As per Intent Market Research, the Generic Sterile Injectables Market was valued at USD 9.9 billion in 2024-e and will surpass USD 19.7 billion by 2030; growing at a CAGR of 12.2% during 2025 - 2030.

The global generic sterile injectables market is expanding rapidly, driven by the increasing demand for cost-effective alternatives to branded injectable drugs. Generic sterile injectables, which are widely used in the treatment of a variety of medical conditions, offer the same efficacy as branded counterparts but at a fraction of the cost. This affordability factor, coupled with the rising demand for injectable drugs in hospitals and homecare settings, positions generics as a significant growth driver in the pharmaceutical industry. The market is also bolstered by regulatory initiatives that encourage the development and approval of generic injectables, especially as patents for branded injectables expire.

Factors such as the global aging population, the rising prevalence of chronic diseases, and the increasing preference for injectable therapies over oral medications are contributing to the market's growth. Moreover, the ability to administer injectables in outpatient and homecare settings has expanded the potential reach of these products, offering greater convenience for both healthcare providers and patients. Innovations in packaging, delivery systems, and formulations also play a role in shaping the market dynamics, making generic sterile injectables an essential component of the global healthcare system.

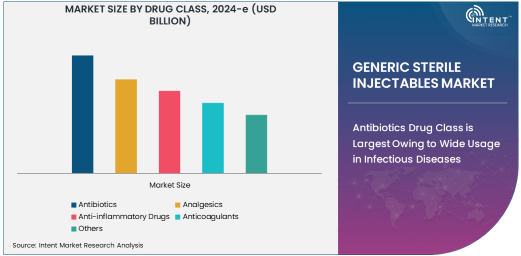

Antibiotics Drug Class is Largest Owing to Wide Usage in Infectious Diseases

The antibiotics segment is the largest drug class within the generic sterile injectables market. Antibiotics are essential for treating a wide range of bacterial infections, making them one of the most frequently prescribed drugs in both inpatient and outpatient settings. With the rise of antibiotic-resistant infections and the need for effective treatments, the demand for injectable antibiotics has surged. These injectables are especially crucial in hospital settings where infections require immediate and potent intervention.

The continued prevalence of infectious diseases, including hospital-acquired infections (HAIs) and conditions like pneumonia, sepsis, and urinary tract infections, contributes to the dominance of antibiotics in the market. Furthermore, antibiotics administered intravenously or intramuscularly provide faster and more efficient delivery compared to oral formulations, which makes them the preferred choice for acute infections. This growth trend is expected to continue, bolstered by advancements in antibiotic formulations and expanded use in therapeutic areas like oncology and immunology.

Prefilled Syringes Packaging Type is Fastest Growing Owing to Convenience and Safety

The prefilled syringes segment is the fastest-growing packaging type within the generic sterile injectables market, driven by the convenience, ease of use, and enhanced safety features they provide. Prefilled syringes offer significant advantages, including reduced preparation time, accurate dosing, and a lower risk of contamination, which makes them highly preferred by both healthcare professionals and patients. These features are particularly beneficial in the context of homecare settings, where patients can self-administer injectable medications without requiring medical supervision.

The demand for prefilled syringes is also growing due to their compatibility with biologics, oncology treatments, and vaccines, which require precision and minimal handling to maintain efficacy. The increasing trend of administering complex treatments at home or in outpatient settings further supports the growth of this segment. Additionally, prefilled syringes reduce the likelihood of needle-stick injuries, addressing safety concerns in healthcare environments and contributing to their market expansion.

Intravenous Route of Administration is Largest Owing to Fast and Direct Delivery

The intravenous (IV) route of administration dominates the market for generic sterile injectables. Intravenous injections offer the advantage of delivering drugs directly into the bloodstream, ensuring rapid onset of action, which is particularly crucial in emergency medical situations. IV injectables are widely used in hospitals for treating conditions that require immediate therapeutic effects, such as severe infections, dehydration, and critical care needs in intensive care units (ICUs).

Furthermore, the IV route is highly preferred in the treatment of chronic conditions like cancer and cardiovascular diseases, where patients need continuous and controlled drug delivery. The ability to administer large volumes of fluid, along with a high level of control over drug dosage and delivery rate, positions the intravenous route as the primary method for many injectable therapies. This broad applicability, combined with ongoing advancements in intravenous drug formulations, ensures that the IV administration route continues to be the largest segment in the generic sterile injectables market.

Infectious Diseases Therapeutic Area is Largest Owing to Growing Global Health Challenges

Infectious diseases represent the largest therapeutic area in the generic sterile injectables market, driven by the increasing global burden of infectious diseases and the need for effective, rapid treatments. Conditions such as pneumonia, sepsis, tuberculosis, and viral infections require timely intervention with injectable antibiotics and antiviral medications to prevent complications and improve patient outcomes. This demand is particularly high in hospital settings, where severe cases of infection need prompt and potent treatment.

The increasing prevalence of hospital-acquired infections (HAIs), the emergence of new infectious pathogens, and the growing threat of antibiotic resistance are key factors propelling the demand for injectable drugs in the infectious diseases therapeutic area. With governments and healthcare organizations prioritizing infection control and management, the market for generic sterile injectables in this area is expected to remain strong. The development of new injectable antibiotics and vaccines further boosts the segment's growth, ensuring its dominance in the market.

Hospitals End-User Segment is Largest Owing to High Patient Volume and Critical Care

The hospitals segment is the largest end-user category in the generic sterile injectables market, owing to the high patient volume and the need for critical care treatments. Hospitals are the primary settings for the administration of injectable drugs, especially for patients who require immediate or intensive care. Sterile injectables are essential in a variety of hospital departments, including emergency rooms, intensive care units (ICUs), oncology wards, and surgical suites.

With the increasing prevalence of chronic diseases and the growing demand for inpatient care, hospitals continue to be the leading consumers of generic sterile injectables. Furthermore, hospitals benefit from the efficiency of prefilled syringes and other advanced packaging technologies, which streamline drug administration and improve patient safety. As hospitals adopt more cost-effective generic alternatives to branded injectables, this segment is expected to maintain its dominant position in the market.

North America is the Largest Region Owing to Healthcare Infrastructure and Market Demand

North America is the largest region for the generic sterile injectables market, driven by the robust healthcare infrastructure, advanced medical technologies, and high demand for injectable treatments. The region's well-established pharmaceutical industry, along with a large number of hospitals and healthcare facilities, positions it as the leading market for sterile injectables. In addition, the high incidence of chronic diseases, infectious diseases, and cancer fuels the demand for injectable medications, especially in the U.S. and Canada.

The regulatory environment in North America also supports the growth of generic injectables, with strong regulatory frameworks that encourage the approval of generic versions of branded drugs. Moreover, the increasing shift toward cost-effective healthcare solutions further drives the demand for generic sterile injectables in the region. This, combined with the presence of major pharmaceutical manufacturers, ensures that North America remains a key hub for the growth of this market.

Competitive Landscape: Innovation and Strategic Partnerships

The generic sterile injectables market is highly competitive, with key players like Sandoz, Teva Pharmaceuticals, Mylan (now part of Viatris), and Fresenius Kabi leading the way. These companies focus on expanding their portfolios by developing generic alternatives to high-cost branded injectables, particularly in high-demand therapeutic areas such as oncology, infectious diseases, and cardiovascular conditions.

Innovation plays a critical role in maintaining a competitive edge, with companies investing in advanced drug delivery systems, such as prefilled syringes, and exploring opportunities in biologics and biosimilars. Strategic partnerships and collaborations with healthcare providers, distributors, and other stakeholders also help companies expand their market reach and strengthen their position in the market. Additionally, as regulatory authorities streamline the approval process for generic injectables, new players are entering the market, further intensifying competition and driving innovation.

Recent Developments:

- In June 2024, Hikma Pharmaceuticals acquired assets from Xellia Pharmaceuticals for up to $185 million, including manufacturing and research facilities.

- In June 2024, Teva launched a generic version of Victoza® (liraglutide injection 1.8 mg) for type 2 diabetes in the U.S.

- Alembic received FDA approval in June 2024 for its generic Icatibant injectable, used for hereditary angioedema treatment.

- Cipla received FDA approval for generic Lanreotide injections in May 2024 for acromegaly and other conditions.

- In September 2023, Meitheal Pharmaceuticals announced plans to launch up to 20 new generic injectables in 2024.

List of Leading Companies:

- Pfizer Inc.

- Fresenius Kabi

- Hikma Pharmaceuticals

- Mylan N.V. (Viatris)

- Teva Pharmaceutical Industries Ltd.

- Sandoz (Novartis)

- Baxter International Inc.

- Amneal Pharmaceuticals

- Sun Pharmaceutical Industries Ltd.

- Cipla Ltd.

- Aurobindo Pharma

- Dr. Reddy’s Laboratories

- Zydus Cadila

- Lupin Pharmaceuticals

- Eli Lilly and Company

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 9.9 billion |

|

Forecasted Value (2030) |

USD 19.7 billion |

|

CAGR (2025 – 2030) |

12.2% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Generic Sterile Injectables Market By Drug Class (Antibiotics, Analgesics, Anti-inflammatory Drugs, Anticoagulants), By Packaging Type (Vials, Prefilled Syringes, Ampoules), By Route of Administration (Intravenous, Intramuscular, Subcutaneous), By Therapeutic Area (Infectious Diseases, Cardiovascular Conditions, Neurological Disorders, Oncology), By End-User (Hospitals, Ambulatory Surgery Centers, Clinics, Homecare Settings) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Pfizer Inc., Fresenius Kabi, Hikma Pharmaceuticals, Mylan N.V. (Viatris), Teva Pharmaceutical Industries Ltd., Sandoz (Novartis), Baxter International Inc., Amneal Pharmaceuticals, Sun Pharmaceutical Industries Ltd., Cipla Ltd., Aurobindo Pharma, Dr. Reddy’s Laboratories, Zydus Cadila, Lupin Pharmaceuticals, Eli Lilly and Company |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Generic Sterile Injectables Market, by Drug Class (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Antibiotics |

|

4.2. Analgesics |

|

4.3. Anti-inflammatory Drugs |

|

4.4. Anticoagulants |

|

4.5. Others |

|

5. Generic Sterile Injectables Market, by Packaging Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Vials |

|

5.2. Prefilled Syringes |

|

5.3. Ampoules |

|

5.4. Others |

|

6. Generic Sterile Injectables Market, by Route of Administration (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Intravenous |

|

6.2. Intramuscular |

|

6.3. Subcutaneous |

|

6.4. Others |

|

7. Generic Sterile Injectables Market, by Therapeutic Area (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Infectious Diseases |

|

7.2. Cardiovascular Conditions |

|

7.3. Neurological Disorders |

|

7.4. Oncology |

|

7.5. Others |

|

8. Generic Sterile Injectables Market, by End-User (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Hospitals |

|

8.2. Ambulatory Surgery Centers |

|

8.3. Clinics |

|

8.4. Homecare Settings |

|

9. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Regional Overview |

|

9.2. North America |

|

9.2.1. Regional Trends & Growth Drivers |

|

9.2.2. Barriers & Challenges |

|

9.2.3. Opportunities |

|

9.2.4. Factor Impact Analysis |

|

9.2.5. Technology Trends |

|

9.2.6. North America Generic Sterile Injectables Market, by Drug Class |

|

9.2.7. North America Generic Sterile Injectables Market, by Packaging Type |

|

9.2.8. North America Generic Sterile Injectables Market, by Route of Administration |

|

9.2.9. North America Generic Sterile Injectables Market, by Therapeutic Area |

|

9.2.10. North America Generic Sterile Injectables Market, by End-User |

|

9.2.11. By Country |

|

9.2.11.1. US |

|

9.2.11.1.1. US Generic Sterile Injectables Market, by Drug Class |

|

9.2.11.1.2. US Generic Sterile Injectables Market, by Packaging Type |

|

9.2.11.1.3. US Generic Sterile Injectables Market, by Route of Administration |

|

9.2.11.1.4. US Generic Sterile Injectables Market, by Therapeutic Area |

|

9.2.11.1.5. US Generic Sterile Injectables Market, by End-User |

|

9.2.11.2. Canada |

|

9.2.11.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

9.3. Europe |

|

9.4. Asia-Pacific |

|

9.5. Latin America |

|

9.6. Middle East & Africa |

|

10. Competitive Landscape |

|

10.1. Overview of the Key Players |

|

10.2. Competitive Ecosystem |

|

10.2.1. Level of Fragmentation |

|

10.2.2. Market Consolidation |

|

10.2.3. Product Innovation |

|

10.3. Company Share Analysis |

|

10.4. Company Benchmarking Matrix |

|

10.4.1. Strategic Overview |

|

10.4.2. Product Innovations |

|

10.5. Start-up Ecosystem |

|

10.6. Strategic Competitive Insights/ Customer Imperatives |

|

10.7. ESG Matrix/ Sustainability Matrix |

|

10.8. Manufacturing Network |

|

10.8.1. Locations |

|

10.8.2. Supply Chain and Logistics |

|

10.8.3. Product Flexibility/Customization |

|

10.8.4. Digital Transformation and Connectivity |

|

10.8.5. Environmental and Regulatory Compliance |

|

10.9. Technology Readiness Level Matrix |

|

10.10. Technology Maturity Curve |

|

10.11. Buying Criteria |

|

11. Company Profiles |

|

11.1. Pfizer Inc. |

|

11.1.1. Company Overview |

|

11.1.2. Company Financials |

|

11.1.3. Product/Service Portfolio |

|

11.1.4. Recent Developments |

|

11.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

11.2. Fresenius Kabi |

|

11.3. Hikma Pharmaceuticals |

|

11.4. Mylan N.V. (Viatris) |

|

11.5. Teva Pharmaceutical Industries Ltd. |

|

11.6. Sandoz (Novartis) |

|

11.7. Baxter International Inc. |

|

11.8. Amneal Pharmaceuticals |

|

11.9. Sun Pharmaceutical Industries Ltd. |

|

11.10. Cipla Ltd. |

|

11.11. Aurobindo Pharma |

|

11.12. Dr. Reddy’s Laboratories |

|

11.13. Zydus Cadila |

|

11.14. Lupin Pharmaceuticals |

|

11.15. Eli Lilly and Company |

|

12. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Generic Sterile Injectables Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Generic Sterile Injectables Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Generic Sterile Injectables Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA