As per Intent Market Research, the Generative AI In Energy Market was valued at USD 1.1 billion in 2024-e and will surpass USD 17.6 billion by 2030; growing at a CAGR of 48.4% during 2025 - 2030.

The use of generative AI in the energy sector is rapidly transforming how energy systems are managed, optimized, and integrated. Leveraging technologies such as machine learning, deep learning, and natural language processing, AI is enabling more accurate predictions, improving grid management, and optimizing energy consumption across the entire energy value chain. From grid optimization to predictive maintenance, the energy sector is experiencing significant advancements driven by AI-powered tools. In particular, the growing focus on renewable energy integration and smart grid technology is creating substantial opportunities for AI applications, allowing for the optimization of both energy production and distribution.

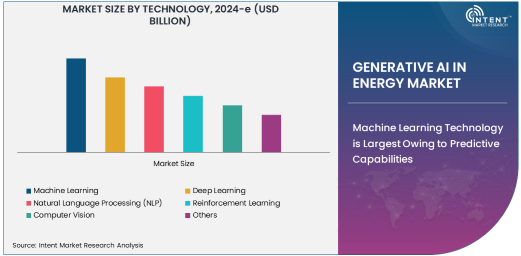

Machine Learning Technology is Largest Owing to Predictive Capabilities

Among the various AI technologies, machine learning is the largest subsegment in the generative AI in energy market. Machine learning algorithms can analyze vast amounts of data generated from power grids, energy consumption patterns, and weather forecasts to predict demand, detect anomalies, and optimize energy distribution. The ability to provide real-time decision-making is one of the key drivers behind machine learning's dominance in the energy sector. This technology is particularly valuable in grid management, energy forecasting, and predictive maintenance, where it can forecast demand surges, detect equipment malfunctions, and minimize downtime.

Machine learning is also crucial for predictive maintenance in the energy sector, helping to identify potential failures before they occur. By continuously monitoring infrastructure and analyzing patterns in data, these systems can alert operators to necessary repairs or component replacements. As more energy companies embrace digital transformation and the Internet of Things (IoT), machine learning is expected to maintain its leading position due to its ability to deliver real-time insights and actionable data that enhance operational efficiency.

Grid Management Application is Largest Owing to Energy Stability Requirements

Grid management is the largest application for generative AI in the energy market. The continuous and efficient supply of energy requires sophisticated tools to optimize grid stability and address challenges such as load balancing, integration of renewable sources, and demand fluctuations. AI-driven grid management systems can predict grid congestion, control energy flows, and adjust to real-time changes, ensuring a reliable and stable energy supply. These systems help utilities manage energy across multiple sources, ensuring a seamless integration of renewable energy while minimizing operational disruptions.

The focus on renewable energy sources, such as solar and wind, which are inherently intermittent, has further accelerated the adoption of AI for grid management. As the transition to greener energy sources progresses, the need for AI-based solutions that can dynamically adjust to these fluctuations is paramount. With the energy demand expected to rise in the coming years, the ability to efficiently manage grids through AI is becoming increasingly critical to avoid blackouts and ensure a stable power supply.

Power Generation End-User Industry is Largest Owing to Energy Production Optimization

Power generation remains the largest end-user industry for generative AI in energy. AI-powered solutions are instrumental in improving the efficiency of power generation by optimizing energy production processes, reducing operational costs, and enhancing the performance of power plants. Machine learning models are applied in power plants to predict equipment failures, optimize fuel usage, and increase overall system efficiency. This helps reduce maintenance costs and ensures that power generation is both cost-effective and environmentally sustainable.

In addition to traditional power generation, AI is playing a critical role in the integration of renewable energy sources. By predicting energy generation from wind and solar farms based on weather forecasts, AI can adjust power generation and manage fluctuations more effectively. As energy demand increases, the need for optimizing power generation while minimizing environmental impact is becoming more urgent, positioning AI as an essential tool in this segment.

Asia Pacific Region is Fastest Growing Owing to Expanding Infrastructure

Asia Pacific is the fastest-growing region for generative AI in the energy market. Rapid industrialization, a surge in energy demand, and increasing investments in smart grid technologies are driving the growth of AI applications in this region. Countries like China, India, and Japan are leading the way in adopting AI-driven solutions for grid management, predictive maintenance, and energy forecasting. The region's focus on integrating renewable energy sources into the grid has further accelerated the need for AI technologies that can optimize the distribution and storage of energy.

Furthermore, the rise in government initiatives to boost renewable energy infrastructure and the adoption of AI technologies in various industries are creating favorable market conditions in Asia Pacific. With a significant portion of the global population residing in this region, the demand for efficient energy systems and sustainable solutions is expected to continue driving the market's rapid growth.

Competitive Landscape and Leading Companies

The competitive landscape of the generative AI in energy market is marked by a mix of established technology companies and energy-focused startups. Leading players in the market include Google DeepMind, IBM Corporation, Siemens AG, GE Renewable Energy, Schneider Electric, and Tesla, Inc. These companies are at the forefront of developing AI technologies that optimize grid management, enhance energy efficiency, and integrate renewable energy sources into existing infrastructure. Additionally, AI startups such as C3.ai and Enel Group are leveraging cutting-edge AI solutions to address specific energy sector challenges, ranging from predictive maintenance to energy consumption optimization.

The market is becoming increasingly competitive as companies push for AI-driven solutions to address the growing global demand for clean energy and efficient power management. With the integration of advanced AI technologies, companies are not only enhancing their operational efficiencies but also offering innovative solutions that improve energy production and distribution systems. Partnerships and acquisitions between technology firms and energy providers are expected to continue as both sectors seek to combine their expertise in AI and energy systems to meet evolving energy needs.

List of Leading Companies:

- Google DeepMind

- IBM Corporation

- Microsoft Corporation

- Siemens AG

- GE Renewable Energy

- Schneider Electric

- Tesla, Inc.

- Honeywell International Inc.

- ABB Ltd.

- Accenture

- Enel Group

- C3.ai

- Schneider Electric

- Oracle Corporation

- Rockwell Automation

Recent Developments:

- Google DeepMind collaborated with EDF to implement AI in energy forecasting to enhance power plant optimization, aiming for more efficient energy production.

- Siemens and Schneider Electric joined forces to develop AI-driven solutions for smart grids, improving energy distribution and reducing waste.

- IBM announced an expansion of its AI solutions for the oil and gas industry, focusing on predictive maintenance and optimizing energy production.

- Tesla launched an AI-powered energy storage system that dynamically adjusts to energy demand fluctuations, enhancing grid stability and supporting renewable energy integration.

- Accenture acquired a leading AI firm specializing in energy solutions to strengthen its AI-driven analytics and sustainability offerings for the energy sector.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 1.1 Billion |

|

Forecasted Value (2030) |

USD 17.6 Billion |

|

CAGR (2025 – 2030) |

48.4% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Generative AI in Energy Market By Technology (Machine Learning, Deep Learning, Natural Language Processing (NLP), Reinforcement Learning, Computer Vision), By Application (Grid Management, Energy Forecasting, Predictive Maintenance, Demand Response Optimization, Energy Efficiency), By End-User Industry (Power Generation, Power Transmission & Distribution, Renewable Energy, Oil & Gas, Utilities, Manufacturing) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Google DeepMind, IBM Corporation, Microsoft Corporation, Siemens AG, GE Renewable Energy, Schneider Electric, Tesla, Inc., Honeywell International Inc., ABB Ltd., Accenture, Enel Group, C3.ai, Schneider Electric, Oracle Corporation, Rockwell Automation |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Generative AI In Energy Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Machine Learning |

|

4.2. Deep Learning |

|

4.3. Natural Language Processing (NLP) |

|

4.4. Reinforcement Learning |

|

4.5. Computer Vision |

|

4.6. Others |

|

5. Generative AI In Energy Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Grid Management |

|

5.2. Energy Forecasting |

|

5.3. Predictive Maintenance |

|

5.4. Demand Response Optimization |

|

5.5. Energy Efficiency |

|

5.6. Others |

|

6. Generative AI In Energy Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Power Generation |

|

6.2. Power Transmission & Distribution |

|

6.3. Renewable Energy |

|

6.4. Oil & Gas |

|

6.5. Utilities |

|

6.6. Manufacturing |

|

6.7. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Generative AI In Energy Market, by Technology |

|

7.2.7. North America Generative AI In Energy Market, by Application |

|

7.2.8. By Country |

|

7.2.8.1. US |

|

7.2.8.1.1. US Generative AI In Energy Market, by Technology |

|

7.2.8.1.2. US Generative AI In Energy Market, by Application |

|

7.2.8.2. Canada |

|

7.2.8.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Google DeepMind |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. IBM Corporation |

|

9.3. Microsoft Corporation |

|

9.4. Siemens AG |

|

9.5. GE Renewable Energy |

|

9.6. Schneider Electric |

|

9.7. Tesla, Inc. |

|

9.8. Honeywell International Inc. |

|

9.9. ABB Ltd. |

|

9.10. Accenture |

|

9.11. Enel Group |

|

9.12. C3.ai |

|

9.13. Schneider Electric |

|

9.14. Oracle Corporation |

|

9.15. Rockwell Automation |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Generative AI in Energy Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Generative AI in Energy Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Generative AI in Energy Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA