As per Intent Market Research, the Generative AI In Medicine Market was valued at USD 2.2 billion in 2024-e and will surpass USD 46.3 billion by 2030; growing at a CAGR of 54.3% during 2025 - 2030.

The Generative AI in Medicine market has been transforming healthcare by offering advanced solutions across a range of applications, from drug discovery to personalized medicine. Leveraging machine learning, deep learning, and other AI techniques, generative AI enables faster, more accurate decision-making processes in both clinical and research settings. The market is gaining momentum as healthcare providers and pharmaceutical companies increasingly adopt AI-driven solutions to optimize treatment outcomes, reduce costs, and accelerate innovation in drug development. The integration of AI technologies into medical applications promises to address existing challenges and pave the way for more efficient and tailored healthcare delivery.

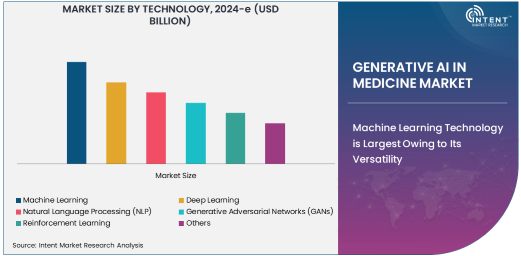

Machine Learning Technology is Largest Owing to Its Versatility

Machine learning (ML) stands as the largest technology segment within the generative AI in medicine market. ML’s ability to analyze large datasets and identify patterns is critical for applications such as disease prediction, drug discovery, and personalized medicine. ML algorithms process data from electronic health records, medical imaging, and genetic databases to identify trends that may not be immediately apparent, thus improving diagnostic accuracy and enabling the development of targeted treatments. Its widespread adoption by healthcare providers and pharmaceutical companies is expected to continue growing due to its ability to provide predictive insights and automate repetitive tasks, reducing human error and enhancing the overall efficiency of healthcare systems.

The increasing demand for machine learning in drug discovery is particularly notable. Pharmaceutical companies are using ML models to analyze vast chemical libraries and predict the effectiveness of new compounds, significantly speeding up the traditionally lengthy and expensive process of drug development. As ML technologies evolve, their ability to support more personalized and precise medical care will expand, further consolidating their position as the dominant technology in this space.

Drug Discovery Application is Fastest Growing Due to Rising Demand for New Treatments

In terms of application, drug discovery is the fastest growing segment within the generative AI in medicine market. AI-powered solutions are transforming the process of discovering new drug candidates, enabling companies to shorten development timelines and improve the accuracy of predictions. Traditional drug discovery methods are time-consuming, expensive, and often yield low success rates. Generative AI accelerates this process by automating the analysis of vast chemical datasets, predicting the behavior of new compounds, and identifying promising drug candidates much more quickly than traditional methods.

The integration of AI in drug discovery not only reduces the costs associated with trial and error but also enhances the success rate of clinical trials. With AI models being able to simulate interactions between molecules and predict their efficacy, pharmaceutical companies can focus resources on the most promising candidates. This increases the likelihood of successful outcomes and ensures that patients receive more effective treatments at a faster pace.

Healthcare Providers Segment is Largest Owing to High Adoption of AI Solutions

The healthcare providers segment, which includes hospitals and clinics, remains the largest end-user industry for generative AI in medicine. The healthcare sector has been quick to adopt AI technologies due to the increasing need for automation and optimization in clinical processes. AI helps healthcare providers improve decision-making, streamline administrative tasks, and enhance patient outcomes through predictive analytics and personalized treatment plans. Additionally, the rise in chronic diseases and the need for effective treatment protocols further drives the demand for AI-driven solutions in this sector.

Healthcare providers use AI for various applications such as diagnostic imaging, disease prediction, and treatment planning. For example, machine learning algorithms are employed to analyze medical images, enabling radiologists to detect abnormalities like tumors at earlier stages. With AI’s growing ability to assist in clinical decision-making, healthcare providers are increasingly relying on these technologies to reduce workload, improve diagnostic accuracy, and provide better patient care.

North America is Largest Region Driven by Technological Advancements and Investment

North America holds the largest share of the generative AI in medicine market, primarily driven by significant technological advancements, high healthcare expenditures, and substantial investments in AI research and development. The region has a strong presence of leading healthcare providers, pharmaceutical companies, and research institutions that are at the forefront of AI adoption. The U.S. government and private sector have invested heavily in the development and deployment of AI technologies to address inefficiencies in the healthcare system and accelerate medical research.

In particular, North America has witnessed significant advancements in AI applications related to drug discovery and disease prediction. The region’s healthcare providers have increasingly integrated AI into clinical settings, with applications such as diagnostic imaging, predictive analytics, and personalized medicine becoming commonplace. The high demand for innovative healthcare solutions and the availability of advanced AI technologies make North America the dominant player in the generative AI in medicine market.

Competitive Landscape: Leading Companies Shaping the Market

The competitive landscape in the generative AI in medicine market is dominated by a combination of established technology giants, pharmaceutical companies, and specialized AI startups. Leading companies like IBM, Google Health, and Microsoft are at the forefront of AI integration in healthcare, leveraging their expertise in machine learning, cloud computing, and data analytics. These companies are forming partnerships with healthcare providers, research institutions, and pharmaceutical firms to develop and deploy AI-based solutions that can optimize medical processes.

Additionally, companies like Tempus, Insilico Medicine, and BenevolentAI are emerging as key players in drug discovery and personalized medicine, using generative AI to accelerate the identification of new drug candidates and treatment strategies. These companies are benefiting from large-scale investments and a growing interest in AI-powered healthcare solutions. The increasing focus on regulatory approvals, data privacy, and ethical considerations in AI adoption is driving the market's competitive dynamics, with companies that can navigate these challenges poised to lead the next wave of innovation in medical AI technologies

Recent Developments:

- Tempus Labs launched an AI-powered platform for oncology that integrates clinical and molecular data to assist in personalized treatment plans, enhancing precision medicine practices.

- Siemens Healthineers announced a collaboration with biotech firms to leverage AI for more efficient drug discovery, aiming to provide better-tailored treatments for patients.

- Merck & Co. has invested in AI-based diagnostic tools for personalized cancer treatment, incorporating machine learning models to predict drug efficacy based on genetic markers.

- Philips Healthcare unveiled a new AI-driven imaging system designed to personalize medical treatments for patients with complex conditions like heart disease, by leveraging machine learning for data analysis.

- Accenture partnered with leading research institutions to develop new AI algorithms that predict personalized treatment pathways in rare diseases, helping to provide tailored solutions to complex cases.

List of Leading Companies:

- IBM

- Google Health

- Microsoft

- NVIDIA Corporation

- Siemens Healthineers

- Philips Healthcare

- GE Healthcare

- Accenture

- Cerner Corporation

- Medtronic

- Tempus

- Butterfly Network

- Atomwise

- Insilico Medicine

- BenevolentAI

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 2.2 Billion |

|

Forecasted Value (2030) |

USD 46.3 Billion |

|

CAGR (2025 – 2030) |

54.3% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Generative AI in Medicine Market By Technology (Machine Learning, Deep Learning, Natural Language Processing, Generative Adversarial Networks, Reinforcement Learning), By Application (Drug Discovery, Personalized Medicine, Diagnostic Imaging, Disease Prediction and Prevention, Virtual Health Assistants, Treatment Planning), By End-User Industry (Healthcare Providers, Pharmaceutical Companies, Biotechnology Firms, Research Institutions, Medical Device Manufacturers, Healthcare Technology Companies) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

IBM, Google Health, Microsoft, NVIDIA Corporation, Siemens Healthineers, Philips Healthcare, GE Healthcare, Accenture, Cerner Corporation, Medtronic, Tempus, Butterfly Network, Atomwise, Insilico Medicine, BenevolentAI |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Generative AI In Medicine Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Machine Learning |

|

4.2. Deep Learning |

|

4.3. Natural Language Processing (NLP) |

|

4.4. Generative Adversarial Networks (GANs) |

|

4.5. Reinforcement Learning |

|

4.6. Others |

|

5. Generative AI In Medicine Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Drug Discovery |

|

5.2. Personalized Medicine |

|

5.3. Diagnostic Imaging |

|

5.4. Disease Prediction and Prevention |

|

5.5. Virtual Health Assistants |

|

5.6. Treatment Planning |

|

5.7. Others |

|

6. Generative AI In Medicine Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Healthcare Providers (Hospitals, Clinics) |

|

6.2. Pharmaceutical Companies |

|

6.3. Biotechnology Firms |

|

6.4. Research Institutions |

|

6.5. Medical Device Manufacturers |

|

6.6. Healthcare Technology Companies |

|

6.7. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Generative AI In Medicine Market, by Technology |

|

7.2.7. North America Generative AI In Medicine Market, by Application |

|

7.2.8. North America Generative AI In Medicine Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Generative AI In Medicine Market, by Technology |

|

7.2.9.1.2. US Generative AI In Medicine Market, by Application |

|

7.2.9.1.3. US Generative AI In Medicine Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. IBM |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Google Health |

|

9.3. Microsoft |

|

9.4. NVIDIA Corporation |

|

9.5. Siemens Healthineers |

|

9.6. Philips Healthcare |

|

9.7. GE Healthcare |

|

9.8. Accenture |

|

9.9. Cerner Corporation |

|

9.10. Medtronic |

|

9.11. Tempus |

|

9.12. Butterfly Network |

|

9.13. Atomwise |

|

9.14. Insilico Medicine |

|

9.15. BenevolentAI |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Generative AI in Medicine Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Generative AI in Medicine Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Generative AI in Medicine Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA