As per Intent Market Research, the Generative AI in Financial Services Market was valued at USD 3.1 billion in 2024-e and will surpass USD 58.1 billion by 2030; growing at a CAGR of 51.7% during 2025 - 2030.

The generative AI market in financial services is experiencing significant growth as financial institutions increasingly leverage AI technologies to optimize operations, enhance customer experiences, and minimize risks. Technologies like machine learning, deep learning, and natural language processing (NLP) are driving this transformation, offering solutions across various applications, including fraud detection, risk management, and algorithmic trading. The integration of AI within the financial sector is expected to continue accelerating, as institutions seek to harness its capabilities to gain a competitive edge in a highly dynamic and regulated environment.

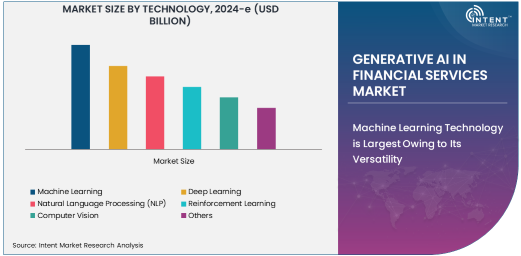

Machine Learning Technology is Largest Owing to Its Versatility

Machine learning remains the largest subsegment within the generative AI technology category in financial services. Its ability to analyze vast amounts of data and generate predictive insights makes it an indispensable tool for institutions focused on improving decision-making and operational efficiency. In the context of financial services, machine learning is heavily utilized for fraud detection, customer segmentation, and personalized financial solutions. Its adaptability to various applications allows financial institutions to implement it across a wide range of services, from customer support to wealth management.

As financial services companies increasingly recognize the importance of data-driven insights, machine learning’s role is set to expand further. The technology continues to evolve, with models becoming more sophisticated, enabling institutions to perform more accurate risk assessments and make quicker, better-informed decisions. This expansion is also facilitated by the increasing availability of data and improved computational power, allowing machine learning models to scale and offer real-time solutions.

Fraud Detection Application is Fastest Growing Owing to Rising Cyber Threats

Fraud detection is the fastest growing application of generative AI in the financial services market. As cyber threats and financial frauds become more complex, financial institutions are turning to advanced AI models to proactively identify and prevent fraudulent activities. Machine learning algorithms and deep learning models are particularly effective at detecting unusual patterns, flagging transactions that deviate from normal behavior, and continuously learning from new data to refine their detection capabilities.

The ability of AI to process massive volumes of transactions in real time makes it highly valuable in preventing fraud, particularly in areas like banking, online transactions, and insurance. With an increasing emphasis on cybersecurity, fraud detection powered by AI is becoming a key priority for financial institutions. As digital transactions grow and cybercriminals adopt more sophisticated techniques, the demand for AI-driven fraud detection solutions is expected to rise, ensuring that this application remains at the forefront of generative AI adoption in financial services.

Banking Industry is Largest Owing to High Adoption of AI for Risk Management

The banking industry is the largest end-user of generative AI in financial services, owing to its high adoption of AI for various applications, especially risk management. Banks are utilizing AI tools to assess credit risk, monitor financial markets, and manage liquidity. The complexity and scale of banking operations make them ideal candidates for the implementation of AI-driven solutions that can analyze vast datasets, detect patterns, and mitigate risks more effectively than traditional methods.

In addition to risk management, AI is being increasingly applied in areas like fraud detection, customer service, and algorithmic trading within banks. As financial regulations evolve, banks are also leveraging AI for compliance and reporting, ensuring that they stay ahead of regulatory requirements. The combination of operational efficiency, enhanced decision-making capabilities, and improved customer experience makes AI an essential tool for the banking industry, thereby cementing its position as the largest segment in the generative AI market in financial services.

North America is Largest Region Owing to Technological Advancements

North America remains the largest region for generative AI in financial services. The region's early adoption of AI technologies, strong presence of major financial institutions, and a well-developed technology ecosystem have all contributed to its leadership in this space. The United States, in particular, is a hub for innovation, with many fintech companies, banks, and investment firms actively investing in AI-driven solutions to enhance their operations and offerings.

The robust regulatory framework in North America also encourages the development and deployment of AI solutions in financial services. Financial institutions are working closely with AI developers to ensure compliance with regulations while integrating cutting-edge technologies to stay competitive. As the adoption of AI technologies continues to rise, North America is expected to maintain its dominant position in the generative AI market within the financial services industry.

Leading Companies and Competitive Landscape

The competitive landscape for generative AI in financial services is highly dynamic, with key players ranging from traditional technology companies to fintech startups. Leading companies such as IBM, Google, Microsoft, and Amazon Web Services (AWS) dominate the market with their advanced AI tools and platforms that cater to the specific needs of financial institutions. These companies provide machine learning and NLP-based solutions for applications like fraud detection, credit scoring, and customer service automation.

In addition to tech giants, financial services firms such as Goldman Sachs and JPMorgan Chase are increasingly developing in-house AI capabilities or forming strategic partnerships with AI providers to enhance their offerings. Accenture and Cognizant also play a significant role by offering AI-driven consulting and solutions tailored to the financial services sector. The competitive landscape is marked by heavy investments in research and development, with companies constantly innovating to maintain their competitive edge.

As the market continues to grow, there will likely be further consolidation, with companies acquiring AI startups to enhance their capabilities and expand their market reach. This competitive environment is driving rapid advancements in AI technology, ensuring that financial institutions continue to benefit from more efficient, scalable, and secure AI solutions.

List of Leading Companies:

- IBM

- Google LLC

- Microsoft Corporation

- Amazon Web Services (AWS)

- Accenture

- NVIDIA Corporation

- Cognizant

- SAP SE

- Hewlett Packard Enterprise (HPE)

- Oracle Corporation

- FIS

- Goldman Sachs

- JPMorgan Chase & Co.

- Visa Inc.

- Mastercard Incorporated

Recent Developments:

- Google Cloud & JPMorgan Chase announced an expanded partnership to integrate Google's AI tools into JPMorgan's financial services, improving customer support and operational efficiency.

- Microsoft launched a new AI-powered platform aimed at improving credit scoring and financial planning, targeting banks and fintech companies.

- Accenture acquired a leading AI company to enhance its capabilities in providing AI-driven financial solutions, particularly in fraud detection and risk management.

- NVIDIA unveiled its latest deep learning models designed specifically for financial services, offering better risk management and predictive analytics for investment firms.

- Amazon Web Services (AWS) introduced a new set of machine learning tools aimed at algorithmic trading and wealth management, providing financial institutions with faster and more accurate market predictions

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 3.1 billion |

|

Forecasted Value (2030) |

USD 58.1 billion |

|

CAGR (2025 – 2030) |

51.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Generative AI in Financial Services Market by Technology (Machine Learning, Deep Learning, Natural Language Processing, Reinforcement Learning, Computer Vision), by Application (Fraud Detection, Risk Management, Algorithmic Trading, Credit Scoring, Customer Service & Chatbots, Personalized Recommendations, Wealth Management), by End-User Industry (Banking, Insurance, Investment Management, Wealth Management, Fintech) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

IBM, Google LLC, Microsoft Corporation, Amazon Web Services (AWS), Accenture, NVIDIA Corporation, Cognizant, SAP SE, Hewlett Packard Enterprise (HPE), Oracle Corporation, FIS, Goldman Sachs, JPMorgan Chase & Co., Visa Inc., Mastercard Incorporated |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Generative AI in Financial Services Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Machine Learning |

|

4.2. Deep Learning |

|

4.3. Natural Language Processing (NLP) |

|

4.4. Reinforcement Learning |

|

4.5. Computer Vision |

|

4.6. Others |

|

5. Generative AI in Financial Services Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Fraud Detection |

|

5.2. Risk Management |

|

5.3. Algorithmic Trading |

|

5.4. Credit Scoring |

|

5.5. Customer Service & Chatbots |

|

5.6. Personalized Recommendations |

|

5.7. Wealth Management |

|

5.8. Others |

|

6. Generative AI in Financial Services Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Banking |

|

6.2. Insurance |

|

6.3. Investment Management |

|

6.4. Wealth Management |

|

6.5. Fintech |

|

6.6. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Generative AI in Financial Services Market, by Technology |

|

7.2.7. North America Generative AI in Financial Services Market, by Application |

|

7.2.8. North America Generative AI in Financial Services Market, by End-User Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Generative AI in Financial Services Market, by Technology |

|

7.2.9.1.2. US Generative AI in Financial Services Market, by Application |

|

7.2.9.1.3. US Generative AI in Financial Services Market, by End-User Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. IBM |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. Google LLC |

|

9.3. Microsoft Corporation |

|

9.4. Amazon Web Services (AWS) |

|

9.5. Accenture |

|

9.6. NVIDIA Corporation |

|

9.7. Cognizant |

|

9.8. SAP SE |

|

9.9. Hewlett Packard Enterprise (HPE) |

|

9.10. Oracle Corporation |

|

9.11. FIS |

|

9.12. Goldman Sachs |

|

9.13. JPMorgan Chase & Co. |

|

9.14. Visa Inc. |

|

9.15. Mastercard Incorporated |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Generative AI in Financial Services Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Generative AI in Financial Services Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Generative AI in Financial Services Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA