As per Intent Market Research, the Generative AI In Design Market was valued at USD 0.7 billion in 2024-e and will surpass USD 4.1 billion by 2030; growing at a CAGR of 34.5% during 2025 - 2030.

The Generative AI in Design Market is witnessing rapid adoption across various industries, driven by the increasing demand for automation, customization, and efficiency in design processes. Generative AI leverages advanced algorithms, such as machine learning and deep learning, to autonomously create design solutions, transforming how industries approach product development, creative processes, and problem-solving. This technology is being widely embraced for its ability to streamline workflows, enhance creativity, and provide innovative solutions in areas like product design, graphic design, architecture, and more. As businesses increasingly seek to stay competitive and meet consumer demands for personalized experiences, the generative AI in design market is set for significant growth.

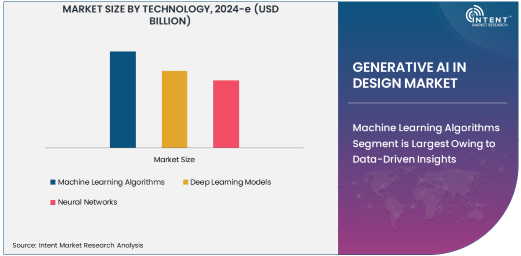

Machine Learning Algorithms Segment is Largest Owing to Data-Driven Insights

The Machine Learning Algorithms segment is the largest in the Generative AI in Design Market, primarily due to the widespread use of data-driven models that improve design accuracy and efficiency. Machine learning algorithms, particularly supervised and unsupervised learning techniques, enable AI systems to process vast amounts of data and identify patterns that can inform design decisions. This ability to quickly analyze large datasets and generate insights has made machine learning an essential tool in industries like automotive, fashion, and industrial design. By learning from past designs, machine learning algorithms can predict optimal design features, automate iterations, and suggest new design possibilities, ultimately accelerating the design process.

Machine learning algorithms also offer a high degree of scalability and adaptability, making them suitable for various design applications. As the technology improves, machine learning models become more precise in predicting outcomes based on input data, allowing for more sophisticated and personalized designs. This growing reliance on machine learning is expected to drive its dominance in the market, with industries increasingly turning to AI to streamline their design processes and bring innovative products to market faster.

Product Design Application is Fastest Growing Due to Customization Demands

The Product Design application within the Generative AI in Design Market is the fastest growing, driven by the rising demand for highly customized and innovative products. AI-powered generative design tools are transforming how companies approach product development by enabling them to explore a wide range of design alternatives based on specific performance, cost, and aesthetic criteria. Whether it’s designing consumer electronics, automotive components, or industrial machinery, generative AI accelerates the design phase, allowing for rapid prototyping and optimization based on user needs.

Generative AI in product design offers significant advantages, such as reducing the time and cost associated with traditional design processes. It allows designers to input constraints and goals, with the AI generating countless design variations, each optimized for the given parameters. This flexibility is particularly beneficial in industries such as automotive and consumer electronics, where innovation and customization are key competitive differentiators. As companies continue to prioritize personalization and efficiency, the product design application is expected to witness substantial growth over the coming years.

Automotive End-User Industry is Largest Owing to High Adoption of AI Solutions

The Automotive end-user industry is the largest in the Generative AI in Design Market, as the sector has been quick to adopt AI technologies to improve design, manufacturing, and innovation. Generative AI plays a significant role in automotive design by optimizing parts and components, improving vehicle aerodynamics, and even suggesting new interior and exterior designs. The ability to leverage AI for material selection, structural optimization, and safety features has made generative design an essential tool for automakers seeking to enhance performance while reducing costs. Leading automotive manufacturers are increasingly using AI to stay competitive by shortening design cycles and offering more personalized, eco-friendly, and innovative vehicles.

Moreover, automotive companies benefit from the ability of generative AI to simulate real-world conditions and test design concepts virtually. By integrating AI into their design processes, automotive manufacturers can significantly reduce prototyping costs and time-to-market, which are crucial in a rapidly evolving market. This growing trend toward AI-driven automotive design is set to continue, cementing the automotive industry’s position as the largest end-user of generative AI technology.

Cloud-Based Deployment Mode is Fastest Growing Due to Scalability and Accessibility

The Cloud-based deployment mode is the fastest growing in the Generative AI in Design Market, driven by its scalability, accessibility, and cost-effectiveness. Cloud platforms provide businesses with the computational power needed to run complex AI models without the need for expensive on-premise infrastructure. This flexibility is particularly beneficial for small and medium-sized enterprises (SMEs) that may lack the resources to maintain their own data centers. Cloud-based solutions also allow for easy collaboration across teams and geographies, making them an attractive option for global design projects.

As the demand for AI-driven design tools grows, the cloud-based model enables businesses to scale their usage according to project requirements, ensuring that companies can access the latest generative AI technology without upfront capital investments. Furthermore, cloud platforms often offer integrated solutions, allowing for seamless data storage, processing, and analysis. This growing preference for cloud-based deployment is expected to drive its rapid adoption, making it the dominant deployment mode in the market.

North America Region is Largest Owing to Advanced Technological Infrastructure

The North America region is the largest in the Generative AI in Design Market, owing to its well-established technological infrastructure, high adoption rates of AI, and strong presence of major companies in the design and manufacturing sectors. The region benefits from a highly developed IT ecosystem and a robust research and development environment, which accelerates the adoption of generative AI technologies. The presence of major players such as Autodesk, Adobe, and NVIDIA further strengthens the region's dominance, providing access to cutting-edge AI solutions that cater to diverse industries such as automotive, architecture, and fashion.

North America also benefits from a strong focus on innovation and product development, which is driving demand for AI-powered design tools. As businesses continue to invest in automation and AI to stay competitive, North America is expected to maintain its leadership position in the market. With significant investments in AI research and a high level of awareness regarding the benefits of AI in design, the region is poised to continue leading the global market for generative AI in design solutions.

Competitive Landscape

The Generative AI in Design Market is highly competitive, with several leading companies driving innovation and market expansion. Autodesk, Adobe, and Siemens are among the top players, offering a range of generative design tools across multiple industries such as automotive, architecture, and manufacturing. These companies leverage their established industry presence, technological expertise, and partnerships to enhance their AI-driven design solutions. Other notable players, including NVIDIA, PTC, and Corel, are also making significant strides by integrating AI into their design platforms, offering users advanced capabilities such as machine learning-powered optimization and real-time design suggestions.

The competitive landscape is further characterized by strategic collaborations, acquisitions, and the development of new AI-driven design tools. As the demand for generative AI solutions grows, companies are increasingly focusing on providing cloud-based solutions and enhancing their AI capabilities to meet evolving market needs. The market is expected to remain dynamic, with continuous advancements in AI technology driving the next wave of innovation in design.

Recent Developments:

- Autodesk recently launched a new generative design software that enables faster and more efficient product development, particularly in the automotive and manufacturing sectors.

- Adobe acquired a generative AI startup specializing in 3D modeling and design to enhance its Creative Cloud offerings, bolstering AI-driven design tools for graphic designers.

- NVIDIA announced a partnership with leading architecture firms to integrate its AI-powered design platform into architectural workflows, improving design speed and innovation.

- Siemens received regulatory approval for its new generative design tool focused on industrial and automotive applications, streamlining the design process with AI-driven solutions.

- PTC upgraded its generative design capabilities within the Creo platform, allowing manufacturers to leverage AI in creating highly customized and optimized product designs faster than ever before.

List of Leading Companies:

- Autodesk Inc.

- Adobe Inc.

- Dassault Systèmes

- Siemens AG

- PTC Inc.

- NVIDIA Corporation

- Generative Design Technologies

- Google Inc.

- IBM Corporation

- Bentley Systems Inc.

- Corel Corporation

- Unity Technologies

- Zaha Hadid Architects

- DeepMind Technologies (Google)

- Trimble Inc.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 0.7 Billion |

|

Forecasted Value (2030) |

USD 4.1 Billion |

|

CAGR (2025 – 2030) |

34.5% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Generative AI in Design Market By Technology (Machine Learning Algorithms, Deep Learning Models, Neural Networks), By Application (Product Design, Graphic Design, Architecture & Urban Planning, Fashion Design, Automotive Design, Industrial Design), By End-User Industry (Automotive, Architecture & Construction, Fashion & Apparel, Consumer Electronics, Industrial Manufacturing, Media & Entertainment), By Deployment Mode (Cloud-based, On-premise) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Autodesk Inc., Adobe Inc., Dassault Systèmes, Siemens AG, PTC Inc., NVIDIA Corporation, Generative Design Technologies, Google Inc., IBM Corporation, Bentley Systems Inc., Corel Corporation, Unity Technologies, Zaha Hadid Architects, DeepMind Technologies (Google), Trimble Inc. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Generative AI In Design Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Machine Learning Algorithms |

|

4.2. Deep Learning Models |

|

4.3. Neural Networks |

|

5. Generative AI In Design Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Product Design |

|

5.2. Graphic Design |

|

5.3. Architecture & Urban Planning |

|

5.4. Fashion Design |

|

5.5. Automotive Design |

|

5.6. Industrial Design |

|

6. Generative AI In Design Market, by End-User Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Automotive |

|

6.2. Architecture & Construction |

|

6.3. Fashion & Apparel |

|

6.4. Consumer Electronics |

|

6.5. Industrial Manufacturing |

|

6.6. Media & Entertainment |

|

7. Generative AI In Design Market, by Deployment Mode (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Cloud-based |

|

7.2. On-premise |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Generative AI In Design Market, by Technology |

|

8.2.7. North America Generative AI In Design Market, by Application |

|

8.2.8. North America Generative AI In Design Market, by End-User Industry |

|

8.2.9. North America Generative AI In Design Market, by Deployment Mode |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Generative AI In Design Market, by Technology |

|

8.2.10.1.2. US Generative AI In Design Market, by Application |

|

8.2.10.1.3. US Generative AI In Design Market, by End-User Industry |

|

8.2.10.1.4. US Generative AI In Design Market, by Deployment Mode |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Autodesk Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Adobe Inc. |

|

10.3. Dassault Systèmes |

|

10.4. Siemens AG |

|

10.5. PTC Inc. |

|

10.6. NVIDIA Corporation |

|

10.7. Generative Design Technologies |

|

10.8. Google Inc. |

|

10.9. IBM Corporation |

|

10.10. Bentley Systems Inc. |

|

10.11. Corel Corporation |

|

10.12. Unity Technologies |

|

10.13. Zaha Hadid Architects |

|

10.14. DeepMind Technologies (Google) |

|

10.15. Trimble Inc. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Generative AI in Design Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Generative AI in Design Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Generative AI in Design Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA