As per Intent Market Research, the Generative AI in Construction Market was valued at USD 0.2 billion in 2024-e and will surpass USD 1.7 billion by 2030; growing at a CAGR of 35.6% during 2025 - 2030.

Generative AI in the construction market is revolutionizing the way projects are designed, managed, and executed. By leveraging advanced algorithms, machine learning, and artificial intelligence, generative AI enhances productivity, reduces costs, and improves safety. The adoption of these technologies is accelerating across various segments of the construction industry, including design and planning, project management, safety, and predictive maintenance. As the construction industry seeks to meet growing demand while simultaneously addressing labor shortages and increasing project complexities, generative AI is becoming an indispensable tool for optimizing operations.

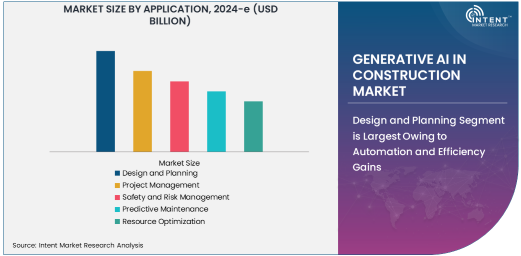

Design and Planning Segment is Largest Owing to Automation and Efficiency Gains

The design and planning segment is the largest within the generative AI market for construction, driven by the need for greater efficiency and innovation in project designs. AI-powered generative design tools are enabling architects and engineers to create optimal building layouts and structural designs, which can reduce material waste, improve energy efficiency, and accelerate project timelines. This technology analyzes multiple design parameters and quickly generates a wide range of design alternatives, allowing for faster decision-making and better resource management. By automating the time-consuming aspects of design, AI is transforming how construction projects are planned, making it a critical subsegment for the market.

Furthermore, generative AI allows for simulations that predict how designs will perform in real-world conditions. This ensures that construction professionals can refine their plans before beginning physical construction, minimizing costly mistakes during the building phase. As the demand for sustainable and efficient buildings grows, the design and planning segment will continue to lead the market.

Cloud-Based Deployment Mode is Fastest Growing Due to Scalability and Cost Efficiency

Cloud-based deployment mode is the fastest growing segment in the generative AI in construction market, driven by the increasing need for scalability, flexibility, and cost efficiency. Cloud-based platforms allow construction firms to leverage AI-driven tools without the burden of costly on-premises infrastructure. These platforms offer significant benefits, such as real-time collaboration, remote access, and seamless integration with other cloud-based tools and software. As a result, construction companies can deploy generative AI solutions on a larger scale, improving project coordination, data management, and decision-making across various stakeholders.

Additionally, cloud-based solutions are enabling small and medium-sized businesses to access cutting-edge AI technology, leveling the playing field in the construction industry. The ability to scale operations and access AI tools via subscription models without hefty upfront costs is a key driver for the growth of this segment. The cloud-based deployment mode is expected to dominate the market as more construction businesses transition to digital-first strategies.

Residential Construction is the Largest End-Use Industry Segment Owing to High Demand for Housing

The residential construction sector is the largest end-use industry segment in the generative AI market. With the global population continuing to grow and urbanization increasing, the demand for residential buildings is rising sharply. Generative AI is being employed to optimize building designs, manage construction schedules, and ensure that projects stay within budget. AI tools are being used for everything from creating energy-efficient designs to predicting potential delays, which ultimately leads to faster and more cost-effective construction processes.

The residential sector is also benefiting from AI-driven automation in resource management, which helps reduce waste and material costs. As construction firms look to meet sustainability goals, AI-powered solutions are becoming indispensable in designing energy-efficient and environmentally friendly homes. As such, the residential construction market is the largest consumer of generative AI solutions, and its demand is expected to grow substantially over the next decade.

AI-Driven Simulations are Fastest Growing Functionality Due to Real-World Application Benefits

AI-driven simulations are the fastest growing functionality within generative AI in the construction market. These simulations play a critical role in construction design and project management by providing real-time, data-driven insights into how different variables will impact a project. For example, AI simulations can predict how a building will behave under various environmental conditions, helping engineers make better-informed decisions about materials and structural integrity. This is particularly valuable in large-scale infrastructure and residential projects, where unforeseen issues can lead to costly delays and rework.

Additionally, AI simulations improve the safety of construction sites by allowing firms to anticipate potential risks and hazards before they occur. This predictive capability is essential for minimizing workplace accidents and ensuring compliance with safety regulations. As AI-driven simulations become more sophisticated, their role in construction planning and execution will continue to grow, making them a cornerstone of the industry’s digital transformation.

North America is the Largest Region for Generative AI in Construction Market

North America is the largest region in the generative AI in construction market, driven by the widespread adoption of advanced technologies and the presence of major market players. The United States and Canada are at the forefront of incorporating AI in construction, with numerous tech companies, construction firms, and governmental initiatives supporting the transition to AI-driven solutions. The region has a highly developed construction sector, which is increasingly leveraging AI for design, predictive maintenance, and project management.

Government regulations and incentives aimed at improving energy efficiency and reducing carbon footprints are also accelerating the demand for AI technologies in construction. Additionally, the availability of skilled professionals in AI, along with access to cutting-edge technologies, further strengthens North America's dominance. The region’s leadership in AI adoption in construction is expected to continue as more businesses explore and implement AI-driven solutions.

Competitive Landscape and Leading Companies

The generative AI in construction market is highly competitive, with several key players driving innovation and growth. Leading companies in the market include Autodesk, Trimble, IBM, and Bentley Systems, all of which have developed AI-driven solutions for various aspects of construction. These companies are focusing on expanding their offerings by integrating AI with other advanced technologies like building information modeling (BIM) and project management software to provide comprehensive solutions for the construction industry.

In addition to these established players, new entrants and startups are bringing innovative solutions to the market, often focusing on niche applications such as AI-driven simulations or resource optimization. Strategic partnerships, mergers, and acquisitions are common as companies aim to enhance their AI capabilities and expand their market reach. As the generative AI market in construction continues to evolve, competition will intensify, and technological advancements will play a pivotal role in shaping the future of the industry.

Recent Developments:

- Autodesk, Inc. launched a new generative design tool that uses AI to automate the building design process, enabling faster and more efficient project planning.

- Trimble Inc. partnered with a leading AI technology company to enhance its construction management software, integrating generative AI for better resource allocation and predictive analytics.

- Microsoft Corporation has rolled out an AI-driven collaboration platform for the construction industry, helping teams improve project planning, communication, and execution.

- Bentley Systems introduced a new AI-powered digital twin solution that enhances construction design and operations, offering real-time simulation and predictive capabilities.

- Cognizant Technology Solutions entered into a strategic partnership with a major construction firm to integrate AI into their operations for smarter project management and automation.

List of Leading Companies:

- Autodesk Inc.

- Bentley Systems

- Trimble Inc.

- Nemetschek Group

- Procore Technologies

- Oracle Corporation

- IBM Corporation

- Microsoft Corporation

- Google LLC (Alphabet Inc.)

- NVIDIA Corporation

- Hexagon AB

- Dassault Systèmes

- AECOM

- PlanGrid (Autodesk)

- Buildots

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 0.2 Billion |

|

Forecasted Value (2030) |

USD 1.7 Billion |

|

CAGR (2025 – 2030) |

35.6% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Generative AI in Construction Market by Application (Design and Planning, Project Management, Safety and Risk Management, Predictive Maintenance, Resource Optimization), By Deployment Mode (Cloud-Based, On-Premises), By End-Use Industry (Residential Construction, Commercial Construction, Industrial Construction, Infrastructure Development), By Functionality (AI-Driven Simulations, Predictive Analytics, Natural Language Processing, Visual Recognition and Analysis) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Autodesk Inc., Bentley Systems, Trimble Inc., Nemetschek Group, Procore Technologies, Oracle Corporation, IBM Corporation, Microsoft Corporation, Google LLC (Alphabet Inc.), NVIDIA Corporation, Hexagon AB, Dassault Systèmes, AECOM, PlanGrid (Autodesk), Buildots |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Generative AI in Construction Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Design and Planning |

|

4.2. Project Management |

|

4.3. Safety and Risk Management |

|

4.4. Predictive Maintenance |

|

4.5. Resource Optimization |

|

5. Generative AI in Construction Market, by Deployment Mode (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Cloud-Based |

|

5.2. On-Premises |

|

6. Generative AI in Construction Market, by End-Use Industry (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Residential Construction |

|

6.2. Commercial Construction |

|

6.3. Industrial Construction |

|

6.4. Infrastructure Development |

|

7. Generative AI in Construction Market, by Functionality (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. AI-Driven Simulations |

|

7.2. Predictive Analytics |

|

7.3. Natural Language Processing |

|

7.4. Visual Recognition and Analysis |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Generative AI in Construction Market, by Application |

|

8.2.7. North America Generative AI in Construction Market, by Deployment Mode |

|

8.2.8. North America Generative AI in Construction Market, by End-Use Industry |

|

8.2.9. North America Generative AI in Construction Market, by Functionality |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Generative AI in Construction Market, by Application |

|

8.2.10.1.2. US Generative AI in Construction Market, by Deployment Mode |

|

8.2.10.1.3. US Generative AI in Construction Market, by End-Use Industry |

|

8.2.10.1.4. US Generative AI in Construction Market, by Functionality |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Autodesk Inc. |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Bentley Systems |

|

10.3. Trimble Inc. |

|

10.4. Nemetschek Group |

|

10.5. Procore Technologies |

|

10.6. Oracle Corporation |

|

10.7. IBM Corporation |

|

10.8. Microsoft Corporation |

|

10.9. Google LLC (Alphabet Inc.) |

|

10.10. NVIDIA Corporation |

|

10.11. Hexagon AB |

|

10.12. Dassault Systèmes |

|

10.13. AECOM |

|

10.14. PlanGrid (Autodesk) |

|

10.15. Buildots |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Generative AI in Construction Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Generative AI in Construction Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Generative AI in Construction Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA