illumina Inc., Thermo Fisher Scientific Inc., Roche Diagnostics, Agilent Technologies, Pacific Biosciences of California, Inc., Bio-Rad Laboratories, PerkinElmer, Inc., QIAGEN N.V., BGI Group, Thermo Fisher Scientific Inc., Oxford Nanopore Technologies, Danaher Corporation, 23andMe Inc., Invitae Corporation, Guardant Health |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Genomics Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Consumables |

|

4.2. Instruments |

|

4.3. Software & Services |

|

5. Genomics Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Next-Generation Sequencing (NGS) |

|

5.2. Polymerase Chain Reaction (PCR) |

|

5.3. Microarrays |

|

5.4. CRISPR Technology |

|

5.5. Mass Spectrometry |

|

6. Genomics Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Disease Diagnostics |

|

6.2. Drug Discovery & Development |

|

6.3. Personalized Medicine |

|

6.4. Agricultural Genomics |

|

6.5. Forensic Applications |

|

7. Genomics Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Pharmaceutical & Biotechnology Companies |

|

7.2. Academic & Research Institutes |

|

7.3. Healthcare Providers |

|

7.4. Agriculture & Environmental Research |

|

7.5. Government Agencies |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Genomics Market, by Product Type |

|

8.2.7. North America Genomics Market, by Technology |

|

8.2.8. North America Genomics Market, by Application |

|

8.2.9. North America Genomics Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Genomics Market, by Product Type |

|

8.2.10.1.2. US Genomics Market, by Technology |

|

8.2.10.1.3. US Genomics Market, by Application |

|

8.2.10.1.4. US Genomics Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Illumina Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Thermo Fisher Scientific Inc. |

|

10.3. Roche Diagnostics |

|

10.4. Agilent Technologies |

|

10.5. Pacific Biosciences of California, Inc. |

|

10.6. Bio-Rad Laboratories |

|

10.7. PerkinElmer, Inc. |

|

10.8. QIAGEN N.V. |

|

10.9. BGI Group |

|

10.10. Thermo Fisher Scientific Inc. |

|

10.11. Oxford Nanopore Technologies |

|

10.12. Danaher Corporation |

|

10.13. 23andMe Inc. |

|

10.14. Invitae Corporation |

|

10.15. Guardant Health |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Genomics Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Genomics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Genomics Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA