As per Intent Market Research, the Gas Analyzer Systems Market was valued at USD 4.0 billion in 2023 and will surpass USD 6.5 billion by 2030; growing at a CAGR of 7.2% during 2024 - 2030.

The Gas Analyzer Systems market plays a crucial role in various industries by providing accurate measurements of gas concentrations in different environments. These systems are designed to monitor and analyze gases in real-time, ensuring safety, compliance, and efficiency across sectors like oil and gas, environmental monitoring, automotive, and power generation. With increasing environmental regulations, the need for continuous gas monitoring has become more pronounced, further driving the demand for these systems. Technological advancements in sensors, portability, and multi-gas detection capabilities are key trends shaping the future of the market.

As industries continue to focus on reducing emissions and ensuring worker safety, the demand for gas analyzer systems is expected to grow across both developed and emerging economies. The introduction of advanced technologies like Non-Dispersive Infrared (NDIR) and electrochemical sensors has expanded the application scope of gas analyzers, offering more precise and reliable gas detection. This has also led to a greater emphasis on portable and handheld analyzer systems that cater to a wide range of applications, from environmental monitoring to industrial safety.

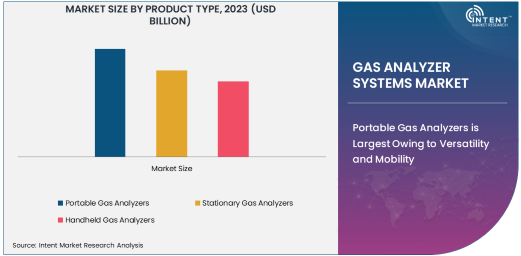

Portable Gas Analyzers is Largest Owing to Versatility and Mobility

Portable gas analyzers hold the largest share in the gas analyzer systems market, driven by their versatility, mobility, and increasing demand for on-site gas monitoring in various industries. These portable systems are essential for field applications, particularly in industries like oil and gas, environmental monitoring, and emergency response. The ability to quickly measure and assess gas concentrations in remote locations or hazardous environments makes portable gas analyzers invaluable.

The growing need for compliance with safety regulations in hazardous areas has significantly contributed to the growth of the portable gas analyzer segment. In industries such as oil and gas, portable analyzers help monitor emissions and air quality in real-time, ensuring worker safety and environmental protection. Furthermore, these devices are increasingly used in environmental monitoring applications to detect pollutants and track air quality, especially in urban areas and regions with strict environmental policies. The convenience and effectiveness of portable gas analyzers have solidified their dominance in the market.

Non-Dispersive Infrared (NDIR) Technology is Largest Owing to High Accuracy and Reliability

Non-Dispersive Infrared (NDIR) technology is the most widely used in gas analyzer systems, owing to its high accuracy and reliability in detecting gases like carbon dioxide (CO?), carbon monoxide (CO), and methane (CH?). NDIR sensors are based on the absorption of infrared light by gases, providing precise and stable measurements over extended periods. This makes NDIR a preferred technology in applications requiring high precision, such as air quality monitoring, power generation, and industrial processes.

The growing need for environmental monitoring and emissions control in sectors like oil and gas, power generation, and automotive has been a key driver for the adoption of NDIR-based gas analyzers. These analyzers are not only highly accurate but also offer long-term stability and minimal maintenance, making them cost-effective for industries with continuous monitoring requirements. The advanced capabilities of NDIR technology make it an indispensable tool for monitoring a wide range of gases, from combustion by-products to industrial pollutants, ensuring compliance with environmental regulations and improving operational efficiency.

Oil & Gas End-Use Industry is Largest Owing to Safety and Emission Monitoring Needs

The oil and gas industry is the largest end-user of gas analyzer systems, driven by the critical need for gas detection and monitoring in extraction, refining, and transportation processes. Gas analyzer systems play an essential role in ensuring the safety of workers and preventing hazardous situations, such as gas leaks and explosions. These systems help detect flammable, toxic, and combustible gases, thus preventing accidents and ensuring regulatory compliance.

The oil and gas sector’s increasing focus on operational safety, environmental sustainability, and regulatory compliance has further accelerated the demand for gas analyzer systems. Real-time monitoring of gas emissions also supports the industry’s efforts to reduce its environmental impact by identifying leaks, managing gas releases, and optimizing fuel efficiency. As regulatory bodies enforce stricter environmental standards, gas analyzers are becoming an integral part of the operational landscape in the oil and gas industry, supporting the transition towards cleaner and safer energy production.

Environmental Monitoring is Fastest Growing Application Owing to Increased Regulatory Pressures

The environmental monitoring application segment is growing the fastest in the gas analyzer systems market, driven by the increasing regulatory pressures to monitor and control air quality. Governments and environmental agencies are enforcing stricter laws related to emissions, air pollution, and overall environmental quality, prompting industries and municipalities to adopt continuous gas monitoring solutions. Gas analyzers are essential for detecting harmful gases such as sulfur dioxide (SO?), nitrogen oxides (NOx), and particulate matter, which are critical to ensuring air quality and public health.

With growing concerns over climate change and pollution, environmental monitoring has become a high priority globally. Gas analyzer systems enable the monitoring of industrial emissions, vehicle exhaust, and ambient air quality, making them a key tool for regulatory compliance. The demand for these systems is further bolstered by rising urbanization, industrialization, and increased awareness about the need for sustainable practices. As environmental standards continue to tighten, the need for reliable gas monitoring systems in environmental applications will continue to expand.

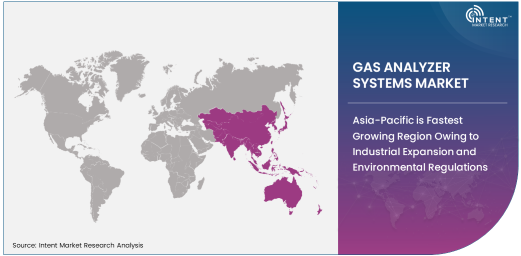

Asia-Pacific is Fastest Growing Region Owing to Industrial Expansion and Environmental Regulations

The Asia-Pacific region is the fastest-growing market for gas analyzer systems, fueled by rapid industrialization, urbanization, and increasing environmental awareness. Countries like China, India, and Japan are experiencing significant growth in industrial activities, leading to a surge in demand for gas analyzers across industries such as oil and gas, automotive, and power generation. At the same time, stringent government regulations regarding emissions control and environmental monitoring are driving the adoption of gas analyzer systems.

In addition to industrial growth, governments in the Asia-Pacific region are implementing more stringent air quality standards to address pollution levels and public health concerns. This has led to a rise in the demand for gas analyzers for environmental monitoring applications, particularly in densely populated urban areas. The growing focus on sustainability and environmental protection is expected to further propel the gas analyzer systems market in this region, making it a key growth driver in the global market.

Competitive Landscape and Leading Companies

The gas analyzer systems market is highly competitive, with several global and regional players offering a variety of products to meet the diverse needs of industries and applications. Leading companies in the market include ABB Ltd., Emerson Electric Co., Honeywell International Inc., Siemens AG, and Thermo Fisher Scientific, among others. These companies are leveraging advanced technologies, strategic partnerships, and acquisitions to expand their market presence and meet the growing demand for gas monitoring solutions.

To maintain a competitive edge, these companies are focusing on product innovation, including the development of portable, multi-gas analyzers, and incorporating advanced features like wireless connectivity and real-time data analysis. The growing focus on environmental sustainability, stricter regulatory requirements, and the demand for high-precision monitoring are driving innovation in the gas analyzer systems market. As a result, companies are investing heavily in R&D to enhance the performance, reliability, and user-friendliness of their products.

Recent Developments:

- Thermo Fisher Scientific introduced a new line of portable gas analyzers, enhancing the accuracy and portability of environmental monitoring equipment.

- ABB Ltd. launched a new emissions monitoring system designed to improve efficiency and regulatory compliance for industrial operations.

- Emerson Electric Co. expanded its gas analyzer portfolio with a new line of advanced sensors for real-time emissions monitoring in power plants.

- Honeywell International Inc. announced a partnership to develop new gas detection solutions for the automotive industry, focusing on air quality monitoring.

- Testo AG unveiled a handheld gas analyzer designed for accurate indoor air quality measurements in commercial and residential buildings.

List of Leading Companies:

- Thermo Fisher Scientific Inc.

- ABB Ltd.

- Emerson Electric Co.

- Siemens AG

- Honeywell International Inc.

- Horiba Ltd.

- Beckman Coulter Inc.

- Ametek Inc.

- Emerson Process Management

- Testo AG

- Yokogawa Electric Corporation

- Mettler Toledo

- RKI Instruments, Inc.

- Drägerwerk AG & Co. KGaA

- KROHNE Group

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 4.0 Billion |

|

Forecasted Value (2030) |

USD 6.5 Billion |

|

CAGR (2024 – 2030) |

7.2% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

Gas Analyzer Systems Market by Product Type (Portable Gas Analyzers, Stationary Gas Analyzers, Handheld Gas Analyzers), by Technology (Non-Dispersive Infrared (NDIR), Electrochemical Sensors, Chemiluminescence, Flame Ionization Detection (FID), Others), by End-Use Industry (Oil & Gas, Environmental Monitoring, Power Generation, Automotive, Others) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Thermo Fisher Scientific Inc., ABB Ltd., Emerson Electric Co., Siemens AG, Honeywell International Inc., Horiba Ltd., Ametek Inc., Emerson Process Management, Testo AG, Yokogawa Electric Corporation, Mettler Toledo, RKI Instruments, Inc. and KROHNE Group. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

|

1. Introduction |

|

1.1. Market Definition |

|

1.2. Scope of the Study |

|

1.3. Research Assumptions |

|

1.4. Study Limitations |

|

2. Research Methodology |

|

2.1. Research Approach |

|

2.1.1. Top-Down Method |

|

2.1.2. Bottom-Up Method |

|

2.1.3. Factor Impact Analysis |

|

2.2. Insights & Data Collection Process |

|

2.2.1. Secondary Research |

|

2.2.2. Primary Research |

|

2.3. Data Mining Process |

|

2.3.1. Data Analysis |

|

2.3.2. Data Validation and Revalidation |

|

2.3.3. Data Triangulation |

|

3. Executive Summary |

|

3.1. Major Markets & Segments |

|

3.2. Highest Growing Regions and Respective Countries |

|

3.3. Impact of Growth Drivers & Inhibitors |

|

3.4. Regulatory Overview by Country |

|

4. Gas Analyzer Systems Market, by Product Type (Market Size & Forecast: USD Million, 2022 – 2030) |

|

4.1. Portable Gas Analyzers |

|

4.2. Stationary Gas Analyzers |

|

4.3. Handheld Gas Analyzers |

|

5. Gas Analyzer Systems Market, by Technology (Market Size & Forecast: USD Million, 2022 – 2030) |

|

5.1. Non-Dispersive Infrared (NDIR) |

|

5.2. Electrochemical Sensors |

|

5.3. Chemiluminescence |

|

5.4. Flame Ionization Detection (FID) |

|

5.5. Others |

|

6. Gas Analyzer Systems Market, by End-Use Industry (Market Size & Forecast: USD Million, 2022 – 2030) |

|

6.1. Oil & Gas |

|

6.2. Environmental Monitoring |

|

6.3. Power Generation |

|

6.4. Automotive |

|

6.5. Others |

|

7. Regional Analysis (Market Size & Forecast: USD Million, 2022 – 2030) |

|

7.1. Regional Overview |

|

7.2. North America |

|

7.2.1. Regional Trends & Growth Drivers |

|

7.2.2. Barriers & Challenges |

|

7.2.3. Opportunities |

|

7.2.4. Factor Impact Analysis |

|

7.2.5. Technology Trends |

|

7.2.6. North America Gas Analyzer Systems Market, by Product Type |

|

7.2.7. North America Gas Analyzer Systems Market, by Technology |

|

7.2.8. North America Gas Analyzer Systems Market, by End-Use Industry |

|

7.2.9. By Country |

|

7.2.9.1. US |

|

7.2.9.1.1. US Gas Analyzer Systems Market, by Product Type |

|

7.2.9.1.2. US Gas Analyzer Systems Market, by Technology |

|

7.2.9.1.3. US Gas Analyzer Systems Market, by End-Use Industry |

|

7.2.9.2. Canada |

|

7.2.9.3. Mexico |

|

*Similar segmentation will be provided for each region and country |

|

7.3. Europe |

|

7.4. Asia-Pacific |

|

7.5. Latin America |

|

7.6. Middle East & Africa |

|

8. Competitive Landscape |

|

8.1. Overview of the Key Players |

|

8.2. Competitive Ecosystem |

|

8.2.1. Level of Fragmentation |

|

8.2.2. Market Consolidation |

|

8.2.3. Product Innovation |

|

8.3. Company Share Analysis |

|

8.4. Company Benchmarking Matrix |

|

8.4.1. Strategic Overview |

|

8.4.2. Product Innovations |

|

8.5. Start-up Ecosystem |

|

8.6. Strategic Competitive Insights/ Customer Imperatives |

|

8.7. ESG Matrix/ Sustainability Matrix |

|

8.8. Manufacturing Network |

|

8.8.1. Locations |

|

8.8.2. Supply Chain and Logistics |

|

8.8.3. Product Flexibility/Customization |

|

8.8.4. Digital Transformation and Connectivity |

|

8.8.5. Environmental and Regulatory Compliance |

|

8.9. Technology Readiness Level Matrix |

|

8.10. Technology Maturity Curve |

|

8.11. Buying Criteria |

|

9. Company Profiles |

|

9.1. Thermo Fisher Scientific Inc. |

|

9.1.1. Company Overview |

|

9.1.2. Company Financials |

|

9.1.3. Product/Service Portfolio |

|

9.1.4. Recent Developments |

|

9.1.5. IMR Analysis |

|

*Similar information will be provided for other companies |

|

9.2. ABB Ltd. |

|

9.3. Emerson Electric Co. |

|

9.4. Siemens AG |

|

9.5. Honeywell International Inc. |

|

9.6. Horiba Ltd. |

|

9.7. Beckman Coulter Inc. |

|

9.8. Ametek Inc. |

|

9.9. Emerson Process Management |

|

9.10. Testo AG |

|

9.11. Yokogawa Electric Corporation |

|

9.12. Mettler Toledo |

|

9.13. RKI Instruments, Inc. |

|

9.14. Drägerwerk AG & Co. KGaA |

|

9.15. KROHNE Group |

|

10. Appendix |

A comprehensive market research approach was employed to gather and analyze data on the Gas Analyzer Systems Market. In the process, the analysis was also done to analyze the parent market and relevant adjacencies to measure the impact of them on the Gas Analyzer Systems Market. The research methodology encompassed both secondary and primary research techniques, ensuring the accuracy and credibility of the findings.

.jpg)

Secondary Research

Secondary research involved a thorough review of pertinent industry reports, journals, articles, and publications. Additionally, annual reports, press releases, and investor presentations of industry players were scrutinized to gain insights into their market positioning and strategies.

Primary Research

Primary research involved conducting in-depth interviews with industry experts, stakeholders, and market participants across the E-Waste Management ecosystem. The primary research objectives included:

- Validating findings and assumptions derived from secondary research

- Gathering qualitative and quantitative data on market trends, drivers, and challenges

- Understanding the demand-side dynamics, encompassing end-users, component manufacturers, facility providers, and service providers

- Assessing the supply-side landscape, including technological advancements and recent developments

Market Size Assessment

A combination of top-down and bottom-up approaches was utilized to analyze the overall size of the Gas Analyzer Systems Market. These methods were also employed to assess the size of various subsegments within the market. The market size assessment methodology encompassed the following steps:

- Identification of key industry players and relevant revenues through extensive secondary research

- Determination of the industry's supply chain and market size, in terms of value, through primary and secondary research processes

- Calculation of percentage shares, splits, and breakdowns using secondary sources and verification through primary sources

.jpg)

Data Triangulation

To ensure the accuracy and reliability of the market size, data triangulation was implemented. This involved cross-referencing data from various sources, including demand and supply side factors, market trends, and expert opinions. Additionally, top-down and bottom-up approaches were employed to validate the market size assessment.

NA