As per Intent Market Research, the General Anesthesia Drugs Market was valued at USD 6.0 billion in 2023 and will surpass USD 9.4 billion by 2030; growing at a CAGR of 6.7% during 2024 - 2030.

The general anesthesia drugs market has witnessed significant growth driven by the increasing number of surgeries performed globally and the advancement in anesthetic drug development. General anesthesia is crucial for ensuring patients remain unconscious and pain-free during medical procedures. The growing geriatric population, rise in the prevalence of chronic diseases, and an increase in surgeries, especially in emerging economies, are contributing to the expansion of the market. Innovations in anesthetic drug formulations and delivery systems have further enhanced the safety and effectiveness of general anesthesia, improving patient outcomes and driving market demand.

The market for general anesthesia drugs is also shaped by the ongoing advancements in drug development, with a focus on reducing side effects and enhancing recovery times. The ongoing research into combination therapies and the discovery of new mechanisms of action are expected to fuel the market's growth in the coming years. As medical technology continues to improve and surgical procedures become more common, the demand for general anesthesia drugs is projected to increase, making this market an important sector within the broader pharmaceutical industry.

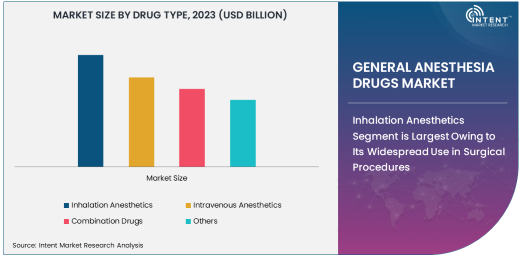

Inhalation Anesthetics Segment is Largest Owing to Its Widespread Use in Surgical Procedures

Among the different drug types used in general anesthesia, inhalation anesthetics dominate the market. This segment is the largest due to the widespread use of volatile anesthetics in surgeries. Inhalation anesthetics such as sevoflurane, isoflurane, and desflurane are preferred for their ability to quickly induce and maintain anesthesia, making them ideal for both short and long surgical procedures. Their predictable and controllable properties make them a preferred choice in hospitals and surgical centers worldwide. Additionally, the ease of administration through a mask or endotracheal tube contributes to the widespread adoption of inhalation anesthetics in various clinical settings.

Inhalation anesthetics are particularly favored in surgeries requiring rapid onset and recovery times, which are crucial for patient safety and minimizing the risks associated with anesthesia. With continued advancements in inhalation anesthetic formulations, including the development of agents with fewer side effects, this segment is expected to maintain its leadership in the general anesthesia drugs market. The ability of inhalation anesthetics to be adjusted during surgery for depth control and the availability of various inhaled agents further solidify its dominance.

Opioid Agonists Mechanism Is Widely Used for Pain Control During Anesthesia

The opioid agonists mechanism of action is commonly used in general anesthesia drugs due to its effectiveness in managing pain. Opioids such as fentanyl and remifentanil are widely employed as adjuncts to general anesthesia, providing profound analgesia during surgery. By binding to opioid receptors in the brain and spinal cord, opioid agonists block pain transmission and induce sedation. This makes them essential in ensuring that patients remain pain-free during and after surgical procedures, especially for high-intensity surgeries. Opioids are often combined with other anesthetic agents to provide a balanced anesthesia approach, reducing the required doses of individual drugs and enhancing patient safety.

The opioid agonists segment continues to grow, driven by the increasing demand for effective pain management and advancements in opioid formulations. With an expanding range of opioid-based anesthetic drugs, many designed to offer a rapid onset of action and shorter duration of effect, this mechanism of action remains critical to the administration of general anesthesia. Despite concerns regarding opioid addiction, the continued development of more targeted opioid drugs is expected to mitigate risks while maintaining the mechanism's effectiveness in clinical settings.

Surgical Procedures Segment Is Largest Application Area

The surgical procedures segment is the largest application area for general anesthesia drugs. This segment encompasses a wide variety of surgeries, ranging from routine procedures such as appendectomies to more complex surgeries like organ transplants and cardiac surgeries. The demand for anesthesia drugs is driven by the increasing number of surgeries performed globally, particularly in regions with aging populations and high incidences of chronic diseases. Surgical procedures require the use of general anesthesia to ensure that patients are unconscious and free from pain during the operation, making this segment crucial to the overall general anesthesia drugs market.

Technological advancements in surgical techniques and minimally invasive surgeries are also contributing to the growth of this segment. These innovations often require precise and controlled anesthesia, further driving demand for more effective and safer anesthesia drugs. As surgical volume continues to rise, particularly in emerging economies where healthcare infrastructure is improving, the surgical procedures segment will continue to be the dominant application area for general anesthesia drugs.

Hospitals Are the Largest End-User in General Anesthesia Drugs Market

Hospitals are the largest end-user of general anesthesia drugs, accounting for the majority of the market share. This is because hospitals perform a wide range of surgical procedures, from elective surgeries to emergency interventions, all of which require anesthesia. The availability of specialized equipment and skilled healthcare professionals in hospitals ensures the safe and effective administration of general anesthesia. Moreover, hospitals are often the first healthcare institutions to adopt the latest anesthetic drugs and technologies, making them critical players in the growth of the general anesthesia drugs market.

The hospital segment continues to lead, driven by the increasing volume of surgeries and the demand for advanced, highly controlled anesthetic management. As healthcare infrastructure continues to improve, particularly in emerging markets, the role of hospitals in the general anesthesia drugs market will remain significant. The growing number of specialized hospitals and the expansion of surgical specialties are expected to further fuel the demand for general anesthesia drugs in this segment.

North America Leads the General Anesthesia Drugs Market

North America is the largest region in the general anesthesia drugs market, owing to the advanced healthcare infrastructure, widespread availability of anesthetic drugs, and the presence of leading pharmaceutical companies. The United States, in particular, is a dominant market for general anesthesia drugs, driven by the high volume of surgical procedures, advancements in anesthesia drug development, and strong regulatory frameworks. The FDA's approval of new anesthesia drugs and the increasing use of personalized medicine in surgical settings further contribute to the region's market leadership.

In addition, the growing number of healthcare facilities, coupled with increasing surgical volumes and a high standard of care in the region, has led to a continued rise in the demand for general anesthesia drugs. The presence of key market players in North America, such as Pfizer, AbbVie, and Merck, also supports the growth of the market, with these companies continually developing new and improved anesthetic drugs to meet the needs of the healthcare industry. As the demand for surgeries continues to rise in North America, the region will remain a major driver of the general anesthesia drugs market.

Competitive Landscape and Leading Companies

The general anesthesia drugs market is highly competitive, with several key players dominating the space. Leading companies include Pfizer, AbbVie, Merck, Fresenius Kabi, and Baxter International, which are recognized for their comprehensive portfolios of general anesthesia drugs and their ongoing research into novel anesthetic formulations. These companies are focused on improving the safety, efficacy, and recovery time associated with general anesthesia, as well as addressing the growing demand for personalized anesthesia solutions. Partnerships, mergers, and acquisitions are also common strategies among market leaders to expand their product offerings and increase market penetration.

The competitive landscape is marked by intense R&D activity aimed at developing new anesthetic drugs that offer quicker onset times, fewer side effects, and faster recovery. As the global demand for surgical procedures continues to grow, companies are increasingly investing in innovative technologies to meet the evolving needs of the healthcare industry. With the continued emphasis on improving patient outcomes and reducing healthcare costs, the general anesthesia drugs market is expected to remain dynamic and competitive in the coming years.

Recent Developments:

- In November 2024, Fresenius Kabi AG launched a new intravenous anesthetic aimed at reducing recovery time for surgical patients.

- In October 2024, Baxter International Inc. received FDA approval for a new inhaled anesthetic for use in general surgery.

- In September 2024, AbbVie Inc. acquired a company specializing in opioid-based anesthesia for enhanced pain management in surgical settings.

- In August 2024, Eli Lilly and Company announced the successful completion of a Phase III trial for a novel intravenous anesthetic.

- In July 2024, Grünenthal GmbH expanded its anesthesia portfolio with a new combination drug for long-lasting sedation in critical care.

List of Leading Companies:

- Fresenius Kabi AG

- Baxter International Inc.

- AbbVie Inc.

- Mylan N.V.

- Hospira (Acquired by Pfizer)

- AstraZeneca PLC

- Eli Lilly and Company

- Novartis International AG

- Hikma Pharmaceuticals

- Grünenthal GmbH

- Medtronic PLC

- Sandoz (Novartis)

- B. Braun Melsungen AG

- Johnson & Johnson Services, Inc.

- Sun Pharmaceutical Industries Ltd.

Report Scope:

|

Report Features |

Description |

|

Market Size (2023) |

USD 6.0 billion |

|

Forecasted Value (2030) |

USD 9.4 billion |

|

CAGR (2024 – 2030) |

6.7% |

|

Base Year for Estimation |

2023 |

|

Historic Year |

2022 |

|

Forecast Period |

2024 – 2030 |

|

Report Coverage |

Market Forecast, Market Dynamics, Competitive Landscape, Recent Developments |

|

Segments Covered |

General Anesthesia Drugs Market By Drug Type (Inhalation Anesthetics, Intravenous Anesthetics, Combination Drugs), By Mechanism of Action (GABA Receptor Agonists, NMDA Receptor Antagonists, Opioid Agonists, Other Mechanisms), By Application (Surgical Procedures, Diagnostic Procedures, Pain Management), By End-User (Hospitals, Ambulatory Surgical Centers, Specialty Clinics) |

|

Regional Analysis |

North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, South Korea, Australia, India, and Rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), Middle East & Africa (Saudi Arabia, UAE, Rest of Middle East & Africa) |

|

Major Companies |

Fresenius Kabi AG, Baxter International Inc., AbbVie Inc., Mylan N.V., Hospira (Acquired by Pfizer), AstraZeneca PLC, Eli Lilly and Company, Novartis International AG, Hikma Pharmaceuticals, Grünenthal GmbH, Medtronic PLC, Sandoz (Novartis), B. Braun Melsungen AG, Johnson & Johnson Services, Inc., Sun Pharmaceutical Industries Ltd. |

|

Customization Scope |

Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements |

.jpg)

.jpg)