As per Intent Market Research, the Genetic Analysis Market was valued at USD 13.8 billion in 2024-e and will surpass USD 38.0 billion by 2030; growing at a CAGR of 15.6% during 2025 - 2030.

The global genetic analysis market is evolving rapidly due to significant advancements in biotechnology, research, and diagnostic capabilities. The increasing demand for personalized medicine, coupled with a growing focus on genomic research, is driving market growth. As genomic data collection and analysis become more accessible, various industries, including healthcare, agriculture, and research, are leveraging genetic analysis for a wide array of applications. Furthermore, developments in sequencing technologies, alongside decreasing costs, are accelerating adoption across regions. As a result, the genetic analysis market is poised for continued growth, with applications spanning clinical diagnostics, drug discovery, and even forensic science.

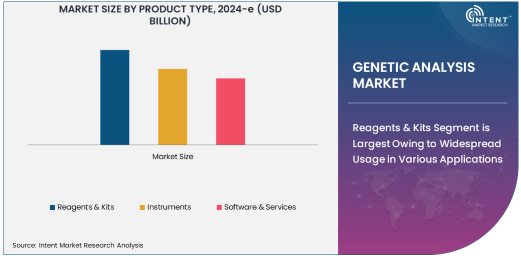

Reagents & Kits Segment is Largest Owing to Widespread Usage in Various Applications

Among the product types in the genetic analysis market, reagents and kits hold the largest market share. These products are crucial for various genetic testing processes, including PCR, NGS, and microarray analysis. Reagents and kits are used extensively across clinical diagnostics, personalized medicine, and research applications, contributing significantly to their widespread adoption. The simplicity, cost-effectiveness, and consistency these products provide make them indispensable in genetic analysis workflows. They are fundamental for facilitating precision medicine and enabling high-throughput sequencing in research environments. Their role in clinical diagnostics for detecting genetic disorders and diseases, as well as their ability to assist in drug discovery and development, make them a dominant segment within the market.

Next-Generation Sequencing (NGS) Technology is Fastest Growing Due to Its Accuracy and Cost-Efficiency

In terms of technology, Next-Generation Sequencing (NGS) is experiencing the fastest growth. NGS technology offers high-throughput, cost-efficient, and precise genomic sequencing, making it a game-changer in the genetic analysis landscape. This technology has revolutionized the way genetic data is gathered and analyzed, enabling faster and more detailed insights into the human genome. Its applications span across clinical diagnostics, personalized medicine, drug discovery, and oncology. The ability to sequence genomes rapidly and at lower costs than traditional methods has led to a surge in adoption. Furthermore, advancements in NGS technologies continue to enhance its accuracy and reduce errors, making it the go-to technology for genetic analysis.

Clinical Diagnostics Application is Largest Owing to High Demand for Genetic Testing

Clinical diagnostics is the largest application segment within the genetic analysis market. Genetic testing plays a critical role in diagnosing various genetic disorders, identifying risk factors for diseases, and guiding the development of personalized treatment plans. The demand for genetic diagnostics has surged, driven by advancements in genetic technologies such as PCR and NGS, which enable rapid and accurate testing. The need for genetic analysis in clinical settings is compounded by the growing prevalence of genetic disorders, cancer, and other chronic diseases that benefit from early detection. Moreover, clinical diagnostics provides critical insights for decision-making, thus playing a pivotal role in patient care, especially in oncology and prenatal testing.

Healthcare & Diagnostics End-User Industry is Largest Due to Rising Demand for Precision Medicine

Among the end-user industries, healthcare and diagnostics represent the largest segment in the genetic analysis market. The rise of precision medicine, which tailors treatment based on individual genetic profiles, has contributed significantly to the expansion of this segment. Healthcare providers are increasingly integrating genetic analysis into their diagnostics, leading to more accurate diagnoses and more effective, personalized treatment options. Furthermore, the aging population and the rise in chronic conditions such as cancer and genetic disorders are increasing the demand for genetic testing and diagnostics in healthcare. The ability to provide tailored medical treatments based on a person’s genetic makeup has made genetic analysis indispensable in clinical care.

North America is the Largest Region Owing to Robust Healthcare Infrastructure and R&D Investment

North America is the largest region in the genetic analysis market, owing to its well-established healthcare infrastructure, significant investments in genomic research, and widespread adoption of advanced genetic technologies. The United States, in particular, stands out due to its dominance in both the healthcare and biotechnology sectors. Furthermore, the presence of leading companies in genetic testing, such as Illumina and Thermo Fisher Scientific, boosts market growth. The region’s high level of investment in research and development ensures continuous innovation in genetic analysis tools and technologies. Additionally, North America's regulatory environment supports the expansion of genetic analysis applications, contributing to the region’s continued market leadership.

Competitive Landscape and Leading Companies

The genetic analysis market is highly competitive, with key players leading in technology development and product offerings. Thermo Fisher Scientific, Illumina, QIAGEN, Roche Diagnostics, and Agilent Technologies are among the leading companies that dominate the market. These companies are focused on continuous innovation and strategic collaborations to maintain their positions. Additionally, mergers and acquisitions are common, as companies seek to broaden their product portfolios and expand into emerging markets. For instance, companies like Thermo Fisher have made acquisitions to enhance their genomics capabilities, while Illumina remains a leader in sequencing technologies. The competitive landscape is expected to remain dynamic, with constant advancements in sequencing technologies, reagents, and diagnostic applications driving the evolution of the market.

Recent Developments:

- Illumina Inc. announced the launch of a new genetic sequencing platform that promises to reduce sequencing costs while increasing accuracy and throughput for genomic research.

- Thermo Fisher Scientific has expanded its genomic offerings by acquiring a leading provider of molecular biology kits to strengthen its position in the genetic analysis market.

- QIAGEN N.V. introduced a next-gen diagnostic platform that integrates genetic testing with advanced data analytics, aimed at accelerating clinical diagnostics in oncology.

- Roche Diagnostics secured FDA approval for a new genetic testing service designed to provide precision treatment recommendations for patients with rare genetic disorders.

- PerkinElmer unveiled a new digital PCR solution that enhances the precision of genetic testing and supports clinical research and diagnostics, particularly in oncology and infectious diseases

List of Leading Companies:

- Thermo Fisher Scientific Inc.

- Illumina Inc.

- Agilent Technologies Inc.

- Roche Diagnostics

- Bio-Rad Laboratories, Inc.

- QIAGEN N.V.

- GE Healthcare Life Sciences

- Becton Dickinson and Company

- PerkinElmer, Inc.

- Oxford Nanopore Technologies Ltd.

- Abbott Laboratories

- Pacific Biosciences of California, Inc.

- Promega Corporation

- Danaher Corporation

- Sysmex Corporation

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 13.8 Billion |

|

Forecasted Value (2030) |

USD 38.0 Billion |

|

CAGR (2025 – 2030) |

15.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Genetic Analysis Market By Product Type (Reagents & Kits, Instruments, Software & Services), By Technology (Polymerase Chain Reaction (PCR), Next-Generation Sequencing (NGS), Microarray, Fluorescence In Situ Hybridization (FISH), Northern Blotting, Western Blotting), By Application (Clinical Diagnostics, Drug Discovery & Development, Agriculture & Animal Genetics, Forensic Science, Personalized Medicine, Research), By End-User Industry (Healthcare & Diagnostics, Research Institutes, Pharmaceutical & Biotechnology Companies, Agricultural & Environmental Sector) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Thermo Fisher Scientific Inc., Illumina Inc., Agilent Technologies Inc., Roche Diagnostics, Bio-Rad Laboratories, Inc., QIAGEN N.V., GE Healthcare Life Sciences, Becton Dickinson and Company, PerkinElmer, Inc., Oxford Nanopore Technologies Ltd., Abbott Laboratories, Pacific Biosciences of California, Inc., Promega Corporation, Danaher Corporation, Sysmex Corporation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Genetic Analysis Market, by Product Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Reagents & Kits |

|

4.2. Instruments |

|

4.3. Software & Services |

|

5. Genetic Analysis Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Polymerase Chain Reaction (PCR) |

|

5.2. Next-Generation Sequencing (NGS) |

|

5.3. Microarray |

|

5.4. Fluorescence In Situ Hybridization (FISH) |

|

5.5. Northern Blotting |

|

5.6. Western Blotting |

|

6. Genetic Analysis Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Clinical Diagnostics |

|

6.2. Drug Discovery & Development |

|

6.3. Agriculture & Animal Genetics |

|

6.4. Forensic Science |

|

6.5. Personalized Medicine |

|

6.6. Research |

|

7. Genetic Analysis Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Healthcare & Diagnostics |

|

7.2. Research Institutes |

|

7.3. Pharmaceutical & Biotechnology Companies |

|

7.4. Agricultural & Environmental Sector |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Genetic Analysis Market, by Product Type |

|

8.2.7. North America Genetic Analysis Market, by Technology |

|

8.2.8. North America Genetic Analysis Market, by Application |

|

8.2.9. North America Genetic Analysis Market, by End-User Industry |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Genetic Analysis Market, by Product Type |

|

8.2.10.1.2. US Genetic Analysis Market, by Technology |

|

8.2.10.1.3. US Genetic Analysis Market, by Application |

|

8.2.10.1.4. US Genetic Analysis Market, by End-User Industry |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Thermo Fisher Scientific Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Illumina Inc. |

|

10.3. Agilent Technologies Inc. |

|

10.4. Roche Diagnostics |

|

10.5. Bio-Rad Laboratories, Inc. |

|

10.6. QIAGEN N.V. |

|

10.7. GE Healthcare Life Sciences |

|

10.8. Becton Dickinson and Company |

|

10.9. PerkinElmer, Inc. |

|

10.10. Oxford Nanopore Technologies Ltd. |

|

10.11. Abbott Laboratories |

|

10.12. Pacific Biosciences of California, Inc. |

|

10.13. Promega Corporation |

|

10.14. Danaher Corporation |

|

10.15. Sysmex Corporation |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Genetic Analysis Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Genetic Analysis Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Genetic Analysis Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA