As per Intent Market Research, the Generative AI In Travel Market was valued at USD 1.1 billion in 2024-e and will surpass USD 25.9 billion by 2030; growing at a CAGR of 56.8% during 2025 - 2030.

The generative AI market in the travel industry is evolving rapidly, with businesses seeking advanced solutions to enhance customer experience, optimize operations, and maximize profitability. From personalized recommendations to dynamic pricing optimization, AI technologies such as machine learning, natural language processing (NLP), and computer vision are being increasingly integrated into the travel sector. This technological transformation is being driven by both large enterprises and smaller companies looking to innovate and stay competitive. With key applications across travel agencies, airlines, hotels, and online travel agencies (OTAs), generative AI is poised to redefine how travel services are offered and consumed.

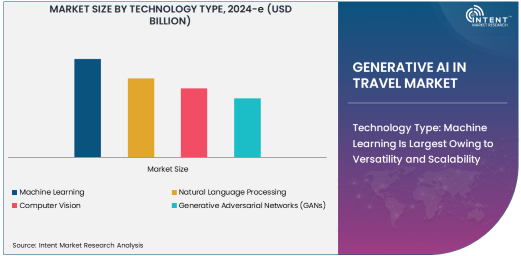

Technology Type: Machine Learning Is Largest Owing to Versatility and Scalability

Machine learning (ML) remains the largest technology type within the generative AI market in travel, primarily due to its versatility and ability to scale across various applications. ML enables travel companies to leverage vast amounts of data for personalized recommendations, dynamic pricing, and improved customer service. By learning from historical data, ML models can predict consumer behavior, optimize booking systems, and streamline travel itineraries. Its adaptability in various scenarios, from fraud detection to customer support automation, has made machine learning a core component in AI-powered travel solutions.

The widespread adoption of ML within travel companies is transforming the way services are provided. For instance, airlines and OTAs use machine learning algorithms to adjust flight prices in real-time based on demand and competitor pricing, while hotels use it to offer tailored experiences to guests. The ability of machine learning models to continually improve with more data makes it the go-to solution for businesses looking to deliver more personalized, efficient, and cost-effective services.

Deployment Type: Cloud-Based Solutions Are Fastest Growing Due to Flexibility and Scalability

Cloud-based solutions are the fastest-growing subsegment in the generative AI in travel market, driven by the increasing demand for flexibility and scalability. Cloud platforms offer travel companies the ability to quickly deploy AI applications without the need for extensive on-premise infrastructure. With the cloud, businesses can scale operations in real time, ensuring they are able to handle large volumes of customer data and respond to changing market conditions with agility. The cloud also enables seamless collaboration across regions, which is crucial for global travel brands.

The rise of cloud-based AI solutions is especially beneficial to smaller travel businesses and startups that may not have the resources to invest in on-premise systems. With cloud infrastructure, these companies can access the same powerful AI tools used by larger enterprises, helping them compete in an increasingly competitive market. Additionally, the cloud allows for faster updates, continuous improvements to AI models, and easier integration of new AI technologies, all of which are key drivers of cloud adoption in the travel sector.

Application: Personalized Recommendations Are Largest Owing to Consumer Demand

Personalized recommendations stand out as the largest application of generative AI in the travel industry, driven by growing consumer expectations for tailored experiences. With the vast amount of data collected from customers, AI-powered systems can predict travel preferences and suggest destinations, accommodations, and activities that match individual tastes. Personalized recommendations not only enhance the customer experience but also increase conversion rates, as travelers are more likely to book services that align with their specific interests.

Travel companies are leveraging this AI application to enhance their services across multiple touchpoints. For example, online travel agencies (OTAs) like Expedia and Booking.com use AI to recommend hotels, flights, and car rentals based on a user’s search history and past bookings. Similarly, airlines and hotel chains use AI to personalize offers and promotions for travelers, thereby increasing loyalty and customer satisfaction. As customer-centric services become more crucial in the travel industry, the demand for AI-driven personalized recommendations is expected to grow, solidifying its position as the largest application.

End-Use Industry: Online Travel Agencies (OTAs) Are Largest Due to Digital Transformation

Online travel agencies (OTAs) are the largest end-user industry in the generative AI market within travel. OTAs like Expedia, Booking.com, and Airbnb are increasingly integrating AI into their platforms to enhance the user experience and optimize business operations. These platforms rely heavily on AI technologies to manage vast inventories, provide personalized recommendations, and dynamically adjust prices. Moreover, AI solutions help OTAs improve their customer service capabilities by implementing chatbots and AI-driven customer support systems.

The shift towards digital and mobile-first strategies in the travel industry has led OTAs to adopt AI at an accelerated pace. The ability to offer personalized, real-time services has become a critical factor for success, and AI solutions are enabling OTAs to meet these demands effectively. As more consumers turn to online platforms for booking their travel experiences, OTAs are expected to remain at the forefront of AI adoption in the travel sector.

Solution Type: Software Solutions Are Dominating the Market

Software solutions are the dominant subsegment in the generative AI in travel market, primarily due to their scalability and adaptability across different applications. AI software solutions help travel companies automate and enhance various processes, from dynamic pricing and fraud detection to customer support and personalized marketing. These software applications are designed to be integrated into existing systems, providing businesses with AI capabilities without having to overhaul their entire infrastructure.

Travel companies, both large and small, are increasingly adopting AI-powered software to stay competitive. These solutions allow companies to harness the power of machine learning, NLP, and other AI technologies to improve operational efficiency, reduce costs, and enhance customer experience. The growing demand for software solutions reflects the broader trend of digital transformation in the travel industry, where automation and AI are key to improving business outcomes and meeting evolving customer expectations.

Business Size: Large Enterprises Are Leading the Adoption of AI

Large enterprises lead the way in the adoption of generative AI within the travel industry, primarily due to their vast resources and complex operational requirements. Large-scale travel providers, including major airlines, OTAs, and hotel chains, are deploying AI-powered solutions to optimize everything from booking systems to customer service. These companies have the capital and infrastructure to integrate sophisticated AI technologies at scale, making them the largest adopters of AI in the travel market.

In addition, large enterprises are investing heavily in AI research and development to stay ahead of the competition. By leveraging AI, these companies can enhance operational efficiency, reduce costs, and offer highly personalized services to customers. As AI technologies continue to advance, large travel companies are expected to maintain their position as the leading drivers of AI adoption in the industry.

Region: North America is the Largest Market for Generative AI in Travel

North America is the largest market for generative AI in the travel industry, driven by the region’s technological advancements, high adoption of AI solutions, and the presence of leading companies in the travel and tech sectors. The United States, in particular, is home to numerous global players in the travel industry, such as Expedia, Airbnb, and Booking.com, who are actively integrating AI into their operations. Furthermore, the region boasts a well-developed digital infrastructure and a large customer base, making it an ideal market for AI adoption.

As the demand for personalized services, dynamic pricing, and optimized travel planning grows, North America is expected to continue leading the global generative AI market in travel. With a strong focus on digital transformation and innovation, the region is set to maintain its position as a key hub for AI development and adoption in the travel industry.

Competitive Landscape and Leading Companies

The competitive landscape for generative AI in the travel market is dominated by major players in both the travel and technology sectors. Leading companies include IBM, Google Cloud, Microsoft, Accenture, Amadeus IT Group, and Booking Holdings. These companies are actively working on developing AI-driven solutions to address the unique challenges faced by the travel industry, such as personalization, pricing optimization, and customer support.

In addition to large enterprises, there are a growing number of startups and smaller companies focusing on AI-driven travel solutions. These companies are often at the forefront of innovation, offering niche solutions that address specific challenges within the travel sector. As AI technology continues to evolve, the competition among established players and emerging companies is expected to intensify, driving further advancements and adoption of AI across the travel industry

Recent Developments:

- IBM announced the launch of a new AI-powered solution for travel agencies, designed to enhance personalized travel recommendations and automate customer service interactions.

- Google Cloud collaborated with a leading online travel agency to integrate generative AI into their booking platforms, aiming to optimize pricing strategies and improve customer engagement.

- Amadeus IT Group unveiled a new AI-driven tool for airlines, designed to optimize flight scheduling and enhance the passenger experience by predicting delays and offering personalized travel updates.

- Booking Holdings expanded its AI-driven recommendations system, allowing users to receive more accurate travel suggestions based on their browsing history and preferences.

- Accenture partnered with a global hotel chain to deploy an AI-powered customer service chatbot that assists guests with booking, room preferences, and real-time requests, enhancing customer satisfaction

List of Leading Companies:

- IBM Corporation

- Google Cloud

- Microsoft Corporation

- Amadeus IT Group

- Accenture

- SAP SE

- Oracle Corporation

- Expedia Group

- Booking Holdings

- Airbnb

- Travelport

- Sabre Corporation

- TCS (Tata Consultancy Services)

- Travel Leaders Group

- Trivago

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 Billion |

|

Forecasted Value (2030) |

USD 25.9 Billion |

|

CAGR (2025 – 2030) |

56.8% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Generative AI in Travel Market By Technology Type (Machine Learning, Natural Language Processing, Computer Vision, Generative Adversarial Networks), By Deployment Type (On-premise, Cloud-based), By Application (Personalized Recommendations, Travel Planning Assistance, Customer Support Chatbots, Dynamic Pricing Optimization, Fraud Detection, Marketing Automation), By End-use Industry (Travel Agencies, Airlines, Hotels & Resorts, Online Travel Agencies, Cruise Lines), By Solution Type (Software, Services), and By Business Size (Large Enterprises, SMEs) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

IBM Corporation, Google Cloud, Microsoft Corporation, Amadeus IT Group, Accenture, SAP SE, Oracle Corporation, Expedia Group, Booking Holdings, Airbnb, Travelport, Sabre Corporation, TCS (Tata Consultancy Services), Travel Leaders Group, Trivago |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Generative AI In Travel Market, by Technology Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Machine Learning |

|

4.2. Natural Language Processing |

|

4.3. Computer Vision |

|

4.4. Generative Adversarial Networks (GANs) |

|

5. Generative AI In Travel Market, by Deployment Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. On-premise |

|

5.2. Cloud-based |

|

6. Generative AI In Travel Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Personalized Recommendations |

|

6.2. Travel Planning Assistance |

|

6.3. Customer Support Chatbots |

|

6.4. Dynamic Pricing Optimization |

|

6.5. Fraud Detection |

|

6.6. Marketing Automation |

|

7. Generative AI In Travel Market, by End-use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Travel Agencies |

|

7.2. Airlines |

|

7.3. Hotels & Resorts |

|

7.4. Online Travel Agencies (OTAs) |

|

7.5. Cruise Lines |

|

8. Generative AI In Travel Market, by Solution Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Software |

|

8.2. Services |

|

9. Generative AI In Travel Market, by Business Size (Market Size & Forecast: USD Million, 2023 – 2030) |

|

9.1. Large Enterprises |

|

9.2. SMEs (Small and Medium Enterprises) |

|

10. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

10.1. Regional Overview |

|

10.2. North America |

|

10.2.1. Regional Trends & Growth Drivers |

|

10.2.2. Barriers & Challenges |

|

10.2.3. Opportunities |

|

10.2.4. Factor Impact Analysis |

|

10.2.5. Technology Trends |

|

10.2.6. North America Generative AI In Travel Market, by Technology Type |

|

10.2.7. North America Generative AI In Travel Market, by Deployment Type |

|

10.2.8. North America Generative AI In Travel Market, by Application |

|

10.2.9. North America Generative AI In Travel Market, by End-use Industry |

|

10.2.10. North America Generative AI In Travel Market, by Solution Type |

|

10.2.11. North America Generative AI In Travel Market, by Business Size |

|

10.2.12. By Country |

|

10.2.12.1. US |

|

10.2.12.1.1. US Generative AI In Travel Market, by Technology Type |

|

10.2.12.1.2. US Generative AI In Travel Market, by Deployment Type |

|

10.2.12.1.3. US Generative AI In Travel Market, by Application |

|

10.2.12.1.4. US Generative AI In Travel Market, by End-use Industry |

|

10.2.12.1.5. US Generative AI In Travel Market, by Solution Type |

|

10.2.12.1.6. US Generative AI In Travel Market, by Business Size |

|

10.2.12.2. Canada |

|

10.2.12.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

10.3. Europe |

|

10.4. Asia-Pacific |

|

10.5. Latin America |

|

10.6. Middle East & Africa |

|

11. Competitive Landscape |

|

11.1. Overview of the Key Players |

|

11.2. Competitive Ecosystem |

|

11.2.1. Level of Fragmentation |

|

11.2.2. Market Consolidation |

|

11.2.3. Product Innovation |

|

11.3. Company Share Analysis |

|

11.4. Company Benchmarking Matrix |

|

11.4.1. Strategic Overview |

|

11.4.2. Product Innovations |

|

11.5. Start-up Ecosystem |

|

11.6. Strategic Competitive Insights/ Customer Imperatives |

|

11.7. ESG Matrix/ Sustainability Matrix |

|

11.8. Manufacturing Network |

|

11.8.1. Locations |

|

11.8.2. Supply Chain and Logistics |

|

11.8.3. Product Flexibility/Customization |

|

11.8.4. Digital Transformation and Connectivity |

|

11.8.5. Environmental and Regulatory Compliance |

|

11.9. Technology Readiness Level Matrix |

|

11.10. Technology Maturity Curve |

|

11.11. Buying Criteria |

|

12. Company Profiles |

|

12.1. IBM Corporation |

|

12.1.1. Company Overview |

|

12.1.2. Company Financials |

|

12.1.3. Product/Service Portfolio |

|

12.1.4. Recent Developments |

|

12.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

12.2. Google Cloud |

|

12.3. Microsoft Corporation |

|

12.4. Amadeus IT Group |

|

12.5. Accenture |

|

12.6. SAP SE |

|

12.7. Oracle Corporation |

|

12.8. Expedia Group |

|

12.9. Booking Holdings |

|

12.10. Airbnb |

|

12.11. Travelport |

|

12.12. Sabre Corporation |

|

12.13. TCS (Tata Consultancy Services) |

|

12.14. Travel Leaders Group |

|

12.15. Trivago |

|

13. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Generative AI in Travel Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Generative AI in Travel Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Generative AI in Travel Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA