As per Intent Market Research, the Gastrointestinal Diagnostics Market was valued at USD 06.3 billion in 2024-e and will surpass USD 10.1 billion by 2030; growing at a CAGR of 8.1% during 2024 - 2030.

The gastrointestinal diagnostics market is experiencing significant growth due to increasing incidences of gastrointestinal (GI) disorders, heightened awareness regarding early diagnosis, and the continuous advancement of diagnostic technologies. With rising concerns about conditions such as cancer, inflammatory bowel disease (IBD), gastrointestinal infections, and irritable bowel syndrome (IBS), the demand for effective diagnostic solutions has surged. This market includes a range of diagnostic techniques, including endoscopy, imaging, biopsy, and various molecular and immunoassay-based technologies, each offering specific benefits for diagnosing GI diseases. The development of more efficient and non-invasive diagnostic methods is expected to further propel the market's growth.

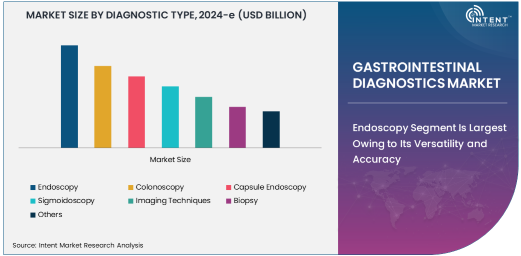

Endoscopy Segment Is Largest Owing to Its Versatility and Accuracy

The endoscopy diagnostic type segment is the largest within the gastrointestinal diagnostics market, primarily due to its versatility, accuracy, and broad range of applications. Endoscopy procedures allow physicians to directly visualize the GI tract, providing valuable insights into conditions such as ulcers, cancers, and gastrointestinal bleeding. The ability to perform both diagnostic and therapeutic interventions during endoscopic procedures has further solidified its dominance in the market. Colonoscopy, one of the most widely used forms of endoscopy, plays a crucial role in detecting early-stage colorectal cancer and other GI disorders, making it a cornerstone of GI diagnostics.

The demand for endoscopy is driven by advancements in endoscopic equipment, such as high-definition cameras, flexible scopes, and minimally invasive technologies, improving patient outcomes and reducing recovery times. With the increasing prevalence of GI diseases, particularly colorectal cancer, endoscopy is expected to maintain its leading position within the market, contributing to the early detection and management of these conditions.

Molecular Diagnostics Segment Is Fastest Growing Due to Precision and Early Detection

Molecular diagnostics is the fastest-growing technology segment in the gastrointestinal diagnostics market, driven by the demand for precision medicine and early disease detection. Molecular techniques, such as polymerase chain reaction (PCR) and next-generation sequencing, allow for the detection of genetic markers, pathogens, and mutations in DNA and RNA, enabling a more accurate diagnosis of various gastrointestinal disorders. These technologies offer higher sensitivity and specificity compared to traditional methods, making them invaluable for detecting conditions like gastrointestinal cancers, infections, and inflammatory diseases.

The rapid growth of molecular diagnostics can also be attributed to the increasing adoption of personalized medicine, where treatments are tailored to individual genetic profiles. As research into genetic markers and disease mechanisms continues to expand, molecular diagnostics will play an even more critical role in the management of GI diseases, especially for patients with complex or rare conditions. This segment's potential for early detection and targeted treatment strategies positions it as a key driver of growth in the market.

Cancer Diagnosis Application Is Largest Due to Rising Incidences of GI Cancer

Cancer diagnosis is the largest application segment within the gastrointestinal diagnostics market, primarily due to the increasing incidence of gastrointestinal cancers, including colorectal cancer, gastric cancer, and liver cancer. The rise in the aging population and lifestyle factors, such as poor diet and lack of physical activity, have contributed to a higher burden of GI cancers, leading to an increased demand for diagnostic testing. Early and accurate detection of cancer through advanced diagnostic tools is crucial for improving patient prognosis and survival rates.

Technologies such as endoscopy, biopsy, and molecular diagnostics are integral to the detection of GI cancers, allowing for the identification of abnormalities at the cellular and molecular levels. With continued research into cancer biomarkers and genetic predispositions, the cancer diagnosis application is expected to grow significantly, supported by efforts to enhance early screening programs and develop more effective diagnostic methods for cancer detection.

Hospitals End-Use Segment Is Largest Due to Advanced Infrastructure and Specialized Care

The hospitals end-use segment is the largest within the gastrointestinal diagnostics market, driven by the advanced infrastructure and specialized care offered by hospitals. Hospitals are equipped with the latest diagnostic technologies, including endoscopic suites, imaging equipment, and molecular diagnostic labs, enabling them to conduct a wide range of GI diagnostic procedures. Furthermore, hospitals provide comprehensive care, from diagnostics to treatment, making them the preferred healthcare setting for patients with complex gastrointestinal conditions.

The increasing number of GI procedures performed in hospitals, along with the expansion of specialized departments for gastrointestinal care, further supports the dominance of this segment. Additionally, hospitals offer the expertise of gastroenterologists and other specialists, ensuring accurate diagnoses and appropriate treatment plans. As the demand for GI diagnostics grows, hospitals will continue to be a key contributor to market growth.

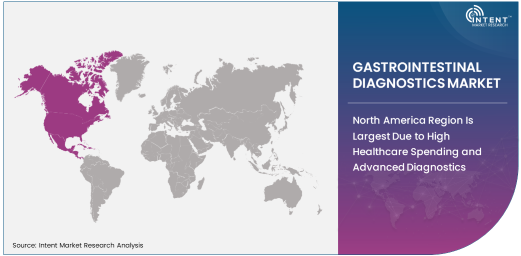

North America Region Is Largest Due to High Healthcare Spending and Advanced Diagnostics

North America is the largest region in the gastrointestinal diagnostics market, driven by high healthcare spending, advanced healthcare infrastructure, and a strong focus on early disease detection. The United States, in particular, has one of the highest rates of gastrointestinal disorders, such as colorectal cancer and IBD, leading to increased demand for diagnostic services. The region's robust healthcare system is equipped with state-of-the-art diagnostic technologies, ensuring patients have access to the latest treatments and diagnostic tools.

Furthermore, North America is a hub for medical research and innovation, contributing to the development of new diagnostic technologies and treatment methods for gastrointestinal diseases. The region's growing aging population, coupled with rising awareness of GI conditions, will continue to drive the demand for advanced gastrointestinal diagnostics, making it a dominant force in the global market.

Leading Companies and Competitive Landscape

The gastrointestinal diagnostics market is competitive, with several key players leading the development of innovative diagnostic solutions. Prominent companies in the market include Medtronic, Olympus Corporation, Boston Scientific, Abbott Laboratories, and Hologic, which offer a wide range of diagnostic products, including endoscopic devices, imaging systems, and molecular diagnostic tools. These companies are focusing on innovation, such as the development of minimally invasive procedures, AI-powered diagnostic tools, and advancements in molecular diagnostics to enhance the accuracy and efficiency of GI disease detection.

The competitive landscape is marked by strategic partnerships, mergers, and acquisitions as companies seek to expand their product portfolios and strengthen their market presence. Additionally, the growing trend toward personalized medicine and the need for more accurate and timely diagnostics are pushing companies to invest in research and development. With ongoing technological advancements and an increasing focus on patient-centric care, the gastrointestinal diagnostics market is expected to remain dynamic and competitive in the coming years.

Recent Developments:

- Medtronic PLC launched an advanced endoscopy system designed to improve diagnostic accuracy for gastrointestinal diseases.

- Thermo Fisher Scientific, Inc. introduced a new PCR-based diagnostic kit for the rapid detection of gastrointestinal infections.

- Hologic, Inc. announced the approval of a new molecular diagnostic test for detecting colorectal cancer at early stages.

- Olympus Corporation expanded its portfolio of imaging technologies, including enhanced endoscopic devices for more detailed gastrointestinal diagnostics.

- Siemens Healthineers launched a next-generation immunoassay platform for faster and more accurate gastrointestinal disease detection.

List of Leading Companies:

- Abbott Laboratories

- Medtronic PLC

- Olympus Corporation

- Boston Scientific Corporation

- Johnson & Johnson

- Hologic, Inc.

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche AG

- Siemens Healthineers

- Labcorp Drug Development

- Qiagen

- Cepheid, Inc.

- Becton Dickinson and Company (BD)

- Endo International PLC

- DiaSorin S.p.A.

Report Scope:

|

Report Features |

Description |

|

Market Size (2024-e) |

USD 6.3 billion |

|

Forecasted Value (2030) |

USD 10.1 billion |

|

CAGR (2025 – 2030) |

8.1% |

|

Base Year for Estimation |

2024-e |

|

Historic Year |

2023 |

|

Forecast Period |

2025 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Gastrointestinal Diagnostics Market By Diagnostic Type (Endoscopy, Colonoscopy, Capsule Endoscopy, Sigmoidoscopy, Imaging Techniques, Biopsy), By Technology (Molecular Diagnostics, Immunoassays, Polymerase Chain Reaction (PCR), Enzyme-Linked Immunosorbent Assay (ELISA), Fecal Immunochemical Test (FIT)), By Application (Cancer Diagnosis, Inflammatory Bowel Disease (IBD), Gastrointestinal Infection Diagnosis, Celiac Disease Diagnosis, Irritable Bowel Syndrome (IBS)), By End-Use (Hospitals, Diagnostic Laboratories, Ambulatory Surgical Centers, Clinics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Abbott Laboratories, Medtronic PLC, Olympus Corporation, Boston Scientific Corporation, Johnson & Johnson, Hologic, Inc., Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche AG, Siemens Healthineers, Labcorp Drug Development, Qiagen, Cepheid, Inc., Becton Dickinson and Company (BD), Endo International PLC, DiaSorin S.p.A. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Gastrointestinal Diagnostics Market, by Diagnostic Type (Market Size & Forecast: USD Million, 2023 – 2030) |

|

4.1. Endoscopy |

|

4.2. Colonoscopy |

|

4.3. Capsule Endoscopy |

|

4.4. Sigmoidoscopy |

|

4.5. Imaging Techniques |

|

4.6. Biopsy |

|

4.7. Others |

|

5. Gastrointestinal Diagnostics Market, by Technology (Market Size & Forecast: USD Million, 2023 – 2030) |

|

5.1. Molecular Diagnostics |

|

5.2. Immunoassays |

|

5.3. Polymerase Chain Reaction (PCR) |

|

5.4. Enzyme-Linked Immunosorbent Assay (ELISA) |

|

5.5. Fecal Immunochemical Test (FIT) |

|

5.6. Others |

|

6. Gastrointestinal Diagnostics Market, by Application (Market Size & Forecast: USD Million, 2023 – 2030) |

|

6.1. Cancer Diagnosis |

|

6.2. Inflammatory Bowel Disease (IBD) |

|

6.3. Gastrointestinal Infection Diagnosis |

|

6.4. Celiac Disease Diagnosis |

|

6.5. Irritable Bowel Syndrome (IBS) |

|

6.6. Others |

|

7. Gastrointestinal Diagnostics Market, by End-Use (Market Size & Forecast: USD Million, 2023 – 2030) |

|

7.1. Hospitals |

|

7.2. Diagnostic Laboratories |

|

7.3. Ambulatory Surgical Centers |

|

7.4. Clinics |

|

7.5. Others |

|

8. Regional Analysis (Market Size & Forecast: USD Million, 2023 – 2030) |

|

8.1. Regional Overview |

|

8.2. North America |

|

8.2.1. Regional Trends & Growth Drivers |

|

8.2.2. Barriers & Challenges |

|

8.2.3. Opportunities |

|

8.2.4. Factor Impact Analysis |

|

8.2.5. Technology Trends |

|

8.2.6. North America Gastrointestinal Diagnostics Market, by Diagnostic Type |

|

8.2.7. North America Gastrointestinal Diagnostics Market, by Technology |

|

8.2.8. North America Gastrointestinal Diagnostics Market, by Application |

|

8.2.9. North America Gastrointestinal Diagnostics Market, by End-Use |

|

8.2.10. By Country |

|

8.2.10.1. US |

|

8.2.10.1.1. US Gastrointestinal Diagnostics Market, by Diagnostic Type |

|

8.2.10.1.2. US Gastrointestinal Diagnostics Market, by Technology |

|

8.2.10.1.3. US Gastrointestinal Diagnostics Market, by Application |

|

8.2.10.1.4. US Gastrointestinal Diagnostics Market, by End-Use |

|

8.2.10.2. Canada |

|

8.2.10.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

8.3. Europe |

|

8.4. Asia-Pacific |

|

8.5. Latin America |

|

8.6. Middle East & Africa |

|

9. Competitive Landscape |

|

9.1. Overview of the Key Players |

|

9.2. Competitive Ecosystem |

|

9.2.1. Level of Fragmentation |

|

9.2.2. Market Consolidation |

|

9.2.3. Product Innovation |

|

9.3. Company Share Analysis |

|

9.4. Company Benchmarking Matrix |

|

9.4.1. Strategic Overview |

|

9.4.2. Product Innovations |

|

9.5. Start-up Ecosystem |

|

9.6. Strategic Competitive Insights/ Customer Imperatives |

|

9.7. ESG Matrix/ Sustainability Matrix |

|

9.8. Manufacturing Network |

|

9.8.1. Locations |

|

9.8.2. Supply Chain and Logistics |

|

9.8.3. Product Flexibility/Customization |

|

9.8.4. Digital Transformation and Connectivity |

|

9.8.5. Environmental and Regulatory Compliance |

|

9.9. Technology Readiness Level Matrix |

|

9.10. Technology Maturity Curve |

|

9.11. Buying Criteria |

|

10. Company Profiles |

|

10.1. Abbott Laboratories |

|

10.1.1. Company Overview |

|

10.1.2. Company Financials |

|

10.1.3. Product/Service Portfolio |

|

10.1.4. Recent Developments |

|

10.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

10.2. Medtronic PLC |

|

10.3. Olympus Corporation |

|

10.4. Boston Scientific Corporation |

|

10.5. Johnson & Johnson |

|

10.6. Hologic, Inc. |

|

10.7. Thermo Fisher Scientific, Inc. |

|

10.8. F. Hoffmann-La Roche AG |

|

10.9. Siemens Healthineers |

|

10.10. Labcorp Drug Development |

|

10.11. Qiagen |

|

10.12. Cepheid, Inc. |

|

10.13. Becton Dickinson and Company (BD) |

|

10.14. Endo International PLC |

|

10.15. DiaSorin S.p.A. |

|

11. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Gastrointestinal Diagnostics Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Gastrointestinal Diagnostics Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Gastrointestinal Diagnostics Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA