As per Intent Market Research, the Generative AI in Agriculture Market was valued at USD 0.3 billion in 2024-e and will surpass USD 1.6 billion by 2030; growing at a CAGR of 26.7% during 2025 - 2030.

The generative AI in agriculture market is seeing substantial growth as AI technologies become increasingly integrated into farming practices. Generative AI leverages machine learning algorithms and data analysis to create innovative farming solutions that improve efficiency, sustainability, and productivity. The application of AI across various agricultural sub-sectors is transforming how food is produced, helping farmers optimize crop yields, manage livestock, monitor soil health, and control pests. These advancements are reshaping the agricultural landscape, addressing challenges like resource management, environmental impact, and the need for higher crop output to meet global demand.

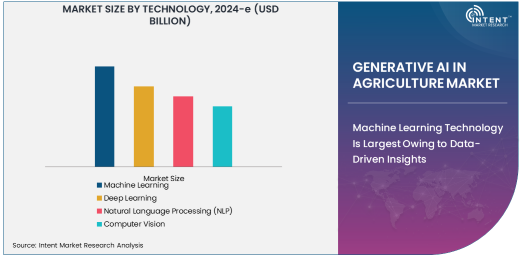

Machine Learning Technology Is Largest Owing to Data-Driven Insights

Machine learning (ML) technology is the largest segment in the generative AI in agriculture market due to its ability to analyze vast amounts of data and generate actionable insights. ML algorithms can process data from various sources, such as sensors, satellite imagery, and weather forecasts, to predict outcomes, optimize resources, and improve decision-making. In agriculture, machine learning plays a critical role in crop management, pest control, and precision farming. It helps farmers make data-driven decisions, ensuring that they use water, fertilizers, and other resources efficiently while minimizing waste and maximizing productivity.

The benefits of machine learning in agriculture are expansive. For example, it can predict yield outcomes based on environmental factors, optimize irrigation schedules, and detect early signs of diseases or pests. As the agriculture industry increasingly relies on data for decision-making, machine learning remains the primary technology enabling these advancements.

Crop Management Application Is Fastest Growing Owing to Demand for Efficiency

In the application segment, crop management is the fastest-growing area. With the rising global demand for food, crop management solutions using AI are being rapidly adopted to improve yield, reduce waste, and ensure sustainable farming practices. AI-powered crop management tools help farmers monitor crop health, predict harvest times, and automate irrigation systems. Additionally, these solutions enable farmers to optimize their use of fertilizers and pesticides, reducing environmental impact while increasing crop quality and quantity.

Crop management encompasses a broad range of tasks, from monitoring plant growth to managing soil health. Generative AI applications in crop management help farmers make informed decisions at every stage of the crop lifecycle, from planting to harvesting. The ability to predict and prevent crop failures through AI is driving the growth of this application segment, as it provides farmers with the tools necessary for meeting the increasing demand for food production.

Agricultural Enterprises End-User Is Largest Owing to Scale and Investment

In the end-user segment, agricultural enterprises are the largest group adopting generative AI solutions. These enterprises, which operate at a large scale, are investing in AI technologies to optimize farming operations across various crops and livestock. AI helps agricultural enterprises with tasks such as precision farming, crop management, and monitoring livestock health, all aimed at improving productivity and minimizing costs. The large-scale operations of agricultural enterprises make them ideal candidates for AI adoption, as the efficiency gains from AI technologies can significantly impact their bottom lines.

Agricultural enterprises also have the resources to invest in AI infrastructure and technology, making them key drivers of market growth. Furthermore, these enterprises often have the capacity to implement AI solutions across their entire operation, from farm-level to corporate management, enhancing their overall efficiency and competitiveness in the market.

Cloud-Based Deployment Mode Is Fastest Growing Owing to Scalability and Flexibility

Cloud-based deployment is the fastest-growing mode of deployment in the generative AI in agriculture market. Cloud solutions offer flexibility, scalability, and cost-effectiveness that traditional on-premise systems cannot match. Farmers and agricultural enterprises are increasingly turning to cloud-based AI tools because they allow real-time data processing and analysis without the need for costly, on-site infrastructure. Cloud platforms enable remote monitoring of crops, livestock, and soil conditions, making it easier for farmers to make timely decisions without being tied to physical locations.

The scalability of cloud-based solutions allows agricultural businesses to start small and expand their AI capabilities as their needs grow. This is especially important for farmers and enterprises looking to integrate AI into their operations without a significant upfront investment in hardware. Cloud-based systems also facilitate collaboration and data sharing, enabling farmers to access insights from a global network of agricultural experts and peers.

Asia Pacific Region Is Fastest Growing Owing to Expanding Agricultural Sector

Asia Pacific is the fastest-growing region in the generative AI in agriculture market, driven by rapid technological advancements and increasing adoption of AI solutions. The region’s vast agricultural sector, particularly in countries like China, India, and Japan, is embracing AI technologies to boost productivity and address challenges such as water scarcity, soil degradation, and labor shortages. With a growing population and a rising demand for food, Asia Pacific is focusing on transforming its agricultural practices through AI to ensure food security and sustainability.

The region’s governments and agricultural enterprises are investing heavily in AI research and development, leading to the rapid adoption of generative AI tools for crop management, livestock monitoring, and precision farming. As more farmers in Asia Pacific gain access to advanced AI solutions, the market in this region is expected to continue growing at a fast pace.

Competitive Landscape and Leading Companies

The competitive landscape of the generative AI in agriculture market is highly dynamic, with several key players offering innovative solutions. Leading companies in this market include IBM Corporation, Microsoft Corporation, Google LLC, Bayer AG, and Corteva Agriscience, among others. These companies are leveraging their strengths in AI, cloud computing, and data analytics to deliver cutting-edge agricultural solutions. They are continuously improving their offerings, with a focus on machine learning, deep learning, and other AI technologies to enhance farming practices.

In addition to large tech companies, numerous startups and agricultural technology firms are entering the market, contributing to increased innovation and competition. Companies are also forming partnerships with agricultural enterprises, government agencies, and research institutions to expand their reach and improve the effectiveness of their AI solutions. This competitive landscape ensures rapid advancements in AI technology, making it a transformative force in the global agriculture industry.

Recent Developments:

- In 2024, IBM partnered with Bayer to use AI and cloud computing to develop solutions that help farmers monitor and optimize crop health in real-time.

- Google introduced a new AI-powered platform that offers real-time crop data analytics, empowering farmers to make data-driven decisions for improving yields and reducing environmental impact.

- In 2024, John Deere acquired a leading AI-powered agricultural technology company to strengthen its smart farming solutions, focusing on precision farming and autonomous machinery.

- Microsoft announced a new AI-based farm management platform designed for the Asian market, helping local farmers optimize their operations with data-driven insights.

- Corteva Agriscience launched a new AI-powered pest control system designed to predict and manage pest outbreaks, offering farmers an efficient and sustainable solution for crop protection.

List of Leading Companies:

- IBM Corporation

- Microsoft Corporation

- Google LLC

- Bayer AG

- Corteva Agriscience

- John Deere

- AG Leader Technology

- Trimble Inc.

- Taranis

- The Climate Corporation (a subsidiary of Bayer)

- Descartes Labs

- S2G Ventures

- Intello Labs

- XAG

- Ripe Robotics

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 0.3 Billion |

|

Forecasted Value (2030) |

USD 1.6 Billion |

|

CAGR (2025 – 2030) |

26.7% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Generative AI in Agriculture Market By Technology (Machine Learning, Deep Learning, Natural Language Processing, Computer Vision), By Application (Crop Management, Livestock Management, Precision Farming, Weed and Pest Control, Irrigation Management, Soil Health Monitoring), By End-User (Farmers, Agricultural Enterprises, Government Agencies, Research Institutes), By Deployment Mode (Cloud-based, On-premise) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

IBM Corporation, Microsoft Corporation, Google LLC, Bayer AG, Corteva Agriscience, John Deere, AG Leader Technology, Trimble Inc., Taranis, The Climate Corporation (a subsidiary of Bayer), Descartes Labs, S2G Ventures, Intello Labs, XAG, Ripe Robotics |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Generative AI In Agriculture Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Machine Learning |

|

4.2. Deep Learning |

|

4.3. Natural Language Processing (NLP) |

|

4.4. Computer Vision |

|

5. Generative AI In Agriculture Market, by Application (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Crop Management |

|

5.2. Livestock Management |

|

5.3. Precision Farming |

|

5.4. Weed and Pest Control |

|

5.5. Irrigation Management |

|

5.6. Soil Health Monitoring |

|

6. Generative AI In Agriculture Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Farmers |

|

6.2. Agricultural Enterprises |

|

6.3. Government Agencies |

|

6.4. Research Institutes |

|

7. Generative AI In Agriculture Market, by Deployment Mode (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Cloud-based |

|

7.2. On-premise |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Generative AI In Agriculture Market, by Technology |

|

8.2.7. North America Generative AI In Agriculture Market, by Application |

|

8.2.8. North America Generative AI In Agriculture Market, by End-User |

|

8.2.9. North America Generative AI In Agriculture Market, by Deployment Mode |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Generative AI In Agriculture Market, by Technology |

|

8.2.10.1.2. US Generative AI In Agriculture Market, by Application |

|

8.2.10.1.3. US Generative AI In Agriculture Market, by End-User |

|

8.2.10.1.4. US Generative AI In Agriculture Market, by Deployment Mode |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. IBM Corporation |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Microsoft Corporation |

|

10.3. Google LLC |

|

10.4. Bayer AG |

|

10.5. Corteva Agriscience |

|

10.6. John Deere |

|

10.7. AG Leader Technology |

|

10.8. Trimble Inc. |

|

10.9. Taranis |

|

10.10. The Climate Corporation (a subsidiary of Bayer) |

|

10.11. Descartes Labs |

|

10.12. S2G Ventures |

|

10.13. Intello Labs |

|

10.14. XAG |

|

10.15. Ripe Robotics |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Generative AI in Agriculture Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Generative AI in Agriculture Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Generative AI in Agriculture Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA