As per Intent Market Research, the Gas Insulated Ring Main Unit Market was valued at USD 1.8 billion in 2023 and will surpass USD 2.7 billion by 2030; growing at a CAGR of 5.8% during 2024 - 2030.

The gas-insulated ring main unit (RMU) market has seen substantial growth driven by the rising demand for efficient, compact, and reliable electrical distribution solutions across a variety of industries. RMUs are essential components of modern electrical networks, primarily used in medium voltage power distribution systems to ensure safety, reliability, and space efficiency. These units are particularly valued for their ability to function in confined spaces, with minimal maintenance requirements, making them ideal for urban environments, industrial plants, and commercial establishments. Additionally, the global shift toward sustainable energy sources and smart grid infrastructure has further bolstered the demand for gas-insulated RMUs as key enablers of efficient energy management and distribution.

Technological advancements in gas-insulated ring main units, such as the integration of SF6 and hybrid gas insulation, have significantly enhanced their performance, durability, and environmental sustainability. As utilities, renewable energy projects, and industries move toward automation and digitalization, gas-insulated RMUs are increasingly being adopted as part of modernized electrical grids. The growing need for reliable, safe, and cost-effective power distribution systems, coupled with the integration of renewable energy, is expected to drive continued market expansion in the coming years.

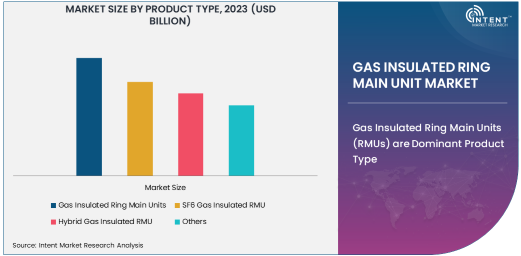

Gas Insulated Ring Main Units (RMUs) are Dominant Product Type

The gas-insulated ring main unit (RMU) product type holds the largest share of the market due to its reliability, compact design, and adaptability to various power distribution systems. These units are designed to provide an effective means of isolating sections of an electrical network to ensure continuous power supply, making them ideal for urban areas, industrial plants, and commercial buildings. Their gas-insulated design allows them to operate in confined spaces, a key advantage as the demand for space-saving electrical solutions continues to rise.

The gas-insulated RMUs offer enhanced safety features, reducing the risk of faults and providing protection against external environmental factors such as dust, moisture, and temperature extremes. With the growing focus on sustainability and reliability in the power sector, the demand for these units is expected to remain strong. Furthermore, the integration of SF6 gas, known for its excellent insulating properties, has further reinforced the market's preference for gas-insulated RMUs, as they ensure optimal performance in demanding environments and contribute to the overall efficiency of power distribution networks.

SF6 Gas Insulated RMUs Lead in Market Share

The SF6 gas-insulated ring main units dominate the market due to their exceptional insulating properties, which allow for superior performance and safety in medium voltage power distribution systems. SF6 gas offers excellent dielectric strength, which helps prevent electrical faults and enhances the overall efficiency of power transmission and distribution. These units are particularly favored for their ability to operate in harsh conditions, such as high humidity, dust, and extreme temperatures, making them ideal for industrial plants, power utilities, and other critical infrastructure where reliability is paramount.

SF6 gas-insulated RMUs provide an added benefit of reduced maintenance requirements, as the sealed nature of the units prevents external contaminants from affecting the internal components. The high insulation quality offered by SF6 ensures long-term durability and minimizes operational risks, which is particularly important for mission-critical applications such as power utilities and renewable energy projects. Given these advantages, SF6 gas-insulated RMUs are expected to remain the preferred choice in the market, especially as the need for reliable and efficient power distribution systems continues to grow.

Hybrid Gas Insulated RMUs Gaining Popularity

Hybrid gas-insulated ring main units are gaining traction in the market, driven by their ability to combine the advantages of traditional gas-insulated units with the flexibility of newer technologies. Hybrid RMUs incorporate both SF6 and solid-state insulation, offering a more environmentally friendly solution with reduced reliance on SF6 gas. These units are designed to address the growing concerns over the environmental impact of SF6, which, although effective as an insulating medium, has a high global warming potential.

The adoption of hybrid RMUs is being driven by industries and utilities that are seeking to reduce their carbon footprint without compromising on performance and reliability. These units provide the same space-saving, high-performance benefits as their SF6 counterparts, but with an added focus on sustainability. As environmental regulations tighten and the push for greener technologies intensifies, the hybrid gas-insulated RMU segment is expected to see significant growth, particularly in regions with strong environmental regulations and sustainability goals.

Power Utilities Lead the End-User Segment

The power utilities sector is the largest end-user of gas-insulated ring main units, accounting for the majority of the market share. This is due to the critical role RMUs play in the power distribution infrastructure, ensuring safe and reliable energy transmission in both urban and rural areas. Gas-insulated RMUs are particularly favored in power utilities for their ability to operate efficiently in compact spaces, their long lifespan, and their ability to handle medium voltage power with minimal risk of failure. With the ongoing expansion of power grids and the increasing integration of renewable energy sources, power utilities continue to rely on these units to manage and distribute power effectively.

Moreover, the growing demand for smart grid technologies and the need for increased grid reliability are propelling the adoption of gas-insulated RMUs in the power utilities sector. These units contribute to the automation and digitalization of grid infrastructure, making them crucial components in the modernization of electrical grids. As utilities work to meet the rising energy demands and improve grid resilience, the market for gas-insulated RMUs in power utilities is expected to expand further, driven by both the growth of traditional power generation and the integration of sustainable energy sources.

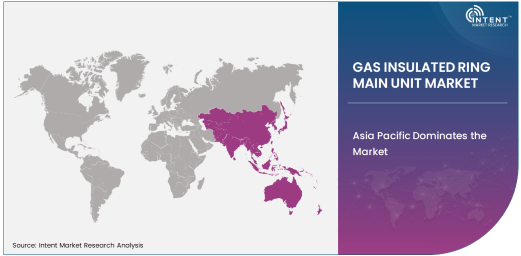

Asia Pacific Dominates the Market

Asia Pacific is the largest and fastest-growing region in the gas-insulated ring main unit market. The region's rapid industrialization, urbanization, and infrastructure development are driving significant demand for reliable and space-saving power distribution solutions. As key economies such as China, India, and Southeast Asia invest in modernizing their electrical grids, the need for gas-insulated RMUs has surged. The region's growing focus on renewable energy integration and the expansion of smart grid infrastructure further support the adoption of these units.

In countries like China and India, where industrial and commercial sectors are rapidly expanding, the demand for efficient power distribution systems continues to rise, making Asia Pacific a key market for gas-insulated ring main units. Additionally, government initiatives promoting sustainable energy practices and grid modernization are contributing to the market's growth. With the increasing need for high-performance, compact, and reliable power distribution solutions, Asia Pacific is expected to continue dominating the market in the foreseeable future.

Competitive Landscape

The gas-insulated ring main unit market is highly competitive, with several global players striving to capture market share through product innovation, strategic partnerships, and geographic expansion. Key companies in the market include Schneider Electric, Siemens AG, ABB Ltd., and General Electric, all of which offer advanced gas-insulated RMU solutions designed to meet the growing demand for reliable and efficient power distribution systems. These companies focus on expanding their product portfolios, incorporating hybrid and environmentally friendly technologies, and improving the performance of their RMUs to cater to diverse industrial needs.

The competitive landscape is characterized by ongoing efforts to develop eco-friendly RMUs with reduced SF6 usage and to integrate smart grid capabilities into RMU solutions. As the market evolves, companies are expected to increasingly focus on sustainability, digitalization, and offering integrated solutions that align with the global trend toward greener, smarter power grids. The competitive pressure is expected to intensify as new players enter the market, while established companies continue to innovate and expand their presence globally.

Recent Developments:

- In November 2024, Schneider Electric introduced an enhanced gas-insulated RMU solution designed for higher efficiency in renewable energy projects.

- In October 2024, Siemens AG launched a new hybrid gas-insulated ring main unit with improved eco-friendly insulation materials, reducing the environmental impact.

- In September 2024, General Electric unveiled a compact and efficient gas-insulated RMU with automated monitoring features for smart grid applications.

- In August 2024, Mitsubishi Electric introduced a gas-insulated ring main unit with advanced safety mechanisms for industrial plants.

- In July 2024, Hitachi ABB Power Grids expanded its portfolio with a new SF6-free RMU solution for the power distribution sector.

List of Leading Companies:

- Schneider Electric

- Siemens AG

- General Electric

- Mitsubishi Electric

- Hitachi ABB Power Grids

- Eaton Corporation

- Schneider Electric

- Chint Group

- Toshiba Corporation

- S&C Electric Company

- Hyundai Electric

- CG Power and Industrial Solutions Ltd.

- Nissin Electric Co., Ltd.

- Trench Group

- Larsen & Toubro Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 1.8 billion |

|

Forecasted Value (2030) |

USD 2.7 billion |

|

CAGR (2024 – 2030) |

5.8% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Gas Insulated Ring Main Unit Market By Product Type (Gas Insulated Ring Main Units, SF6 Gas Insulated RMU, Hybrid Gas Insulated RMU), By End-User (Power Utilities, Industrial Plants, Renewable Energy Projects, Commercial Buildings, Smart Grid Infrastructure) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Schneider Electric, Siemens AG, General Electric, Mitsubishi Electric, Hitachi ABB Power Grids, Eaton Corporation, Schneider Electric, Chint Group, Toshiba Corporation, S&C Electric Company, Hyundai Electric, CG Power and Industrial Solutions Ltd., Nissin Electric Co., Ltd., Trench Group, Larsen & Toubro Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Gas Insulated Ring Main Unit Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Gas Insulated Ring Main Units |

|

4.2. SF6 Gas Insulated RMU |

|

4.3. Hybrid Gas Insulated RMU |

|

4.4. Others |

|

5. Gas Insulated Ring Main Unit Market, by End-User (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Power Utilities |

|

5.2. Industrial Plants |

|

5.3. Renewable Energy Projects |

|

5.4. Commercial Buildings |

|

5.5. Smart Grid Infrastructure |

|

5.6. Others |

|

6. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Regional Overview |

|

6.2. North America |

|

6.2.1. Regional Trends & Growth Drivers |

|

6.2.2. Barriers & Challenges |

|

6.2.3. Opportunities |

|

6.2.4. Factor Impact Analysis |

|

6.2.5. Technology Trends |

|

6.2.6. North America Gas Insulated Ring Main Unit Market, by Product Type |

|

6.2.7. North America Gas Insulated Ring Main Unit Market, by End-User |

|

6.2.8. By Country |

|

6.2.8.1. US |

|

6.2.8.1.1. US Gas Insulated Ring Main Unit Market, by Product Type |

|

6.2.8.1.2. US Gas Insulated Ring Main Unit Market, by End-User |

|

6.2.8.2. Canada |

|

6.2.8.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

6.3. Europe |

|

6.4. Asia-Pacific |

|

6.5. Latin America |

|

6.6. Middle East & Africa |

|

7. Competitive Landscape |

|

7.1. Overview of the Key Players |

|

7.2. Competitive Ecosystem |

|

7.2.1. Level of Fragmentation |

|

7.2.2. Market Consolidation |

|

7.2.3. Product Innovation |

|

7.3. Company Share Analysis |

|

7.4. Company Benchmarking Matrix |

|

7.4.1. Strategic Overview |

|

7.4.2. Product Innovations |

|

7.5. Start-up Ecosystem |

|

7.6. Strategic Competitive Insights/ Customer Imperatives |

|

7.7. ESG Matrix/ Sustainability Matrix |

|

7.8. Manufacturing Network |

|

7.8.1. Locations |

|

7.8.2. Supply Chain and Logistics |

|

7.8.3. Product Flexibility/Customization |

|

7.8.4. Digital Transformation and Connectivity |

|

7.8.5. Environmental and Regulatory Compliance |

|

7.9. Technology Readiness Level Matrix |

|

7.10. Technology Maturity Curve |

|

7.11. Buying Criteria |

|

8. Company Profiles |

|

8.1. Schneider Electric |

|

8.1.1. Company Overview |

|

8.1.2. Company Financials |

|

8.1.3. Product/Service Portfolio |

|

8.1.4. Recent Developments |

|

8.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

8.2. Siemens AG |

|

8.3. General Electric |

|

8.4. Mitsubishi Electric |

|

8.5. Hitachi ABB Power Grids |

|

8.6. Eaton Corporation |

|

8.7. Schneider Electric |

|

8.8. Chint Group |

|

8.9. Toshiba Corporation |

|

8.10. S&C Electric Company |

|

8.11. Hyundai Electric |

|

8.12. CG Power and Industrial Solutions Ltd. |

|

8.13. Nissin Electric Co., Ltd. |

|

8.14. Trench Group |

|

8.15. Larsen & Toubro Ltd. |

|

9. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Gas Insulated Ring Main Unit Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Gas Insulated Ring Main Unit Market. The research methodoloagy encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Gas Insulated Ring Main Unit Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA